Trump’s Debt Stand-off

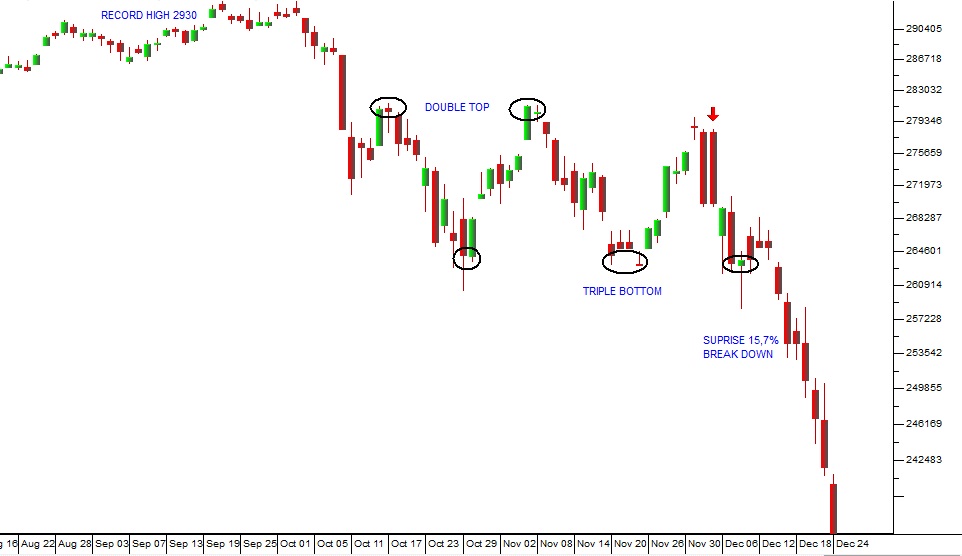

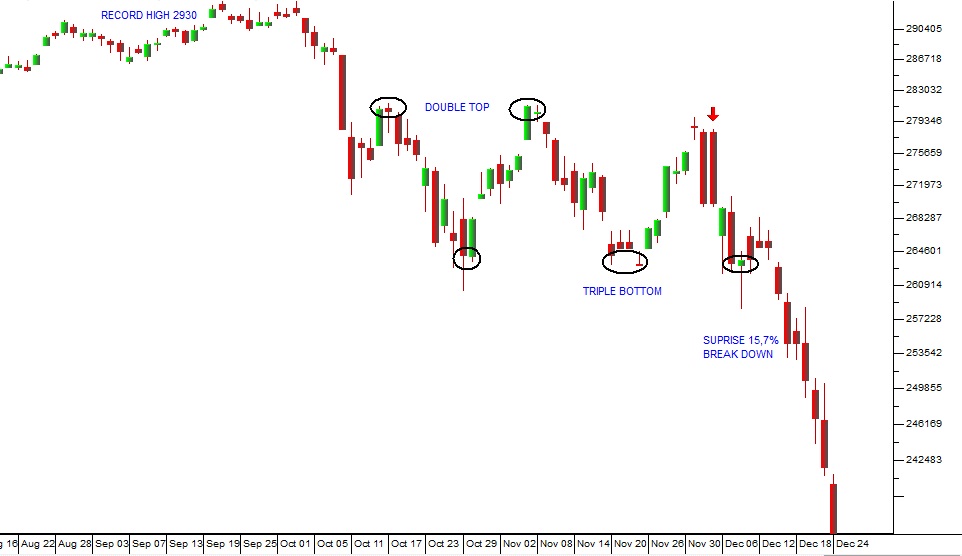

At the time of the previous article we said that we thought that the S&P500 index had found some support at its “triple bottom” at 2632 – we were wrong. Consider the chart:

S&P500 Index August to December 2018 - Chart by ShareFriend Pro

The triple bottom was broken decisively and this resulted in severe investor disappointment. At the time of writing, the S&P has fallen for 7 straight days and reached a low of 2351. This means that it has now fallen 19,76% from its record high of 2930 made on 20-9-2018 – which takes it dangerously close to a technical bear trend (anything above 20%). There is no especially good reason for a 20% decline or more to be considered a bear trend – but that is the convention. There are three points that make this December collapse notable:- Normally, December is a good month for stocks. It is extraordinary for December to be a down month – and we cannot recall another December which saw this type of fall.

- December is typically characterised by low volumes traded, because most investors and traders are on holiday. Volumes can be down by half or more, especially in the week before Christmas and between Christmas and New Year. This implies that the fall we are seeing represents only a fraction of the investing public’s opinion.

- None of the other markets appear to be following Wall Street down. Since the 2970 cycle high on 3rd December, the S&P has fallen by 15,7%. Over the same time period, the FTSE is down only 5,3% while the JSE is actually up.

← Back to Articles