Kore

14 October 2024 By PDSNETMining exploration ventures are typically very high risk and difficult to evaluate. This is especially true if the venture is located in a country which has a history of being politically volatile and unpredictable. Kore Potash (KP2) is such a company. It is attempting to bring a massive potash deposit in the Republic of Congo (ROC) into production.

Potash is the essential ingredient of fertilisers required for many crops. It is in demand to boost crop productivity as the world’s demand for food grows.

Back on 29th January 2019, Kore announced the completion of a definitive feasibility study (DFS) done by a consortium of French engineering companies. The DFS showed an internal rate of return (IRR) of 17% at a price of $350 to $360 per ton generating a free cash flow from the operation of about $500m per annum. The average operating cost is under $62 per ton.

Since that study was done, the potash price has declined to about $286 per ton, but with Kore’s two deposits (Kola and Dougou) able to produce at prices around $62 per ton the operation remains immensely profitable.

The problem is that these deposits are located in the ROC which is dominated politically by the 81-year-old Denis Sassou Nguesso who is a virtual dictator. This makes the investment of capital to exploit the potash deposits potentially highly risky.

From an investment perspective it is also very difficult to accurately evaluate both potential of the potash deposits and the political developments in the ROC. Kore is still in a development phase. It is not producing anything yet and so is unprofitable. It is being sustained by raising capital and has listings on the Australian Stock Exchange (ASX) and the JSE.

In its latest financial statements for the six months to 30th June 2024 the company reported a loss of $528 636 – and cash in the bank of $959 956. The company is negotiating with the Power Construction Corporation of China to obtain further funding.

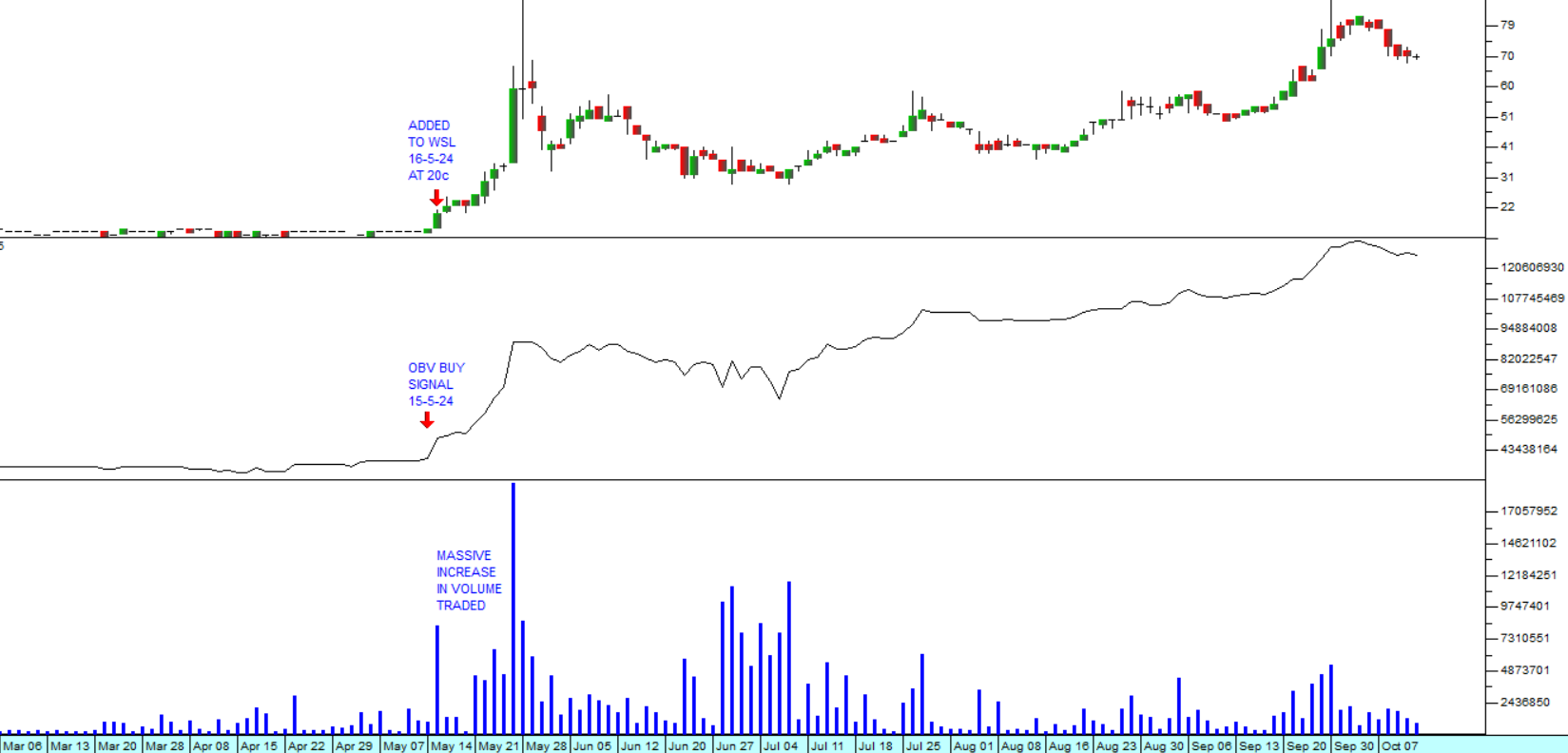

Considering all these factors, the primary reason that we added KP2 to the Winning Shares List (WSL) was technical. We observed a strong On Balance Volume (OBV) buy signal on 15th May 2024. Such a signal occurs because of a large increase in volumes traded with a small increase in price. It shows that an insider is mopping up all the loosely-held shares available in the market.

Every company has insiders who are usually people in senior management with access to privileged information about the company’s prospects. Inevitably, some of these insiders will use that information to trade the share to their advantage before key information is made public. Thei activity shows up in the OBV chart and the observant private investor can sometimes use it to generate a significant capital gain. Consider the chart:

There are three charts here which all use the same timeline on the X-axis. The top chart is a standard candlestick chart of daily price action. The middle chart is an OBV chart, and the bottom chart is a histogram of the daily volumes traded.

The first point to note it that prior to 15th May 2024 the volumes traded were relatively low. For example, our calculations indicated that in the 30 trading days to 14th May 2024 (Tuesday), an average of 854 476 shares were traded each day. The next day (Wednesday 15th) a massive 8,432 million shares changed hands. Accompanied by a jump in the price, this immediately triggered a strong OBV buy signal and we acted on that to add the share to the WSL.

Since we added KP2 to the WSL it has risen 250% to 70c per share. This gives it an annualised return of over 600%.

Now clearly, KP2 is not a blue-chip share. It has no profit history and subsists on capital that it raises from a variety of sources. Despite this, it has given astute private investors the best single stock opportunity on the JSE for many, many years.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: