The Confidential Report - May 2020

6 May 2020 By PDSNETWall Street

It is becoming clear that the lack of nation-wide response to COVID19 in America is now endangering the entire world economy. It is apparent that the virus is going to have a much greater and more prolonged impact in the US than was originally expected. This is mostly because of the patchy lockdowns and the state-by-state response. There have been no useful nation-wide directives emanating from the president's office and a complete absence of a uniform response. This has made the US the worst hit country with the highest infection and death rate. This will impact on the recovery of the rest of the world which depends on America to lead the way economically.

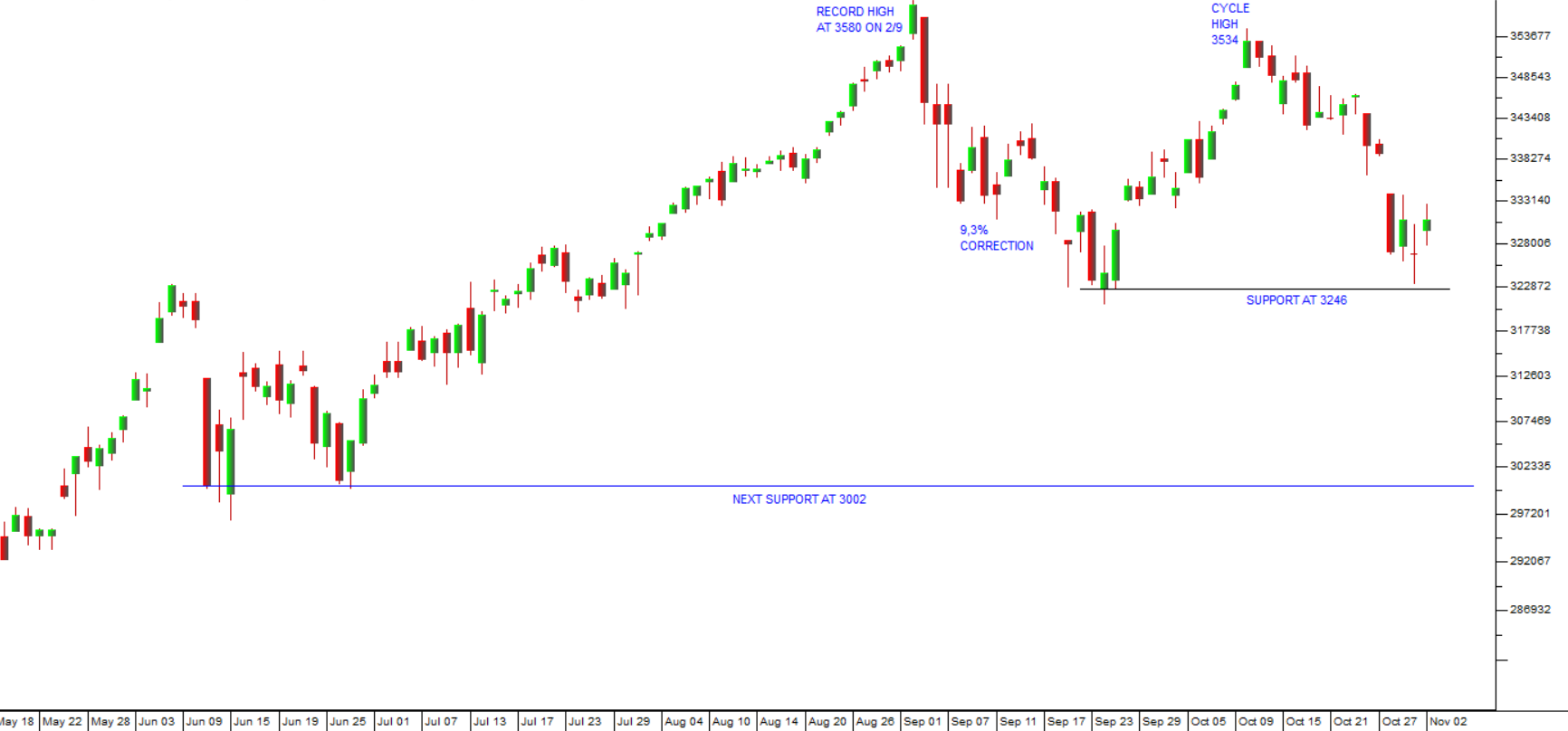

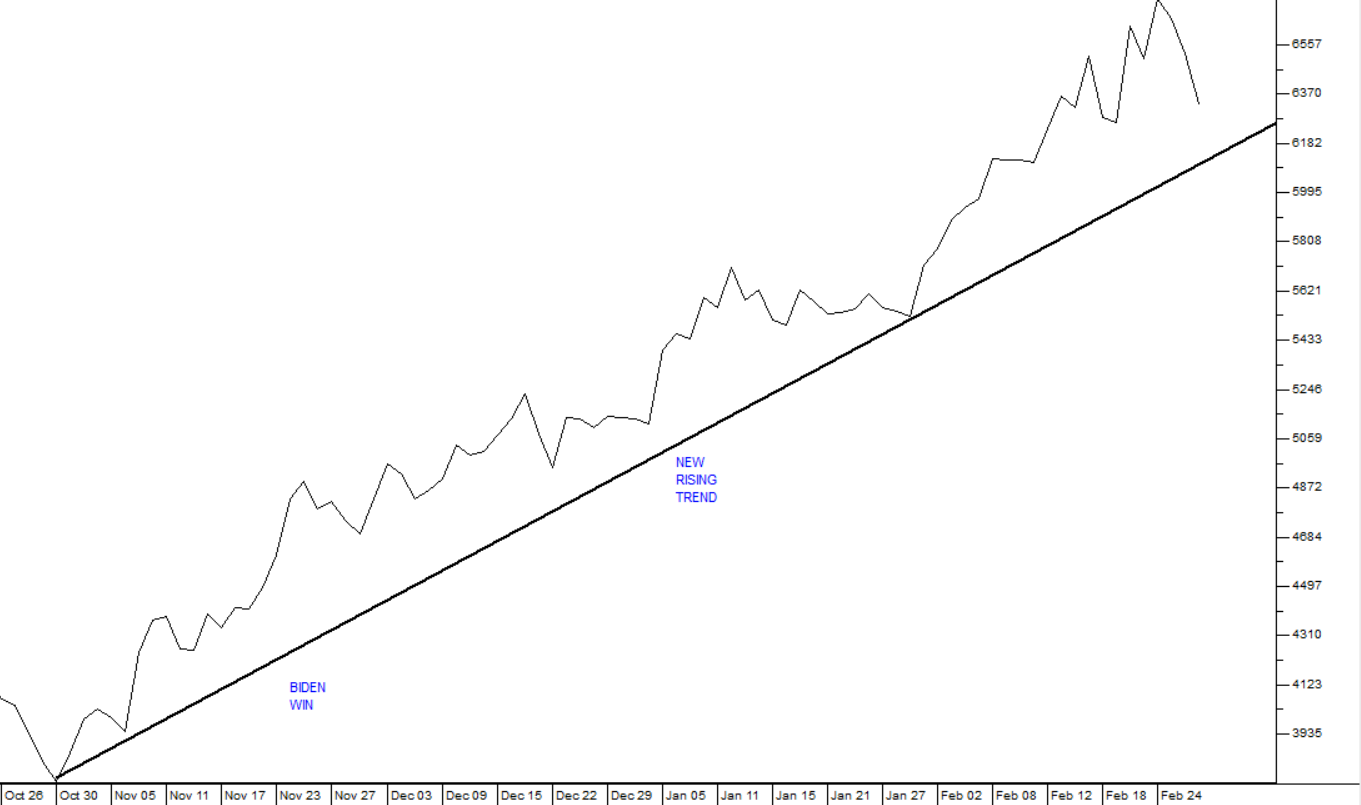

April month was one of the best months in the history for the S&P500 index, but it was followed on Friday (01-05-2020) by a 2,8% slump. The sudden downturn was caused by two things: (1) an unexpected drop in the sales of Apple iPhones especially in China and a profit warning by Apple; (2) Donald Trump's talk of more sanctions and a renewed trade war with China. Clearly, Trump is trying to divert attention from his catastrophic management of the pandemic but his words nonetheless negatively impacted investor sentiment. After the strong run-up in April, probably some sort of correction was inevitable, even healthy - and, in our opinion, the recovery in the S&P should continue. In March 2020, while the S&P was still falling, we predicted a V-bottom and rapid recovery of the S&P. We suggested then that the bear trend and recovery would follow investor perceptions of the progress of the virus rather than the normal bear trend pattern. Consider the chart:

Countries all over the world from Italy to Spain and Germany are announcing gradual relaxation of their lockdowns - indicating a return to normality probably by the end of this year. Stock markets always move ahead of economies, so the S&P is recovering in anticipation of a general recovery in world economic activity. The chart shows that the recovery is not quite as steep as the fall, but it still qualifies as a V-bottom, in our opinion.

The Economy and COVID19

The decision to extend the lockdown for a further two weeks to the end of April 2020 followed by the staged unwinding process cannot have been an easy one for President Ramaphosa. For thousands of small businesses, especially those which are client-facing, the news of these developments must have sounded their death knell. Small business is the largest employer in South Africa and much of the lockdown's damage will go unrecorded in the informal sector. The crux of the suffering is being felt in our numerous informal settlements which are the whip-end of economic contraction. There, starvation is becoming a constant reality and driving force.

The Rupert and Oppenheimer families' Sukuma Relief Program aimed at helping small and medium-sized businesses (SMME) has been overwhelmed by more than 10 000 applications for at least R2,8bn in support. It has been forced to stop taking additional applications. This is a clear indication of where the axe will fall once the lockdown is over. Tens of thousands of small businesses are becoming insolvent, resulting in a massive increase in unemployment. Some experts are now suggesting that unemployment could reach as much as 50% of the available workforce.

Because the situation is unique in history there is no way of knowing what the ultimate fall-out will be, but one point is clear, those businesses and individuals who were debt-free and had some reserves to fall back on will survive best, while the 9 million credit-active consumers in this country who were already behind on their repayments face a bleak future. A survey by Stats SA indicates that 42% of businesses do not have the funds to survive through the Corona pandemic.

The economist Ricardo Hausmann has stated the "Hobson's choice" which faces governments around the world and here in South Africa. He asks, "Do you let 10% of your population die from COVID19 or 100% die from starvation?" Lockdowns are obviously not economically sustainable but allowing the virus free reign is also not really an option. In South Africa's case, all we are trying to do is to buy time to get sufficient field hospitals and intensive care facilities organised to cope with an expected tidal wave of infections. According to the experts, that tidal wave will reach us in September - and already we can see that the number of cases and deaths is beginning to spike upwards. It's becoming clear that the lull in new cases and deaths for the first three weeks of April was just the calm before the storm. The advent of winter is an exacerbating factor. The virus spreads most rapidly and is most virulent at a temperature of 3 degrees Celsius.

The main problem with a lockdown is that it is not targeted. The entire country is locked down rather than just those places, known as "hot spots" where the virus has taken hold. The key to this problem is obviously testing. Right now, we don't really know who in South Africa is infected and who is not. Asymptomatic carriers of the disease are spreading it before they even know that they have it. Testing has been increased rapidly, with 12000 tests now being done each day, but the virus is still gaining ground rapidly. The plan is to ramp testing up to 36000 a day. As we increase the rate of testing, we are uncovering new hot spots and more cases. The President has deployed 10000 field workers to undertake home checks and screen for COVID19 so we are doing what we can. South Korea has provided the best example. They launched a massive testing campaign almost immediately after the virus took hold and the result is that they now have it virtually under control. China did a similar thing.

The impact on the economy is difficult to assess. Certain industries are clearly doomed - such as the airline industry and the restaurant business. Can Famous Brands, Spur, Comair and other smaller companies in these industries survive? At the moment, that seems unlikely. Are we looking at the ultimate demise of shopping centers? Will consumers return to these construction and financial behemoths once the restrictions are lifted? Probably not in the same numbers - and the drop in footfall could easily make them unsustainable. Does the new extended Fourways Mall still make financial sense? And what of the sports industry - will people ever again crowd into a massive stadium to watch a cricket or football match? Even after restrictions are lifted, will South Africans dare to go to a restaurant or board an airplane? If these industries do survive, it must surely be as a shadow of their former selves or in some radically changed form.

Other industries may well benefit from COVID19. The most obvious of these is the IT and telecommunications sector. Data usage has ramped up significantly during the lockdown with all service providers noting sharp increases. Businesses and consumers are adapting rapidly to the new normal. Some institutions that were central to our culture are disappearing while others are gaining much wider acceptance. The whole "work-from-home" ethic has taken hold. A trend which was in its infancy before the pandemic has now suddenly becoming the only viable way forward. All companies are finding ways to allow their employees to do things from home wherever possible. The rapid move towards online buying which was previously at less than 2% of retail spend is gaining momentum rapidly and will accelerate as consumers are allowed to receive deliveries at home in due course. All of this will reshape our society and economy quite significantly - resulting in the demise of some businesses and the emergence of others. From a private investor's perspective, it is important to try to identify the direction in which things are moving. For example, cheap as shares are, industries which do not or cannot embrace and adjust to the new normal, will probably turn out to be bad investments while others will flourish in their place.

And then there is the impact of the pandemic on the ANC and our politics in South Africa. It is becoming more and more clear that one of the victims of COVID19 is the post-apartheid ANC of the past 25 years which culminated in the Zuma/Gupta disaster. What will emerge is probably a leaner and more efficient government, no longer deeply divided between the Zuma and Ramaphosa camps. The pandemic has consolidated and entrenched Ramaphosa's leadership in a very decisive way by demonstrating his consummate ability to run the country during a crisis. We believe that in the future economic anomalies, like ubiquitous corruption, the nepotistic and excessive civil service, the ever-narrowing tax base and the dominance of the labour unions, will be reviewed and altered hopefully for the better. Populist solutions are likely to take a back seat to the simple imperative of economic realities. The plethora of red tape will be simplified, while bureaucratic inefficiency and corruption will be reduced. We believe that our society will emerge more unified and less racially divided - which can only be good in the longer term. One point which South Africans should pause to consider - how would it have been if COVID19 had struck when Zuma was President and his sycophant, Malusi Gigaba was Minister of Finance.

SARS commissioner Edward Keiswetter says that the measures taken to counter COVID19 will have a substantial negative impact on tax collections in the 2019/2020 tax year. Economists are suggesting that the government deficit could be as high as 10%. Obviously, this will make it that much more difficult for South Africa to recover from the legacy of state capture. The Reserve Bank is now estimating that the lockdown could result in South Africa's GDP shrinking by 6,1% in 2020. The Bank has cut interest rates by a further 1% in less than a month to help revive the economy. It also expects that inflation will fall to as little as 3,5% this year. The Reserve Bank is also urging commercial banks to halt dividend payments and payment of bonuses to executives to give them more room to lend. The rand has reacted negatively to the further drop in interest rates, but not by as much as might have been expected. It is also interesting that the Reserve Bank expects growth in 2021 of 2,2% - which means that it expects the economy to rebound off a low base next year.

The government has done what it can to compensate for the economic impact of the lockdown. On 21st April 2020 President Ramaphosa announced a R500bn relief package which should help to alleviate some of the stress, but inevitably it will not be enough. Social welfare grants have been temporarily boosted and food parcels are being distributed in informal settlements. At the moment the government pays out about 18 million welfare grants for everything from old age pensions to child support. Those grants cost about R16bn a month. In many cases a single welfare grant supports an entire family. The idea is to add R250 a month for the next three months to what is put into recipients' bank accounts. This would help the poorest of the poor get through the tough times and it will help stimulate the economy. The cost to the fiscus is expected to be around R9bn a month.

The impact of the lockdown on Eskom will be significant. The demand for electricity has dropped sharply as businesses and factories close. This means that Eskom's revenue will also decline. As a result, Eskom has declared a force majeure in its contracts with various independent power producers (IPP) as well as coal suppliers - and they are contesting this. Once the lockdown is over, it is expected that electricity demand will rise slowly back to previous levels. The lower demand has allowed Eskom to shut down some of its power generation for much-needed maintenance which probably means that load shedding will not be a major factor as the economy recovers.

The inevitable downgrade by Moody's to junk status came at the worst possible time for South Africa, and yet no one can say that Moody's was not patient enough. It has taken them 3 years to reach this decision and it was never based on the impact of COVID19. In our view, the downgrade will continue to impact the rand for several months as international funds re-orientate away from investments in South Africa. However, in the first auction of R4,5bn worth of government bonds on 31-03-2020, following the downgrade, demand for our debt instruments has been high. Of course, the fall of the rand has made our bonds much cheaper for overseas investors. The latest auction of government bonds took place at yields above 10% for 5 and 10-year bonds - which may prove difficult and expensive to sustain in the longer term. The downgrade will hamper and slow the recovery from COVID19. It is important to grasp that the downgrade is the result of the slowness of reform since the Ramaphosa administration took over. And that in turn was the direct result of him being impeded by members of the Zuma camp still active within the government. One of the good effects of COVID19 will be that President Ramaphosa has been able to strengthen his political position and his popularity - which should allow him to remove some of these dissident elements.

It has become clear that the real economic pain of COVID19 will only come during the second half of the year as the lockdown is gradually lifted. That is the time when, as South Africa desperately tries to re-establish economic growth, we will be beset by a deluge of small and medium business failures. We can expect a spike in liquidations and insolvencies. And then, perhaps, towards the end of the year, the economy will begin its recovery - off a very low base. All of that, however, also depends on the rest of the world getting into control of the virus. Right now, America's response has been disjointed and patchy - which means that they now boast the highest infection and death rates in the world. Together with their lockdown, this will severely impact the US economy, and with it the rest of the world, including us.

Economists often talk about production capacity as an important constraining factor to growth, but as South Africa (and the rest of the world economy) recovers from COVID19, there will be a huge amount of surplus production capacity - which means that the ramp up to full production should be rapid. Already trained employees will take up positions in factories which are already built and equipped. There will be no need to finance and build new capacity for some time. That is why we believe that there will be a V-bottom in stock markets - rather than the usual protracted "saucer bottom" after a bear trend.

The decision by The Foschini Group (TFG) not to pay its rents at the end of April because of the lockdown raises a new and potentially dangerous precedent. Most landlords have accepted that they have to allow their tenants some sort of indulgence over the next three months. Obviously, everyone, including landlords, has to cope financially with the fall-out of the lockdown. If too many companies follow TFG's example, some of the real estate investment trusts (REIT) with large South African portfolios could find themselves in dire straits. TFG says it has taken legal advice - so obviously they have some sort of a case, maybe based on a force majeure, but our view is that all they really hope for is a brief respite. In the meantime, some of the weaker REITs, in an industry that is already under enormous pressure, and those with excessive loan-to-value (LTV) ratios may end up in liquidation.

COVID19 has thrust the government's February 2020 budget into the background and with it the conflict over the civil service wage agreement. It is now apparent that no pay increases were put through for civil servants on 1st April 2020 - which means that the government has reneged on its three-year agreement with the civil service unions. The purpose of holding back the pay increases was to save the fiscus about R38bn and the unions have threatened the government with everything from strike action to litigation. COVID19 makes strike action impractical at least for the time being, but ultimately we can expect a court action based on the three-year agreement. The government may be forced by the courts to comply with its agreement despite its parlous financial position. Some economists expect the government debt to reach as high as 10% of GDP this year and the Reserve Bank is expecting GDP to shrink by 6,1%.

Amazingly, the government is still trying to rescue SAA. SA Express has been unceremoniously dumped into business rescue with "no prospect of recovery". So its R2bn of debt will have to be written off. SAA's business rescue practitioners have issued a proposal in which all staff were to be retrenched by the end of April 2020 with retrenchment packages dependent on the availability of funds after the winding down process. Apparently, there are insufficient funds to pay salaries after the end of April and the liquidators are saying that, if employees do not accept their winding down proposal, they will be forced to apply to the courts for an urgent liquidation. Despite this there are still efforts by public enterprises minister, Pravin Gordhan, and the unions to save the airline. The idea is to develop a new financially viable airline - and that there could be no further dependence on the fiscus for funding. The Public Finance Management Act gives Gordhan the final say in SAA's fate. It is hard not to see this effort to save SAA as absurd.

The Land Bank's default on its debt obligations puts an already overstrained fiscus into an unbearable position. If they don't make good on their government guaranteed loan obligations then lenders generally may think that none of the government-backed debt held by state-owned enterprises will be honoured - which will lead to a massive downgrading and much higher costs of obtaining further debt in the future.

Most companies in South Africa are in survival mode which means cutting costs wherever possible and includes making some staff redundant. This will impact significantly on the unemployment rate. In a survey by Willis Towers Watson, 41% of companies are considering retrenchments. Clearly, the economy is shrinking rapidly, but it will retain its basic structure and should be able to grow fairly quickly as the lockdown is phased out. Hopefully, by the end of 2020, the health crisis will be substantially behind us and we can begin to return to some semblance of economic normality. And then there is the hope, hinted at by President Ramaphosa, that he will take the opportunity to remove some of the structural impediments to economic growth that have dogged the economy for the past decade leading to faster growth.

Harsh as it is, the effect of COVID19 has been and will be to clean out all the weaker businesses - those with no cash reserves and whose businesses have been the worst impacted by the pandemic. So what can private investors learn from this pandemic? Three important lessons come to mind. Firstly, both businesses and individuals should always strive to minimise debt and accumulate savings - because the future is always going to be uncertain. No one can predict what new "black swan" event is waiting down the road. The second important lesson is to pay attention to the quality of a company's income. What percentage of it is received in the form of debits orders or regular monthly retainers? A company's annuity income is what will get it through even the worst crisis. So, when you look at a share ask what percentage of its monthly income is guaranteed. Companies that start every month from zero and have to sell through their overheads are most at risk. Finally, the overwhelming importance of having an effective stop-loss strategy has been made abundantly clear. Stop-loss is one of the great advantages that private investors have over big institutions. If Old Mutual had known about the corona pandemic three months before it struck, it is doubtful that they could have sold more than a few percent of their portfolio - because they were holding trillions of rands worth of shares at the time. If they had tried to do this, they would simply have caused the bear trend to come earlier. But your R20 000 or R50 000 will not move that share one cent. In the share market being small is a huge advantage.

The Rand

One of the clearest and most powerful impacts of the pandemic has been a massive wave of risk-off sentiment amongst international investors. Huge quantities of international money have fled emerging markets and moved to safe havens like gold and the US 10-year treasury bill. These secure investments either offer a zero return like gold or even a negative real return like US T-bills. The impact on the rand has been dramatic - it has fallen by 23% in two months. The rand, because of its relative liquidity, is generally the emerging market currency of choice among international currency speculators. This means that major shifts in world investor's sentiment tend to affect it more than other emerging market currencies - in both directions. The shift to risk-off sentiment was made worse by the impact of the double downgrades, first by Moody's to junk status and then by Fitch. Consider the chart:

You can see here that, prior to the pandemic, fairly strong support was developing for the rand at around R15.50 to the US$. The pandemic has taken the rand to R19 where it has formed a tentative "double top". It may be too early to see this as an indication of a new strengthening trend, and there may be further weakness. In our view, the rand is now probably heavily over-sold and should recover somewhat - although it may not get back to pre-COVID levels. Obviously, a weaker rand means much higher borrowing costs for the government on its debt-financing - but rand-denominated assets look more and more attractive as it weakens.

Commodities

The declaration by Richards Bay Coal Terminal of a force majeure in response to the lockdown has caused most coal producing companies to also declare force majeures. This will obviously impact on South Africa's coal exports this year and the profitability of coal companies big and small. Exxaro and Sasol have also now been forced to declare force majeures and Anglo American Coal is considering it. The coal supply to Eskom has been exempted from the lockdown in an effort to keep power production going. Obviously, coal exports are vital for the country's foreign exchange reserves. Anglo American has said that it expects to produce about 3m tons less of iron ore and 2m tons less of coal due to the lockdown.

Iron ore production has been severely curtailed by the responses of various governments around the world to COVID19. The price of 62% iron ore to China has risen to $93 per ton as a result. The Chinese economy is returning to higher production levels leading to increased demand for iron.

The price of oil (Brent) has ticked up off its low of below $18 per barrel to around $25. Some of that is due to OPEC cutting 9,7m barrels per day off production. Obviously, for the oil price to recover there must be some signs that the COVID19 outbreak is coming under control. With lockdowns in place in many countries, the demand for oil has more-or-less halved from a level which was already very weak. Nonetheless, we expect that the oil price will be an early indicator of a nascent recovery in the world economy. At this stage there is no clear indication of such a recovery.

A number of mining companies are returning to limited operations with as much as two-thirds of their staff. This applies particularly to those companies which have surface operations. Notably the return to work has been hampered by taxi operators who threatened to burn the buses provided by mining companies and by the unions who launched legal actions to prevent the return. Nonetheless, the mining industry is gradually beginning to produce again. Obviously, underground operations which require workers to be crowded into a lift are the most difficult. Anglogold is ramping up its surface operations and looks to be in a good position. It has a strong balance sheet now that it has repaid its $700m bond and is enjoying a record high rand price of gold.

Gold in rands is at a record R32162 per ounce, benefiting both from the rising dollar price and the collapse of the rand. In an article written on 24th June 2019 we suggested that the rand price of gold might be entering a new bull trend because it had broken above key resistance at $1350 per ounce. Since then, the rand price of gold has risen by 67% to R31288. During the same period the JSE gold index has risen by 123%.

This is partly because of the role of gold as a safe haven asset and partly because of the 23% decline in the value of the rand against the US dollar. Nonetheless gold shares have undoubtedly been about the best investment on the JSE over the last two months.

Companies

BANKING SHARES

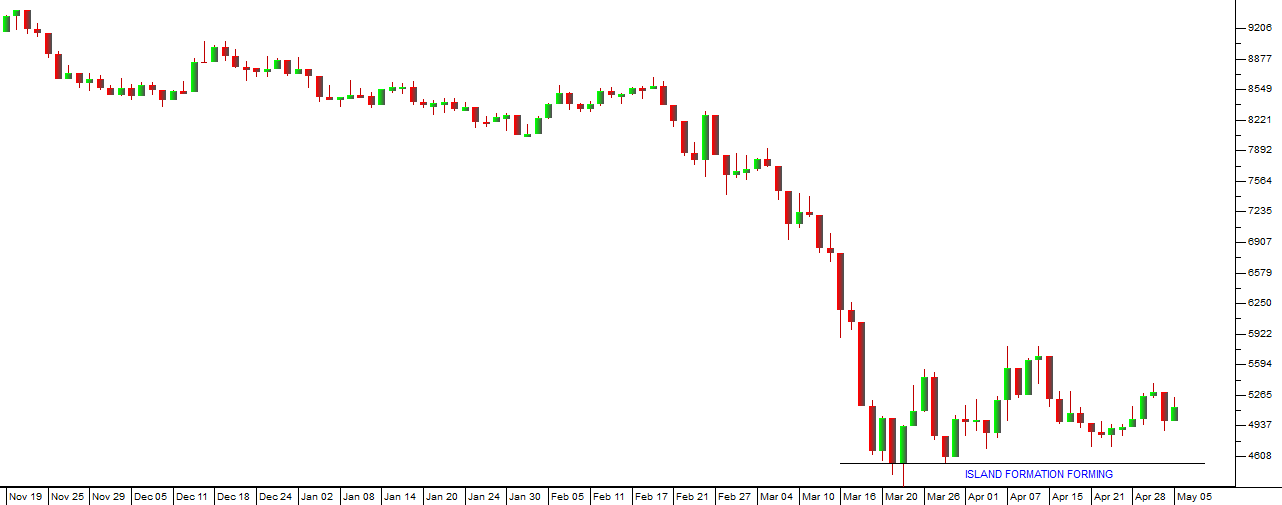

There are now many high-quality shares trading at very low prices and the private investor's problem is to find those which will give the best returns, assuming that the bear trend is coming to an end and the rally that we have seen in world markets is not a "dead cat bounce". Among the blue chips trading at huge discounts are the big banks. Nedbank is on an almost absurd P:E of 3,8 while ABSA is on 4,8, Standard at 5,4 and FNB just under 8. Way out in front is Capitec on a P:E of over 15,7. These ratings reflect the market sentiment towards the various banks. Capitec is seen as the most highly rated and is expected to be able to respond to the COVID19 crisis quickly and effectively. Of the big four, FNB is seen as the most valuable and Nedbank as the least - but there can be no doubt that all of them are at almost absurdly low levels. The only real question for the private investor is, "Has the bear trend ended?" Two things are almost certain: (1) the recovery in the share market, led by Wall Street, is looking more and more convincing; (2) if you buy now you are doing far better than those who bought in mid-February 2020. Banks are generally heavily traded, so with a strict stop-loss in place you stand to lose a maximum of 15% (or whatever level you choose as your stop), but you could make as much as 50% to 100%. Consider the chart of the banking index:

Technically, the fall due to the pandemic appears to have run its course and a solid "basing formation" or "island" has formed. Banking shares are still cheap, but they will be among the first shares to be bought up by big institutions once confidence levels increase. We believe that they are at extraordinarily cheap levels right now.

ALTRON (AEL)

The decision to unbundle and separately list Bytes UK will lead to a substantial release of value into the hands of Altron shareholders. The process is expected to take about 9 - 12 months and will result in Bytes being listed on the LSE with a secondary listing in South Africa. The listing will be accompanied by an initial public offer (IPO) to raise additional cash. Obviously, this process could be delayed or impeded somewhat by the advent of COVID19, but in our opinion this is an opportunity for private investors to make a relatively risk-free capital gain - similar to the capital gains which have been made with the unbundling of Multichoice and Prosus from Naspers. Obviously, when the two companies are separated, the Altron share price will fall. Bytes accounts for about 40% of its turnover and around 23% of its profits. However, the two shares combined are likely to have a combined market capitalisation which is greater than the market capitalisation of Altron on its own, especially as they benefit from increased focus on their respective businesses. Both companies have a strong relationship with Microsoft. Bytes is the leading supplier of Microsoft products in the UK and Altron recently won the Microsoft contract which EOH lost in South Africa.

Technically, Altron has had an interesting history. Consider the chart:

You can see here that Altron went through a difficult time in 2015 where for a while it lost direction and focus. The downward trend was followed by a classical "island formation" which was broken on the upside in November 2016. From that time the company restructured itself and obtained more focus which resulted in a protracted upward trend which only came to an end three years later in October 2019 and was exacerbated by the pandemic. The decision to split the company should release shareholder value and add more focus. We believe that the current downward trend will be relatively short-lived, despite the moving average sell signal given in February this year.

MASTER DRILLING (MDI)

Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the depressed South African mining industry and now provides services in North and South America, Europe and elsewhere. It is in the process of developing a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast and clear methods currently in use. At the moment it requires three operators, but the company is working on a completely automated remote-controlled version. On 5th November 2018, Master Drilling announced that it had formed a joint venture with an Italian construction company called Ghella which will be called Tunnel Pro. Master Drilling will own 49% of this operation which will go after smaller tunnel boring contracts and civil construction. We believe that this company has a unique and disruptive technology that will ultimately revolutionise mining world-wide. There is no doubt that the mining industry will be one of the first to recover from COVID19. Perhaps at this low price and on a price:earnings multiple of just 3,98 it represents good value.

EOH

EOH is the kind of business that should do well during the COVID19 pandemic. This is because, being an IT company, it has a very limited working capital requirement and most of its staff can quite easily arrange to work from home. In addition, much of its income is in the form of retainers paid by monthly debit order - so it has relatively stable cash flows. Against this, it is swamped by debt. Its current debt (R3bn) is about 5 times its market capitalisation (R600m). The board of directors has been desperately selling non-core businesses and cutting costs. Its most recent proposal is that directors take a 25% cut in salary and that all staff earning above R250 000 a year take a 20% cut. This will probably save the company around R50m a year. Looking at the chart, it appears that it is going through a "saucer bottom" - which could be the precursor to a new upward trend.

Here you can see the descending "double top" formation which we drew your attention to some time ago, together with its "final failure" which was followed by a steep downtrend. There cannot be much doubt that the current price is not demanding, given that it has a net asset value (NAV) of three times that amount.

Clearly, investing in this company at current prices is risky - but then it has been well said that "in the share market, if you don't feel the risk, then you probably aren't going to make any money". We believe that, if you apply a strict stop-loss strategy, this is a share with substantial potential for growth. If you buy at 380c you will at least have the great satisfaction of knowing that you did not buy it for R174 - but somebody did - because otherwise the chart does not go there (as it did in September 2016).

ZEDER (ZED)

Zeder is a PSG-controlled (43,7%) investment holding company that is focused in the food and agricultural industries. Like most investment holding companies it usually trades at a significant discount to its net asset value (NAV) or to its preferred measurement of value - sum-of-the-parts (SOTP). Pioneer has just been sold to Pepsi for $1,7bn - which gave Zeder a R6,41bn cash injection. The company is paying out R4bn of that in a special dividend of 230c per share and retaining the balance. After the special dividend the SOTP was 367c against a current share price of 185c - which is a 46,8% discount. That seems excessive to us even given the relatively pedestrian nature of Zeder's remaining assets and their exposure to weather conditions. Perhaps there is an opportunity for private investors to make a good capital gain once confidence levels begin to return.

AFRIMAT (AFT)

Afrimat (AFT) is an open-pit mining company that supplies composites, construction materials and other commodities to a range of industries in Southern Africa. Until the end of 2015, Afrimat was one of the best performing shares on the JSE. In the last three years the share has been moving sideways - reflecting the tough economic environment in South Africa, especially in the construction industry. The acquisition of the Demaneng iron mine in the Northern Cape has insulated Afrimat against the difficulties in the construction industry. The company is also looking to diversify into other base minerals like manganese, chrome and coal.

Technically it has been in a sideways market since late in 2016 and made a convincing upside breakout in July last year. The advent of COVID19 caused the share to drop dramatically, but we believe that this offers a potential buying opportunity to private investors. We see the impact of the virus as temporary and anticipate that by next year this diversified base metals mining business will be growing strongly again.

In our view, this share represents very good value at current prices around R25.

PAN AFRICAN RESOURCES (PAN)

Pan African Resources (PAN) is a London- and JSE-listed re-treatment gold producer. It has shifted most of its operation from underground mining at the recently closed Evander mine to surface operations which are obviously much cheaper. With its Elikhulu plant it will be able to produce about 700 000 ounces of gold a year at a cost of about R450 564 per kilogram against a current gold price of close to R700 000.

In its results for the six months to 31st December 2019, the company reported gold sales up 14,7%. The CEO, Cobus Loots, said, "The first six months of the year saw higher production from Pan African's high-margin operations and investment in our growth projects, with the group demonstrating its ability to reduce debt and pay dividends to our shareholders. In addition, the operational and safety performance during the current reporting period demonstrates our continued progress in positioning Pan African as a sustainable, safe, high-margin and long-life gold producer, with an attractive project pipeline." Headline earnings per share (HEPS) was 1,13c (US) up from 0,5c in 2018. Safe, highly profitable and sustainable ounces at Elikhulu have replaced those of Evander's loss-making underground operations.

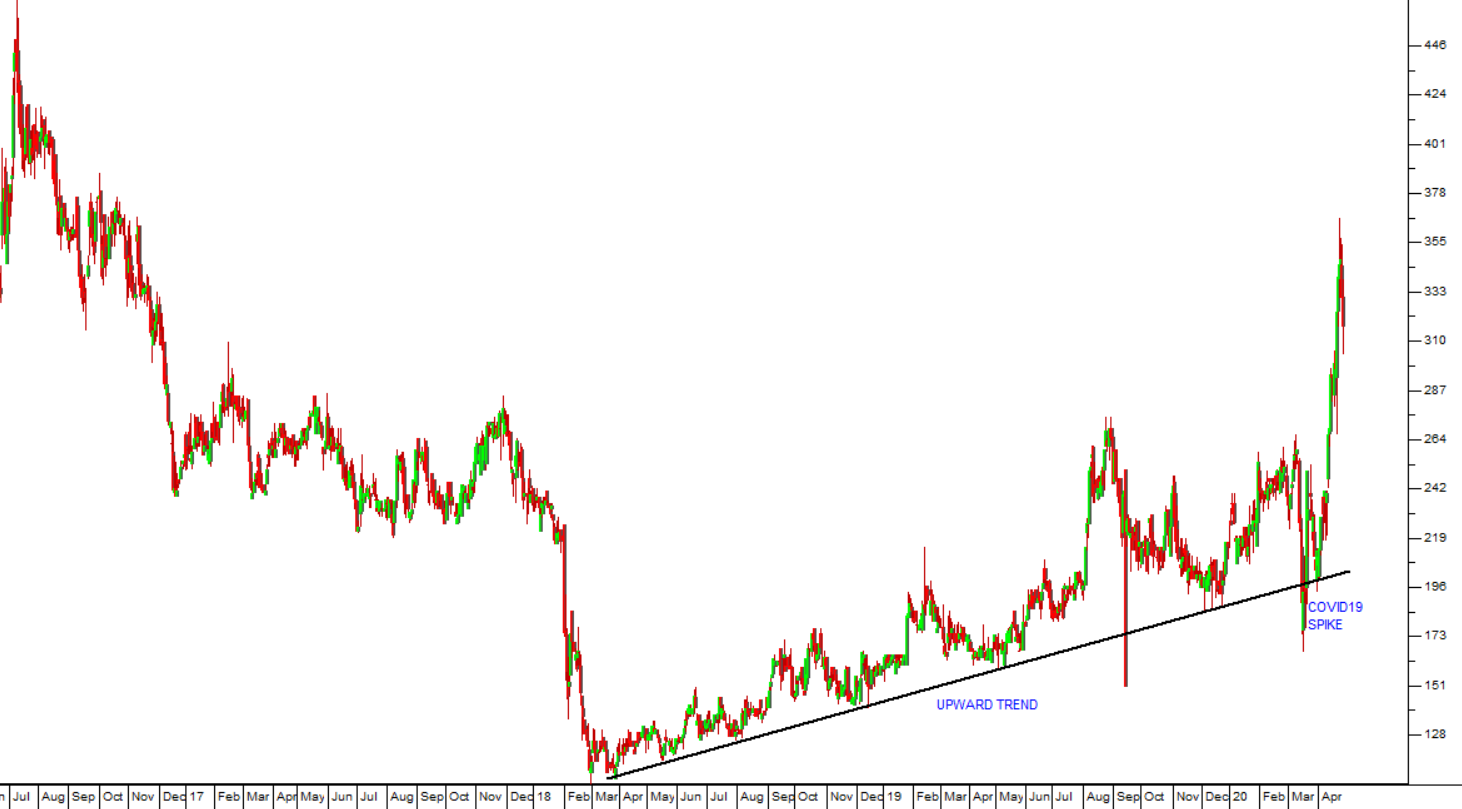

Technically, the share fell from a high of 444c in July 2016 to levels around 112c in March 2018, but since then it has been in a sustained upward trend. It looks like good value with relatively low risk. Consider the chart:

The Group's liquidity position is robust, with immediately available facilities of U$20m. Furthermore, the Group has access to an additional gold loan facilities of approximately U$11m, "should it be required". On 30th March 2020 it added, "As part of essential services, the Group is also currently conducting limited surface re-mining and processing activities at its Elikhulu Tailings Retreatment Plant and at its Barberton Tailings Retreatment Plant (collectively the "Group surface operations"). The Group surface operations are currently operating at approximately 70 per cent of normal capacity". This company will benefit directly from the rising rand gold price which is over R32 000 per ounce.

MC MINING (MCZ)

This is a small coal producer which runs the Uitkomst mine and is developing some other options. In the quarter ended 31st March 2020 the company said, "Average API4 export thermal coal prices for the Quarter of $79/t were 5% lower than the comparative March 2019 period's $83/t; and available cash at Quarter-end was $1.8 million". What makes this share interesting for private investors is that it is trading for around 200c but the net asset value is 1320c. The share traded as high as 1425c in January 2019 and it looks like it has good prospects. It has recently made a double bottom formation which suggests that the downtrend may be over. Consider the chart:

Obviously, the slump in energy prices world-wide is not good for it, but we believe that energy prices (oil and coal) will probably rise from current levels even before the end of this year.

PSG/CAPITEC

The unbundling of Capitec into the hands of the PSG shareholders will release a considerable amount of value. The stake which is 30,7% is worth about R46bn. The only possible negative is that Capitec has fallen from around R1440 in February 2020 to current levels around R900. PSG may prefer to wait until the pandemic is over and then realise a much bigger benefit. As things stand now, the Capitec holding represents about half of PSG's market capitalisation. We have always liked Capitec and believe that it still has far to go.

You can view a visual presentation of this report here.

To be added to our mailing list for the next webinar, click here.

For more up to date, expert opinions on JSE listed companies, subscribe to our online software by clicking here.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: