The Confidential Report - July 2025

2 July 2025 By PDSNETConfidential Report - July 2025

America

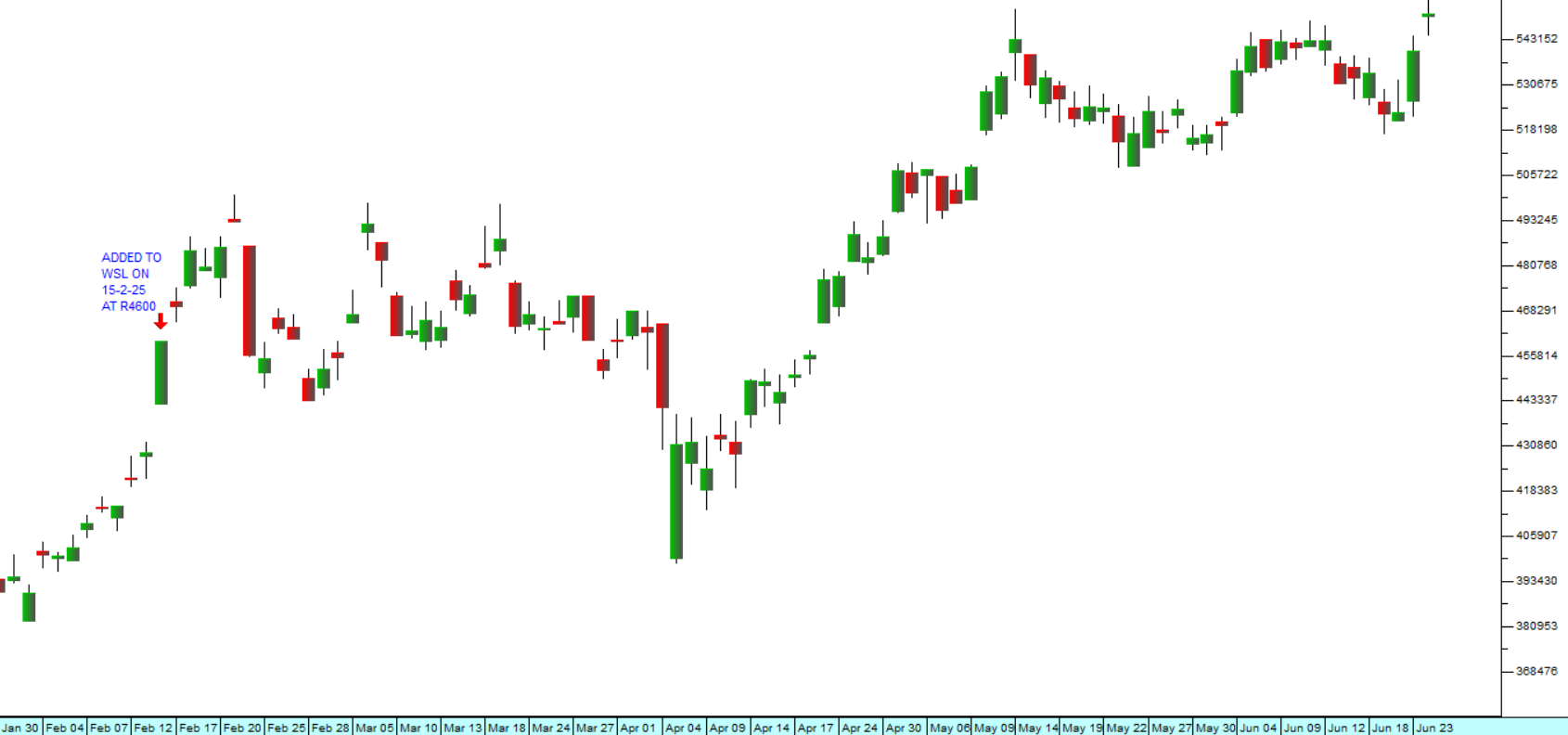

The S&P500 index closed at a new record high on Friday the 27th of June 2025, marking the end of the Trump tariff correction. Consider the chart:

As we expected and predicted the correction turned out to be a classical “V-bottom” formation – which is typical of corrections which come about as a result of extraneous influences which are abnormal for the market and are not a result of normal economic and market activities. These types of influences are “black swan” events and generally unpredictable. However, once the full scope of their impact is understood and assessed by investors, the market tends to recover as quickly as it fell, resulting in a V-bottom. The most recent similar event was COVID-19 in 2020 which was also an abnormal and unpredictable black swan event – and resulted in a very similar although slightly larger V-bottom.

Essentially, an event like this temporarily distracts the market from the underlying forces which have been driving it. Those forces are a function of the massive productivity gains which are being generated and will be generated by new technologies like AI, humanoid robotics, and the advances in solar energy. Once the event has been digested and discounted by investors their attention switches back to the more normal bullish forces driving the market. And then there is some catch-up as markets rapidly compensate for the lost time.

While the Trump tariff correction has been in force (for just over 4 months from the 19th of February 2025 to the 27th of June 2025) the impact of AI and other technologies have been gathering momentum. Notably the S&P is being taken higher by tech shares like Nvidia which reached a new record high on Friday and has risen by more than 80% from its low point in April 2025.

Our expectation, now that a new closing record high has been established on the S&P, is that markets will move higher steadily. There is usually a mini-correction after an upside break like this which sees the market come back to the previous high which then becomes a support level where it used to be a resistance level – so watch out for that. But aside from that, we predict that the S&P will continue to make a series of further new record highs and take other world markets up with it, including the JSE.

The US economy created 139 000 new jobs in May 2025 – better than the 125 000 expected but less than April’s 147 000. This shows that the US economy is still growing despite the turmoil caused by Trump’s tariffs. Nobody really yet knows what the full impact of the tariffs will be on growth and inflation, but at this stage it appears that they will be minimal and certainly far less than once feared. The jobs number shows once again that the Federal Reserve Bank is achieving its objective of a “soft landing.” The solid jobs number had a positive impact on Wall Street, taking the S&P rising back above 6000 and making the new record high, which has now occurred, almost inevitable.

US inflation came in lower than expected in May 2025 with both the consumer price index (CPI) and the core CPI slightly lower than analysts were expecting, but slightly up from the figures for April. The figure gave investors confidence that Trump’s tariffs would not have a dramatic impact on inflation – at least not in the short term. The tension between the Federal Reserve Bank and the Trump administration continues to escalate with Trump demanding that interest rates be reduced rapidly and Jerome Powell continuing to wait for data which suggests that a more rapid reduction is indicated. We expect that tension to continue and even escalate as the date for the end of Powell’s contract in 2026 draws closer. The S&P500 index responded positively to the inflation print, rising closer to the new record high which we have been consistently predicting and which has now happened.

The US monetary policy committee’s (MPC) decision to keep interest rates unchanged was expected, but the Federal Reserve Bank’s (the Fed) reduction in its growth forecast had a negative impact on Wall Street. The Fed now expects growth of only 1,4% in 2025, down from its previous estimate of 1,8% and inflation is expected to rise to 3% - up from its previous projection of 2,7%. Unemployment is also expected to rise to 4,5% from current levels around 4,2%. In its efforts to create a “soft landing” for the US economy, the bank projects two further interest rate cuts later this year but completely ignored Trump’s call for significantly lower rates immediately. There is some concern that the Fed is leaving it too late to cut rates further in this cycle. The conflict between Israel and Iran and consequent sharp rise in the oil price are negative factors both in the US and worldwide.

The results coming out of S&P companies, especially those involved in tech, have been consistently good. For example, Oracle’s results on the 11th of June 2025 caused the share price to rise by 13% as it beat forecasts both on the top and the bottom line while predicting more growth in cloud computing in the future. The CEO, Safra Catz, said that revenue from cloud infrastructure should increase by 70% in 2026.

Koos Bekker, CEO of Naspers, said recently that the AI technology revolution was similar in terms of its impact on business to the development of the steam engine and the railway in the 1800’s. He believes it will transform the whole world economy over time. We have previously pointed to the importance of the current developments in technology, particularly in AI, humanoid robotics and solar power. We believe that these technologies are the underlying driving force behind the bull trend in world markets and that their impact is only just beginning.

Geopolitical Risks

Teams from Ukraine and Russia have been meeting in Istanbul for peace talks. Both sides have drawn up draft memorandums of what they require for peace. Needless to say, they are worlds apart. In our view, Russia is not interested in achieving any sort of peace because that could lead to the overthrow of Putin’s regime. The recent successful drone attack on Russian airfields destroyed 41 Russian aircraft, especially long-range bombers, which are estimated to be worth at least $7bn. This attack demonstrates Ukraine’s growing technical sophistication in the war and must be contrasted with Russia's recent use of donkeys to transport ammunition to the frontlines.

The war in Ukraine appears to have reached something of a stalemate with neither side able to advance significantly. Friday the 27th of June 2025, marked 3 years and 124 days since the war began. On that day, which is typical of most days, Russia launched 363 drones and eight missiles against Ukrainian targets. Of those 359 drones and six missiles were shot down by Ukraine’s air defenses. It is apparent that Russia’s so-called “spring offensive” has not produced any significant results and is bogged down.

The Russian economy is teetering on the edge of recession with a sharp drop in foreign holdings in Russia which have fallen by almost 50% and foreign direct investment (FDI) down 62,5%. The situation has been made worse by government asset seizures which have seen about twelve companies nationalized in the past 3 years. At the same time, car sales are plummeting and are expected to fall by as much as 25% this year which shows that Russian consumers are taking enormous strain. Russia’s $2 trillion economy is only being sustained by the sale of oil combined with massive defense spending. The recent surge in the oil price from $60 to around $78 as a result of the Israel/Iran conflict is having a positive impact on the Russian economy. Notably, the Russian central bank has recently reduced interest rates by 1% to 20%, but rates remain very high.

It is apparent that Trump has now given up on getting the Nobel peace prize for bringing peace to the war between Russia and Ukraine. He is basically ignoring that situation and focusing on the conflict in the Middle East. In that area, there is little doubt that Iran has been trying to build a nuclear weapon for the past three years. Their heavy water facility is located in a bunker 80 meters below the surface which is designed to withstand even America’s most powerful bunker bombs which can only penetrate to 60 meters. That is not nuclear power for peaceful civilian purposes. Israel has basically done the world’s “dirty work” for it by destroying Iran’s nuclear capability. Even the other Arab countries have not intervened on Iran’s side in this conflict because they are also concerned about Iran having a nuclear weapon. Russia does not have the ability to help Iran despite the fact that Iran has been providing them with Shahid drones to attack Ukraine – Putin is happy that the oil price has popped up, but we believe that it will not remain at higher levels for long and will ultimately resume its downward trend.

The June 12th 2025 bombing of Iran’s nuclear facilities by Israel, in what it described as a pre-emptive strike to prevent Iran from becoming a nuclear power, had immediate negative consequences on Wall Street taking the S&P500 index down nearly 1% as some investors moved into “safe haven” assets like gold and US Treasury bills. Investors are responding to the increased level of geopolitical tension and uncertainty with Iran vowing to retaliate. The situation is similar to, but not as extreme as, the situation which pertained when Russia invaded Ukraine in February 2022. In that case the S&P fell 7% initially - but then recovered within a month. We do not see this renewed tension in the Middle East being as radical or impacting markets heavily.

This conflict between Iran and Israel has significantly increased risk in the international investment community. It has resulted in a sharp move towards “risk-on” which has in turn negatively impacted on the rand. The Trump administration is fully behind Israel and has entered the conflict directly by dropping “bunker buster” bombs on Iran’s nuclear facilities. This adds a whole new layer of risk to international investments. Notably, Iran’s limited supply of hyper-sonic missiles have been penetrating Israel’s “iron dome” and striking various civilian and other targets inside the country. The conflict has had inevitable negative consequences for Wall Street, but we do not believe that those consequences will be protracted, mainly because Iran’s ability to strike Israel and/or America is relatively limited and they do not appear to have the support of other Arab countries. There is also the possibility that Iran could seek to close the Straits of Hormuz which would impact the oil industry and international trade.

Political

The firing of the DA’s deputy minister of trade and industry, Andrew Whitfield by President Ramaphosa has shaken the stability of the government of national unity (GNU). The DA has called on the ANC and Ramaphosa to fire those ANC ministers who have been implicated in corruption like Nobuhle Nkabane, David Mahlobo and others. Whitfield was apparently fired for not getting permission from Ramaphosa to travel abroad – but he had written to Ramaphosa about it seeking permission and had not received a reply. The dismissal has been characterized as a “calculated assault” on the DA and a display of ANC double standards. Clearly, Ramaphosa will have to reverse this decision or endanger the continued existence of the GNU.

Operation Vulindlela, which is part of President Ramaphosa’s reform process, has turned its attention on the municipalities which are responsible for service delivery in South Africa’s major cities. What they have found is that between 2010 and 2024 their wage and salary bills have increased by 84%. The massive increase in the cost of staff has absorbed all surplus revenue, leaving almost nothing for the maintenance of infrastructure – resulting in a collapse in service delivery. This, in turn, caused the ANC to lose votes ushering in the government of national unity (GNU). Like Eskom, the major metros have bloated, inefficient and overpaid staff.

The Free-Market Foundation and the Solidarity Research Institute have produced a well-researched report on Black Economic Empowerment (BEE). Their findings are that the policy of BEE has cost South Africa R5 trillion and at least 4m jobs over the past 20 years. The report compares South Africa to Namibia and Malaysia which also implemented policies to redress past injustices, they did so without specifically discriminating against certain groups within society. BEE policies are estimated to have reduced gross domestic product (GDP) growth by between 1,5% and 3% per annum and resulted in 3,8m fewer jobs. Over the 31 years since 1994, the Black middle class has expanded to between four million and six million. The gap between the poor and the wealthy is now not so much a matter of race as it is of privilege. The politically connected elite have benefited at the expense of lower income groups. Black Business Council president, Elias Monage, has said that the report is nonsensical and is not based on proper research, but Alec Hogg of BizNews TV says that the report is “superbly researched.”

Economy

Gross domestic product (GDP) grew by just 0,1% in the first quarter of 2025 – down from the 4th quarter of 2024 when growth was 0,4%. Contractions in mining and manufacturing were compensated for by a strong performance from agriculture and consumer spending. The figure is disappointing and indicates that economic growth for the whole of 2025 might be as little as 1% - considerably less than the Treasury’s estimated of 1,4%. However, our opinion is that growth will surprise to the upside. The increase in consumer spending is a direct result of lower inflation and the rising level of real take-home pay this year. We expect that to continue to have a positive impact. Mining production was down 4,1% reducing GDP growth by 0,4%. Manufacturing production was down 2% and reduced the total growth figure by 0,2%. Agriculture grew by 15,8% and contributed 0,4% to the final growth figure.

Real take home pay (after inflation) rose by 10,7% in the year to the end of February 2025 according to BankServ’s take home pay index. The increase over the previous year is largely due to the fact that the consumer price index (CPI) is at just 2,7%. The CPI is expected to average about 3,6% for the whole of 2025. Salary increases this year from the government and the private sector have averaged 5,3% which means that workers are about 1,7% better off. The strong increases in real salaries are having an impact on retail sales which rose by 5,9% in the 4 months to the end of January 2025. Other positive factors have been the advent of the two-pot retirement system and the drop in interest rates.

BankServ’s economic transactions index (BETI) shows that the value of transactions increased in May 2025. The index climbed from 136,2 in April to 138,3 in May – after allowing for inflation. The BETI is 1,4% higher than it was a year ago. The number of transactions was 176,3m up from April’s 167,9 and the average transaction size increased to R7618 compared to R7485. The average of salary increases this year is expected to be between 5% and 6% while inflation is only 2,7% - so spending power is rising.

The disappointing growth figure for the first quarter of 2025 resulted in Nedbank cutting its forecast of growth for the full year to just 1% - down from their previous forecast of 1,4%. The modest growth is expected to be driven by modest growth in consumer spending given the low level of inflation. Structural problems especially in Transnet’s rail and port facilities is a major impediment while growth in the agricultural sector may not be sufficient to overcome the negatives as it did last year for a second time.

Standard & Poors (S&P), the international rating agency retained its stable rating on South Africa in May and expects the economy to grow by 1,3% this year. This is in line with the other ratings agencies (Moodys and Fitch) and indicates a slightly more positive stance. Moody’s has also recently predicted that the economy will grow by 1,8% by 2027 with government debt at around 80% of GDP. Moody’s believe that Trump’s tariffs will only have a slight impact on the SA economy because they affect only 2% of our GDP. There are still major problems with the rail infrastructure and the inefficiencies at state owned enterprises (SOE) which are holding the economy back, but S&P is positive about the impact of the GNU and the DA’s role in pushing economic reform from within it. The current growth rate still is not sufficient to result in an improvement in living standards, but the country does have low inflation and strong current account. Obviously, if the country can work its way back towards an investment grade rating it would be enormously beneficial.

The unemployment rate increased to 32,9% at the end of the first quarter of 2025 when compared with the last quarter of 2024. The economy lost 74000 jobs, bringing the total number of people employed in the formal sector to 10,579m. Trade lost 52000 jobs while community services lost 17000 and mining 4000. Manufacturing added 2000 new jobs. Year over year, the total number of jobs declined from the 31st of March 2024 to the 31st of March 2025 by 0,9%. The economy is hardly growing with business confidence at low levels. Uncertainty over the budget process increased the level of uncertainty in the economy and caused growth to slow. The second quarter is expected to be better.

The increase in the fuel levy (4,01c per litre on petrol and 3,85c on Diesel) which came into effect from Wednesday the 4th of June 2025 will raise approximately a further R4bn – not enough to compensate the government for the loss of revenue from the elimination of the 0,5% VAT increase. Obviously, raising VAT would have impacted poor people in South Africa and its removal is a relief for them – but raising the cost of fuel will also impact the poor, most of whom spend a large percentage of their income on transport.

The CEO of Capitec bank, Gerrie Fourie, recently commented that the unemployment rate in South Africa is much lower than the official figure of 32,9%. He said that the true unemployment rate could be as low as 10% because self-employed people in the informal sector are not included in the official figures. This supports our long-held view that the official unemployment rate is incorrect. Basically, the informal sector is a euphemism for tax evasion. Millions of people conduct small businesses, mainly for cash, and do not submit tax returns. Fourie points to Mexico which is an emerging economy similar to South Africa, but with a much larger informal sector and a much lower unemployment rate. He says that the government should be encouraging the informal sector. Capitec regards it as a major source of new customers as more and more people adopt digital banking.

The Reserve Bank Bulletin is published every quarter and gives details of South Africa’s gold and foreign exchange reserves. The latest bulletin shows that our gold holdings have almost doubled in value since 2015 adding $7bn to the country’s reserves. This is primarily due to the sharp rise in the gold price especially after it broke up through resistance at $2060 in March 2024. In February 2024 the Bank agreed to transfer R150bn of this gain to the Treasury to reduce its borrowings. The bulletin also reported that during the first quarter of 2025 there had been an inflow of nearly R37bn into South Africa following the previous quarter’s outflow of R9,5bn. Much of this was foreign direct investment (FDI). The inflow added to the increased value of our gold holdings has resulted in the rand strengthening steadily. This in turn reduces the level of inflation because the price of fuel comes down which benefits everyone.

In its review of financial stability for the period since November 2024 the Reserve Bank says that the SA economy is doing well in the face of rising geopolitical uncertainty. A positive factor is the probability that SA will be removed from the Financial Action Task Force (FATF) grey list in October this year, but the outflow of R111bn of foreign capital from the equity market shows that investment sentiment has shifted to “risk-off” with a potential negative impact on the rand. Nicola Brink, head of the Bank’s stability unit says that the level of uncertainty in the world economy is similar to what existed following the COVID-19 crisis in 2020 due to Trump’s “Liberation Day” tariffs and the latest conflict in the Middle East.

South Africa is running at a profit with the trade account recording continuous surpluses as our export revenue exceeds the cost of imports. In the first quarter of 2025 the surplus was R221,2bn – slightly less than the 4th quarter of 2024 which had a surplus of 226,4bn – or about 3% of gross domestic product (GDP). South African exports in April 2025 were R166,2bn against imports of R152,1bn resulting in a trade surplus of R14,1bn. This was considerably lower than the March surplus - which was R22,6bn – but still a surplus which basically means that the country is operating at a profit. Mineral exports were lower while imports were up. Obviously, we are benefiting from the higher price of gold because of its role as a safe haven asset. The impact of trade negotiations with America and its stated 25% tariff on vehicles and vehicle parts is not yet known. These figures show that South Africa’s economy continues to be “export-led”, dependent on our exports of minerals and agricultural products. The strengthening of the rand over the past five weeks to around R17,74 to the US dollar will make our exports more expensive on world markets while making imports into South Africa cheaper. Imports are already rising in response to the steady increase in real wages and salaries. We believe that the trade surplus will continue to narrow during the rest of 2025 and into 2026.

Manufacturing in the second quarter of 2025 has been weighed down by high electricity costs, political uncertainty and skilled labour shortages. Water outages in Gauteng have been a negative factor. International uncertainty has impacted on demand for exports with the conflict between Israel and Iran. Positives include the recent 25 basis point reduction in interest rates and the abandonment of the VAT increase in the budget. Manufacturing confidence remains at low levels - 33 out of a possible 100. The survey conducted by the Bureau for Economic Research collates responses from 700 manufacturing businesses.

Retail sales increased by 5,1% in the year to the 30th of April 2025, a big jump from the 1,2% recorded in the year to end-March 2025. General dealers (including supermarkets) got the lion’s shares of that with a 5,3% gain while clothing retailers got a 12,5% gain. Seasonally adjusted, sales were up 0,9%. Two-pot withdrawals had an impact as did the low inflation rate which has increased the take-home pay of salary and wage earners. Obviously future retail sales will be negatively impacted by the fact that the budget made no adjustments for “bracket creep” and Eskom’s 12,7% price increase.

New car sales in May month came in at 45308 – up 22% on a year ago. May was the 8th consecutive month of year-on-year gains in sales. After the first five months of 2025, sales are up 12,6% on sales for the first five months of 2024. These figures exclude 12 of the 24 Chinese imported brands that do not report their figures. Car sales were up by a strong 30% while bakkie and minibus sales were down on last year. In May last year sales were depressed by the national elections – so the growth is a little distorted. Falling interest rates and the rise in real incomes due to lower inflation are positive factors. Negatives are the failure of the budget to adjust for “bracket creep” and Eskom’s 12,7% price increase. Vehicle exports were down 14,6% on last year.

Afrimat’s construction index lost 2,6% year-on year in the first quarter of 2025 showing a continued slow-down in construction. This is due to the high level of interest rates and the government’s low level of infrastructure development. Heavy rainfall in some areas has also had an impact. Afrimat claims that construction is the most labour-intensive sector in the economy and blames the high level of interest rates for much of the problem. Interest rates are coming down but are not yet at levels which encourage new spending on major capital projects.

South African mining output shrank by 7,7% in the year to the end of April 2025 – far worse than the 4,3% contraction that economists were predicting. Low commodity prices, rising costs and continuing problems with Transnet’s logistics are the cause. Mining accounts for about 6% of gross domestic product (GDP) so the poor April figure will impact economic growth and could even make it negative following its meagre growth of just 0,1% in the first quarter of 2025. Eskom’s 12,7% price increase this year has pushed mining costs up substantially making our mines less competitive in world markets. Production of platinum group metals (PGM) was down a massive 24% as producer cut back in response to uncertain markets and the spread of electric vehicles (EV). Sibanye is considering closing unprofitable shafts. Obviously the decline in production will also impact tax revenues this year and affect the budget.

Manufacturing output shrank by 6,3% in the year to the end of April 2025 for the 4th consecutive month. Food and beverages was down 7,6% while iron and steel were down by 6,3% and motor vehicles production was down by 13%. Despite this output in April month itself was up 1,9% from March. The decline in manufacturing production impacts directly on gross domestic product (GDP) because it is 13% of GDP. The slowdown in demand from overseas buyers has had an impact due to the uncertainty around Trump’s tariffs. A further indication of declining manufacturing production came in May 2025 when the ABSA purchasing managers’ index (PMI) dropped to 43,1 – down 1,6. This is the 7th month that the index has fallen and shows how weak the demand for South Africa’s manufactured goods is. Transnet’s logistics remain a major problem. It is now almost a year since the government of national unity (GNU) was appointed and there is still relatively little evidence that the economy or job creation have improved. The employment index which is part of the PMI was at 40 indicating a 14th month of job contraction in the sector.

Transnet’s deal with the unions for a 6% wage increase for the next three years is more than double the current inflation rate of 2,8% and come after the state-owned enterprise (SOE) reported a R2,2bn loss in its financials for the six months to the 30th of September 2024. Two months ago, Transnet was granted a further R51bn in government guarantees to enable it to continue in business which comes after the R47bn bailout that it received in December 2023. It currently pays about R1bn a month just in interest on its outstanding debt. Clearly, the wage increase agreed to is excessive and will ultimately be paid for by the South African taxpayer. At the same time, Transnet’s gross inefficiencies are a significant drag on the economy slowing both imports and exports and costing the country massive amounts of lost tax revenue.

Rail congestion at Richards Bay Coal Terminal (RBCT) has reached critical levels with tonnages dropping from 78,5m tons in 2015/16 down to 52,6m tons in 2024/24. Long queues of trucks are waiting to get into the port to off-load as exporters move away from rail towards road transport. The port has a capacity of 91m tons, but the ineffectiveness of the rail transport system is hampering that. There are moves afoot to get the private sector involved in managing the rail corridor, but so far that has not impacted its performance. Critically, the problem is strangling South African mineral exports and impacting directly on the economy. The N2 highway which is supposed to carry 200 trucks a day is currently carrying 2500 trucks a day.

General

The South African Revenue Service (SARS) was allocated an additional R7,5bn over the next 3 years in the budget. The purpose of this extra money was to help it increase tax collections and to continue it modernisation program. The plan is to employ an additional 1700 debt-collectors over and above the 750 appointed last year. SARS has indicated that with these additional resources will enable it to collect an additional R20bn tax revenue next year. That would go a considerable distance towards eliminating the need for any tax increases in future budgets.

Lesetja Kganyago, governor of the Reserve Bank, is arguing that the inflation target for South African should be reduced to 3% from the current range of between 3% and 6%. He says that this will save the country R870bn over the next ten years on government interest payments – and that it will bring us into line with most of our trading partners. The inflation rate (CPI) is now below 3% - mostly because of consistent strength in the rand and the falling oil price. Right now the government is paying out R386bn a year in interest on its debt which is about 5,7 trillion and 5,2% of gross domestic product (GDP). More than 20% of all government revenue is used to pay interest. Kganyago is systematically turning South Africa into a nation of savers – the government included.

The Rand

Over the past month, the rand continued to display strength against the US dollar, despite the shift to “risk-off” which accompanied Israel’s attack on Iran and the subsequent bombing of Iran’s nuclear facilities by America. Our prediction that Trump would inevitably back down on his absurd tariff policy was vindicated and this led to the strong recovery on Wall Street and a shift back towards “risk-on” among international investors. That, in turn, has benefited emerging market currencies like the rand. Consider the chart:

The rand has broken clearly through resistance at R18.80 to the US dollar and is now trading for R17.76. We expect that the rand will continue to strengthen, especially if the DA and the ANC can settle their differences over the firing of Andrew Whitfield.

Commodities

OIL

The price of North Sea Brent oil spiked up on Israel’s attack in Iran and the subsequent US bombing of its nuclear facilities. It climbed back up to touch the descending trendline which has been in place since last year at $78 on the 12th of June 2025 – and then fell back. Consider the chart:

The chart shows the well-established support at $72 which was broken when the price collapsed to find new support at $60 in April and May this year. The chart is also characterised by a series of descending cycle highs the most recent of which was caused by Israel’s attack on Iran. The price has now fallen back $67 and we believe that it will fall further, possibly even breaking below $60 in due course. The falling oil price is good for all economies, reducing their levels of inflation and the cost of doing business. And it is very bad for Russia.

GOLD

The World Gold Council says that it expects demand, especially from central banks, to continue this year and projects that the gold price could reach $4000 per ounce by year end. Over the last three years central bank buying has doubled to around 1000 per annum. The increased buying roughly coincides with Russia’s invasion of Ukraine in 2022 but has been supported by Trump’s election and more recently by the conflict in the Middle East. Consider the chart:

The chart shows that the gold price has risen strongly over the past year but has now encountered some resistance at around $3424. It may now correct back to levels around $3000 in the short term on profit-taking, but the long-term upward trend will almost certainly remain in place.

Gold has always responded well to geo-political uncertainty because it offers investors the best “safe haven” for their funds. Its disadvantage is that it does not pay any return.

PLATINUM

The platinum price has been falling since the start of the sub-prime crisis in 2008. This has resulted in the laying off of mining staff and the closure of mine shafts. Over time, that has caused a major shortage of platinum to develop. Now investors are becoming aware of growing shortage of platinum and the price is beginning to rise. We have always advised investors to wait for the technical signal of a break up through the long-term downward trendline – and that has now happened for platinum on the 19th of May 2025 when the price rose above $1000 per ounce. This is similar to what happened to the gold price in March 2024 when it broke above resistance at $2060. We now expect platinum to continue rising for some time. Consider the chart of the platinum price over the past 23 years:

You can see that it peaked in March 2008 just before the impact of the sub-prime crisis and has been trending sideways and down ever since. The current upside break indicates that we can now expect platinum to enter a new upward trend.

IRON

Iron ore prices fell below $100 a ton this month because of weak Chinese demand and Trump’s tariffs. China is the largest consumer of iron in the world and Chinese steel production has been falling due to lower demand from the construction industry. In the first quarter of 2025, Kumba sold 9 million tons of ore at 11% above the benchmark price and has benefited from a slight improvement in Transnet’s rail performance. The iron ore market is becoming increasingly competitive, and Transnet remains a major problem.

Companies

OUTSURANCE

OUTsurance (OUT) is what remains of RMI Holdings after its stakes in Discovery, Mommet, and Hastings were unbundled or sold. It is involved in writing insurance and investment. The company has operations in South Africa, Ireland and Australia. In its results for the six months to the 31st of December 2024 the company reported gross written premiums up 17,4% and new business up 17,9%. This is a solid blue-chip share which is growing steadily. We added it to the Winning Shares List (WSL) just over a year ago on the 14th of June 2024 at a price of 4457c. It has since risen 78,2% and we believe it will continue to perform. Consider the chart:

Technically, the share is in a steady upward trend with some volatility. We believe that it should be bought on weakness despite the fact that its P:E is 29,31 which is expensive.

NORTHAM

Northam is one of the platinum shares that it benefiting directly from the upside break in the platinum price. The company describes its objective as, “...growing safe and sustainable production down the sector cost curve.” It mines platinum group metals (PGM) and also produces some chrome. In the six months to the 31st of December 2025 the company reported revenue down 3,1% and headline earnings per share (HEPS) down 49,7% - but that was before the platinum price began to move up. Consider the chart:

The chart shows that Northam’s share price had been falling steadily since March 2022 – in line with the falling prices of platinum group metals (PGM). The upside break came in April and May 2025, and we added it to the Winning Shares List (WSL) on the 23rd of May 2025 at a price of 14311c. Since then, it has climbed to 19209c – a gain of 34% in just over a month.

It is subject to the prices of the minerals which it mines on the world market. A commodity share like Northam is therefore volatile and more risky than, for example, a blue-chip industrial share.

PREMIER

Premier is a food producer which was spun out of Brait (BAT) through an initial public offer (IPO) and separately listed on the 24th of March 2023. In its results for the year to the 31st of March 2025 the company reported revenue up 7% and headline earnings per share (HEPS) up 26,8%. Food producers do not usually make for exciting investments, but Premier has been doing well since it broke up out of its sideways market in September 2024. Consider the chart:

As you can see above, the share had been moving sideways from when it was listed about 18 months ago and then it began to attract institutional interest late last year. Since then, the volume traded has been rising and with it the share price. We believe it will continue to perform.

NASPERS

The primary problem with Naspers has always been its extensive use of N shares in its capital structure. This type of share is generally frowned upon by investment community because it does not allow for the main contributors to the company’s capital to control it. Despite this Naspers and its sister company own 29% of the Chinese internet and gaming company, Tencent, which has proved to be a remarkable investment success story. Through the years the Naspers share price has always been lower than its inherent value and the company has been trying to release value into the hands of shareholders. The risk in the company is that the Chinese authorities from time to time threaten to impose strict regulations on gaming. In our view the share still represents value at current levels. Consider the chart:

We added the share to the Winning Shares List (WSL) on the 15th of February 2025 at R4600 per share. It has since risen to R5510 – a gain of nearly 20% in just over 4 months. We believe that it will continue to perform.

PAN AFRICAN

This company is involved in retreatment of mine dumps. This means that it does not have the risks and costs of an underground operation. It also has a relatively low cost of production which makes it a “heavy-weight” gold producer. In an operational update for the year to 30th June 2025 the company reported full-year production up 6% with gold production up 32% in the second half. The massive cash flows from this and the rising price of gold have enabled the company to reduce debt substantially by almost one third since the end of 2024. Consider the chart:

The chart shows the strong upward trend in Pan African since the beginning of last year. We added it to the Winning Shares List (WSL) on 31st January 2024 at a price of 430c and then wrote an article about it on the 13th of May 2024. It has used some of its surplus cash to buy TCMG in Australia which has diversified it and lengthened its life. In the last week or so the share has fallen back from its highest levels, but still closed on Friday at 1087c – up more than 108% from when we added it to the WSL. We believe it will continue to benefit from rising commodity prices, especially gold.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: