Nampak Rights Offer

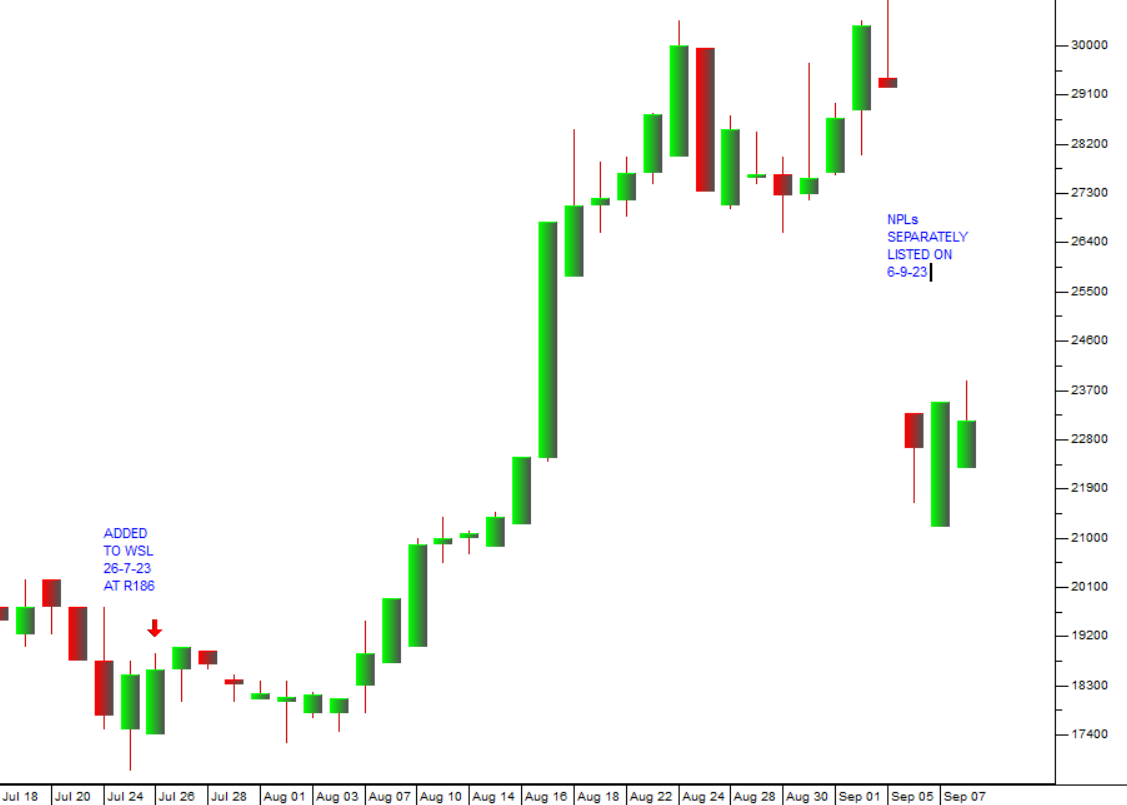

11 September 2023 By PDSNETA couple of weeks ago we published an article about Nampak’s turnaround and the fact that we had added it to the Winning Shares List (WSL) on 26th July 2023 at a price of R186 per share. After that, the share went up strongly reaching a high of R304 on 4th September 2023. That was a gain of 63% in under six weeks.

Throughout this time, we knew as did everyone else in the market, that Nampak was intending to raise R1bn from its existing shareholders through a rights issue. The purpose of the rights issue was to enable the company to reduce its debt to acceptable and workable levels.

In a rights issue, a listed company offers its existing shareholders the opportunity to take up additional shares at a discount to the price which they are trading for in the market. Nampak offered its shareholders the right to buy an additional 2,20902 additional shares for every share they already held. The price was set at R175 per share which was a significant discount to the price of the shares in the market.

Altogether, the company offered 5 714 286 shares in the form of a nil paid letter of allocation or NPL which was allocated to all shareholders owning Nampak shares at the close of trade on Tuesday 5th September 2023. So, on that day the shares were still trading “cum” (which means “with”) the rights and the next day (6-9-23) they were trading “ex” the rights. That explains why Nampak shares opened 22,57% lower on 6th – because investors who bought them on that day did not get the rights.

The rights, in the form of the NPLs mentioned above began trading on the JSE on 6-9-23 and they have been trading since then at between 3123c and 5600c. Their value is approximately the difference between what the share is trading for and the take-up price of R175. They closed on Friday last week (8-9-23) at 5450c per NPL.

So, if you were a shareholder of Nampak on 5th September 2023 you would, by Friday last week, have had a share which closed at R231.50 plus 2,20902 NPL's worth R54,50 each. In other words, your total investment would by then have been worth approximately R351,89.

So, the fall in the price of the Nampak shares due to the dilution of the rights issue was more than compensated for by the value of the Nampak NPL's. The NPL's will trade on the JSE alongside the ordinary shares until 19th September 2023. Investors who are still holding the NPL's on that day must take them up or lose them.

Consider the chart:

An NPL is in effect a derivative instrument because its value is derived from the value of the underlying share – in this case, Nampak. This makes it (like any derivative instrument) far more volatile than the share itself. So, for example, the ordinary shares went up on 7-9-23 by 3,76% and the NPLs jumped from 4300c to 5398c – a gain of 25,5%.

The Winning Shares List (WSL) does not show the value of the Nampak NPL's and so you might have got the impression that the share fell heavily on 6th September 2023.

In fact, as you can now see, with the added value of the NPL's, the share has gone from being worth R186 on the day it was added to the WSL to being worth R351.89 (including NPL's) – a gain of 89,2% in about six weeks. Nampak is definitely our star performer on the WSL so far.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: