JSE All Time Record High

15 July 2024 By PDSNETOn Friday last week, the 12th of July 2024, the JSE Overall index closed at 81686 – an all-time record high. Consider the chart:

The chart shows that the Overall index made a low on the 29th of September 2022 and then a cycle high on the 27th of January 2023. The index made a low in October 2023 (2nd touch point) and then again in March 2024 (3rd touch point). Since then, it has been following international markets, and particularly Wall Street, up.

In part, this upward move, especially recently, is a positive response to the formation of the Government of National Unity (GNU) following our very successful and peaceful elections, but the main driving force behind the JSE’s performance is undoubtedly the extraordinary record-breaking run on Wall Street.

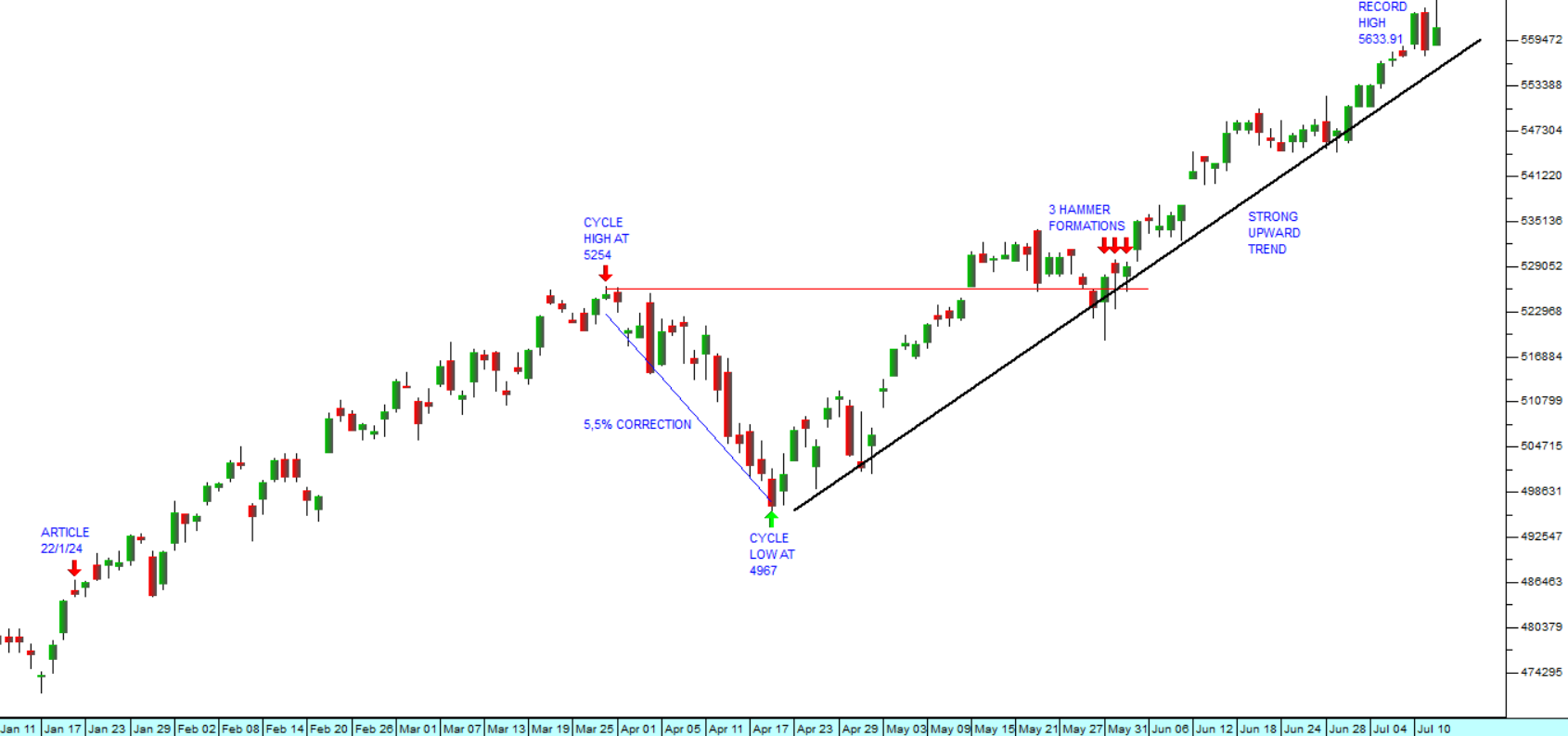

The latest inflation data from America shows that both the core and headline consumer price index (CPI) were better than expected with the core number coming in at -0,1%. This is the first time in four years that prices have actually declined. Clearly, the high level of interest rates is bringing inflation down closer to the Federal Reserve Bank’s goal of 2%. Markets now have an 85% expectation that interest rates will begin falling in September this year – and that expectation is driving Wall Street up to a series of new all-time record highs. Consider the chart:

In January of this year we published an article entitled The Great Bull Resumes in which we said, “Our calculations indicate that the S&P could go as high as 6458 on this leg…”

Our view is that the S&P will continue going up for some time now, driven by the profitability expected to come from artificial intelligence (AI) and switch to renewable energy which is gaining momentum world-wide.

The JSE always ends up following Wall Street sooner or later. Many of our largest shares are international companies and listed on other exchanges. For this reason, the systematic drivers of the JSE tend to be developments overseas rather than local issues.

CAPITEC

One of the shares that has been benefiting directly from the shift in international sentiment and the implementation of the GNU is Capitec Bank. On Friday last week Capitec published a trading statement in which it projected that its headline earnings per share (HEPS) would rise by between 25% and 35% in the six months to 31st August 2024. This is a dramatic improvement and shows that Capitec fully warrants the high rating that it enjoys on the JSE.

We added Capitec to the Winning Shares List (WSL) on 4th November 2023 at 185496c per share. It closed on Friday last week at 273225c – a gain of 47,29% in 8 months.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: