The Confidential Report - April 2019

3 April 2019 By PDSNETWall Street

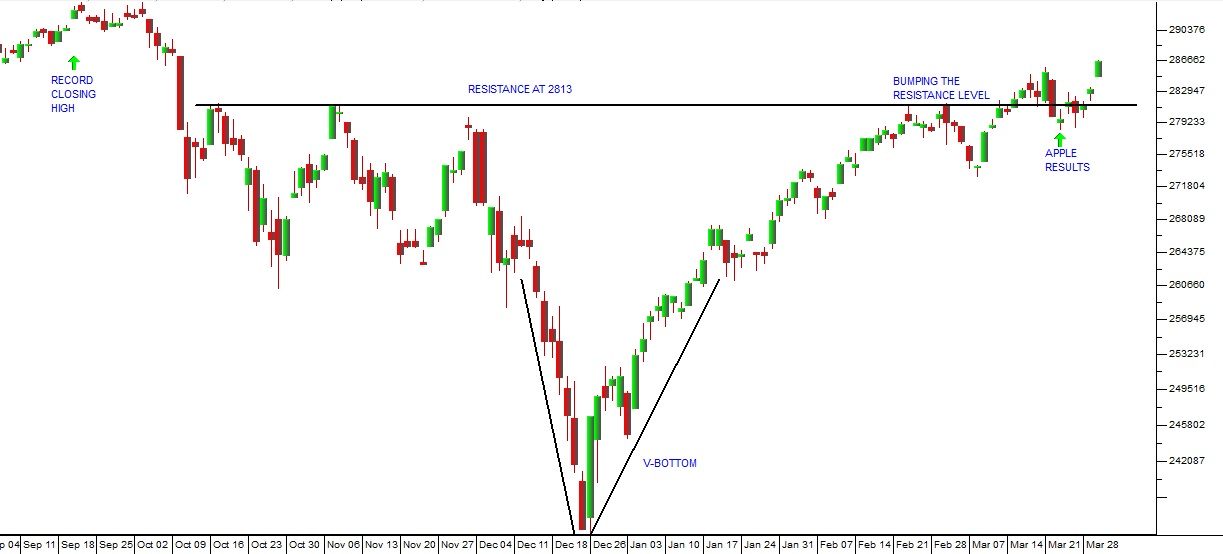

On Friday 22nd March 2019, Apple announced their results to the December 2018 quarter. Turnover was down 5% at $84,3bn while quarterly earnings per share (EPS) were up 7,5% at 418c. 62% of the company’s sales came from outside the US. iPhone sales were down 15%, while sales from other products were up 19%. It also warned that the first quarter of the 2020 financial year would be weak because of poor sales in China. The market didn’t like these results and forecasts and the share price fell by 7%. This in turn dragged the entire S&P down by 1,9% as other tech stocks fell in sympathy. Donald Trump’s “trade war” with China was obviously partly to blame. The drop in the S&P500 index took it just below support at 2813 – but this was an over-reaction and the S&P has bounced back closing at 2867 last night. The resistance level has become the support level – which is common in this type of upside breakout. Now, we expect the S&P to move up strongly towards its record high of 2930. It is just over 2,1% below that level now. And, ultimately, we expect it to exceed that high and the great bull market, which has been in progress for ten years, to continue upwards. Consider the chart:

S&P500 Index September 2018 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

On the fundamental side, the companies which make up the S&P500 had an excellent last quarter in 2018 and have not yet started reporting on the first quarter of 2019. Clearly, 2019’s first quarter cannot match the first quarter of 2018, because 2018 had Donald Trump’s tax breaks. In fact, S&P500 companies are expected to pay 21% in tax this year compared to 19% last year, but that is still well below the 24% which they paid in 2017. At the same time the labour market is reaching a point where wages are starting to climb. The labour shortage must, sooner or later, impact on corporate profits and hence on share prices. Despite all these potential negatives, we remain bullish on the S&P this year.Political

As the election draws near it is apparent that former president Jacob Zuma is probably in deep trouble for taking bribes from Shabir Shaik and French company, Thales. What is notable is that Ramaphosa has allowed the legal process to continue without interference while at the same time cosying up to Zuma, so as not to lose his support during the election. This means that Zuma supporters cannot blame Ramaphosa for Zuma’s legal problems. It was the courts that overturned Ramaphosa’s decision for the government to continue paying for Zuma’s legal representation. This has enabled the ANC to retain the support of the Zuma faction in the coming election, while at the same time standing by while the legal process moved closer to eliminating him permanently as a political force. Zuma’s decision to side with the radical “Black First Land First” (BFLF) party has, however, derailed this strategy somewhat and is a further divisive move in a party that is already divided. The ANC’s candidate list includes some of the worst names from the Zuma era and tends to undermine President Ramaphosa’s much flaunted “New Dawn” rhetoric. People who he has removed from power as part of his “clean-up” are on the candidate list like Malusi Gigaba and Mosebenzi Zwane, Nomvula Mokonyane and Bathabile Dlamini. This is hardly in line with the ANC cleaning up its act, but it may have some benefit in terms of the election. Dlamini, for example, is the head of the ANC Women’s League and could have a significant impact on voting outcomes. Nonetheless, the ANC’s candidate list shows clearly the divisions that remain within the party. It seems that the list of ANC candidates is a major source of discord in the ruling party. The decision by the Zimbabwean government to offer Telkom and MTN up to 60% of its two telecommunications companies, NetOne and TelOne is part of its move to privatise government assets to raise cash. It is notable that this is a reversal of the previous “indigenisation policy” which made it illegal for foreign investors to own more than 49% of a Zimbabwean company. Clearly, the Zimbabwean government is embracing the need to reduce the size of the government and to re-capitalise it by a policy of selling off state owned enterprises (SOE). The South African government is still walking on eggs as far as privatisation is concerned, but is gradually coming around to the position that it is a very effective way to raise funds. Of course, this approach is vehemently opposed by the unions and will probably not gain any real traction until after the election. It now seems that the early poles which gave the ANC around 59% or 60% of the vote may have been wrong. The news of:- The ANC’s controversial candidate list.,

- Renewed load-shedding,

- Agrizzi’s revelations that the top six of the NEC may have been receiving bribes

- Today’s petrol price hike, and

- Zuma’s support for the Black First Land First party,

Economy

In the end, 2018 turned out to have an average growth rate of 0,8% - slightly above consensus expectations and the Reserve Bank’s estimate of 0,7%. The improvement was due to better manufacturing in the December quarter when GDP grew by 1,4% and manufacturing contributed 4,5% growth. This momentum was expected to carry over into the first quarter of 2019, but the resumption of load-shedding has destroyed that hope. The Monetary Policy Committee (MPC) kept rates on hold, but cut their expected growth rate for 2019 to 1,3% from 1,7%, for 2020 to 1,8% from 2% and for 2021 to 2% from 2,2%. Growth of 1,3% is a big improvement on 2018, but far less than the country needs if it is to begin addressing the unemployment situation which is running close to 30% - and it shows that the Reserve Bank believes that the cost of load-shedding is worth roughly 0,4% of GDP growth. The continued growth of the world economy and the improvements under Ramaphosa’s administration should slowly create a better environment for growth – provided load-shedding is not persistent, especially through the coming winter. The primary underlying problem, however, remains the power of the unions and that will probably only be addressed after the 8th May elections. One of the most telling indicators of the health of the economy is the monthly vehicle sales. This is because consumers can easily put off buying a new car if they are feeling financially strapped. They can always repair the old car and keep it going for another year until their circumstances improve. For this reason, the fall in new car sales in February 2019 came as a severe shock to economists. Vehicle sales plunged by over 13% when compared to February last year. Of course, car rental companies account for a significant portion of new car sales each year – and they may have decided to put off fleet renewals until after the elections in May. Consumers might also be constrained in this way. After all, what if the elections are marred by violence and unrest? Or what if the ANC gets less than 50% and is forced to compromise with another party? There is no doubt that this election is the most critical since the ANC took power in 1994. On the positive side, vehicle exports were strongly up reflecting the improved economic conditions in America and Europe. Exports increased by 22,5% to 33700 vehicles – which means that they are now a more important factor than local new car sales. Interestingly, the sales of light commercial vehicles and trucks was up 7% - which tends to imply that the economy is still working, even if consumers are temporarily spooked. The resurgence of load-shedding in March month indicates that Eskom is still in deep trouble despite all the urgent high-level attention which it has received. It seems that the economy will have to limp along with patchy supply for some time. Current estimates are that load-shedding will shave between 0,3% and 1,0% off GDP growth this year and impact the perceptions of the ratings agencies. A longer-term consequence of the unreliability of Eskom’s electricity supply is that major mining companies are taking steps to reduce their dependence on Eskom’s supply. Amplats, Sibanye and Harmony are all at various stages of building their own electricity supply using renewable energy, sometimes at a lower long-term rate than Eskom. The approved 3-year tariff increase for Eskom of 29,5% is expected to result in the loss of about 90 000 jobs over the next 3 years in the gold and platinum sectors alone. Gold production will crash to just 20 tons per annum being produced by just two mines. The new carbon tax is also expected to have a deleterious impact on the mines. As far as business, including mining, is concerned, the Eskom tariffs and inconsistent supply are making it almost impossible to continue their long-term relationship. The inevitable effect of this is that Eskom will have less and less customers, which will further erode its viability. Eskom’s mining customers declined from 1054 in 2013 to 993 in 2017. Some of this is due to mine closures, but it seems more and more likely that anyone seriously considering an energy-intensive business in South Africa will have to consider a more reliable source of supply. What makes this more frustrating is that the independent power producers have about 2 gigawatts of power which could be brought into the grid now but is apparently being frustrated by red tape and regulatory impediments. The opinions of Dawie Roodt, chief economist of the Efficient Group were quoted by Chris Gilmour in his Business Day column. Roodt was commenting on the February 2019 budget as follows: “We have definitely gone over the fiscal cliff. State debt has exploded. The extent of cut-backs required is politically unachievable and it is close to impossible to turn the ship around”. This is an extremely negative comment from an independent expert on the situation in the economy. The February budget was basically an exercise in buying time until after the election. Nothing of significance was dealt with. The major problems in the economy were left unattended. Of course, since the budget we have had a resumption of Eskom’s stringent phase 4 load-shedding which destroys small businesses on a daily basis. In Roodt’s opinion the R69bn allocated to Eskom over the next 3 years is entirely inadequate. Roodt expects that Moodys will downgrade South Africa sooner or later. The signing of the Continental Free Trade Area (CFTA) agreement by 50 African countries holds out the hope that Africa will become one of the world’s largest free trade zones allowing the free movement of goods and business people across the continent. Unfortunately, this dream is prevented by a lack of implementation at regional level as well as poor infrastructure. The goal for trade between countries in Africa is for it to rise from 18% to 25% by the year 2023. South Africa is rated as the most integrated country in Africa, trading well with all its neighbors. Further north, there is a mountain of bureaucratic red tape to wade through before free trade can really begin. The common electronic biometric passport was launched in 2016 but has not really been implemented. Obviously, creating a functioning free trade zone throughout Africa will have a massive impact on economic growth on the continent. The petrol price hike of R1.31 per liter today will have a deeply negative impact on the South African consumer. Petrol will still be a little cheaper than it was in December last year, but consumers will feel that this hike is unlikely to be quickly reversed. The more money that people have to spend on petrol, the less there is for other discretionary spending – which directly impacts on businesses across the board, starting with the retail industry. Of course, the ANC can also expect that they will be blamed for the rising price of fuel as thousands of voters must suddenly pay more for taxi rides. 15c of the increase is entirely due to the government levy which goes directly to the government’s coffers. The fuel rise is substantially due to the weaker rand and a small portion to a slightly higher international oil price. The rand has improved since Moodys decided to keep South Africa at investment grade. Tax collections came in under the target of R1,3 trillion by around R57,4bn. This is a carry-over from the days when Tom Moyane decimated the SARS office and dismantled many tax-generating divisions. It is also a reflection of the poor state of the economy and the general lack of growth. Obviously, it means that the government will have to borrow more to make up the shortfall. SARS has collected less than was targeted for the past 5 years, taking the treasury dangerously close to a debt trap. The new head of SARS, Edward Kieswetter, will have his hands full restoring SARS to its former efficiency levels. Much of the shortfall was due to taxpayers being given the correct refunds – which is of the nature of a “once-off” which should not be a problem in future years. The target for the current year has been set at R1,422 trillion. The appointment of Edward Kieswetter as head of SARS comes after a long selection process recommended by the Nugent Commission. Kieswetter served as deputy commissioner under Pravin Gordhan from 2004 to 2009 – so he trained under the best SARS commissioner that South Africa has had since 1994. He now faces the challenge of reconstructing SARS to be the excellent organisation that it was previously. The collection of taxes is critical. Without collections which are both effective and perceived as being fair, the economy and the government cannot function. Of course, Kieswetter’s first task will be to deal with the strike of SARS employees which is currently in progress. SARS has said they have put in place measures to ensure the minimum disruption at ports, but undoubtedly the strike will have an impact.The Rand and the Long Bond

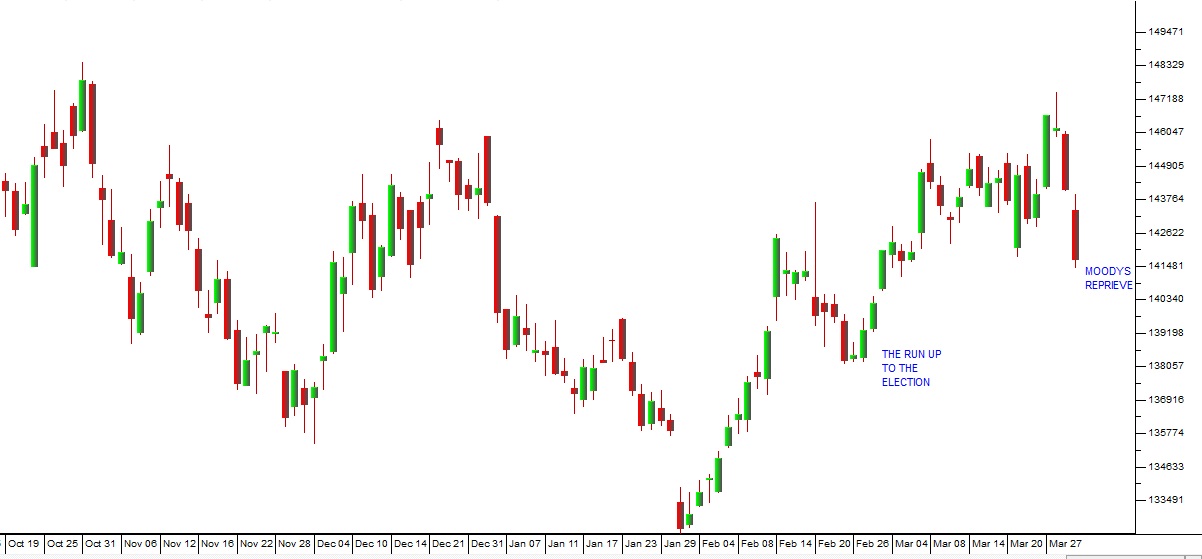

The rand’s progress against the US dollar and other hard currencies has become considerably more volatile. The troubles at Eskom and load-shedding have raised the specter of an eventual ratings downgrade by Moody’s, which is the last ratings agency to retain South Africa’s investment grade. The decision by Moodys keep South Africa at investment grade has had a sharp positive impact on the rand, taking it back to R14.17 to the US dollar. At the same time, as the election approaches, international investors have become increasingly concerned about President Ramaphosa’s ability to address the structural problems, and especially the power of the unions after the election. Load-shedding has undoubtedly damaged the ANC’s election prospects and probably benefited the DA. The testimony of corruption at the Zondo Commission has also damaged the ANC’s election prospects. From being fairly assured of getting 59% to 60% it now appears that the ANC will not do that well – especially if load-shedding resumes. The strength of the rand is, to a large extent, predicated on the ANC, and particularly Ramaphosa being returned with a strong mandate. Anything which puts that in doubt tends to be immediately reflected in rand weakness. And the strength of the rand is a key determinant in the Monetary Policy Committee's (MPC) decision on interest rates. Consider the chart:

Rand Dollar Exchange Rate October 2018 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

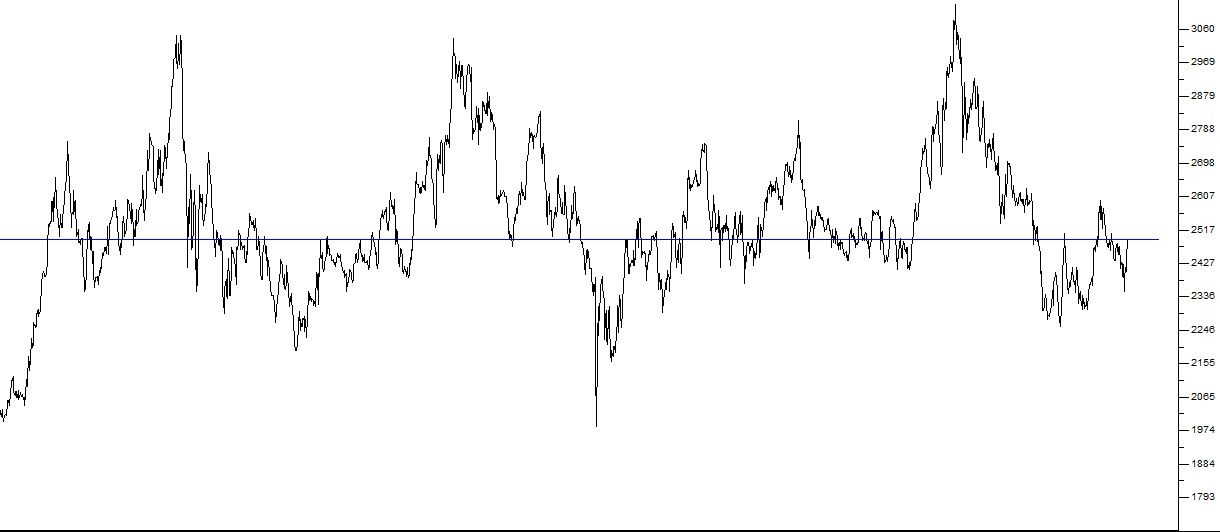

At the same time it is important to observe that despite South Africa’s many problems, which are being well-aired in the media, international investors have not pushed the currency down heavily. In fact, the rand is at much the same levels that it was at three years ago. This implies that overseas investors still believe that the South African economy will ultimately come right. Another measure of the political and economic stability of South Africa in these pre-election days is the yield on our bench-mark long bond – the R186. The long bond has been in a strengthening pattern since September last year, and so far the return of load-shedding does not appear to be having a significant impact on that. Consider the chart:

R186 September 2015 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

You can see here that since Nene was fired as Minister of Finance and Gordhan was appointed, the yield on the R186 bond has been moving sideways and even falling. A falling yield indicates that overseas investors are comfortable with the situation in the country and do not require a higher yield to attract them into the country. In our view, the yield on the R186 will continue to improve, especially if we have peaceful elections and the ANC is returned with a solid majority.Commodities

The natural gas find in Mozambique has the potential to revolutionise that country and should have major spin-off benefits for the South African economy. It is anticipated that the Rovuma basin resource in Northern Mozambique will contribute as much as US$18bn per annum to that economy, taking it from being one of the poorest countries in the world to one of the leading economies in Africa. Obviously, South African companies are already deeply involved, with Standard Bank, providing finance, and Sasol, which has built at 175 megawatt power-plant on the border between South Africa and Mozambique. Sasol is also busy building a gas pipeline to Gauteng. Mozambique’s Gas Master Plan involves liquid natural gas (LNG), power generation, fertilisers and methanol – all of which are within Sasol’s existing expertise. The entire Southern African region will and is benefiting enormously. Of course, the world is in the process of moving away from hydrocarbon fuels and so there may be a limited period of time for the resource to be exploited. The Mozambique government is moving quickly to give effect to the project for this reason. There is a running battle in progress between AMCU and the Sibanye group of companies, which is a microcosm of the probable impending battle between the union movement generally and the South African government after the election. The battle commenced with a strike initiated by AMCU on 21st November last year at Sibanye’s gold mines and then spread by sympathy strike to its platinum mines. AMCU has suffered a set-back in a court ruling that retrenchments at the Sibanye gold mines can proceed. This follows hard on the heels of another judgement which disallowed the spreading of AMCU’s action to other mines by way of a sympathy strike. That judgement drew attention to the level of violence and intimidation which has accompanied the strike action where 9 people have died and 60 houses have been burnt. Sibanye is in the process of retrenching about 5800 employees at its Beatrix and Driefontein mines on the grounds that those mines are loss-making. So far it is clear that Sibanye has the upper hand in this battle, supported as it is by the rising palladium price and its palladium mine in Stillwater in Louisiana. If Joseph Matunjwa, president of AMCU is forced to climb down in this battle it will mean a huge loss of face for him personally, and a major blow to the union movement in South Africa generally. This is good news for President Ramaphosa who will certainly have to face union opposition if he wants to reform the South African economy in any meaningful way.Companies

GROWTHPOINT (GRT)

Growthpoint (GRT) is South Africa’s largest listed real estate investment trust (REIT) with a market capitalisation of around R70bn and property assets worth R138,7bn. Large property REITs like this tend to mirror the performance of long-date government bonds like the R186 – which makes them relatively pedestrian investments. For this reason, Growthpoint’s decision to remove the option of shareholders to take a scrip dividend is a clear indication of their concern that their share price is below their net asset value (NAV). In an announcement on 25th March 2019, the company said that shareholders would have to take their dividend in cash – because a scrip dividend would reduce the company’s NAV. Indeed it should be a general concern that investors do not consider Growthpoint to be worth even the NAV of its properties. It is a reflection of the perceived political risk which pervades this pre-election period. You can see from the horizontal line on the chart below that Growthpoint’s share price is at the same level that it was at in July 2012 – so there has been no capital gain for nearly 7 years. This is part of the legacy of the Zuma years.

Growthpoint (GRT) April 2012 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

METAIR (MTA)

Metair (MTA) produces energy solutions (batteries) and components for the vehicle manufacturing business. It has operations in Africa and in various European and Middle East countries. The company's energy storage business is located in Turkey in an operation called "Mutlu". In its results for the year to 31st December 2018, the company reported that it grew headline earnings per share (HEPS) by 16% with a strong contribution from Mutlu and Rombat (its business in Romania). Turnover was up by 8% and the company's debt ratio improved to 30% or just R1,8bn. Mutlu produced a 55% increase in profits off a 27% improvement in turnover. The Turkish lira was volatile but ended the year 17% weaker against the rand. Rombat produced a 31% increase in its contribution to R87m. Obviously, the impact of Trump's recent sanctions on Turkey is negative, but we believe that this is an excellent share trading at a give-away price. It is on a P:E of just 6,6 and a dividend yield (DY) of 3,7%. The business it is in has every prospect of growing rapidly as electric motor vehicles replace those powered by internal combustion engines. It is also trading far below its net asset value (NAV) of 2059c. We do not believe that the problems which Turkey (which is an emerging economy like South Africa) is currently enduring will be long-lived. The share reached a high of R45 in February 2014, but fell back to levels below R22. It has since recovered somewhat and it trading at around R21 where it seems to us to represent very good value. Consider the chart:

Metair (MTA) June 2017 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

NASPERS (NPN)

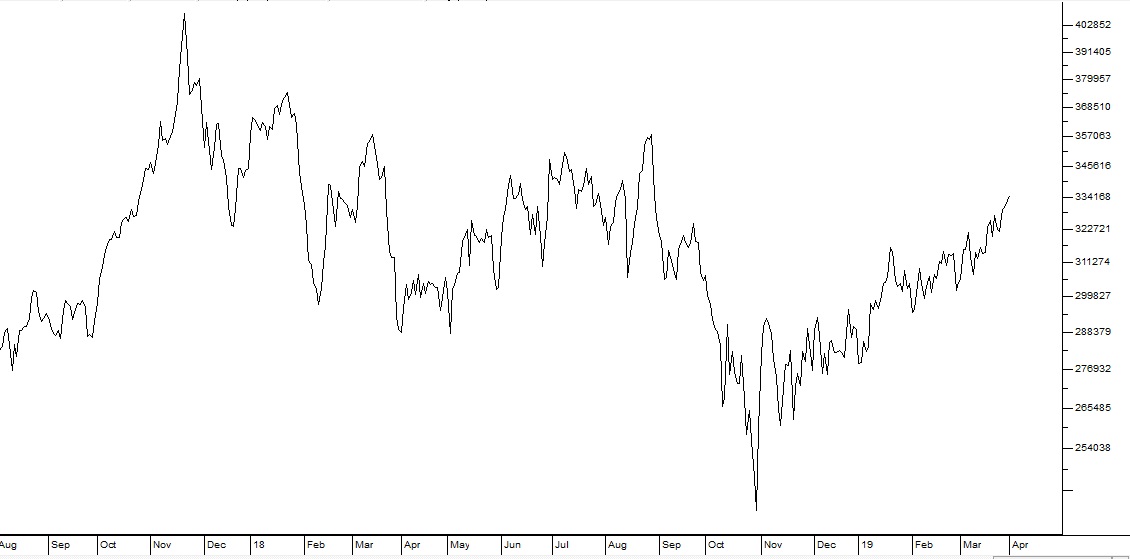

Naspers (NPN) is the largest share on the JSE with a market capitalisation of R1,47 trillion and accounting for as much as 20% of the value of total trades on the JSE. Movements in Naspers dominate most of the JSE’s indexes and it is a major component in the portfolios of most institutional investors on the JSE. When Tencent in Hong Kong is falling, our Overall index and Top 40 index are usually also falling. Naspers itself is dominated by its 31% holding in Tencent - a Hong Kong-listed company that provides social media services and gaming in China. Tencent has had a number of setbacks recently with the authorities forcing it to remove its game "Monster Hunter: World" from its service because it did not fully comply with regulatory standards and the freezing of game approvals for 9 months in 2018. However, recently the Chinese authorities have resumed approvals of new games. Most of the 13 analysts on Bloomberg rate Tencent as a buy and on average predict a 50% rise in its price. In January 2019, Bloomberg increased its target for Naspers by the end of 2019 to R4250. In the six months to 30th September 2018, Naspers reported headline earnings up 39% to $1,7bn (R23bn at R14 to the US$) off an increase of 29% in turnover. These are exceptional results for such a large company. Tencent remains vulnerable to the authoritarian regulators in China and their involvement in the gaming industry but analysts are expecting gaming revenue to climb steeply in 2019 and 2020. Tencent is expected to achieve a 20% per annum compound growth in operating profits over a 10-year period. In March 2019, Tencent announced that it intended to reduce its workforce by 10% to reduce costs. This comes as the Chinese economy cools following a reduced venture capital deal volume partly because of the trade war with the US. The authorities in China have been trying to stem gaming addiction in the country. But the announcement that Tencent had acquired the exclusive rights to create a game out of the HBO TV series "Game of Thrones" should be a massive boost to their gaming business. Naspers itself has an archaic capital structure where it is dominated by its 907128 unlisted "A" ordinary shareholders. Each "A" ordinary share has 1000 times the voting power of the 438,3m "N" shares which are listed - so they effectively control the company with 67,4% of the vote. Naspers has many other interests, mainly in e-commerce and operates in 120 countries worldwide. It has recently bought a further $500m worth of shares in Letgo - an American classifieds platform that has more than 100 million users. It also owns Takealot and Dr. Food in South Africa among other interests - but all those other investments are dominated by Tencent. In our view the share is probably worth closer to R5000 than the R3225 at which it currently trades - mainly because of its "N" share structure which is frowned upon in the investment community. Tencent is heavily influenced by the sentiment towards IT companies like Facebook, Amazon, Apple, Netflix and Google (the FAANGs) in America. The recent unbundling and separate listing of Multichoice (which includes its pay-TV interests and Showmax and a security company, Irdeto) has certainly released some shareholder value as the Multichoice group was not accorded any value in the Naspers share price. Naspers has retained its online shopping operations, Takealot, Mr. D. Food, PayU and Autotrader. On 25th March 2019, Naspers announced its intention to separately list a company ("Newco") on the Euronext in Amsterdam which would house all its international assets including its stake in Tencent, Mail.Ru and other internet brands. Naspers intends to hold 75% of Newco and for it to have a 25% free float. The effect of this development will reduce trade in the Naspers share on the JSE as many international investors will prefer to buy Newco on the Euronext. But it will probably also have the effect of increasing the price of Naspers on the JSE as overseas investors buy directly into Newco rather than coming through the JSE. It is an effort to release further value in Naspers which we believe will have the desired effect. Newco will be Europe's largest consumer internet company. We believe that Naspers continues to be undervalued at current levels and a good buy. Consider the chart:

Naspers (NPN) August 2017 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

You can see here that Naspers has been on an upward trend since November last year as investors became more convinced that the board was taking steps to unlock value.MASTER DRILLING (MDI)

Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the depressed South African mining industry and now provides services in North and South America, Europe and elsewhere. It is in the process of developing a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which can be inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional “blast-and-clear” methods currently in use. At the moment the machine requires three operators, but the company is working on a completely automated remote controlled version. On 26th March 2019, the company announced that it had secured a contract with Northam Platinum (NHM) to conduct a 7-month test of its tunnel boring machine at Northam's Eland mine which is not currently operational. In its results for the year to 31st December 2018, the company reported turnover in US dollars up 14,2% and headline earnings per share down 7,8% in US dollars and 8,2% in rands. The CEO, Danie Pretorius, said that conditions in some countries where it operated (Turkey and India) were definitely worse in some during the second half of the year and better in others (Brazil and Mexico). MDI has recently acquired a drilling company called Bergteamet in Europe and a South African drilling company, the Atlantis Group. The Atlantis Group will increase the number of drilling machines it has by 15 to 143 and it will add $15m to the company's order book. On 5th November 2018, Master Drilling announced that it had formed a joint venture with an Italian construction company called Ghella which will be called Tunnel Pro. Master Drilling will own 49% of this operation which will go after tunnel smaller boring contracts and civil construction. Technically, the share has been in a steady downward trend since February 2017 and is now trading below its net asset value (NAV) and on a very undemanding price:earnings (P:E) multiple of 7,4. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining and construction industries. It will probably extend the life of some mines and makes others viable again. So while this is a risky share, because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies which it has that have the potential to revolutionise the mining and other industries. Technically, the share has been in a long-term downward trend, but has recently made an upside breakout from a reverse head and shoulders formation. It also looks like it may be breaking above its long-term downward trendline. In our view, this is an exciting company with huge potential to perform extremely well as its new horizontal boring machine gains traction.

Master Drilling January 2017 to April 2019 - Chart by ShareFriend Pro (Click to enlarge image)

You can view a visual presentation of this report here. To be added to our mailing list for the next webinar, click here.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: