Capitec and the Bear

12 September 2022 By PDSNETQuite a few people phoned me last week to ask if it was the right time to accumulate some more Capitec shares, since it closed on Friday last week at R1904,32 - almost R470 or 19,76% down from its highest point.

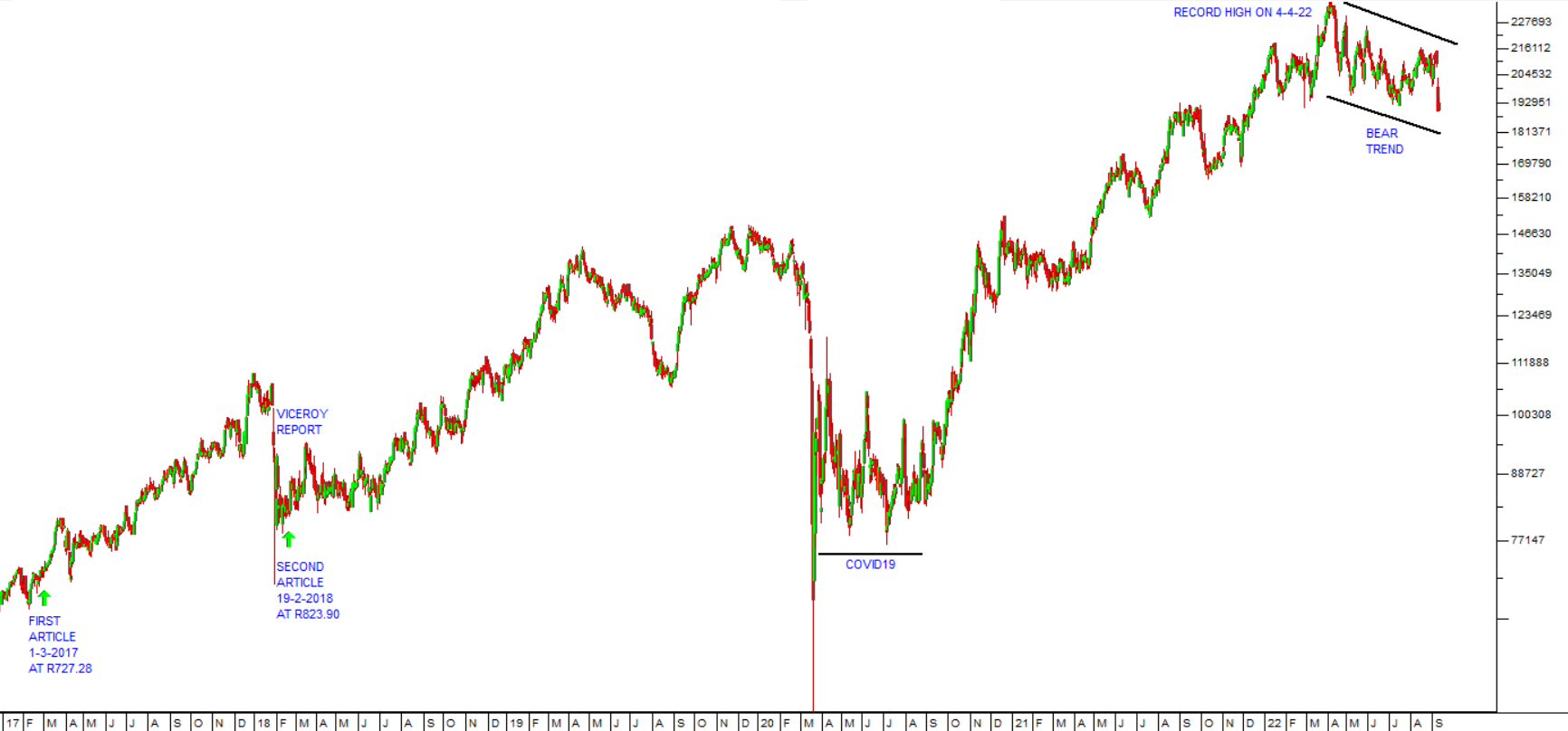

We first recommended buying Capitec more than six years ago in an article published on 2nd March 2017. At that time the share was trading for R727.28 and we did a comparison of its price:earnings growth ratio (PEG) with that of Standard Bank to come to the conclusion that it represented very good value.

A year later, after the infamous Viceroy Report, we again said in an article that Capitec represented good value when it was trading for R823.90. Since then, the share has risen to an all-time record high of R2373.48 made on 4th April 2022 - and now it is down nearly 20% from that high. Consider the chart:

So, two questions need to be answered:

- Does it represent good value at current levels? - Undoubtedly.

- Will it fall further from these levels? - Probably.

Warren Buffett’s advice has always been to find a very high-quality share with excellent management and keep accumulating it on weakness - until your opinion of its quality changes for some fundamental reason.

We cannot see any significant change in Capitec’s business model, management or the environment within which Capitec operates to justify changing our view that it is an excellent company with great medium- to long-term growth prospects. We believe, and have said many times, that every private investor should buy Capitec and accumulate it on weakness.

That leaves the second question of whether it might fall further from current levels. And the answer has very little to do with Capitec itself, its management or even its prospects.

The simple truth of the matter is that the share markets of the world are in a bear trend. As explained in our Confidential Report published on 7th September 2022, last week, this bear trend arrived about 18 months earlier than it should have, brought forward by the unexpected commencement of the war in Ukraine and the impact that has had, especially on the oil price and world inflation. The premature nature of the bear trend has left the market with some residual optimism which is, in our view, misplaced.

The optimists are under the illusion that the pattern of rising interest rates, now well-established throughout the world, will somehow not impact on the profits of listed companies – or, alternatively, that the authorities will for some obscure reason relent and begin reducing rates again much sooner than anticipated.

That optimism finds expression whenever there is the slightest bit of good news, but it is inevitably quashed when reality re-asserts itself. The extraordinary bear market rally during the two months from mid-June to mid-August 2022 was a clear example. That rally was brought to an abrupt end by the remarks of Jerome Powell at the Jackson Hole symposium on 16th August 2022 and the S&P500 index fell all the way back to its support level at 3900.

Now there is a new cause for optimism in the fact that the price of North Sea Brent oil dropped briefly to $88 per barrel last week and, as a consequence, we have had a strong 3-day bounce on the S&P.

So where does all this leave Capitec?

Bear trends usually take the market down by 50% - which implies that the S&P will fall to around 2409 – which is 40% below Friday’s closing level. In our view, this bear trend, despite its relatively slow start, could turn out to be much worse, because of the widely expressed intention of central banks around the world to reduce the size of their balance sheets through a process of quantitative tightening (Q/T).

Nobody quite knows what the impact of persistent quantitative tightening will be – but it certainly cannot be good for equities.

Capitec is still on a P:E multiple of over 26, while Standard Bank is on 8,7 and FNB is on 11,58. This makes it more vulnerable to a general market sell-off than its cheaper competitors.

Certainly, if you buy it now, you will be doing much better than those institutional investors who were filling their pockets with it at R2373 a share just five months ago, but my instinct tells me that it could easily become even cheaper.

In the end, the share market is not about certainties – it is about probabilities. So, what is the probability that Capitec could fall further? We put it at about 75%. But that, of course, is just our opinion - and we can easily be wrong.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: