The Rand Tanks

13 August 2018 By PDSNETThe rand has collapsed from R13.38 to the US dollar to levels as low as R15.26 – in less than two days. It has subsequently stabilised at around R14.50.

South Africans will naturally think that this has been caused by something that the government has done or that President Ramaphosa has said, but in this case they would be mostly wrong.

The current weakness in the rand has been caused by a sudden sharp move from risk-on to risk-off by the international investment community – mainly as a result of President Trump’s decisions to impose sanctions on Russia and continue with his trade war, mainly against China. This, combined with the troubles in Turkey, saw both the Russian ruble and the Turkish lira plummet. And that caused a general sell-off of emerging market assets – including those in South Africa. Emerging markets are seen as being the most vulnerable to a global trade war.

The yield on the R186 long bond spiked up from 8,68% to 8,85% as foreign investors pulled their cash out of South Africa and put it into safe investments like the US 10-year treasury bill.

As sometimes happens, investors suddenly reached a tipping point and then acted swiftly. The problem is that our currency is very vulnerable to this type of shift in international sentiment – because of our political vacillations, our over-indebtedness, and the government’s intention to advocate expropriation of land without compensation. These are negatives for any overseas investor – obviously. Nobody wants to invest in a country where there is even a remote possibility that his investment might be arbitrarily taken from him/her without any compensation.

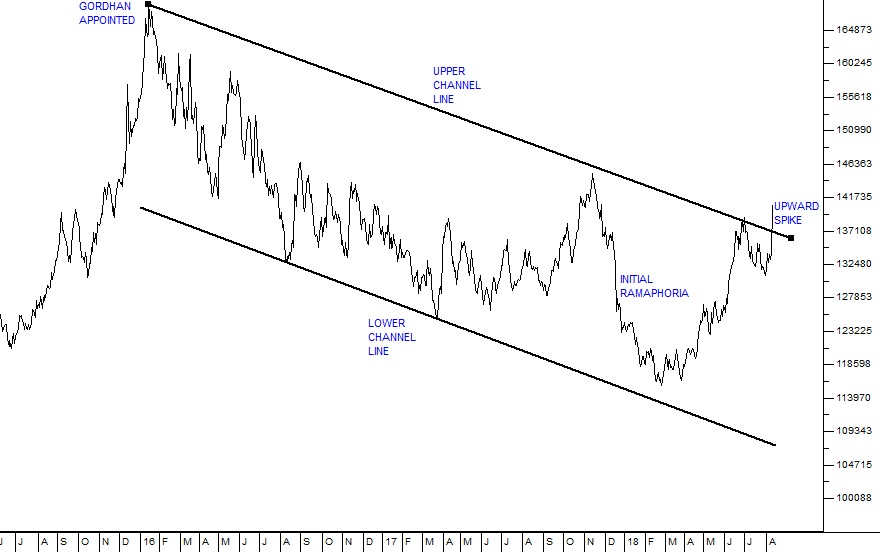

Technically, this spike in the rand/US$ chart is a problem because it takes the rand clearly through its long-term upper channel line:

Rand Dollar Exchange June 2015 to August 2018 - Chart by ShareFriend Pro

As you can see here the upper channel line which has been in place since January 2016 has been convincingly broken. This indicates that there may well be further weakness in the rand going forward. And that changes everything for private investors. Suddenly, investments in rand hedge shares make sense while companies which import from overseas begin to look very shaky. Our advice, however, is that this risk-off phase may not last too long. Trump is renowned for changing his mind about things – and he may be persuaded to change his mind about this. So just wait and watch for a while and make sure that your stop-loss strategy is firmly in place. Footnote: Of course, this weakness of the rand will certainly translate into a further hike in the petrol price as well.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: