Rand Weakness

13 June 2018 By PDSNETConfidential Report of June 2018 published a week ago, we said the following:

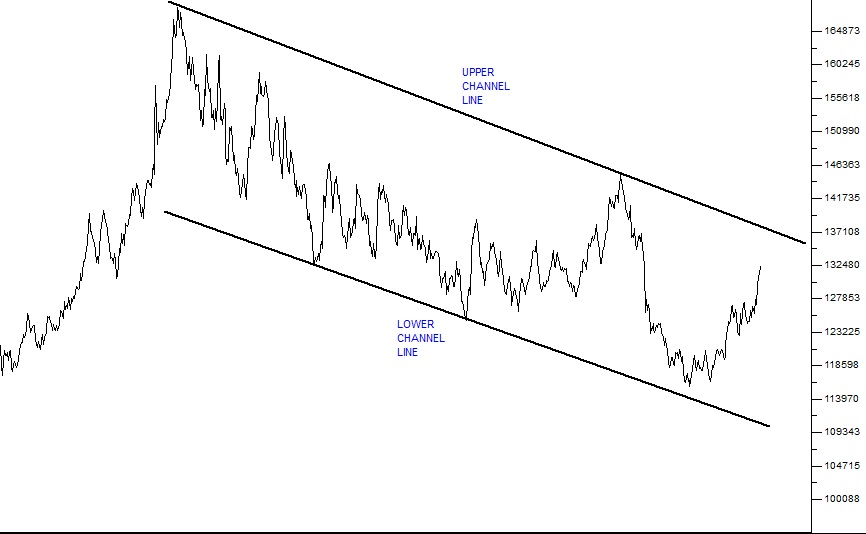

“In our estimation, the rand could weaken all the way back to the upper channel line – which would be at around R13.50 to the US dollar.”

Since then the rand has weakened markedly, mainly because of dollar strength and the “risk-off” attitude which currently prevails among overseas investors.

This sentiment is nothing to do with South Africa and it has impacted on the currencies of all emerging economies. For example, the Brazilian real has weakened 13% over the past month against the US dollar while the rand is off 9,5% and the Mexican peso has weakened 14%.

Of course, the cycles of risk-on/risk-off cause short-term funds to flow into and out of emerging markets on a regular basis. During May 2018, South Africa saw a net R30bn flow out of its bond market and R20bn out of the JSE – making a record total of R50bn in a single month. Most of that money would have found its way into US treasury bills – which are generally regarded as the most secure investment available.

The underlying problem is that the yield on the 10-year US T-bill has recently climbed above 3% - making it temporarily more attractive than high risk investments from emerging economies. But cash is always looking for yield – so sooner or later the 8,98% which we offer on our bench-mark R186 government bond will again appear attractive and the funds will come back.

There is no good way to anticipate the risk-off/risk-on cycle and so, as usual, the private investor is forced to use technical analysis. Consider the rand/US dollar chart over the past three years: