The Confidential Report - December 2017

6 December 2017 By PDSNETPolitics The ANC’s elective conference in December is very difficult for private investors to evaluate. The two main contenders represent either a continuation of the Zuma/Gupta administration which has proved so unsatisfactory, or a move to a new unknown in the form of Cyril Ramaphosa. It is hard to imagine any situation that could be worse than what we have now – so clearly the markets would favour Ramaphosa. But even if Ramaphosa wins, it is likely that it will take several years for the damage of the Zuma/Gupta era to be unwound. The most reliable indications are in the strength of the rand against hard currencies, like the US dollar. A sharp weakening of the rand against the dollar will be a clear indication that the situation is going to get worse and vice versa. Eskom’s mounting cash-flow crisis remains the most immediate and serious threat to the South African economy. The last time that Eskom had less than the R20bn working capital necessary to meet salaries and other day-to-day expenses, the government had to inject R83bn and then wrote off R60bn of that. This time the government simply cannot afford to do that. This means that barring some new financing arrangement, Eskom employees may not get paid at the end of January. Obviously, the government is going to have to come up with a new source of cash very quickly.

Economy

South Africa ran a R4bn trade surplus in the third quarter of 2017 – its fourth consecutive quarterly surplus. This is an indication of rising commodity prices and a booming world economy – particularly in the US and, to a lesser extent, Europe. Obviously, this growth in exports is what provides hope for growth in the economy going forward. Demand in the domestic economy is very low and falling – which is resulting in lower imports – and the result is trade surpluses. Eventually, repeated trade surpluses will filter through to the general economy and stimulate growth, but it may take a while given this government’s penchant for scoring economic “own goals”. At the same time, interest rates should be reduced to stimulate consumer spending and growth – after all, inflation is down at 4,8% and the economy is barely growing. Theoretically, cutting interest rates to restore growth would make good sense, but the probability of further ratings downgrades combined with the uncertainty surrounding the ANC’s December elective conference probably means that the rand is going to decline further. This would make further reductions in interest rates inappropriate. Mr. Gigaba is apparently not too concerned that government debt will reach a projected 60% of GDP. The R51bn shortfall in tax collections does not apparently worry him, even though, by his own admission, it is partly explained by less effective tax collections. His solution is for the government to find new sources of tax. Unfortunately, his reasoning does not seem to have extended to the effect new taxes will have on the economy. It would have been far better if he had suggested looking for ways to reduce government spending – which is clearly out of control. We are expecting an increase in VAT in the February 2018 budget (perhaps by as much as 3%) to make up the shortfall – but this will be both inflationary and will hurt the lower income groups in the economy. Besides, the problem cannot really wait until next year. The government is going to have to re-capitalise Eskom before the February budget. There are only a few solutions to the funding problem. The most obvious is to get control over the Reserve Bank so that they can simply print their way out of their problems, Mugabe-style. As things stand, however, this seems unlikely. The Reserve Bank is still firmly under the control of people appointed and trained by Pravin Gordhan and, more particularly, Trevor Manuel. So, if we assume a 3% increase in VAT in February, it should be possible to borrow a sufficient amount to keep the ship of state afloat until then – and that appears to be what Mr Gigaba may be pinning his hopes on. It is interesting that despite all the negative news about the South African economy and the pattern of downgrades, which seem inevitable and imminent, Ford motor company has decided to invest a further R3bn into its Silverton factory here. This will increase the capacity of that facility from 110 000 ford rangers to 127 000 and make it highly probable that the factory will be used to produce the new Ford “Raptor” which is due to be in production from 2019. Clearly, Ford, at least, believes that South Africa is stable and will continue to be so for the foreseeable future. This supports our view that the South African economy is very resilient and will survive the damage currently being done to it by the Zuma/Gupta state capture assault.The Rand

Since the last confidential report, the rand has managed to strengthen a little or at least to hold its position at below R14 to the US dollar.

Rand Dollar Exchange - Chart by ShareFriend Pro

Technically, the weakening trend remains in place - as shown by the series of weaker bottoms (highlighted by the red circles). The current strength has seen it come all the way back to R13.63 to the dollar (the green arrow). There is nothing in the economy that could cause this strength – everything there is negative - so this must be caused by the expectation among currency speculators that Ramaphosa will win. Much will depend on the outcome of the ANC’s elective conference and how the ratings agencies respond. Our view, based on the chart, is that the rand will probably weaken further over the coming months towards R15 and beyond. This is not necessarily a negative development since many South African companies have substantial rand-hedge components and a weakening rand represents a steady increase in profits. Against this, there is a sense that the Zuma/Gupta era is nearing its end and that whatever new administration takes over from it cannot be worse for the economy. And the rand is very under-valued on world markets. It is currently discounting considerable political risk. A positive outcome at the ANC’s elective conference (i.e. Ramaphosa wins) could result is a dramatic turnaround for our beleaguered currency. This tussle between negative and positive is playing out in the rand/US dollar chart every day.Wall Street

The progress of the S&P500 has been exactly what we have predicted since November last year. It has topped the 2600 level easily and looks set to go quickly to higher levels. And other world indexes (the FTSE, DAX, CAC, Nikkei, Hang Seng etc) are following it up as we predicted. And the JSE is no exception. What is notable is that the S&P is accelerating upwards. In our recent article, S&P500 over 2600, we show how the S&P’s bull trend, which has been moving between well-defined and established trendlines, has suddenly begun to accelerate since the beginning of this year. The pace of that acceleration increased from the middle of August and on Tuesday 28th November it climbed by almost 1% - its strongest one-day showing for the year. Bloomberg does a continuous survey of leading Wall Street strategists’ prediction for the S&P to the end of 2018. At the moment the most bearish predicts 2500 and the most bullish 2950. We predicted that the S&P would go above 3000 about a year ago – and we believe that prediction is very conservative. We also think it will probably happen before the end of next year.

S&P500 Index - Chart by ShareFriend Pro

Technically, it should now fall back into a correction, returning to its lower channel line at about 2550 over the next few months. We think that, given the acceleration, this is relatively unlikely and now it has broken strongly above its upper channel line. These developments have led us to believe that we may be on that part of the exponential chart where it begins to bend upwards (i.e. it shifts from being almost horizontal to being almost vertical). There is a growing euphoria about the rapid expansion of the US economy. Investors are gaining in confidence as they make one profitable transaction after another. A disconnect between share prices and the profitability of the companies that they represent is becoming visible. We expect this trend to continue. Already, bearish [glossary_exclude]investment[/glossary_exclude] experts are thinning out and becoming afraid to make public predictions that the market is over-priced, due for a major correction or about to enter a new bear trend because bears are being ruthlessly eliminated as the market climbs from one record high to the next. Great bull markets eventually gain their own momentum – they go up simply because everyone expects them to go up. The relationship between share prices and the profits of the companies which they represents begins to break down. In our view the bull trend is being driven by three things:- The quantitative easing that America and other countries did (Europe is still printing and injecting 60 billion euros a month).

- The drop in energy prices which began with shale gas and oil but which is continuing with vastly improved photovoltaics and batteries.

- The efficiencies which are flowing from new technologies. These efficiencies are driving costs down for almost every business in the world.

Commodities

MINING ROBOTICS

The South African mining industry is dying. Constrained by adverse legislation, rising costs and weak commodity prices, many mines have been closed down and hundreds of thousands of jobs have been lost. In many ways, the situation is very similar to what happened in the 1930’s when it was widely thought that gold mining was no longer profitable and that most gold mines were reaching the end of their economically viable lives. That was followed by the development of the “heap-leaching” technology for extracting gold which greatly reduced the costs associated with mining gold and gave many mines a new lease of life. South Africa has more than 40% of the world’s proven underground reserves of gold – but is now one of the smallest producers of gold in the world. This is because most of the gold that we have is at very deep levels where the cost of extraction is becoming uneconomic. To overcome the problems of operating at very deep levels, Anglo American has been working on new technologies that would enable robots to work underground instead of people. At the recent Mines and Money conference in London, Anglo claimed that robotic mining was 5 to 7 years away and that the mining industry would be “unrecognisable” after that. Apparently Anglo has developed a robot that can “chisel” as well as any human being. The benefit is that robots do not need to have breathable air and can operate at much higher temperatures. Safety considerations which are a major cost for mines need not be applied. This would enable robots to mine at much deeper levels where grades are generally higher at a fraction of the cost of human miners. The impact of this technology on the South African gold and platinum mining industry will be profound. Mining will cease to be labour intensive. The lives of some of our deep level mines would be significantly extended. It is even possible that South Africa could once again become the world’s biggest gold producer.GOLD

South Africa used to be the world’s number one gold producer – back in 1970 when we produced 1000 tons in a single year. That compares with our production last year of just 120 tons. Obviously, some of the decline is due to the fall in the international dollar price, which has made many of our deep-level mines unprofitable, but the industry has also faced unprecedented hostility from the government and the unions. Instead of trying to make it easy to mine gold in SA the government has been doing everything possible to make the mines more difficult to operate. Does this mean that gold shares are a bad investment? Definitely not. They remain volatile and difficult to predict, but potentially highly profitable. The rand price of gold has been in a long-term steady upward trend for at least 12 years. The recent weakness in our currency gave the gold mines a welcome boost. And the world is slowly running out of gold. There are very few new major deposits of gold being discovered. In time that must mean that the dollar price of gold will also rise. We also believe that new technologies may make our vast underground reserves profitable again, especially if the price goes up. So it is worth watching the gold market – one day it will probably return to its former glory. After all, South Africa still has about 40% of the world’s known underground reserves of gold – it’s just too deep and [glossary_exclude]expensive[/glossary_exclude] to mine profitably with the current technology.PLATINUM

The platinum industry is important to the South African economy as a major employer and source of foreign currency. We have approximately 75% of the world’s platinum in some of the world’s deepest mines. The platinum price has been one of the primary victims of the sub-prime crisis which began in 2008. In March 2003, platinum reached an all-time high of $2273 per ounce on the back of massive auto-catalyst demand. Since then the price has been falling and now wallows at around $933. This has been a disaster for the SA platinum industry, despite the fact that it has been to some extent protected by the weakness of the rand (in March 2003 the rand was trading for less than R8 to the US dollar). For the past six years the world supply of platinum has been less than demand leading to a deficit which has been made up by the “opaque” above ground stocks of already mined platinum. Those stocks are now estimated to be substantially depleted by the 5-month platinum strike in 2014. Added to this is the fact that about 60% of platinum shafts in South Arica are operating unprofitably and many are due for closure. So, it looks likely that the platinum price will rise in 2018 as demand increases while supply is stagnant or declines. The recovery of the world economy is causing a surge of vehicle sales and consequent demand for auto-catalysts. In the background is the rise of electric cars being pioneered by Tesla and others. It is predicted that in time the internal combustion engine will be obsolete – and with it the need for auto-catalysts. Against this, the rise in battery demand and the possible rise of fuel cell technology might create a new source of demand. Our view is that there will be a window of opportunity to capitalise on the platinum shortage over the next few years, but that it will not last.New Listings

LONG 4 LIFE (L4L)

Brain Joffe’s post-Bidvest business has made another acquisition and does not appear to have been slowed down by the departure of Kevin Hedderwick. What is interesting about this share is the chart pattern which now shows a clear “saucer bottom” which is associated with much-increased volumes.

Long 4 Life (L4L) - Chart by ShareFriend Pro

It looks as if the fund managers have decided that below R5 per share, L4L represents good value. Despite Hedderwick’s resignation, it appears that faith in Joffe remains strong. We think that L4L may represent a good buy anywhere below R5.AYO

This share is being spun out of AEEI in much the same way as the recently-listed Premfish – but at double the value. The idea is to raise between R3,7bn and 5,7bn on the listing through a private placement of the shares. This seems a little excessive since AEEI valued the entire company at R3bn in its financials to 31st August 2017. Ayo is in the technology sector and owns a 30% stake in British Telecoms SA – which generates a nice dividend income. It also has a 25% chunk of the hospital market in SA and many well-known names as clients – like Cisco and Microsoft. So that leaves you, as a private investor, wondering if you should take up the shares. Our [glossary_exclude]advice[/glossary_exclude] remains the same: wait for the share to come to the market and study the market action. This means studying the high, low, open, close and volume traded each day to try to discern how the market is valuing the share. Premfish came to the market at 500c and has since fallen to 400c. It appears to have solid support at 365c, but buying it immediately as it listed would have been a mistake.BLACKROCK

This is a secondary listing on the JSE for a massive European asset manager with almost $6 trillion under management. Blackrock intends to raise R650m when it lists and it is pricing its shares at its net asset value in British pounds – which means that the pricing will be impacted by the strength of the rand at the time that it lists. Slightly over 10 million shares will be listed on the JSE. Blackrock’s financials released in October showed that it had increased its net asset value by 23%. The benefit of an investment in Blackrock is that it would offer exposure to the rapidly recovering European economy. We believe that Europe will continue to recover, riding on the back of the surge in the US economy. Also, there will clearly be a solid rand-[glossary_exclude]hedge[/glossary_exclude] component in this share.KAAP AGRI (KAL)

This company listed recently and, like Curro, Stadio and Capitec, has PSG as one of its major shareholders. At listing on 26th June this year, the shares traded as high as 6390c, but since then have fallen back to just below 4800c. In its recent trading update Kaap Agri indicated that headline earnings had increased by between 16% and 18%. It was also announced on 10th November 2017 that the company had made an acquisition for R132m which would significantly enhance its fuel distribution network. The company intends to ultimately make fuel distribution 30% of its turnover. We believe that this PSG-backed company will prove to be an excellent investment in time and that it represents good value at current prices. Its progress since listing shows the wisdom of waiting when a new company is listed to see what value the market gives it.ALPHAMIN

This is a tin mine in the Democratic Republic of Congo (DRC) which is already listed in Toronto and which is looking to open a secondary listing on the JSE. Possibly this is one of the highest risk investments that you could make. Firstly, the mine is located in the DRC where political stability is a problem. Secondly, it is mining a commodity which depends on the world price of tin. Thirdly, it is a start-up operation that will need to spend $172m before it can produce its first tin in 2019. So you have to believe that the tin price will continue to climb over the next two years. If all of that goes right then this could be a great money-spinner. Tin is used mainly in electronics – a sector which in undoubtedly growing as new technologies come into existence. Obviously, a lot will also depend on China continuing to grow. Almost 60% of the world’s tin is used in China. But if you have a strict stop-loss strategy and are not too risk-averse, then this could be a winner – when it comes to the JSE.The Indexes

One of the great paradoxes of the share market is the difference between what is happening in the economy and what is happening to shares. Right now it is difficult to imagine how prospects for the economy could be worse. Political uncertainty is rife with the coming ANC leadership change, economic growth is close to zero, we face a barrage of ratings downgrades, the government has no funds to deal with the imminent crises like the Eskom cash-flow problem. And yet, despite all these negatives, the JSE continues to go up, breaking new records almost daily. Consider the chart of the JSE overall index:

JSE Overall Index - Chart by ShareFriend Pro

Of course, much of this rise is accounted for the fact that many of the largest shares on the JSE, like Naspers and BAT are partly or fully located overseas. Nonetheless, shares like Dischem and Capitec are also making new record highs and they have no rand-[glossary_exclude]hedge[/glossary_exclude] component. Clearly some things are getting better despite all the adverse publicity. Looking at the Mid-Cap index (which contains the next 60 largest companies after the JSE Top 40), we see that it is also in a rising trend – but not nearly as convincing as the JSE [glossary_exclude]Top[/glossary_exclude] 40 or the overall index:

JSE Mid-Cap Index - Chart by ShareFriend Pro

And there are no new record highs here over the past year. But the real crunch comes with the JSE Small Cap index. This contains all the companies that are not in the JSE [glossary_exclude]Top[/glossary_exclude] 40 or the JSE Mid-Cap. Here the direction of the trend is clear:

JSE Small Cap Index - Chart by ShareFriend Pro

After an encouraging start in August and September, this index is falling rapidly back towards support at lower levels. So from this we can see that the brunt of the current local economic problems is being carried by the smaller companies – those listed on the Alt-X and the fledgling index. And this applies to small business, listed or unlisted. The fall-off in consumer demand as a result of job losses is impacting on small and micro-businesses across the [glossary_exclude]board[/glossary_exclude]. And since they are the largest employers in South Africa, the effect is a downward spiral. The normal solution to this would be for the government to step in and fund infrastructure projects and other government works to stimulate demand fiscally – but as we have seen, right now, this government simply does not have the spare cash. And yet there is hope – the world economy is really beginning to shows definite signs of an economic boom.Companies

LEWIS (LEW)

This company has been in difficulties since June 2015 when its shares peaked at R100. The weak economy coupled with changes to the National Credit Act made it much more difficult for Lewis to follow its usual business model – which was based on extending credit to the lower income groups. To these problems was added a dubious sale of insurance and other “back-end” financial products to their customer base – which they have now owned up to and paid a fine. That’s the bad news – which is pretty fully discounted into the share price at around R27. What is interesting about this company is that it has a net asset value (NAV) of 6133c per share and has been buying back 2,9m of its own shares. By doing this they are increasing the value of the shares of the remaining shareholders. A share buy-back is treated by SARS as a dividend because the shares which are bought are destroyed which means that there are less shares in issue and they increase in value as a result. The company is still making profits every year, albeit at much lower levels. It has a strong balance sheet and managers who clearly understand their business. We believe that it is at or close to its low point. It is certainly a share which benefits from any sort of recovery in the South African economy.ORION MINERALS (ORN)

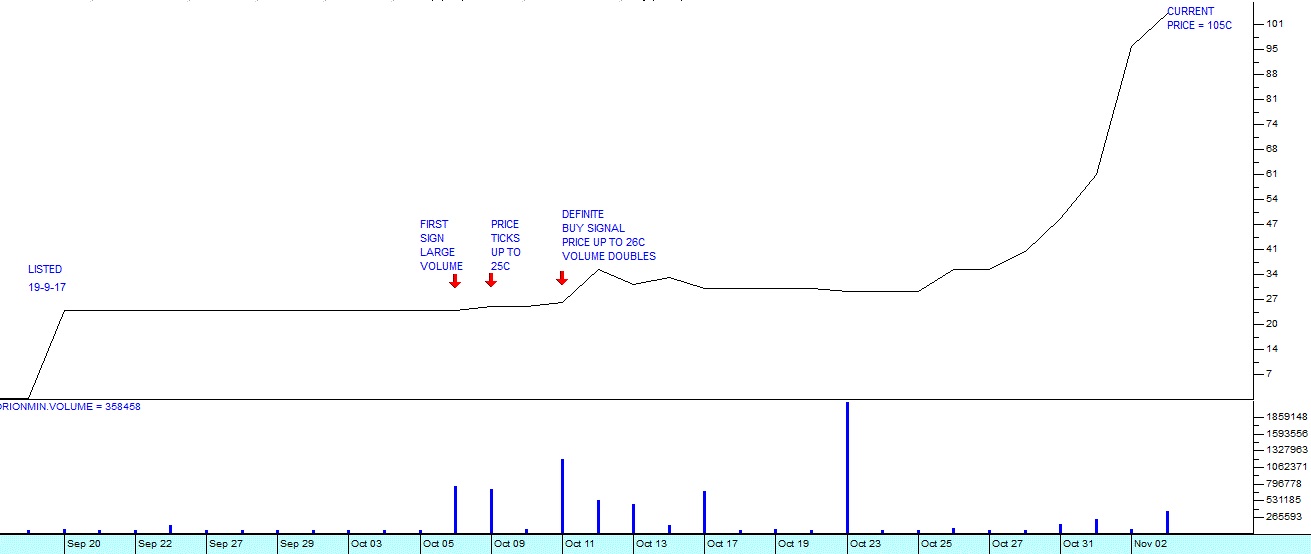

This is yet another new listing on the JSE – but it is not one which really caught the imagination of the investing public. It is a mining operation in Prieska set to produce copper and zinc. What is interesting about this share is how it behaved once it was listed. Consider the chart:

Orion Minerals (ORN) - Chart by ShareFriend Pro

Here you can see that it listed on 19th September and traded at 24c a share on very thin volumes (an average of just over 20 000 shares per day). Then suddenly on 6th October it traded 766 000 shares and the next day the price ticked up to 25c and 722 000 shares were traded. A few days later on 11th October it ticked up again to 26c and a massive 1,2 million shares changed hands. To the astute technical analyst, this can only mean one thing – the smart money was busy mopping up all loosely-held shares available in the market. The only reason they would do this is because they knew something that other people did not know. They knew that something momentous was about to happen to Orion and they wanted to get their hands on as many shares as possible before it became public knowledge. A little while later, on 3rd November, the share was trading at 105c – a massive 300% increase in less than a month. What an amazing opportunity this was! What you need to consider is that your software reflected these facts as they were happening – it’s just that you did not know where to look. Or, if you did know where to look, you did not know the significance of what you were looking at. So, the lesson is to always watch new listings, no matter what they are until you can establish whether they are interesting or not. Particularly, watch for massive increases in volume accompanied by small increases in price – because that is a sure sign of insider trading.THE FOSCHINI GROUP (TFG)

Statistics from TFG are very interesting as regards online shopping. They say that online shopping now represents 6% of group turnover – driven mostly by the UK where it is 28% of turnover and the US where it is 8,5%. Here in South Africa TFG says online shopping is creeping up towards 1%. However, the trend is clear. More and more consumers are choosing to buy goods online – to the point where Walmart is actually closing some stores in the US. In South Africa we are still building massive shopping malls as if online shopping were just a passing phase. In our view, online shopping is only going to grow and some of these huge shopping malls may well find it more difficult to get customers to visit. We think here of the extension of the Fourways shopping mall to 170 000 square meters. Can that really be justified in the long term?ANGLOGOLD (ANG)

Anglogold looks like a very good buy at current prices. Technically, the share has executed an almost perfect “saucer bottom” and looks set to break on the upside. What has happened there is that the company has reduced its exposure to South Africa to just 13% of its profit – from the 40% that it used to have. It is focused on its ultra-deep level mine, Mponeng (the deepest mine in the world at 4000 metres). The point is that most of Anglogold’s asset are now overseas – but the share price is still discounting the negative perceptions of South Africa and the uncertainty in the mining industry here. This gives the private investor an opportunity to pick up the shares at a bargain price before they are re-rated upwards to bring them into line with other overseas gold mining operations. Consider the chart:

Anglogold Ashanti (ANG) - Chart by ShareFriend Pro

CAPREC (CTA)

Caprec is a technology company which owns among other things Fintech. It was the JSE's first Special Purpose Acquisition Company (SPAC) to list on the main board and is focused on acquiring companies in the financial technology sector. This is a sector which is proving to be a “disruptive” sector for the banks and one of the fastest growing sectors in the world. In the interim period to end-September the company increased operating profits by 130% and headline [glossary_exclude]earnings per share[/glossary_exclude] (HEPS) by 87%. It also managed to pay a maiden divided of 2c per share. The company’s directors believe that the company’s share is seriously under-priced and to that end has bought back 25m shares in the open market. Technically the share looks like it may be bottoming out on strong volumes. We are of the opinion that this could well prove to be a good buy at current levels around 80c.

Capprec (CTA) - Chart by ShareFriend Pro

ASCENDIS (ASC)

Ascendis Health is a health care company that acquires businesses in the human, animal and plant health-care industries. The share has fallen from a high of around R29 to its current level of about R15.50.