Winners in 2024

23 December 2024 By PDSNET2024 was always going to be a very good year for the share market. The year began with the S&P500 at 4742.83 (2/1/24) and it reached an all-time record high of 6090.27 (6/12/24) – a gain of 28,4% excluding dividends.

On the 25th of January 2024 we made the following prediction on Twitter (X):

“Our calculations indicate that will reach 6458 some time in the next two years”.

Now, with the year behind us, that prediction is looking much more probable than when it was made. Indeed, we now see the S&P rising to much higher levels – over 10 000 in time.

The JSE Overall index gained 15,7% over more-or-less the same period to its record high of 87643 on the 9th of December 2024.

During the year we picked some great winners. By Friday 20th December 2024, the Winning Shares List (WSL) included 116 shares of which seven were down, one was unchanged and 108 were up.

Altogether the list included 4 shares that had risen at a rate of more than 200% per annum. They are Stefstock (SSK), Kore (KP2), MAS (MSP), and Premier (PMR). A further 12 shares have risen by more than 100% per annum. They are Telkom (TKG) , Brait (BAT), Karoo (KRO), Nampak (NPK), WeBuyCars (WBC), Cashbuild (CSB), PPC (PPC), Pepkor (PPH), Altron (AEL), Hyprop (HYP), ARC Investments (AIL), and OUTsurance (OUT).

And that excludes some of the short-term winners like Bell (BEL) which was added to the list on 27th October 2023 at 1870c and reached a high of 5189c 22nd August 2024 – gaining an impressive 177% in just over 10 months.

The purpose of the WSL is to assist you with the process of share selection and the initial timing of your purchase. So, we have cut the almost 300 shares listed on the JSE down to 116 which we believe have the potential to generate a good capital gain in a relatively short period of time.

Obviously, not all those shares will perform well, and those which underperform are removed from the list as soon as that becomes apparent. However, historically about 70% of the shares on the list have performed well. So, this means that if you select shares from the WSL, you should have a roughly 70% chance of being successful – and, of course, you should always make sure that you maintain a strict stop-loss strategy to cut your losses when the share goes down.

If you are not clear on stop-loss, watch this video.

We often write articles about those shares which have performed well on the WSL, but here are some additions to the list in the last few months, which we have not yet written articles about, and which are already performing very well:

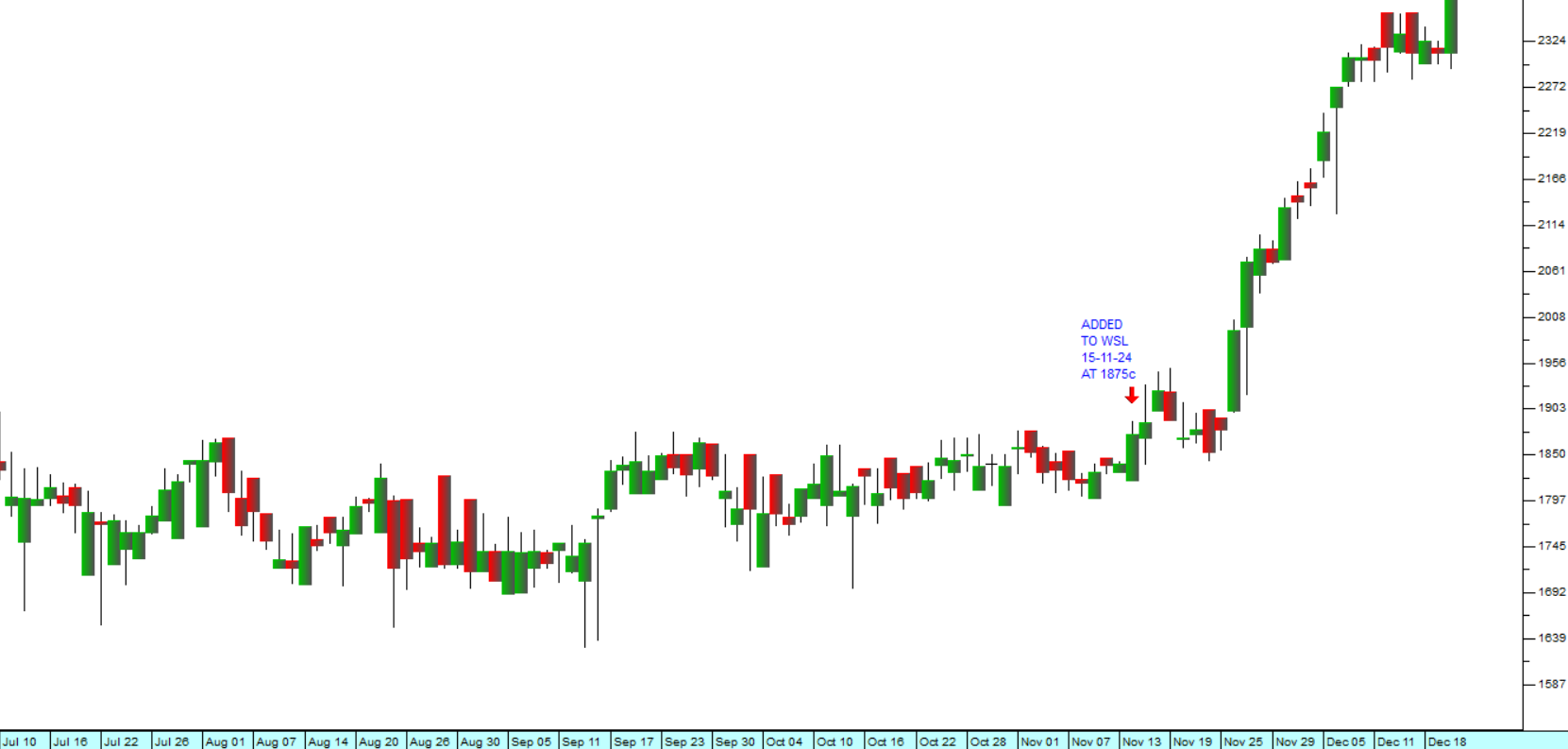

MAS

This was added on the 15th November, just over a month ago, at 1875c and has already risen by 26,7%. Note that we added it after it had been moving sideways for some time – so the timing of the addition is important.

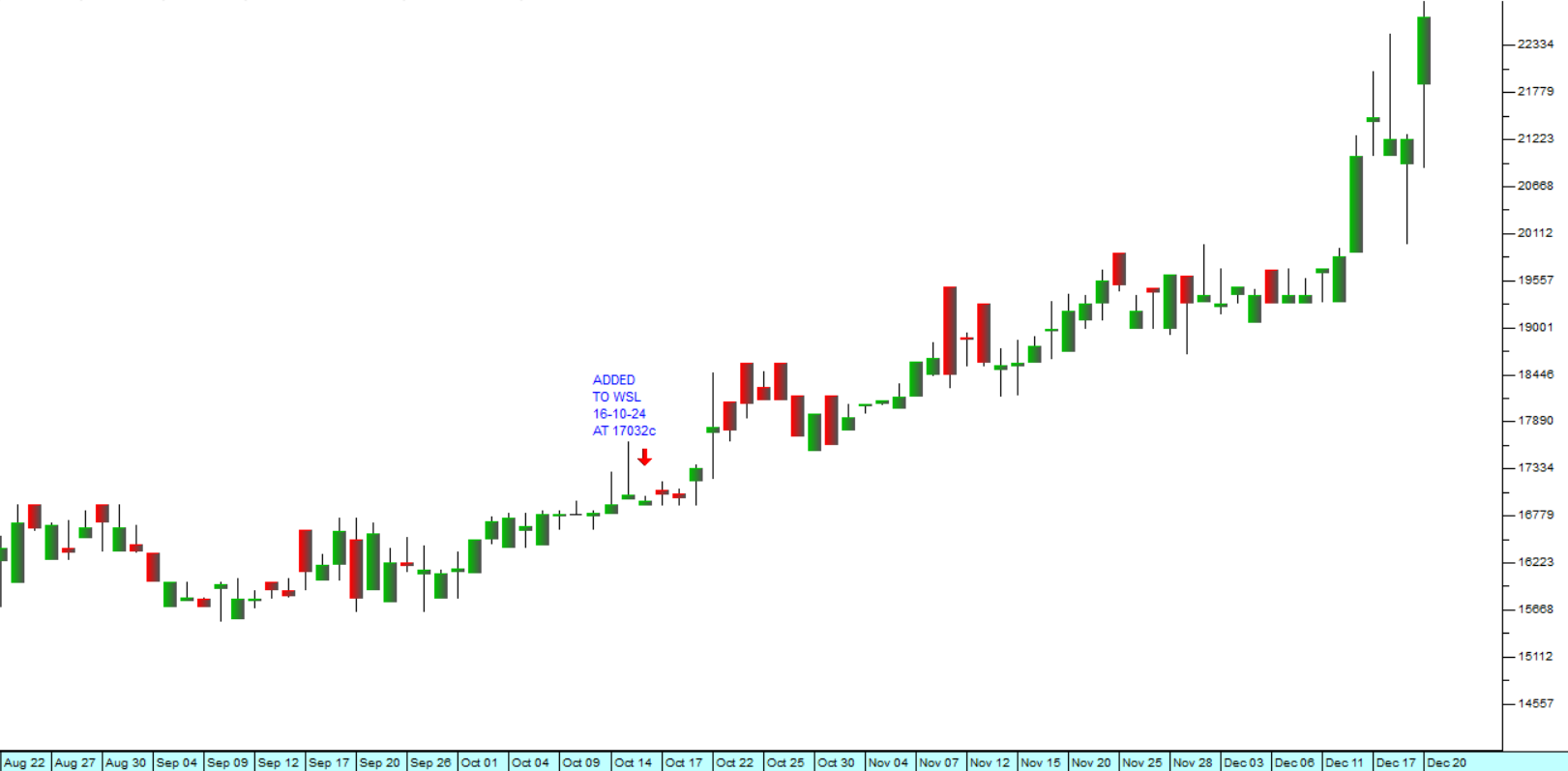

PREMIER

This share was added on 21st August, 3 months ago, at 7635c and has already risen by over 76%. Again, the timing of the addition came after a period of sideways movement and immediately before a strong upward move.

CASHBUILD

Cashbuild is one of those shares which has benefited from improved consumer optimism following the appointment of the new government of national unity (GNU). Prior to that, it too had been drifting sideways.

Don’t forget that if you can make several hundred percent on your winners, but cut your losers with a maximum loss of 15% including dealing costs, then you have to be successful in the market.

Season’s Greetings

The staff and directors of PDSnet take this opportunity to wish you and your family a happy Festive Season and to wish you all the best for the New Year. Our next article will be published on the 6th of January 2025.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: