V-Bottom is likely

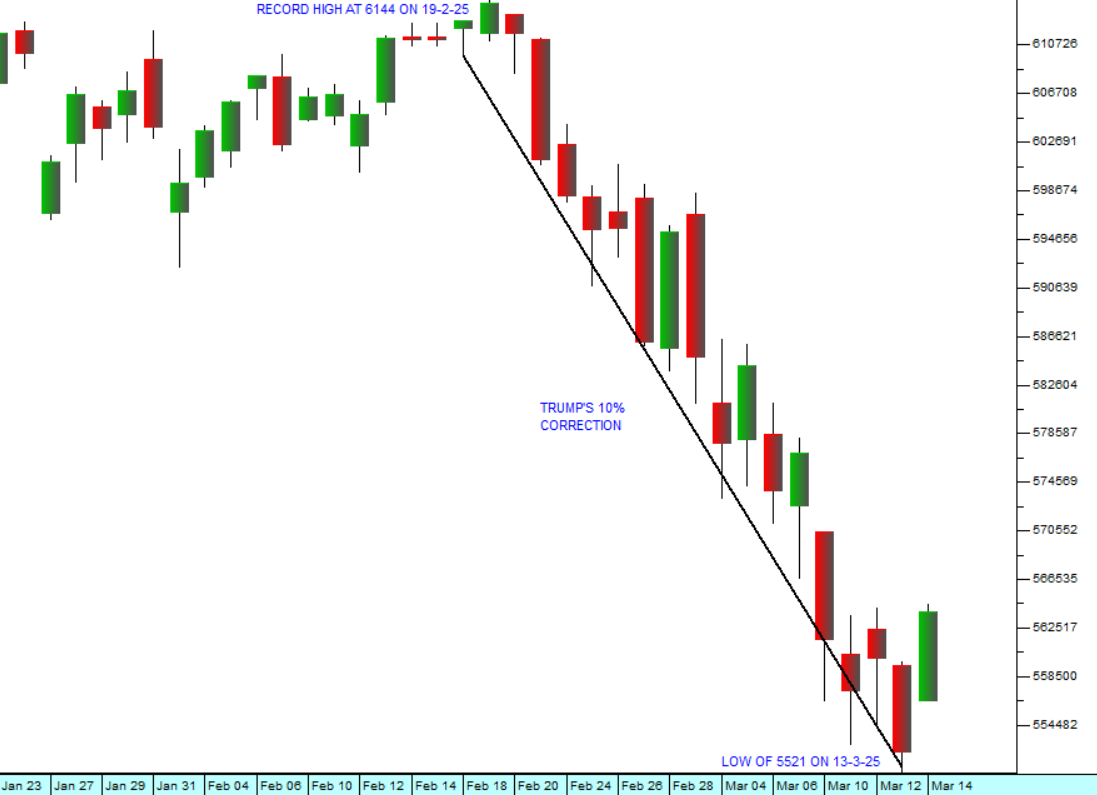

17 March 2025 By PDSNETThe 10% collapse of Wall Street, which is a direct result of Trump’s random policy of on-again, off-again tariffs, is very similar to what happened to Wall Street in February/March 2020 when investors tried desperately to accurately discount the impact of the COVID-19 pandemic.

Normally, corrections in the market are caused by an accumulation of purely economic forces – like the expectation that the US Federal Reserve Bank will shift from being dovish to being hawkish in the interest rate cycle. Such events are a function of well-understood and closely monitored economic indicators, like the monthly jobs report and the level of US housing starts. They are predictable because they are not a function of a black swan event like the pandemic or the apparently erratic and vindictive actions of an individual.

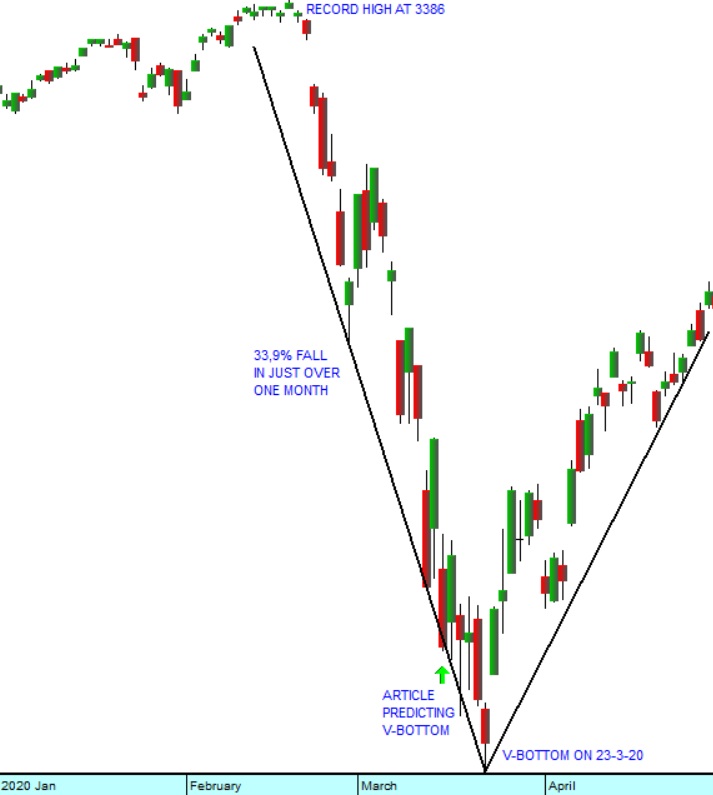

In mid-March 2020, while the S&P500 index was still falling as a result of the pandemic, we published an article in which we said that we expected the downward trend to end in a V-bottom – and giving our reasons. As you can see from the chart below, two weeks later we were proved to be right when the S&P reached a cycle low of 2237 on 23rd March 2020 and made a V-bottom.

Of course, the downward trend as a result of the pandemic took the S&P down 33,9% in just over 1 month – which was a very dramatic fall. Investors simply did not have any clear way to establish how far the market would fall in response to this unique and unpredictable development.

Today, investors are in a very similar position. Trump’s actions and statements are highly unpredictable. Nobody, not even his closest advisors, seem to have any idea what he might say or do next. The downward trend, which he is totally responsible for, is thus a classic black swan event.

What we do know is that (in a similar manner to the 2020 downward trend) the economy was doing very well before Trump began his extraordinary activities. We believe, as we did in March 2020, that the great bull trend, which in our opinion has been in force for 16 years since March 2009, remains essentially in place.

We also think that Trump’s tariffs will not survive for very long – the international trade war which he appears to be intent on fostering simply does not make any sense for anyone – and especially not for America. Sooner or later, we believe that common sense will prevail, and some degree of normality will return. Already, he is rolling some of the tariffs back and delaying the implementation of others.

A few days ago, on 11th March 2025 we tweeted:

“Despite what #Trump is saying, we are not seeing any clear evidence that the #USeconomy is in #recession. In our view, this #correction is probably close to its end and the current levels of the #SP500 (5550) therefore now represent a #buyingopportunity. The #bull remains”. Consider the chart:

So, the S&P has fallen by just over 10% in just less than a month. Because the sole author of this correction is Trump, it is difficult to say just how far the correction will continue, but technically, it looks to us like it is at, or very close to, its bottom. It may have even passed its lowest point.

We do not think that Trump’s tariff strategy has any brilliant and mysterious merit. We certainly do expect markets to recover, but mostly because we expect that he will be forced to abandon the most damaging of his tariffs. Once that happens, markets will undoubtedly continue to discount the future profits to flow from new technologies such as artificial intelligence and humanoid robotics.

It is basic economics that any government interference in the free-market flow of goods between countries always comes with a cost – usually in the form of higher inflation. Tariffs cannot easily be justified except in the short-term to protect nascent industries or perhaps to counter the dumping of products which have been deliberately subsidised by the governments of other countries.

Trump’s tariffs do not fit into either of these categories. He seems to be under the mistaken belief, for example, that the US trade deficit with Canada is, in effect, a debt which somehow Canada owes to America. That, of course, is nonsense as any first-year student of economics could explain to him. Many of the tariffs which he has implemented or threatened appear to be motivated by his clearly enunciated policy of seeking revenge or pressurising the target country to comply with his wishes – such as Canada becoming the 51st state of America.

So, our view is that this downward trend will not last for much longer. Indeed, it might already be over given the 2,13% jump in the S&P on Friday. The low point which we identified in our tweet of 5550 might yet prove to be remarkably accurate.

Footnotes:

- The Trump induced uncertainty in markets has caused gold to rise to new record highs both in US dollars and rands. In our March 2024 Confidential Report we drew attention to the fact that gold had broken up through the key resistance level of $2060 and was therefore entering an upward trend. Since then, it has risen by 44% to Friday’s record close of $2987.

- Bitcoin, following the descending triple top, which we drew attention to in our February 2025 Confidential Report, has been falling steadily. We expect this downward trend to continue and even to gain momentum as the Trump/Musk effect on the US economy diminishes.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: