Tweets

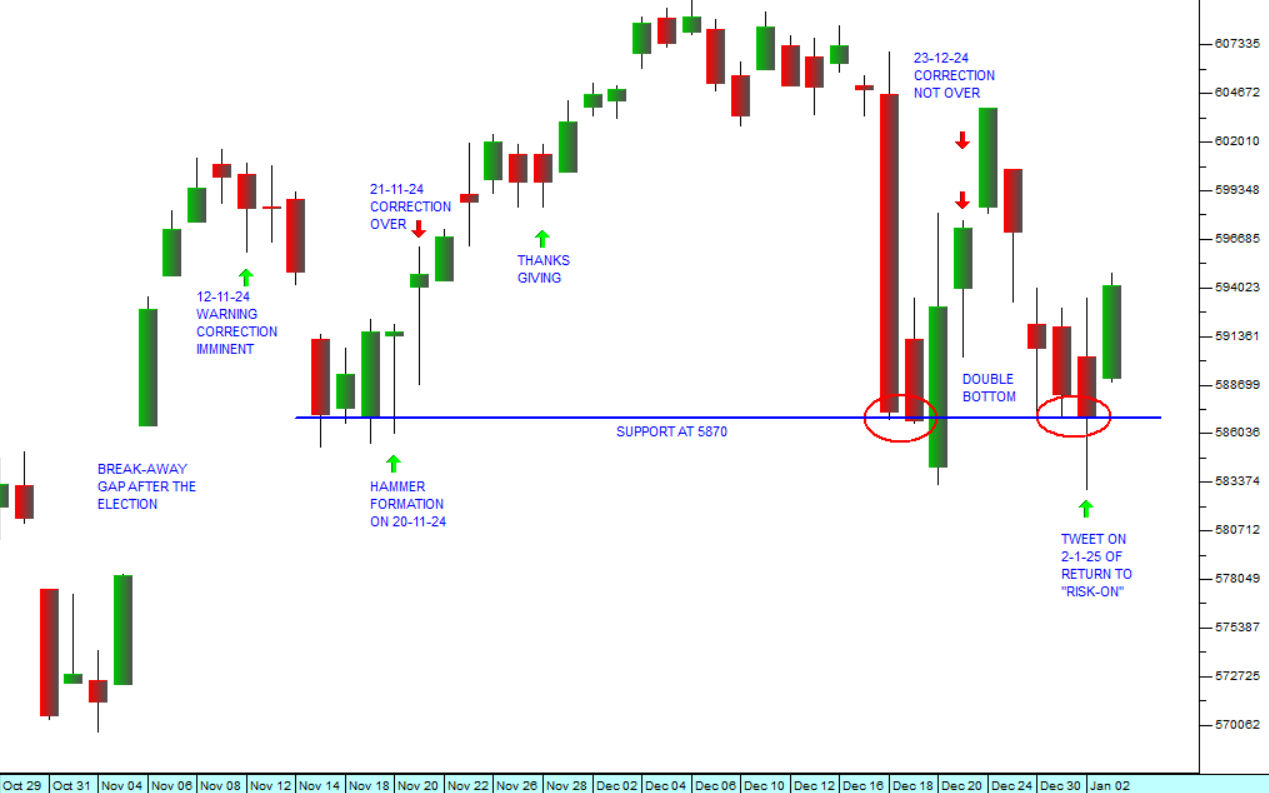

6 January 2025 By PDSNETOver the Festive Season, we have been communicating with you via our tweets on “X”. The chart below shows the timing of our individual tweets and what subsequently happened to the S&P500 index.

The chart begins with the strong upward response to the US elections on the 6th of November 2024, highlighted by the break-away gap in the chart. This is what has happened subsequently:

- On the 12th of November we warned that a correction was imminent. That was followed by the S&P falling back to new support at around 5870 (shown by the horizontal blue line).

- Then on the 20th of November there was a clear hammer formation showing that the bulls were again taking control.

- We tweeted on the 21st of November 2024 that the correction was probably over, and the bull trend was poised to resume.

- After the Thanksgiving holiday on the 26th of November, followed by Black Friday, the S&P moved up to its current all-time record closing high at 6090 (06-12-24).

- That was followed by a period of sideways movement and then a correction back to the support level.

- The S&P bounced off the support and rose sharply, but we tweeted on the 23rd of December that the correction was not yet over and that, in our opinion, there would be further downside.

- The S&P then fell back again to the support level making a double bottom formation (indicated by the red ellipses on the chart).

- Then on 2nd January 2025 we tweeted that the correction was probably over, and the upward trend was likely to resume.

- Finally, on 3rd January (Friday last week) the S&P climbed 1,26% to close at 5942.

You will notice, if you read the various tweets that we have made over this period, that we relied heavily on the rand/US dollar exchange rate as a good leading indicator of shifts in international investor sentiment towards “risk-on” and “risk-off”.

Our tweet on the 12th of November warning of an impending correction in the S&P was based on our perception that the rand was about to enter a period of relative weakness against hard currencies heralding a period of “risk-off”. And our tweet on the 2nd of January 2025 that the correction was likely over was based on our perception that the rand was bottoming out against the US$ and about to strengthen as a result of a return to “risk-on” sentiment.

That in turn was based on the observation that the rand had made a double bottom against the US$ at around R18.90 and that it was likely to strengthen from there.

Our longer-term prediction remains that the great bull market, which began in March 2009, remains in progress. We expect to see a new record high on the S&P fairly soon. We also believe that the rand will strengthen from current levels reflecting the good prospects for the South African economy in 2025 and a general shift back towards risk-on. As a private investor you should be fairly fully invested in high-quality equities, while retaining a strict stop-loss strategy.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: