Trump

I am a stock market analyst, not a political analyst, and I have to admit that I got the recent election in America devastatingly and horribly wrong. I honestly believed that the vast majority of Americans would never vote for Trump. My perception was that were just too many negatives – his proven and almost compulsive dishonesty, his life history of overt sexual perversion, his unashamed racism, his blatant misogyny, his cowardly disdain for the military, his well-established criminality and his octogenarian senility to name but a few. Just one of these negatives would have been sufficient to destroy any hope of winning for any other presidential candidate.

And all this time, I have been discounting Trump’s continued political influence as a right-wing cult of quasi-religious fanatics which was affecting an unusually large minority of relatively uneducated Americans – mainly from the deep South. But, the truth is that Trump does not represent a minority at all. That fact has been brutally and inescapably brought home to all of us.

He represents an overwhelming ground-swell rebellion, especially among the relatively uneducated, but also very much present in both women and college educated people. The rebellion is against the world’s inexorable progress towards liberal egalitarianism in all its forms over at least the last century and perhaps much longer.

Liberals generally have espoused progress towards a society where everyone was treated equally, irrespective of their age, gender, race, and sexual orientation. MAGA republicans and other right-wing people around the world have seen this as steady irreligious degradation and moral dissipation. More and more, they appear to have been hankering after the values and attitudes that existed in Cecil John Rhodes’s time.

They literally wanted to make America great again in the way that they perceived it to have been before the invention of political correctness and wokeism.

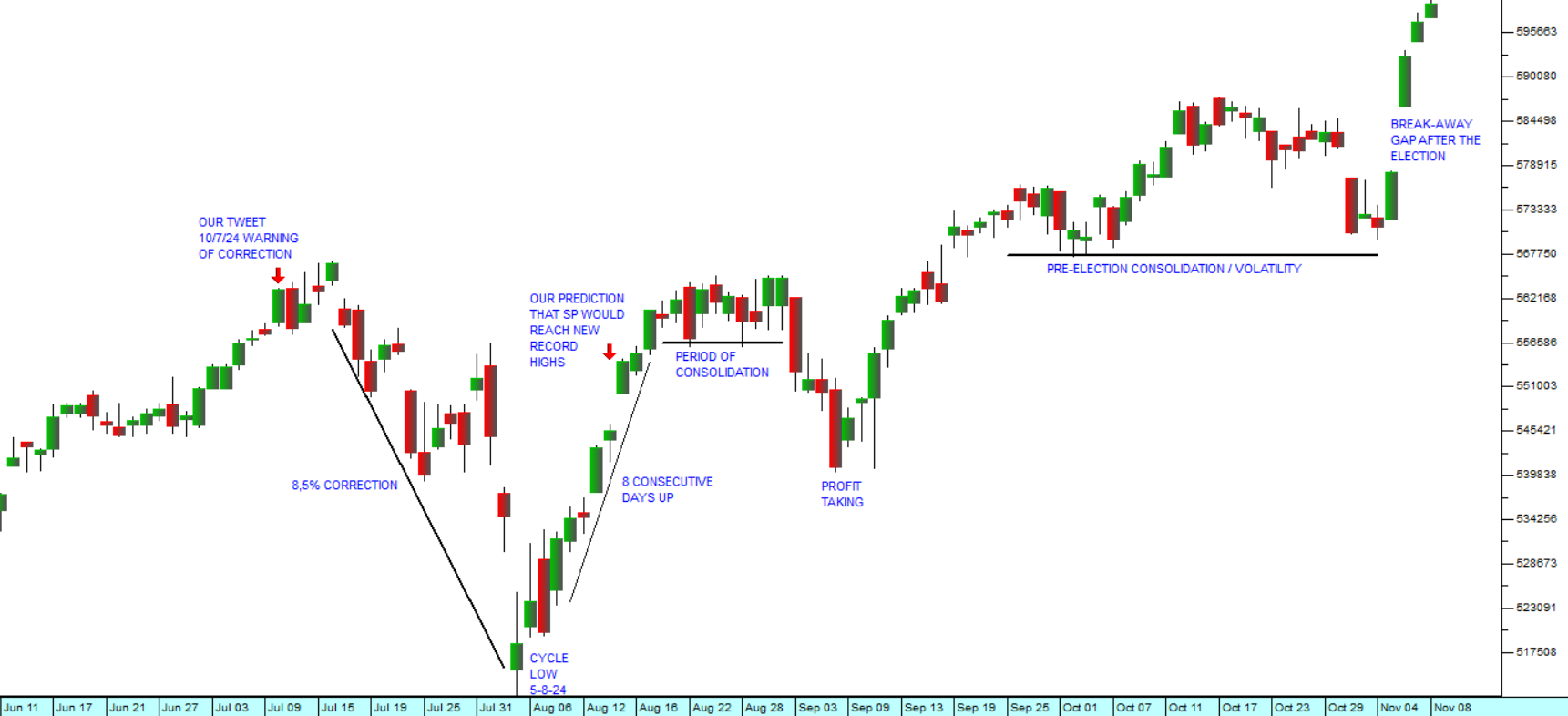

So, how does all this reflect in the equity markets of the world? The answer is, “not very much” – except, of course, that markets really do not like uncertainty, so the sharp reduction in uncertainty following the election has seen markets rise to new record levels – just as we predicted in our tweet on the 26th of October 2024. Consider our annotated chart of the S&P500 – which by now you should be very familiar with:

As you can see the S&P 500 index is now flirting with the 6000 level and we believe it will rise above that level in the near future, probably during the Christmas rally which we have spoken of previously. There can be little doubt that the S&P is already over-valued from an historical perspective, but we believe that it will continue to become even more over-valued as the potential productivity gains of artificial intelligence, humanoid robotics and cheaper renewable energy are discounted.

We remind you of our tweet made on the 25th of January 2024 when we said,

“So now that we are breaking new record highs on the #SP500 almost every day, it is fitting to ask how high it will go. Our calculations indicate that will reach 6458 sometime in the next two years. The upward trend will certainly be broken by corrections”.

At the time that we posted this tweet, the S&P was at 4894.17 – and the suggestion that it might go well above 6000 was regarded as radical, even absurd.

We now believe that our prediction on the 25th of January this year was highly conservative. We are now expecting the S&P to go above 10 000 before this bull trend is done. So, before you become too depressed about the prospect of another 4 years of Trump, make sure that you are fully invested.

← Back to Articles