The Winning Shares List

Private investors typically have a major problem with share selection. Out of the three hundred or so shares now listed on the JSE, they find it difficult to pick out those shares which represent the best opportunities to make a capital gain.

Many of the shares trading on the JSE have very thin volumes which makes them unsuitable for investment. If you buy a thinly traded share, you may not be able to sell out of it if it falls to your stop-loss level. For this reason, we always limit our analyses and our suggestions to those shares which we believe are “free dealing.” The rule of thumb is that you should always make sure that the share that you want to buy trades at least three times the amount that you want to invest on average, every day, over the previous three months.

Of course, the share market is not about certainties – it is about probabilities. This means that if you choose ten shares, the probability is that five will beat the JSE Overall index and five will underperform it. Mathematically, this must be true over the long term because the index is an average of the shares from which you are selecting.

If you maintain a strict stop-loss strategy and stick to free-dealing shares, then you can ensure that you never lose more than, say, 15% on any share market investment ever – including your dealing costs. Since your winners will potentially yield much higher returns, being successful as a private investor can be reduced to a set of rules.

To assist you with your share selection problem we have developed the Winning Shares List into which we will put those free-dealing shares which we believe have an above average probability of going up. We began last week and have already added seven shares to the list. Those shares are: Afrimat, Indlu, Advanced, Argent, Adcock, Textainer and Remgro.

Of course, it is far too early to see which of these shares will perform well, but all of them are on an upward trend and all are well traded. We are confident that as many as 70% will perform well – and those which do not we will remove from the list, in due course.

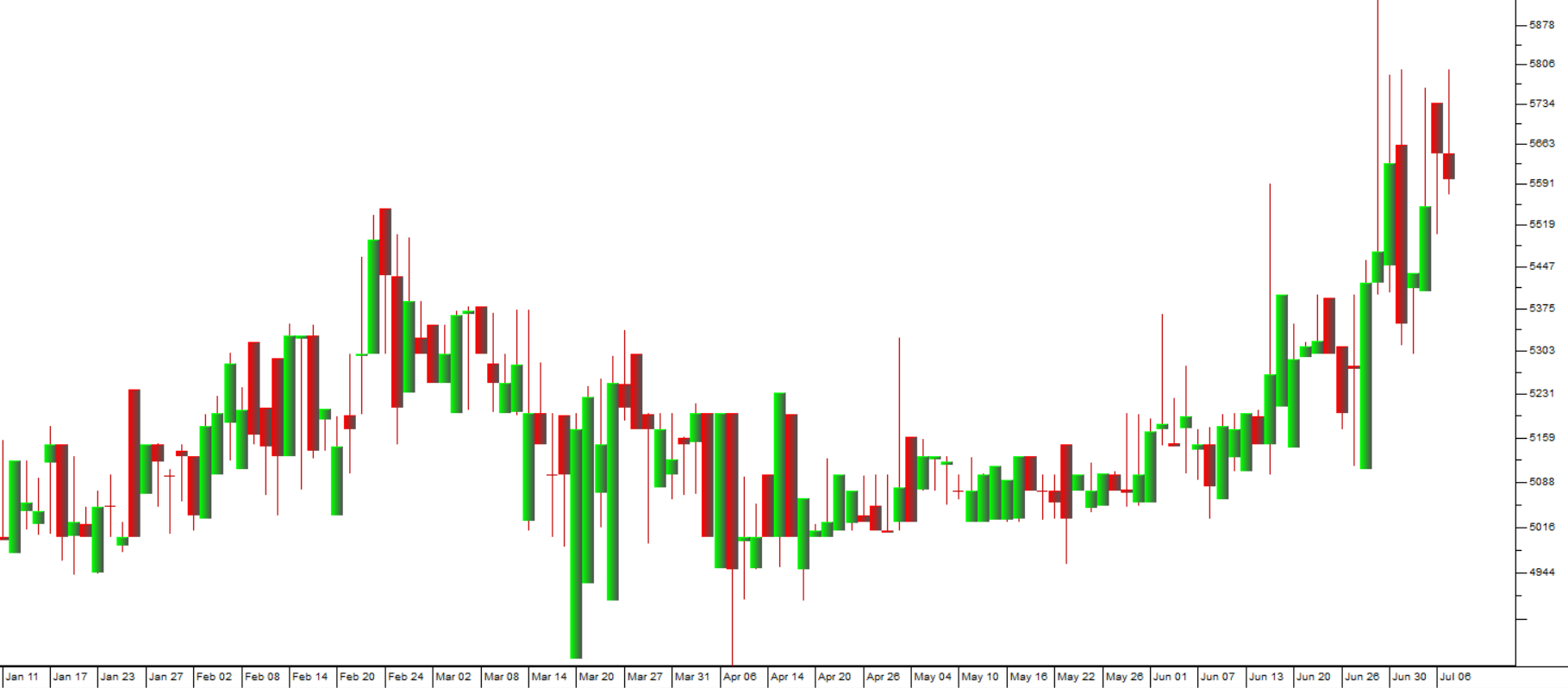

One of these shares, Afrimat (AFT), has been rising steadily this year. It is a commodity share and so its shares are volatile, but it is extremely well managed and has some great prospects. Consider the chart:

The chart shows about 9 months’ data and an upward trend is discernible. From its high of R63 on 28th June 2023, the share has fallen back to just below R60. At this level is should find some support, consistent with the previous cycle high made in January and February of this year.

Another share on the list is Adcock (AIP). This company has begun to show some signs of entering a new upward trend and it has particularly good fundamentals. Consider the chart:

Take the time to read its most recent financials for the six months to 31st December 2022. They are available at: https://senspdf.jse.co.za/documents/2023/JSE/ISSE/AIP/AIP012023.pdf

The Winning Shares List, which is updated daily, will be made available to our clients on our website.

← Back to Articles