The US Economy

17 July 2023 By PDSNETThe year-on-year core consumer price index (CPI) in America for June 2023 came in at 4,8% which is a sharp reduction from May’s figure of 5,3% and shows that inflation in America is slowly coming under control. Core CPI excludes the volatile food and energy sectors and is the Federal Reserve Bank’s (the Fed) preferred measure of inflation when considering changes to the level of interest rates. Their often-stated goal is to bring core CPI down to 2% - so they still have a distance to go.

In the current rate hiking cycle, the Fed has increased rates ten times by a total of 5% and then decided to pause at the last monetary policy committee (MPC) meeting. The MPC, however, said at that time that it envisaged that a further two 25-basis point hikes would be necessary before the upward cycle was over.

Investors now widely expect the US economy to have a “soft landing” – meaning that the rising interest rates will bring inflation under control without the economy moving into a recession. A recession is defined as two successive quarters of negative gross domestic product (GDP) growth).

This optimism has meant that the S&P500 index, which is a weighted average of the 500 largest companies trading on Wall Street, has moved into a bull trend. Consider the chart:

The chart shows the cycle low on the S&P at 3577 on 12th October 2022. Since then, the index has been rising steadily and the 300-day simple moving average has turned up sharply.

There are, however, two key indicators which suggest that the US economy is heading into recession. They are:

- The Yield Inversion – The yield inversion occurs when the yield on the 10-year US treasury bill is below the yield on the 2-year treasury bill. It has been used as a signal of an impending recession in the US for many decades and it is right about 90% of the time. Usually, the US economy goes into recession about a year after the yield curve inverts. The yield has been inverted for about 12 months now, so by this measure the US economy should enter recession before the end of 2023.

- The Leading Economic Index (LEI) – This is an index of ten components produced by The Conference Board. The Conference Board is a 100-year-old international non-profit organization of business leaders who are engaged in forecasting future developments for the benefit of their members. They produce the LEI every month and it has also been a very accurate indicator of US recessions for many decades. Recessions in America begin on average about 15 months after the LEI peaks – and certainly inside two years. It peaked in February 2022 about 17 months ago – so this also indicates that a recession is imminent before the end of the year.

In our view, it is highly likely that the US will enter a recession in the second half of this year, and we expect that recession to be longer and deeper than has generally been predicted.

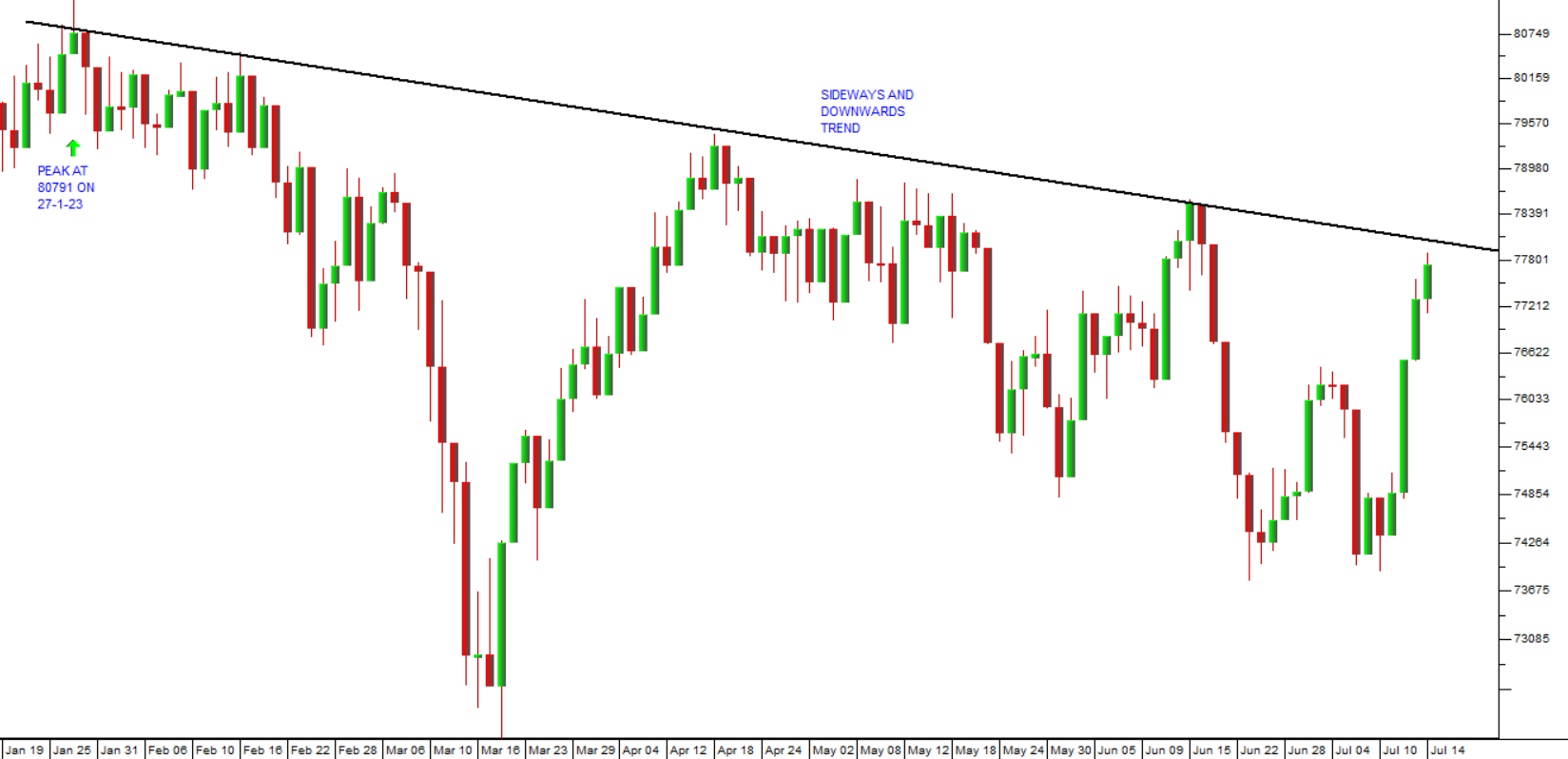

One interesting observation is that while the S&P500 is now firmly in a bull trend, the JSE Overall index is not. Consider the chart:

You can see here that, following its peak at 80791 on 27th January 2023, the JSE Overall index has been in a sideways/downward trend – indicating that South African investors are not convinced that the bull trend now in progress on Wall Street will be sustained.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: