The Trump Correction

It is relatively unusual for the activities of American presidents or what they say to have an impact on the New York Stock Exchange, especially during their first 100 days in office. Trump, however, is the exception. His confused, on-again, off-again rulings on tariffs have rattled the market. Markets hate uncertainty and even Trump himself doesn’t appear to know exactly how his system of tariffs will work or what he is going to do next.

It is basic economics that any government interference in the free-market system (like tariffs) comes with a cost – usually in the form of higher prices. A trade war between countries, characterised by tit-for-tat tariffs, makes the people of all the countries involved worse off.

Trump seems to think that because America has a trade deficit with Canada, that country somehow “owes” America money, and that America is subsidizing Canada. Nothing could be further from the truth. Canada’s trade surplus with America is matched by their trade deficit with other countries, and those countries probably have trade surpluses with America.

There are 195 countries in the world all running trade deficits and surpluses with each other in a complex matrix of international business based on the free enterprise principle of supply and demand. Each country produces what it is good at producing and trades it for the things it is bad at producing with the result that everyone is better off.

Nobody seems to have explained that to Trump, so his incoherent and contradictory tariff policy is unnerving Wall Street and has resulted in a 7,7% market correction – so far. Why do I say that this is a correction and not the start of a bear trend? Because Trump’s economic insanity is unlikely to last while the factors driving the current bull trend in shares will.

AI and humanoid robotics are still generating and will continue to generate massive surpluses for most companies throughout the world. The spread of renewables, and especially solar power, will continue to replace fossil fuels worldwide leading to a new era of much cheaper energy. Nothing that Trump can do will change those trends – and so markets will continue to push higher as soon as they have fully digested the worst that Trump can do.

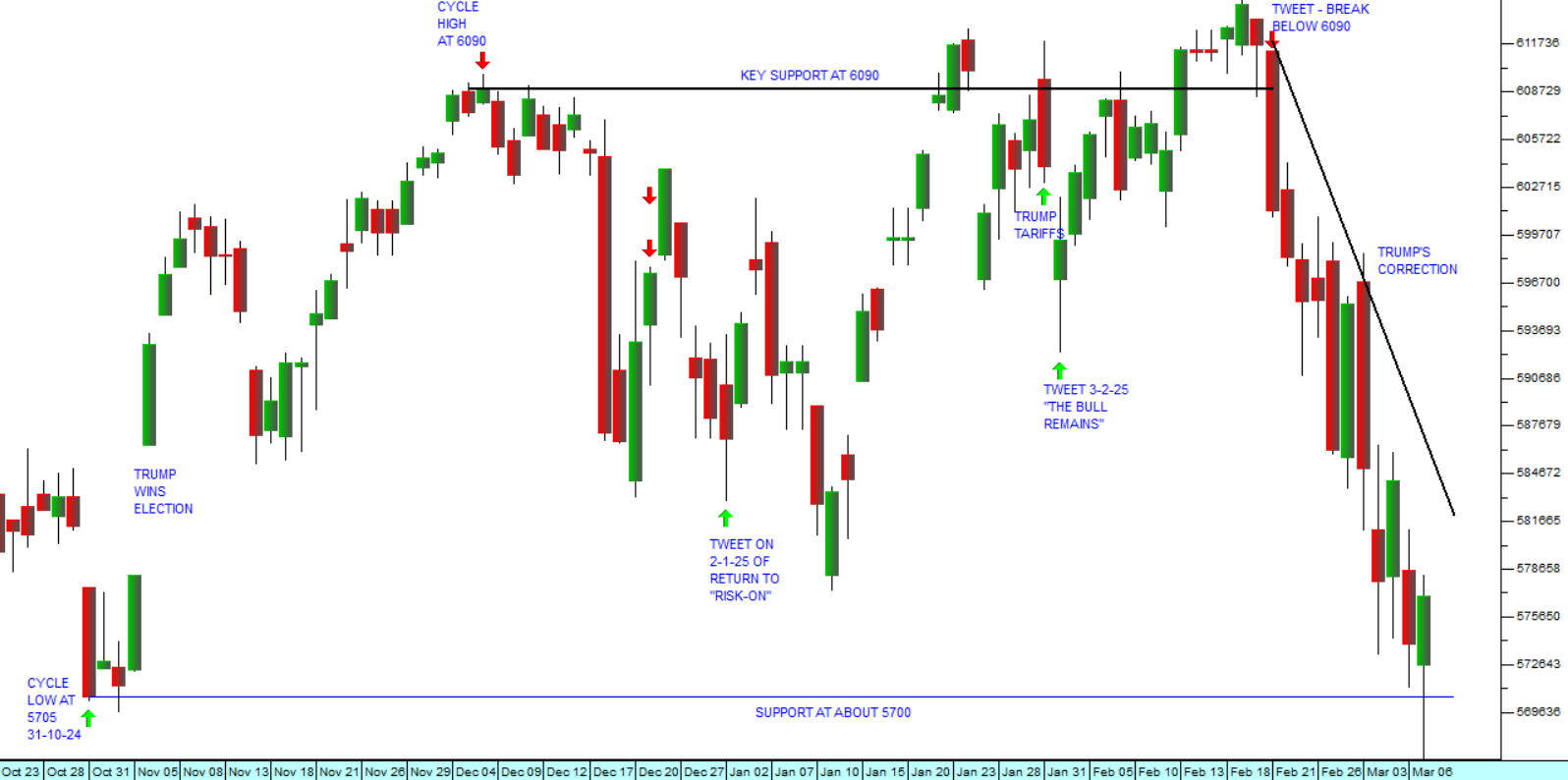

Consider the chart of the S&P500 since Trump’s election victory on the 6th of November 2024:

As you can see, the return of Trump is associated with a period of market volatility. The S&P has essentially been moving sideways bounded by resistance at the 6090 level and support at around 5700. The initial response to Trump’s election was euphoria – which lasted for a month (to the 6th of December 2024) before the reality of his erratic and damaging ideas began to become apparent.

Now investors are truly beginning to appreciate how dangerous Trump can be and share prices are falling in tandem. So, the question is what kind of correction is this and how long will it last? In our view, this correction will end in a V-bottom probably fairly soon. Indeed, it may have already ended. Once investors absorb and discount the likely extent of Trump’s behaviour, the underlying positives of the US economy will surface again to drive markets higher.

On Friday the February 2025 jobs report showed that only 151 000 jobs had been created in the US economy and the unemployment rate had ticked up to 4,1%. This comes after January’s 143 000 new jobs and December’s 256 000. The figure for February was lower than the 170 000 that economists were predicting – but still shows an economy that is growing and creating new jobs. The unemployment rate, hovering just over 4% is ideal.

Basically, it shows an economy at or close to full employment where everyone can be employed if they choose to be. In other words, the US economy is still functioning well despite the high level of interest rates. The Federal Reserve Bank has so far managed to successfully execute a soft landing, reducing inflation with higher interest rates, but without putting the economy into a recession.

Of course, it is possible that Trump’s trade war could bring that to an untimely end, especially as other countries begin to impose reciprocal tariffs on American exports. However, we believe that a more likely scenario is that Trump will be shown the error of his ways and back-pedal on his most damaging executive orders. Indeed, that already appears to be happening.

Trump’s correction, therefore, represents a buying opportunity. You will note that the JSE Overall index fell by less than half of Wall Street’s fall, and has already recovered most of what it lost – showing that our investors, benefitting from the objectivity that comes with distance, fully understand the temporary nature of Trump’s economy fiddling and already anticipate a rapid recovery.

← Back to Articles