The Great Bull Market

28 October 2024 By PDSNETIn recent months I have read a number of articles which suggest that the bull trend which is currently in progress on Wall Street began just over two years ago on 12th October 2022, starting from the S&P500 index’s low point of 3577.03 on that date. The technicians who make this assertion suggest that therefore the bull market is still at an early stage and has some years to run before it reaches maturity.

This position is entirely based on the idea that any downward move in the S&P of more than 20% must automatically be classified as a bear trend – except, of course, for the 34% drop which occurred in 2020, as a result of COVID-19. That event has been regarded as an exception or an aberration because its causes were supposedly not market-related.

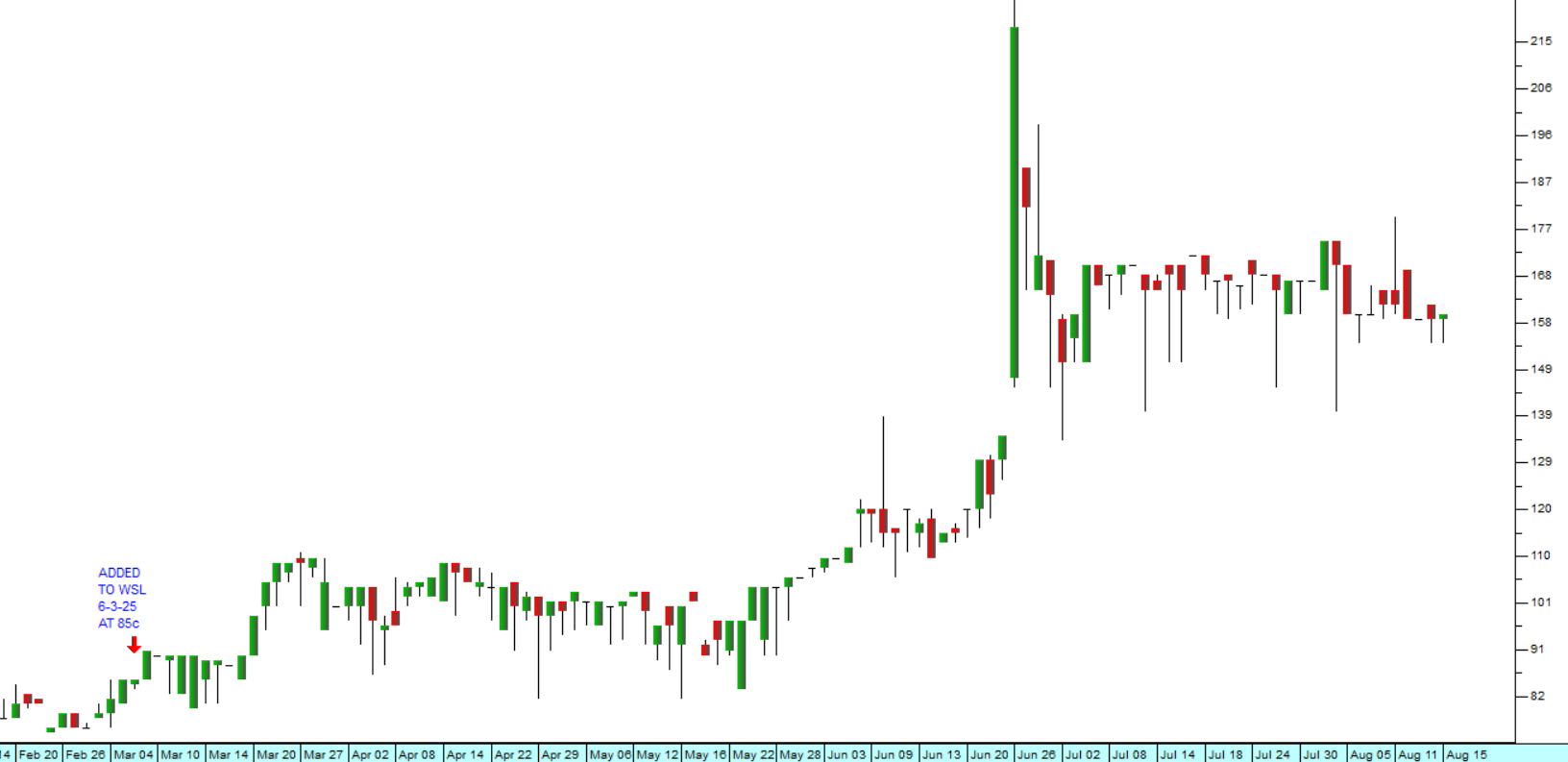

So, what is being touted as a “bear trend” in 2022 took the market down by 25% from 4796.56 on 3rd January 2022 to a low point of 3577.03 on 12th October. Our view is that this move was also the result an event which was not market-related. It arose from one man, Putin’s, decision to invade Ukraine in February 2022. And that event caused the S&P to fall by much less than COVID-19 – so, with the advantage of hindsight, we have come to regard it as an unusually large correction and not a bear trend at all.

COVID-19 saw the market make a short sharp V-bottom lasting just 6 months, while the so-called “bear trend” following the invasion of Ukraine took slightly longer (about 10 months) to resolve. Technically, however, neither of these events was directly linked to the powerful underlying forces which had been driving the great bull market which began in March 2009.

Those bullish factors are really three-fold:

- The huge volumes of cash created and injected into the world economy following the 2008 sub-prime crisis and then again in response to COVID-19 in 2020.

- The on-going advances in technology now including the development of artificial intelligence (AI) and the exploitation of humanoid robotics which have and will still increase the productivity of almost every major business in the world.

- Falling energy costs as a result of the world-wide switch to renewables.

The bull market of the 1920s, like the current bull trend, was also driven by huge, economy-wide increases in business productivity. This productivity resulted from technological advances - the mass production and adoption of motor vehicles and the rapid spread of the telephone system across America and other countries. Eventually, when the profits arising from these advances had been sufficiently over-discounted into Wall Street by October 1929, the market crashed, and the Great Depression followed.

But the technology advances driving productivity today, far from being over-discounted, are probably still in their relative infancy. AI, robotics and renewables will almost certainly continue to generate productivity gains and cost savings in the world economy for some years to come.

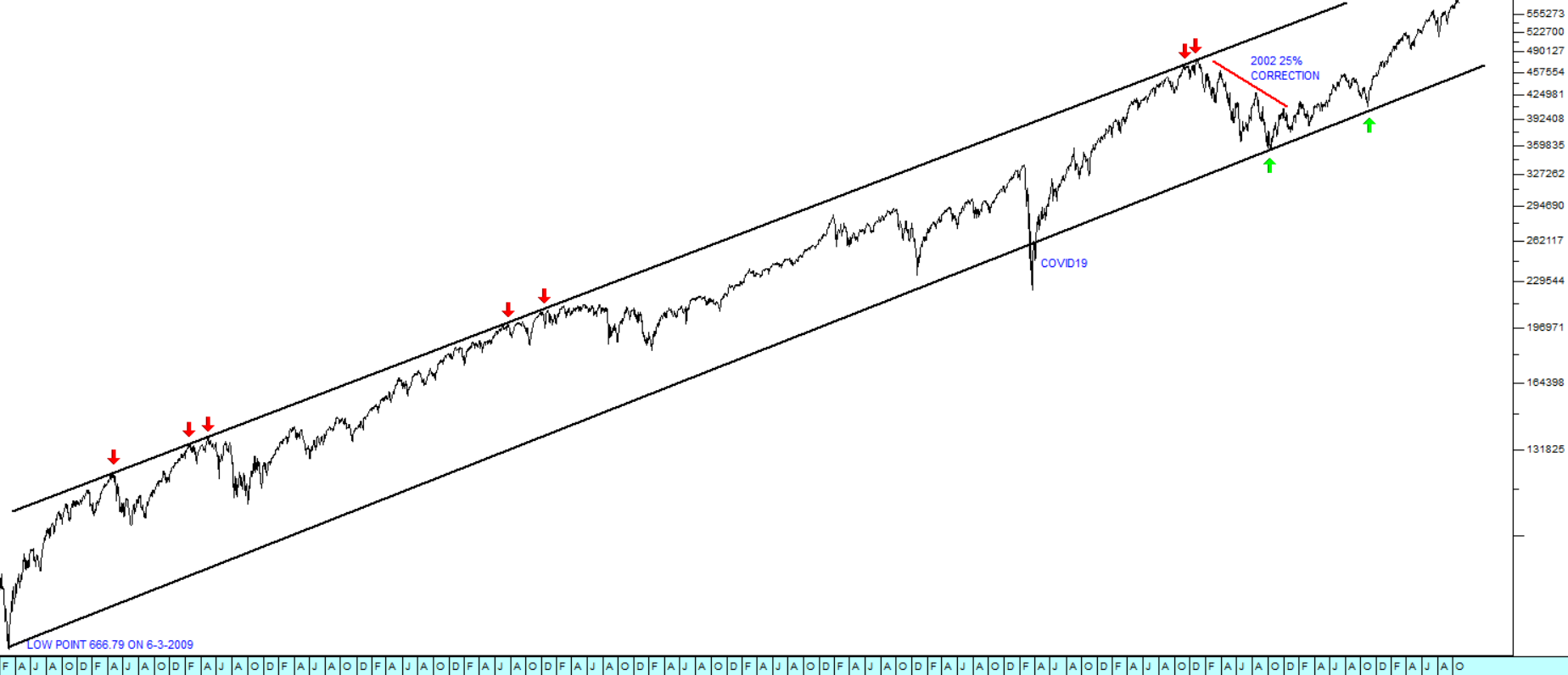

For that reason we believe that the Great bull market which began in March 2009 remains in force and still has some distance to run. Consider the chart:

This chart shows the progress of the Great Bull Market over the past fifteen-and-a -half years. You will note that, if we disregard COVID-19, the bull trend has been taking place between two clearly defined “channel” lines.

The lower channel line begins at the low point of 666.79 made on 6th March 2009 and then has been supported by two touch points (green arrows), in October 2022 and October 2023. The upper channel line is supported by seven or more touch points (red arrows) making it extremely reliable. It is important to observe that, ignoring COVID-19, the lower channel line is parallel to the upper over the entire period of more than 15 years.

The two channel lines clearly delineate and contain the progress and boundaries of the bull trend.

So, what happens next?

As we explained above, we do not believe that the fundamentals driving this bull are anywhere near exhausted. Oil prices have come down, but in time as electric vehicles take over they could be driven as low as $10 per barrel. The blue sky inherent in AI combined with robotics is beyond our imagination – and the massive increase in the balance sheets of the world’s central banks provides the monetary space for enormous growth.

Eventually, of course, the party will have to come to an end – but we do not see that end as any time soon.

Footnote

Historically, where the S&P500 index rose in the 3 months immediately prior to a US election, the incumbent party (the Democrats in this case) won the election 80% of the time. We expect that statistic to hold in this election.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: