The Fed

24 April 2023 By PDSNETThe monetary policy committee (MPC) of America’s Federal Reserve Bank has to conduct a delicate and complex balancing act. On the one hand they are responsible for maximising the growth of the US economy and on the other they must ensure the stability of the US dollar – in other words they must control inflation. These two objectives tend to be mutually exclusive since efforts to control inflation such as raising interest rates inevitably have a negative impact on the growth of the economy, while lowering rates stimulates growth, but leads to higher levels of inflation. The MPC has been likened to the driver of a car alternately pressing on the brakes and the accelerator.

Members of the MPC receive the widest range and the most up-to-date information about the economy’s performance. They have eight scheduled 2-day meetings every year where they discuss the state of the economy and decide on exactly what policy to implement. They have three primary tools at their disposal:

- Raising and lowering the re-discount (repo) rate. This is the rate which the Fed charges commercial banks for money borrowed from them. Raising the repo rate has an immediate impact on the economy because it forces commercial banks and other financial institutions to raise the rates they charge to their clients.

- Conducting open market operations – which means buying and selling government bonds to alternately increase or decrease the money supply. Open market operations are often described as “leaning against the wind” because they are used mainly to fine tune the economy. Following the sub-prime crisis in 2007/8 the Fed has used this facility to conduct what is called quantitative easing (Q/E) - which means financing injections of cash into the economy by expanding its balance sheet. This tends to be highly inflationary as can be seen from the example of Zimbabwe where it ultimately led to the complete collapse of the currency.

- Changing the reserve rate – which is the percentage of money deposited with them that commercial banks are required to hold in reserve. This is very seldom done because it would have such a radical and immediate impact on the banking sector and the economy.

The MPC’s next meeting is due on 2nd and 3rd of May 2023. The market is discounting an 88% probability that they will decide to raise rates by a further twenty-five basis points. This will bring rates up to between 5% and 5.25% - adding to the cumulative effect of previous rate hikes.

The Philadelphia Federal Reserve Bank’s manufacturing activity index measures changes in business growth covering the Pennsylvania, New Jersey, and Delaware region. Anything below zero on this index means contraction and vice versa. Published on 20th April 2023, it hit -31.3, well below the estimate of -19,2 and the previous month’s figure of -23,2. This number should also be compared with the figure from April last year which was +13,1. This shows that some parts of the US economy are definitely slowing rapidly in response to higher interest rates.

The Atlanta Fed’s wage growth tracker measures the growth year-on-year in the country’s nominal wages, based on information taken from the current population survey produced by the US Bureau of Labour Statistics. That survey is drawn from a monthly questionnaire given to 60 000 households in America. Before COVID-19 and up until the end of 2020, the tracker was steady at an annual growth of about 3,6%, but in 2021 the tracker rose sharply to above 6% and has remained there ever since. In other words, wages rose in tandem with US inflation and have continued to rise by above 6% per annum for some time. This reflects just how tight the US labour market is with an average of around 1,7 jobs on offer for every job applicant. In our view, this indicates that the underlying inflationary pressures in America remain high, despite rising interest rates.

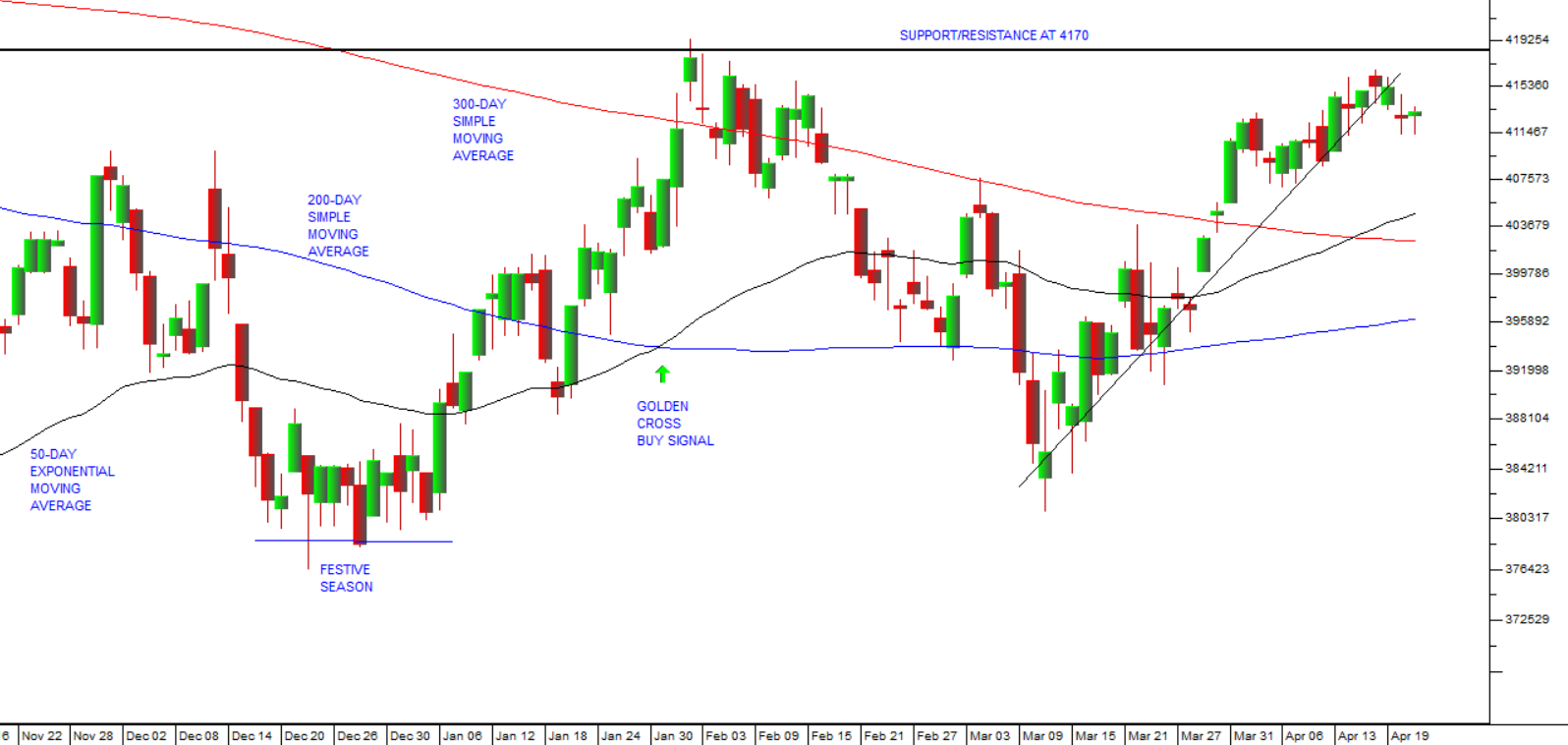

In summary then our view is that the Fed will raise rates as expected by twenty-five basis points in May and will raise them at least one more time after that before the end of this year. We do not anticipate any pivot in Fed policy until well into next year. The equity market is showing that investors are not taking the Fed’s stated objective of reducing inflation to 2% seriously. Instead, many are expecting a pivot in Fed policy this year - and that is keeping the S&P500 index much higher than it should be. Consider the chart:

As you can see above, the S&P has once again tested the long-established resistance level at 4170 and fallen back. In our view it will not penetrate this level and will ultimately fall back to make a new cyclical low in the on-going bear trend. You will also note that the 300-day simple moving average continues to fall, indicating that the bear trend is not yet over.

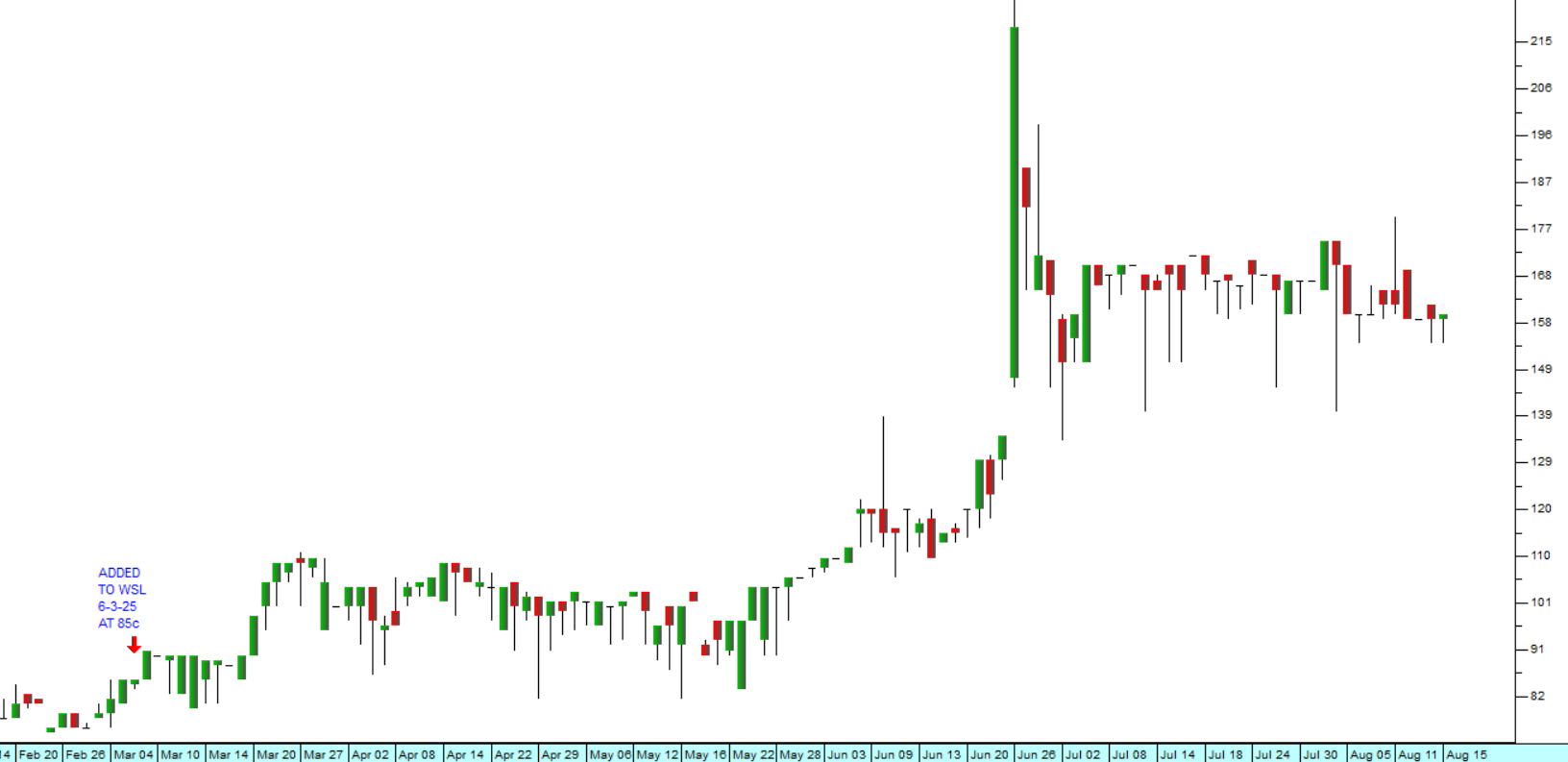

Footnote: South Africa has benefited from 3 years of La Nina weather patterns – which has given us relatively cool wet summers. It is now expected that we will experience several years of El Nino which will mean much a hotter, dryer period and probably result in persistent drought conditions for much of the country. This will have a direct impact on water resources country-wide and will impact directly on agricultural output. Because of climate change, the last 8 years have seen the highest average temperatures world-wide - and the coming El Nino is expected to break new temperature records. We can expect JSE listed companies which are linked to agriculture and the price of agricultural products to face increased costs and lower margins. We should also anticipate water restrictions and outages in the major centers.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: