The Confidential Report - November 2019

5 November 2019 By PDSNETAmerica

Whenever considering a chart of the S&P500, it is important to put it into its historical context. The situation that we are in now is the result of an extended history that actually goes back to 1929 and before. More recently, in the past ten years, the S&P has been in the process of the longest bull trend since its inception. Experts are confused by this unusually long bull trend because they have not studied the history of how the S&P arrived at this point. In the chart below you can see that the bull trend is marked by a clear upward channel going back to 2009:

S&P500 Index November 2008 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

And then, within that long-term trend, consider the market action since the start of 2018:

S&P500 Index November 2017 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

This shows the detail of the most recent of the four major corrections which have marked the bull trend – and that was substantially caused by Donald Trump’s trade war with China and other countries. Throughout this correction, which began in September 2018, we have been consistently bullish. We have also always characterised it as a correction within a bull trend rather than the commencement of a new bear trend. For this reason, we always described it as a buying opportunity – an opportunity to buy high-quality shares at lower prices. During a great bull trend, the statistical probability of the market continuing to go up (and dragging the JSE and other world markets up with it) is considerably higher than the start of a new bear trend. But our bullishness was also supported and under-pinned by the fundamentals of the US economy. If the US economy is expanding, then the stock market (represented by the S&P500 index) will almost certainly rise to new record highs – sooner or later. So, for example, the unexpectedly sharp drop in non-farm payrolls in September was a matter for concern - but did not derail the underlying boom. The US economy created only 136 000 new jobs in September month – well below the estimates of most analysts. But during that same month the average hourly wage rose by just under 3% - which means that once again Americans were considerably better off. On average, this year, the US has created 161 000 new jobs every month – which should be compared to last year’s average of 223 000 a month. Is this something to be worried about? We think not. As the boom continues, it will inevitably become harder and harder for the economy to create new jobs. It should be borne in mind that the unemployment rate in America has now dropped to another new all-time record of 3,5% - which basically means that everyone who wants to work is working. They have reached and even passed the economics concept of “full employmentâ€. This is also reflected in the steady rise of hourly wages, as employers have to pay more and more to get the staff that they need. Inevitably, the rate of job creation is slowing down as the labour market tightens. If anything, we believe that this is a clear indication that the boom in the US economy is getting stronger. And now, as expected and predicted, the S&P has broken to a new all-time record high, closing at 3066,91 last Friday. This clearly signals the continuation of the great bull market - and results in the discrediting of all those who said that we were at or had already reached the top of the market. It is the nature of a great bull trend that bearish sentiment is steadily eliminated. As the market goes higher there are inevitably “experts†who, for whatever reason, decide that it is time to call “the topâ€. They urge investors to sell out while the going is good – but inevitably the market then makes another new record high and they are discredited. Those who followed their advice wish that they hadn’t. Of course, eventually, a time is reached where no one is willing to call the top of the market – and, as you would expect, that is a very good time to get out of shares completely and sit on the side-lines in cash – but we are not there yet.Political

The ANC’s plan on structural reforms was basically a waste of time. It appears that it is politically impossible for structural reforms to be agreed upon by the NEC because such reforms would inevitably bring the ruling party into direct conflict with the union movement. So, the document ended up being a vague hodgepodge of reforms, most of which appeared in the 2011 National Development Plan. Factionalism and fear of the unions within the ANC emasculated any leadership that there might have been. And yet, we believe a confrontation with the unions is inevitable sooner or later. Minister of Finance, Mboweni, has instructed government departments to [glossary_exclude]budget[/glossary_exclude] for savings of 5%, 6% and 7% over the next three years – which, if implemented, will save the government about R300bn. This will reduce the civil service wage bill which is now 35% of government expenditure. Until this is achieved, the government’s borrowings will certainly rise sharply. The latest catch-phrase in government is “strategic equity partnersâ€Â - which is basically a euphemism for privatisation. The term privatisation is one which triggers an emotional knee-jerk reaction from the union movement and the opposition within the ANC. But the reality of the situation requires that the government sells off at least parts of state-owned enterprises to the private sector – both the raise capital and to introduce more efficient management. So far, the unions have not really reacted probably because they do not yet appreciate what the government is trying to achieve. The crime of state capture is not exclusive to South Africa, but has occurred in many African countries and some countries in other parts of the world such as South America and even Asia. Essentially, it means the taking of control of a state by a ruthless group of individuals with the direct intention of accumulating personal wealth and power and with complete disregard for the welfare of the people in that country. The most obvious and closest example is that of Zimbabwe which was systematically plundered by Robert Mugabe resulting in the impoverishment of most of its population. South Africa has only had to endure 9 years of state capture, but still, according to President Ramaphosa, the cost of that was probably well in excess of R500bn and some estimates are as high as R1,5 trillion. Clearly, it will take some time for the South African economy and the state to recover - even under the best management.Economy

The mini-budget and the Moodys shift to a “negative outlook†have dominated the economic news for the past month. Much of what was disclosed in the budget had already been discounted – and yet the bald facts revealed by the Minister of Finance had the effect of taking the rand back below R15 to the US dollar and the yield on the R186 to 8,565% (from 8,15%). The thrust of it was that the government’s debt to GDP ratio is going to be about 2% worse than anticipated in the February budget (4,2%) – mainly because of three things:- The Eskom and other SOE bailouts

- The under-collection of taxes which missed the February budget by R53bn

- Government over-spending – especially on wages and salaries

Eskom

The slip back into level two load-shedding in October came as an unpleasant shock for the South African economy. After more than 200 days without load-shedding, Eskom suddenly hit a crisis which it could not cope with in any other way. The impact on business and consumer confidence was immediate, impacting both the yield on the R186 bond and the strength of the rand against the US dollar. It is apparent that unless this proves to be a very short-term phenomenon, it will quickly destroy whatever hope there is of meaningful economic recovery. It also ratifies the position of many consumers and businesses that have decided to invest capital in getting off the grid. The problem is that Eskom is running with an insufficient safety margin and frequent use of expensive diesel-powered peaking generators. It is estimated that stage two costs the economy about R2bn per day. The October load-shedding is the clearest indication yet that Eskom still has significant problems. Pravin Gordhan has announced the establishment of a separate company to handle electricity distribution. This company will have its own board of directors and will buy power from independent power producers and Eskom generation on an equal footing. This will establish competition – which has been entirely lacking in the Eskom monopoly – and should bring the cost of electricity down steadily as renewables become cheaper. This is very good news for the economy because it is ultimately the only way forward for Eskom. Of course, it puts the government on a direct path to conflict with the unions – but at this stage it seems that the government is determined to proceed despite their opposition. The distribution company will, as a matter of urgency, conduct an audit to ensure that power delivered is matched by money received – and that will mean putting an end to the theft of power – which has become endemic. The release of the integrated resource plan (IRP) by the Minister of Mineral Resources and Energy, Gwede Mantashe, indicates that South Africa’s power generation will be very marginal for the next four years because at least three of the older power stations will probably have to be retired earlier than expected. The obvious simple answer to this problem is to enable “distributed generationâ€. This basically means allowing the private sector to build their own power generation under licence. There is a considerable amount of investment that would come into the country to help finance this type of power generation and it would rapidly close the power gap. But, of course, it would mean that Eskom’s captive market would rapidly diminish. A considerable number of private individuals as well as businesses are already making plans to “get off the grid†because it is becoming impossibly expensive and increasingly unreliable. Perhaps the government needs to accept the fact that Eskom is a dinosaur that cannot be saved and shut it down in an orderly fashion to make way for new technologies to take its place. The Treasury is being very demanding with Eskom, laying down 28 conditions for the granting of the R23bn bailout which is to be paid across. The problem is that there is currently no CEO in Eskom to take responsibility for meeting those conditions and the board appears to be demotivated and lethargic. As always, the problem comes down to management and leadership. No one at Eskom appears to be taking responsibility. Previous sets of conditions from the Treasury have been ignored, so it seems unlikely that the current strictures will be followed – at least not until a new CEO can be found to accept the responsibility. Renewable energy, especially solar and wind, is rapidly becoming inevitable. The only real question left is exactly how South Africa will make the transition. The raw economics of renewables are becoming so compelling that, even without their environmental advantages, they are going to become South Africa’s primary energy source – and far more quickly than the Integrated Resource Plan (IRP) has envisaged. We have 13 coal-fired power stations and those will have to be shut down sooner or later. Obviously, the unions are very anxious about what will happen to the employees who will lose their jobs. No doubt some of them could be re-employed in the renewables sector, but inevitably some will lose their jobs. What is clear is that neither the government nor the unions will be able significantly impede the move to renewables. And that is a good thing because almost unlimited cheap energy can only be hugely beneficial to the entire economy over time. Eskom, in its current form, is a dying entity – it is only the recognition of this fact that has yet to be grasped. Splitting it into three entities will not prevent this because companies and consumers are rapidly moving towards “distributed generation†where they are making arrangements to generate their own electricity and get completely “off the gridâ€.Commodities

The Minister of Mineral Resources and Energy, Gwede Mantashe, has taken an intransigent stance on the new mining charter. Mining houses are already willing to give 30% of their business to black interests as part of the BEE effort and the principle of “once empowered always empowered†has been accepted – until there is a change of ownership. Then Mantashe wants the new owners to have to, once again, pay for BEE partners to have a 30% stake. For overseas mining houses that can place their funds in any country in the world this is obviously a serious negative. What Mantashe does not seem to realise is that overseas investors simply do not care whether South Africa achieves its empowerment goals or not. All they are interested in is whether investing in a mine in South Africa will be profitable for them or not. If they find that clauses in the charter make it less attractive they will simply invest elsewhere – and that will cost this country more job losses, which it can ill-afford. The negotiations in the platinum sector with the Association of Mineworkers and Construction Union (AMCU) are at a critical stage. The dispute has been referred by AMCU to the CCMA for resolution. Joseph Mathunjwa is putting on a brave face saying that AMCU still has the “appetite†for a lengthy strike, but his opponent, Neal Froneman (CEO of Sibanye) has recently forced him into a humiliating defeat in the gold industry and certainly Sibanye now has the cash resources to face a protracted strike if necessary. It seems highly unlikely that Froneman will back down in the circumstances. The benefits of beating Matunjwa and AMCU again far out-weigh the cost of whatever strike action AMCU actually have the stomach for. If they elect to go on strike they will not be paid – maybe for months. It is unlikely that they will be able to hold out for as long as Sibanye with its increasingly profitable Stillwater palladium mine in America. This adversarial situation contrasts sharply with the comments of Mark Cutifani (CEO of Anglo American) who believes that mining has to reposition itself as to be a “valuable and welcome partner†by local communities. In our view, Cutifani’s wish cannot become a reality while there are militant unions intent on exploiting the mining industry and its workers. Cutifani has also said that he believes that mining can play a major role in driving the economy upwards, if the attitude towards mining changes and the uncertainties still contained in the third mining charter were resolved. He says that overseas investors need total certainty about the legal environment before they invest and confidence that it will remain in place for long enough to enable them to get a good return on their investment. Of course, a flood of foreign investment into mining would also create thousands of jobs – which this country sorely needs. Precious metals are in a bull run – led mainly by palladium and rhodium. Prices keep rising mainly because of the demand for auto-catalysts and, more recently, by concerns that Russian stockpiles of the metals may be depleted. Platinum itself is being pulled up by the demand for other platinum group metals (PGM). This has helped to bring platinum mines back from the brink of bankruptcy over the past few years. South Africa has four platinum miners of note – Impala, Angloplats, RB Plats and Northam. Then Sibanye is in both platinum and gold. All of their shares are up sharply this year which has pushed the platinum index up almost 40% during 2019. The future of these metals really depends on the continuing growth of the world economy. If Trump’s trade war with China and others can derail that growth, then the demand for auto-catalysts will fall. In our view, the boom in America will continue to drag the rest of the world economy with it for some time and this will provide good demand for precious metals generally. So far in 2019, there have been about 20 organised attacks on gold mine refineries with the objective of stealing gold concentrate. The attacks are undertaken by gangs of up to 20 heavily armed men. The most recent example is the attack on DRD Gold where about 16 armed men got away with 17 kilograms of gold concentrate worth about R12m. Police were subsequently able to recover about half of it, but in the battle a security officer was shot dead. It appears that organised crime, attracted by the high price of gold, is now taking a direct interest in robbing refineries because they can achieve a substantial pay-off with relatively little effort. Clearly, this is a further example of police ineffectiveness and makes South Africa less attractive as an investment destination. The test which Master Drilling is conducting at Northam Platinum’s Eland mine with its tunnel boring machine is very significant. If it is successful, it could lead to a three-fold reduction in the time that it takes to drill vertical and horizontal shafts. This would reduce costs in the gold and platinum sector substantially. It is busy drilling a 4 meter diameter tunnel at the rate of 1 meter per hour. Sinking a shaft in the conventional manner achieves rates of 2 to 3 meters per day. Clearly, this technology has the potential to revolutionise the mining industry in South Africa.Companies

NEW LISTINGS

Business Day reports that Engen may be listed on the JSE next year by its parent company Petronas. The IPO will raise funds to pay for an upgrade to its refinery. Petronas holds 74% and Phuthuma Nhleko’s Phembani owns the rest. Engen has petrol stations in 7 African countries and is South Africa’s largest fuel retailer. We believe that this listing will certainly be worth examining when it comes to market. Another possible new listing next year is Respublica. This is a property company which specialises in supplying accommodation for students. There is apparently a national shortage of about 250 000 student beds and strong demand for such accommodation. Respublica currently has 9300 beds which means that it has trebled the number of beds which it offers since its inception in 2016. The company is 51% owned by Redefine Properties which is one of the largest real estate investment trusts (REIT) on the JSE. It complains that the sharp deterioration in market conditions combined with the Fees-Must-Fall campaign meant that it could not reach its objective of having 20 000 beds and listing on the JSE in 2020. However, it is on target to reach 12 000 beds by the end of next year or early in 2021. Listing is still an objective, especially if the property sector begins to improve.RETAIL

Online shopping is gaining momentum in the US – a trend which is likely to be followed in South Africa. During 2018, there were 5590 store closings and this year so far there have been more than 8000 with the total expected to reach around 12 000. South Africa always runs behind major trends in first world countries and this trend is no exception, but we believe that new shopping malls like Mall of Africa and Fourways Mall may find it difficult in time to justify the enormous capital invested in these buildings. The latest retailer to close its doors is Forever21 which has filed for bankruptcy in the US. The company has a number of stores in South Africa, but those are expected to continue trading.ONELOGIX (OLG)

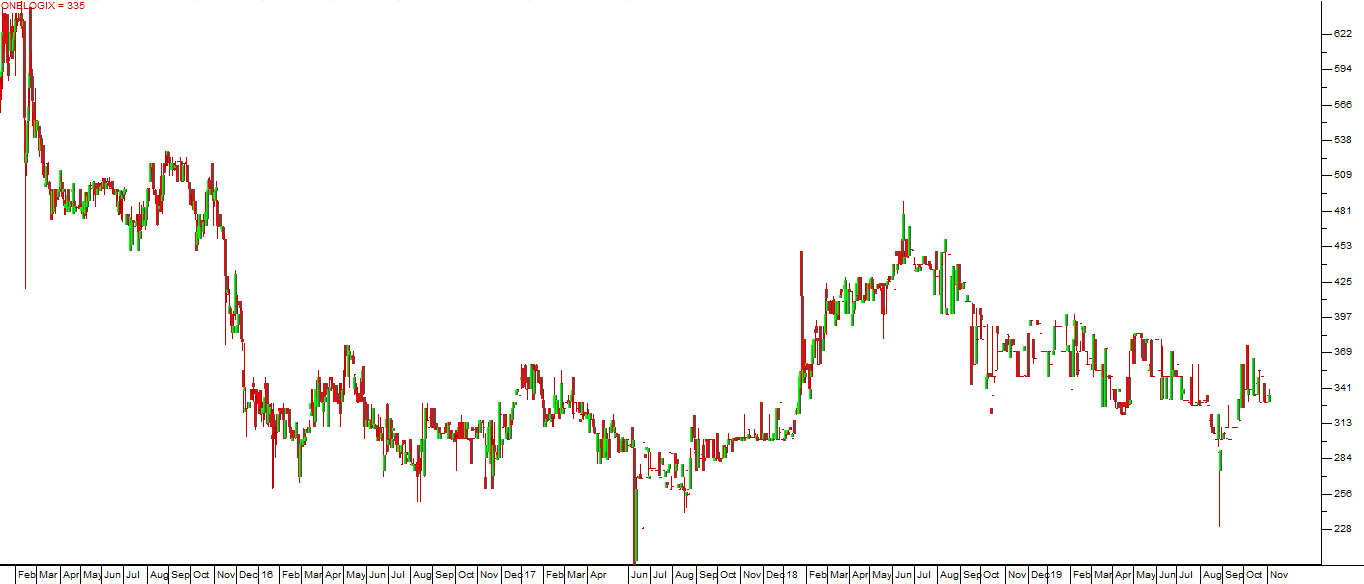

This is a logistics company which listed on the JSE in 2004. The company has three divisions - cross-border delivery of new cars (47% of turnover), auto-logistics for commercial vehicles (46% of turnover) and freight logistics at the Durban harbour managing shipments of freight (7% of turnover). In its results for the year to 31st May 2019 the company reported turnover up 19% and headline earnings per share (HEPS) up 11%. The net asset value (NAV) per share increased by 8% to 389,7c. Over the past 5 years tangible NAV has grown by 21% per annum compound. The company said, "The stronger first half of the year was followed by a much tougher second half. The majority of the group's businesses delivered bottom line growth, almost exclusively organic in nature. This once again affirms the strength of the group's business strategy and the resilient business models of the underlying businesses, guided by skilled management teams." The share trades about R100 000 worth of shares every day on average on the JSE, but many days have little or no volume traded - so private investors should exercise caution when investing. In our view, this is a very profitable company that is doing exceptionally well under difficult trading conditions. The company will benefit from any improvement in the South African economy. Technically, the share made a high of 639c on 6th February 2015. That was followed by a protracted downward trend which saw the share go as low as 260c in August 2017. Today its trades for around 340c on a P:E of around 9. In our view, this company has demonstrated excellent and innovative management in a very difficult trading environment. We believe that, while it is tightly held, it will prove to be one of the better investments on the JSE.

Onelogix Group (OLG) January 2015 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

RESILIENT (RES)

The Resilient group of companies (Resilient, Lighthouse - previously Greenbay, Rockcastle and Fortress) used to be the high-flyers of the property sector until the beginning of 2018 when a damning report was produced by 360ne Asset Management. The report claimed that the high prices enjoyed by the shares of these four real estate investment trusts (REIT) was primarily a result of their incestuous cross-shareholdings. 360ne claimed that the trust value of Resilient itself was about R53 and not the R150 which it was trading for at the time. This caused the price of Resilient (and the other members of the group) to plummet to R51.50 by the 3rd April 2018. Since then it has been wallowing between R50 and R70 while various investigations looked into whether there had been any insider trading in the group. So far, all investigations have shown no insider trading or share manipulation. In its results for the year to 30th June 2019, the company reported headline [glossary_exclude]earnings per share[/glossary_exclude] (HEPS) of 468,87c compared with a loss of 2016,38c in the previous year. The significant change was due to "the repurchase of 52 182 504 Resilient shares and the acquisition of 7 474 707 Fortress B shares, held as collateral for the loans previously advanced by Resilient to the Siyakha Trusts, in full settlement of these loans. The Siyakha Trusts and The Resilient Empowerment Trust no longer hold any Resilient shares and have no liability to Resilient. The Siyakha Trusts were deconsolidated in June 2019 resulting in a profit on deconsolidation of R2,4 billion, being the reversal of the negative net asset value of the trusts' positions relating to Fortress." The purpose of this was to eliminate the cross-shareholdings which 360one complained of. The resilient group owns 38 retail properties in South Africa and 4 in Nigeria. It expects the dividend to be up 5% in 2020 and has a loan-to-value (LTV) ratio of 26,8% - which is good. Property income grew by 5,1% during the period. Obviously, this is a property company, and part of a property group so they own high-quality assets which provide some comfort to investors. The share has now broken up through resistance at R66 and looks to be on a new upward trend. It is also still below its net asset value of R69. We see this share as under-priced. Consider the chart:

Resilient (RES) November 2017 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

EQUITES (EQU)

Equites (EQU) is the only real estate investment trust (REIT) on the JSE which specialises in industrial logistics and distribution properties in South Africa and the UK. Its most recent acquisition of a 100 000 square meter logistics property in Germiston was expensive, but it has an A-grade tenant in the form of Simba and good yield which will make the property highly profitable in 2 years time. The property was bought from Investec Asset Management for R462m. Of all property REITs, those which include logistics properties like warehousing are the most sought-after because of the steady increase in online shopping by consumers. CEO, Andrea Taverna-Turisan says "a wall of cash is leaving retail property and going to logistics". Equites has achieved a return of just under 25% per annum since it listed. In the six months to 31st August 2019, the company reported a 9,3% increase in its distribution and net asset value (NAV) that increased by 6% to 1737c. Gross property revenue was up by 46,7% and headline earnings per share (HEPS) climbed 147,9%. The company says, "The six months to 31 August 2019 was another successful period for Equites. We have established ourselves as a developer of choice to some of the biggest names in logistics, retail and e-commerce. We continued to focus on our development pipeline, delivering modern and efficient logistics facilities to our tenants. We deployed capital well and grew our portfolio by R3.4 billion (33.7%) from August 2018. This means that in the five and a half years since listing, the compounded average growth rate of our property portfolio and our market capitalisation was in excess of 55%. At the same time Equites has consistently delivered sector-leading net asset value and income growth". Technically, Equites has seen its share price move sideways for the past two years. The Resilient Group's collapse saw all property shares fall. Nonetheless, it only fell by about 9% in 2018 and should recover from that fairly soon. Its net asset value (NAV) is 1722c, which compares with a share price of 2110c. In February 2019, the company raised R710m through a book build which shows investor's enthusiasm for the stock. We believe that it represents good value at around R21. In August 2019 there was a rumour that Equites was in talks to buy Shoprite's R7bn property portfolio - a deal which would be worth almost two-thirds of Equites value. Consider the chart:

Equites Property (EQU) September 2016 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

SPEAR (SEA)

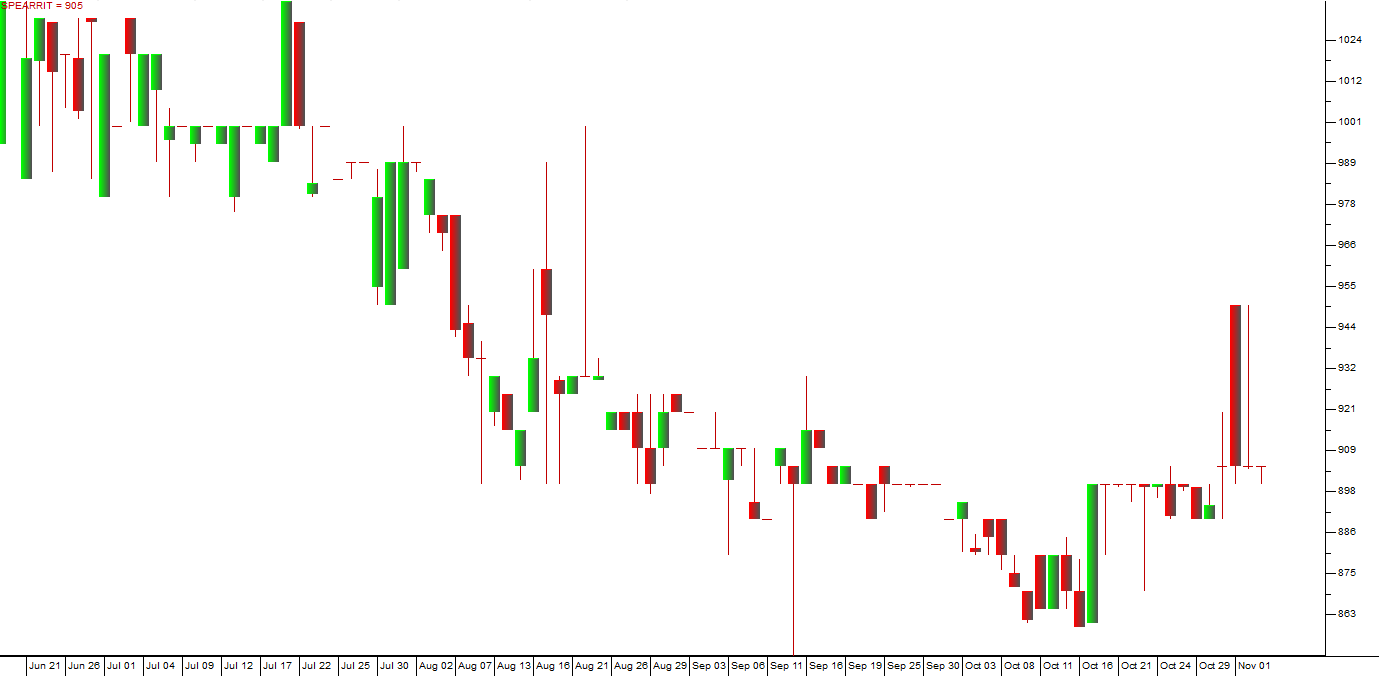

Spear (SEA) is a real estate investment trust (REIT) which specialises in properties in and around Cape Town. It was started by Mike Flax and the CEO is Quintin Rossi. Both of these men have a very good understanding of property in the Cape area. At listing in November 2016, the company had a portfolio worth R1,5bn and that has grown to about 3,4bn now - but the company's market capitalisation has remained well below that at around R1,8bn. The share price at 900c is below the tangible net asset value (NAV) of 1167c. In its results for the six months to 31st August 2019, the company reported a 7% increase in the distribution per share. 100141 square meters has been re-let with a 2,7% reversion. The net asset value (NAV) per share increased by 0,04% to 1167c and the occupancy rate is 98,1%. Loan-to-value (LTV) improved to 38,43% from 39,58% and turnover was up by 18,1%. Headline earnings per share (HEPS) increased by 2,75%. Property in Cape Town has generally done better than in the rest of the country and this REIT benefits from being very focused. The average vacancy ratio in Cape Town is 7,7% while Johannesburg has a vacancy of 12,2% and Durban is at 13,6%. In our view this is one of the best REITs and it has substantial upside potential.

Spear (SEA) June to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

BALWIN (BWN)

Private investors are always looking for a “sure thingâ€. This is an investment where there is plenty of upside potential, but limited downside – and they want that at a very good price. Balwin properties comes very close to that ideal. It is a small property developer that focuses on developing, either for sale or for rent, secure properties mainly in the major centres. The three years that it has been listed have been among the worst ever recorded for property shares in South Africa – especially 2018 when the property (JSE-SAPY) index fell a whopping 25%. This was mainly the fault of the Resilient Group of companies which were the subject of several negative reports which suggested that they were involved in share manipulation arising from their cross-shareholdings and directorships. Most of those allegations have now been shown to be untrue, but the rumours and negativity associated with them have combined with a very difficult property market to cause property shares to be severely re-rated downwards. And this situation has now created an opportunity for private investors, because some property shares are now trading at ridiculously low levels – well below the value of the properties which they own. Balwin is now trading for 350c per share and has a recently updated net asset value (NAV) of 567c – which means that it is trading at a 47,5% discount. Among other things, this makes it a potential take-over target. And what is nice about property shares is that the NAV represents tangible properties which have been independently valued. On 5th December 2018, the company announced a "Strategic Rental Model Initiative" in terms of which it plans to rent out properties for between R4500 and R8500 a month. In our view, the move to rental is a good one as it will build up a passive income which can be used to meet fixed overheads and contribute to profits. It gives the share that much-sought-after “annuity income" which adds stability to the investment. Balwin owns 25% of Balwin Rental which has the right to buy as many as 4544 of the units developed by Balwin. This should help to stabilise the company's income. Eventually, it is expected that Balwin Rentals will be listed. Extraordinarily, the share, at 350c, is trading on a P:E ratio of just 3,58 – well below the P:E of the property index (JSE-Sapy) which is trading on an average P:E of 15,48. Consider the chart:

Balwin Properties (BWN) November 2017 to November 2019 - Chart by ShareFriend Pro (Click to Enlarge Image)

Here you can see that the share has been falling for the past two years – but this year it formed an “island†and has now broken up out of that formation – indicating a probable new upward trend. We see this share as “ticking the boxes†for private investors:- It has sufficient volume traded to make it practical to buy and sell,

- It is trading well below its NAV,

- Its NAV is based on strong assets,

- It has excellent management,

- It is developing a solid annuity income

- It has minimal working capital

- It is not over-geared.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: