The Confidential Report – July 2018

4 July 2018 By PDSNETPolitical

Over the Zuma years there were any number of plans to develop the economy, the latest iteration of which was the National Development Plan, produced in 2012 with a vision for 2030. None of these plans have been effectively implemented. In fact, the economy is probably in a worse position now than it was 10 years ago from a structural point of view. But now we have the Ramaphosa era and he has begun well by mostly saying the right things and doing the right things – like changing the boards of the worst of the state owned enterprises (SOE). He wants to bring in $100bn in foreign direct investment (FDI) over the next 5 years – and he travelled to the G7 conference as part of this effort. There, he was persuading skeptical investors that policy certainty is going to happen in South Africa – especially in the mining industry and with land reform. He was trying to convince them that he is putting South Africa back onto a rational economic path. Of course, he had to be balanced with the fact that he faces an election in 2019 where populist ideas are likely to be important. So there is a limit to what he can do before that election and he is orchestrating a delicate balancing act between necessary and rational economics and the expediency of South Africa’s version of populism. Arguably, the EFF represents the extreme left or liberal constituency in South African politics. They are strongly populist and seek to appeal to the masses, the squatter camp dwellers and the poor. But in their recent rhetoric and especially since Ramaphosa and the ANC effectively deprived them of their primary argument (the land expropriation issue), they have been making blatantly racist statements which have alienated many of the intelligentsia in South Africa and many of their erstwhile supporters. The attack on Treasury’s Momoniat by the EFF’s Shivambu is the worst example. Momoniat is an ANC veteran who went through the “struggle” and is eminently well-qualified for the function he performs at the Treasury. To attack him purely because he is an Indian and for no other reason has attracted widespread criticism. What is interesting though is that many critics, of all race groups, have now characterized Shivambu, a black man, as being racist. Previously, in South Africa, being racist has been an exclusive white province. Many might previously have argued that it was impossible for a black man to be racist – that they rather were the victims of racism, not the perpetrators. That perception is now changing and it is becoming more apparent that anyone, even a black person, can be racist and that any person, irrespective of their race, can be a victim of racism. That is a massive step forward in our collective consciousness as a nation. The National Health Insurance (NHI) bill has now been approved by the cabinet. It will come up for public comment in due course and will combine with the Medical Schemes Amendment Bill. The new legislation aims to provide everyone in the country with at least the same standard of minimum health care. At the moment only about 16% of the South African population is covered by a medical aid or some type of medical insurance – mainly because they are the ones who can afford it. Everyone else has to rely on government provided hospitals and clinics. The idea is to try to level the playing field somehow – but clearly, the new NHI is going to cost a fortune – probably more than the government can afford and there is nothing in the new legislation to suggest how it will be funded. We believe that the NHI is similar to the nuclear build programme which president Zuma implemented. It is too expensive and of dubious merit and so will probably not be implemented. Probably one of Ramaphosa’s most important moves since he became president has been to abandon the idea of building nuclear power stations. Nuclear is both expensive and unnecessary in South Africa, but the real truth is that we simply cannot afford it. Had Ramaposa decided to continue with the nuclear build program the government could not have met its debt covenants and that would have resulted in further downgrades by the ratings agencies. On his recent trip to Russia, deputy-president, David Mabuza, said that nuclear was not on the agenda and was not discussed.Economy

The worse-than-expected figures for the 1st quarter South African GDP growth came as a shock and a wake-up call to many economists. The 2,2% fall in GDP was mainly caused by agriculture which fell 24% when compared with last year’s bumper 1st quarter. This bad start to the year will make it very difficult for the economy to produce the 2% growth for the whole year which, for example, Standard and Poors was predicting. Most economists are now predicting 1,5%. The problem is that confidence levels remain very [glossary_exclude]low[/glossary_exclude], despite the “ramaphoria” that has been going around since Ramaphosa became president. Many of the problems in the South African economy are deep-seated and will take many years to address. The decision to compromise with union demands in the public sector will cost the government R30bn more over the next three years than it budgeted for in the 2018 medium-term budget. This will result in an increase in the public debt which is already at 53% of GDP and has doubled in the last ten years. Clearly, the government decided that it did not want to face a strike by the 230 000 public servants who belong to unions. At the same time Pravin Gordhan has stepped in to force the continuation of negotiations at Eskom in a move which will certainly cost the state even more. The problem with our runaway public debt is that it will make it much more difficult to meet the government’s expenditure ceilings and debt consolidation targets, making further downgrades by the ratings agencies more likely. The only solution, now that the unions are being appeased, is to reduce the size of the civil service by cutting jobs and this idea has been strongly endorsed by the CEOs of the financial organisations which are the main lenders to the government. The first proposal in this regard is to offer all civil servants over the age of 60 early retirement. There are thousands of civil servants in this category and taking them out will involve significant savings in future years. It will also have an immediate, once-off cost to the government, as it has to [glossary_exclude]top[/glossary_exclude] up their retirement packages. There is also now talk of selling a controlling stake in SAA – or divesting of it completely. Of course, the unions are strongly opposed to retrenchments and even more opposed to any move towards nationalisation of Eskom, SAA or any other state owned enterprise (SOE). David Sipunzi, NUM’s General Secretary, said “We remain resolute that Eskom should remain a public entity and not be available for privatisation. We know with privatisations come retrenchments”. The unions naively believe that Eskom, SAA and other SOEs do not need to be profitable – because they can always be bailed out by the government. At some point in the fairly near future, a show-down with the unions in South Africa is inevitable – but it does not now look as though it will happen before the 2019 elections. The radical decision by Hadebe (CEO) and his team at Eskom to offer a 0% increase to their employees was brave and well justified. Eskom’s financial position is still desperate and far from being resolved with about R367bn of debt. Hadebe is trying to get the company back onto a profitable footing in the face of a 5% increase in tariffs from NERSA - and there is just no room for any pay increases or bonuses. The unions were furious threatening strike action and to “physically remove” Hadebe and his new board. Then Pravin Gordhan intervened to force negotiations to resume. So the threatened show-down has been averted. Eskom has now offered 6,2% and the unions are holding out for 9%. The real problem is that the size of the Eskom labour force and the rate at which it is being paid has become unsustainable. Eskom is producing less electricity now that it did in 2011 – but its workforce has risen by nearly 50%. Gordhan says that the country cannot afford more load-shedding now, but the real reason, it would appear, is that Ramaphosa’s new government is not yet ready to have a show-down with the unions (in a similar way to Thatcher’s government in the UK in the 1980s). A culture of entitlement has developed among unions over the past decade where they believe that they are entitled to pay increases every year irrespective of the financial state of the organisation that they work for or the productivity of their members. In the mining industry, this has been a partial cause of mine closures and resulted in thousands of people losing their jobs. The same can be said for many other labour-intensive industries in this country. It will be interesting to see how Gordhan deals with this issue and whether he gets the [glossary_exclude]support[/glossary_exclude] from the ANC that he needs, especially leading up to the 2019 elections. The ratings agency, Fitch, decided to keep South Africa at junk status – with a stable outlook, but said that the situation had improved marginally. They increased the expected growth rate for this year to 1,7% and said they would improve the rating if we were able to reduce government debt. But they also said that any worsening of government debt – or the migration of our state-owned enterprise (SOE) debt onto the government balance sheet would cause them to put through a further downgrade. They indicated that government policy reform would now be constrained by the up-coming elections in 2019. They were very positive about the smooth, violence-free transition from Zuma to Ramaphosa and the reforms which he has so far managed to implement – but pointed out that the ANC was still far from a united front.The US Economy and the Rand

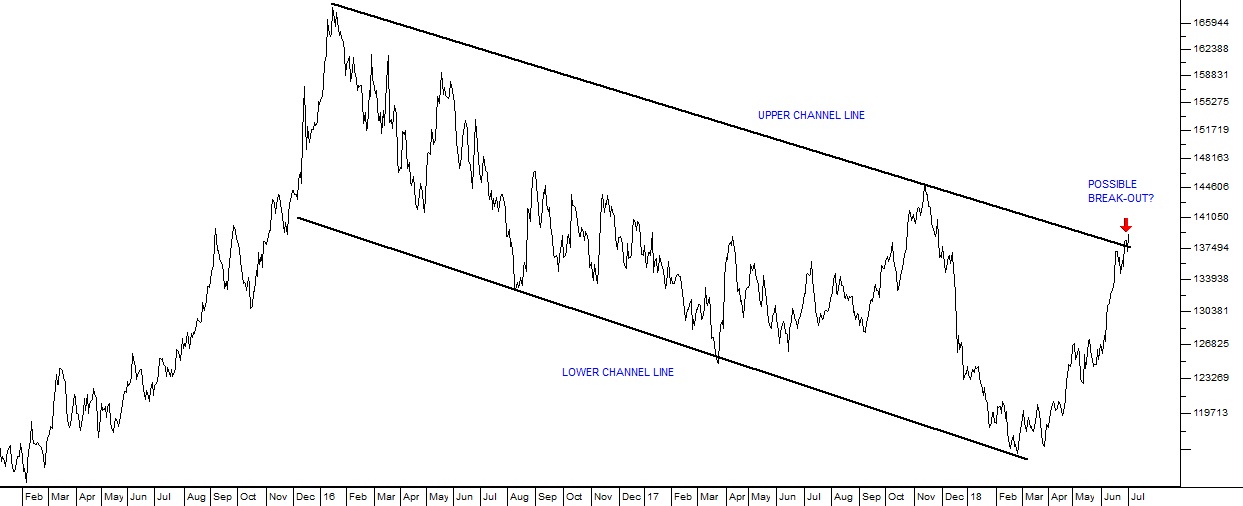

The US Federal Reserve Bank’s (The Fed) decision to sell $20bn worth of bonds a month is a monetary policy decision aimed at reducing the American money supply. With it comes a 0,25% hike in interest rates. This steady increase in interest rates to “tighten” money supply is intended to reverse the effects of the massive quantitative easing and [glossary_exclude]low[/glossary_exclude] interest rates of the past decade. There could possibly be a further two 0,25% rate hikes this year still. When a government sells bonds it takes money out of the economy and replaces it with something that is not money (a bond) thereby reducing the money supply. Trades in government bonds by the central bank are known as “open market operations” and are a normal mechanism of monetary policy. The Fed’s pace of bond-selling might increase to $50bn a month or more. This is having the effect of making the US dollar more expensive against all currencies, including the rand. Together with the current “risk-off” attitude of international investors, this has pushed the rand to its upper channel line at around R13.75 to the dollar. Consider the chart:

Rand Dollar Exchange Rate January 2015 to July 2018 - Chart by ShareFriend Pro

Here you can see the long-term strengthening channel defined by an upper and a lower channel line. The recent weakness has taken the rand back to the upper channel line – but we cannot yet say that it has broken that line. Theoretically it should strengthen back from the line, but recent market action suggests that a weakening breakout is a distinct possibility. Trendlines, like those drawn on the chart above, are not precise things and so there is a little leeway for the rand to go above R13.75 – but any move above that level which is significant or sustained will indicate a weakening breakout from its long-term channel – and it can be seen that there is some hesitation at that level as currency speculators wait to see what will happen. It is also well to note that all emerging market currencies are weakening against hard currencies and particularly the US dollar. The rand is down under 7% since the start of the year compared with the Turkish lira which is off 20% and the Brazilian real which is off 13%. One analyst says that our comparatively better performance is due to the Ramaphosa factor and suggests that if Ramaphosa had not been elected the rand would be at R17 to the US dollar by now. Another factor is the level of the current account of the balance of payments. The trade balance, which is the major part of the current account, has swung from a R75bn surplus in the 4th quarter of 2017 to a R25bn deficit in the first quarter of 2018. That’s a R100bn turnaround and it will certainly have impacted on the rand’s level against the US dollar. But trade account figures are notoriously volatile. What is clear is that the current “risk-off” attitude of international investors is partly a function of the tighter US monetary policy and partly a result of the tough talk coming out of Washington and China which threatens a trade war between these two economic giants. In our opinion, such a trade war is unlikely to materialise to any great extent. We believe that the rhetoric will calm and things will return to normal, leading to renewed rand strength in due course – but the real question is, “Will it remain within the strengthening channel?”.General

By now, everyone is aware of cryptocurrencies and especially Bitcoin. What you may not be aware of is the fact that such currencies (there are now about 3500 crytpocurrencies in the world) rely on a “blockchain database” to maintain their stability and ensure their reliability. Blockchain databases are a type of “distributed ledger technology” (DLT) where information is stored and verified on many independent computers making it impossible to hack the system or interfere with its functioning in any way. In other words, it offers a completely reliable database which does not have to be controlled by a central authority – like the government. You may also be unaware that our Reserve Bank has recently completed a successful test of a DLT to make interbank payments more reliable and efficient. This function is currently handled by the Reserve Bank’s multiple option settlement system known as “SAMOS”. The successful completion of this test opens the door to using DLTs in a number of other financial applications and it puts South Africa at the forefront of the development of DLT technology worldwide. What is even more interesting is the possibility that DLTs could be used to maintain other registers which are currently handled by various government departments – like the home affairs registers (births, deaths, marriages etc) or to replace systems like the E-Natis used to keep track of motor vehicles in South Africa. It could perhaps even replace the voters’ register. Like all new technologies this completely reliable independent database system is in its infancy – but, in time, it is bound to be or contribute towards a number of highly disruptive developments in business and the running of the country. At any point in time the JSE is supported by considerable foreign investment. The attitude of foreign investors can have a major impact on certain blue chip shares. May, 2018 was a bad month because foreigners sold a net R20bn worth of our shares on the JSE. This was mainly caused by the fact that international investor sentiment turned more “risk-off” – which basically means that they were biased against emerging markets because other international investments looked more attractive. Mainly, this was caused by the fact that interest rates have been climbing in America. The US 10-year T-bill has moved above a yield of 3% and that is attracting funds that might otherwise have come to or remained in emerging markets like South Africa. This had a significant impact on the JSE overall index and on certain shares which seemed to remain stubbornly low. For example, there does not seem to be any good reason for a share like Capitec to remain at current levels. It has been thoroughly endorsed by the Reserve Bank and has produced very good results. The effect of the ill-advised Viceroy report has surely by now dissipated - and yet the share has not returned to its previous levels. South Africa has its first computer-driven artificial intelligence (AI) investor in the form of NMRQL Research, which is backed by the former CEO of Firstrand, Michael Jordaan. This company offers unit trusts where the funds are invested by an AI program which supposedly learns from its mistakes. Unfortunately, so far, NMRQL’s [glossary_exclude]high[/glossary_exclude]-equity fund is down more than 2% since it was launched in October last year. Perhaps it needs to learn more from its mistakes before it becomes effective – but there does not seem to be any point in using your capital to pay for those mistakes. In our view, a good understanding of the market can take years to acquire and it involves a deal of intuition and perception. The shift towards delivered convenience food is becoming important in South Africa – as it has in other countries. The idea is that in the modern world many A/B income group people do not have the time to pick out menus and then shop for ingredients to ensure that they and their families eat healthy food. To overcome this problem a number of companies are offering to deliver a week’s food in neatly packaged containers that cover all the meals in a delicious, varied and healthy combination. It includes everything necessary to quickly and easily produce healthy meals and there is very little waste. Central to this idea is a company called Silvertree which is based in Cape Town and is currently producing a turnover of around R500m per annum. They own brands like Ucook and PriceCheck. They are planning to list in a couple of years when they have achieved more scale. They estimate that their industry is growing at about 30% per annum. Famous Brands and Woolworths are also growing businesses in this area, leveraging off their existing brand awareness. Obviously, this is a potentially disruptive trend that could ultimately damage the traditional supermarket model.Commodities

The major impediment to overseas investment in our mining sector is the third charter which Gwede Mantashe is negotiating with the Minerals Council of SA (previously the Chamber of Mines) and people like Neil Froneman (CEO of Sibanye) and Mxolisi Mgojo (CEO of Exxaro), to produce a new charter for the mining industry. The process took more than expected, but now a draft has been agreed to and is out for public comment for the next 30 days. The most important concession in this draft is the fact that past BEE ownership transactions would be recognised even if the shareholders had voluntarily sold the shares that they received. Against this, the BEE component has been increased to 30% from the 26% of the previous charter. At the same time a 10% “free carry” component is split between employees and the community – and it earns a return of 1% of operating profit which is ultimately recouped from dividends. Free carry means that the owners of this will not have to contribute anything to get this 10%, they will not have to contribute any capital to the business as it grows and their share will be financed by the other 90%. This clearly makes South Africa a far less investor-friendly destination for international investment. Actually, Ramaphosa (through Mantashe) is on something of a tightrope here. He must try to balance the needs of mining communities and unions with what is practical to make South Africa attractive to the big international mining houses. He knows there is an election coming next year and he is reluctant to alienate the more populist elements of the electorate that talk about nationalising the entire mining industry and other radical solutions. Clearly, this charter is also a hard-won compromise in which both sides had to give ground and where neither has got everything it wanted. The real question is whether it is sufficiently investor friendly to attract overseas investment, because, without that, there will be no significant mining industry in this country for anyone to benefit from. The platinum group metals (PGMs) industry in South Africa has been taking strain with the price of platinum wallowing below $1000. South Africa’s contribution to world supply has remained at around 72%, but has declined slightly due to the closure of marginal shafts. At the same time the production of recycled platinum from the auto-catalyst industry continues to rise about 5% per annum. It now accounts for about 21% of all platinum produced. And always in the background is the specter of electric cars. Almost every major motor manufacturer has an electric car in production or in development. It is conservatively estimated that as many as 30% of all cars on the road world-wide by 2030 will be electric. The UK is producing a law which will make the internal combustion engine illegal after 2040. The market for auto-catalysts must begin to decline - probably sometime in the next 5 years. Sibanye’s decision to sell forward $500m worth of palladium in a streaming deal plus another $100m in what CEO Froneman describes as “another structure” will enable them to reduce their debt by roughly one third. That should cause a significant re-rating of the share – which has fallen from R66 in August 2016 to its current level of around R8.23. It also has a net asset value of R11. The company has become the world’s second largest palladium producer – and palladium is under-supplied on world markets with a 1,3 million ounce annual shortfall. Froneman is talking about resuming dividends in 2019. Of course, their safety track record has been badly damaged this year with 21 deaths and that is holding the share price down. We believe that this share is definitely speculative (because it is a commodity producer) but that it is at a good price below R9 per share. Consider the chart:

Sibanye (SGL) July 2016 to July 2018 - Chart by ShareFriend Pro

Companies

HAMMER FORMATIONS

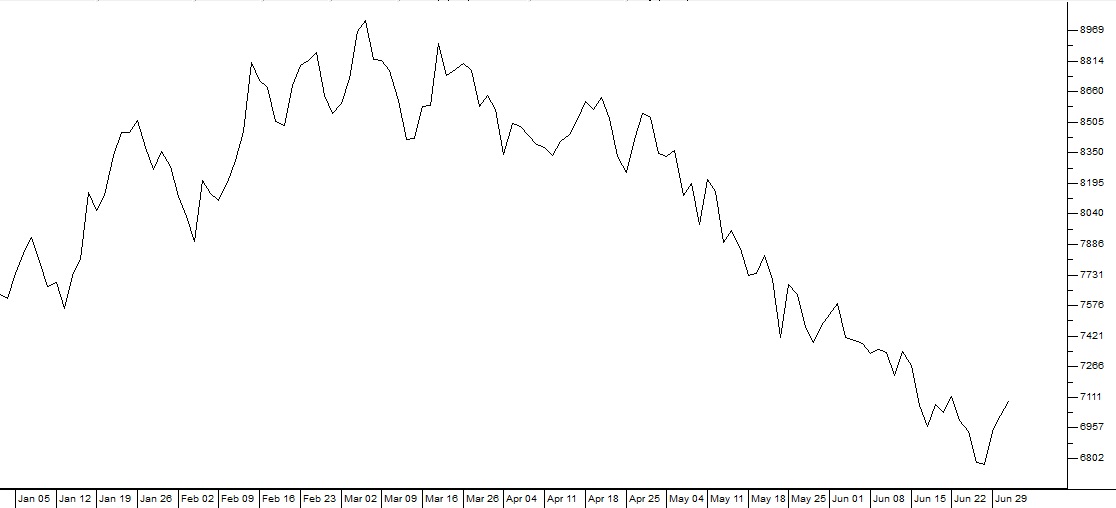

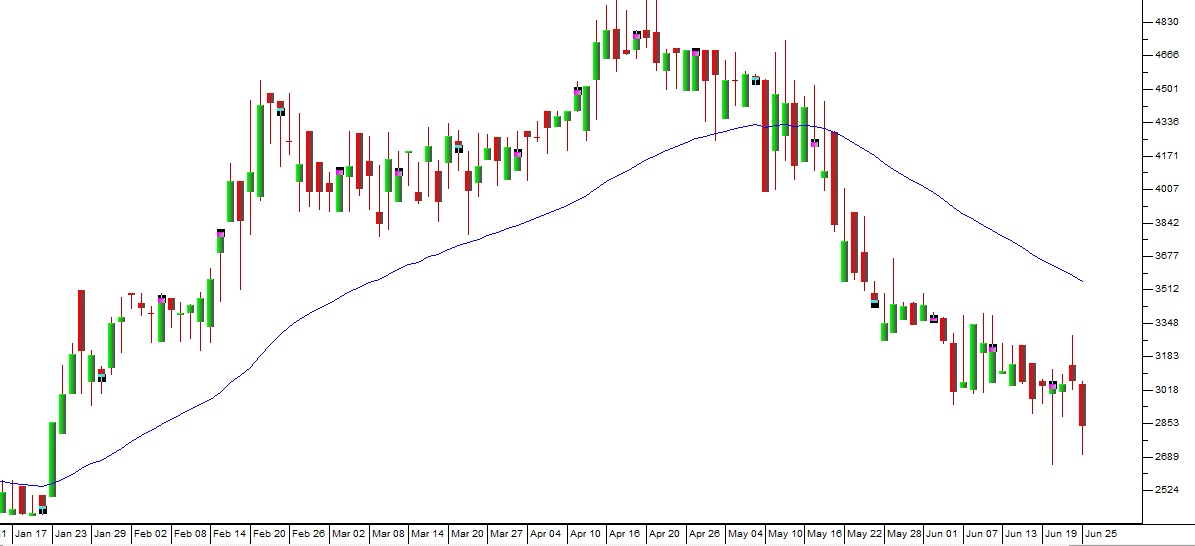

The “hammer” [glossary_exclude]formation[/glossary_exclude] is a Japanese candlestick formation which features a small “body” and a long lower “shadow”. The Japanese, who invented candlestick charting long before western technical analysis came into being, regard each day’s trade as a battle between the bulls and the bears. A hammer formation usually occurs after a downtrend, and on that trading day, the bears make a concerted effort to take the share/index lower, but fail and the bulls are able to bring it back to a position very close to its opening level – which results in the characteristic long downward tail and small body (If you are unclear on candlestick charting re-read our modules 27 and 28 which explain the concepts in much more detail). The JSE Overall index (J203) has displayed three excellent hammers in the past six months – and in each case the hammer has come at the end of a downtrend and been followed by an uptrend. Consider the chart:

JSE Overall Index January 2018 to July 2018 - Chart by ShareFriend Pro

You should make a point of looking out for hammer formations in the shares that interest you – and also their opposite, the “shooting star” formation.RETAIL

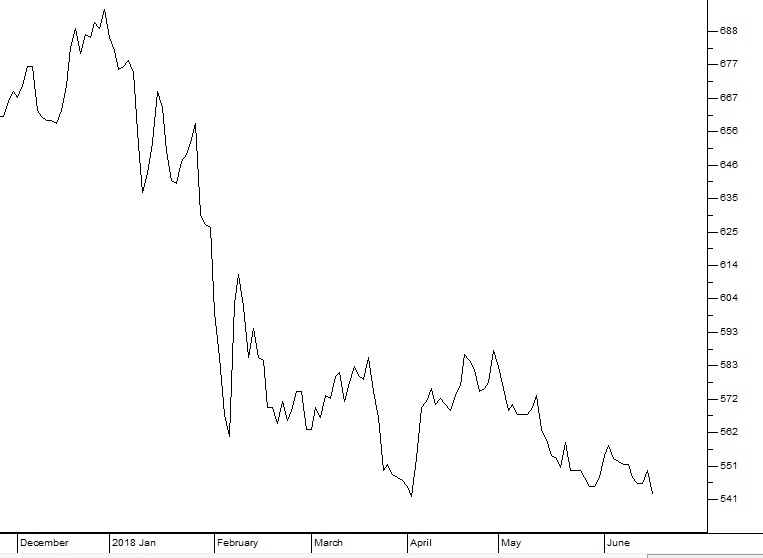

The JSE General Retailers index (J537) has fallen by about 20% since the beginning of March this year – a sure indication that consumers are taking strain. Consider the chart:

Retail Index (JSE-GERE) January 2018 to July 2018 - Chart by ShareFriend Pro

This can be seen in the fall of shares like Shoprite and Woolies. It is also visible in specialist pharmaceutical retailers like recently-listed Dischem and to a lesser extent, Clicks. This shows that the surge in retail spending which was anticipated this year as a result of Ramaphosa taking over as president is not materialising. Instead, a series of sharp petrol price hikes have taken money out of consumers’ pockets.PROPERTY

The JSE property index (JSE-SAPY) usually matches the performance of the yield on government bonds because property is seen as a very similar type of investment with a long-term stable yield. Right now, however, because of the demise of the Resilient group of property companies, the JSE property index (JSE-SAPY) is down 22% so far this year – while the yield on the R186 government bond is up over 9% which is a rise from 7,88% just three months ago (27-3-18). This potentially suggests that some sort of rationalisation is imminent. Either the yield on the long bond must fall, or the property index must rise to bring them back into line. We suggest that it will be the property sector that rallies from its currently over-sold position – and especially the Resilient group, which make up a material percentage of the SAPY. The chart shows the SAPY over for this year:

JSE Property Index (JSE-SAPY) December 2017 to June 2018 - Chart by ShareFriend Pro

NEPI-ROCKCASTLE (NRP)

Despite the controversy surrounding the Resilient group of property companies, Nepi-Rockcastle is forging ahead with acquisitions in Eastern Europe. They recently acquired two more shopping centers in Lithuania and in Poland. What is apparent is that this group (Resilient, Nepi-Rockcastle, Greenbay and Fortress) of companies are all trading significantly below where they were before the 360ne report came out – but they still have value. Unlike Steinhof’s parlous situation, this one is likely to recover. For example, Nepi-Rockcastle was trading for around R217 at the end of last year and it is now at about R128. Its asset base has not changed (except to increase by acquisition) and its management has not changed. What has changed is investor perceptions – and those could change back. What is certain is that if you buy this share for R128 you will be doing a lot better than the investors (probably mostly big institutions) that were filling their pockets with these shares at R217 about six months ago. Consider the chart:

Nepi Rockcastle (NRP) December 2017 to June 2018 - Chart by ShareFriend Pro

FORTRESS (FFB)

This share is a real estate investment trust (REIT) which focuses on logistics properties in South Africa. It took a pounding in the first half of this year because of its cross-shareholding with Resilient. The “B” share price fell from R42 to as little as R12. Since then it has unwound its cross-shareholding with Resilient and just owns 10% of that company with no reciprocal holdings. The company has an awesome track record having increased its market capitalisation from R1,9bn when it listed in 2009 to R46bn in December 2017. It now has plans to double its value in the next three years. Right now its market capitalisation is just fractionally above its net asset value – which probably does not make much sense. It is planning to have 150 high-quality logistics assets within 5 years. These properties are used for on-line retail warehousing. There is a general shift towards on-line shopping and away from shopping malls world-wide.NASPERS (NPN)

Once again we wish to stress that Naspers – whose main asset is its 30% holding of the Chinese internet company Tencent – is massively undervalued on the JSE. It is trading at a discount of about 30% to its true value in our view. The company is sitting on about R150bn in cash and generated turnover of $20bn in the year to end-March – which was a 38% increase on the previous year. Obviously, this share is also a rand hedge and receives most of its income in hard currencies. The only complication is that it is one of the last remaining companies on the JSE which still has “N shares". An “N” share is one with a relatively low par value – and this, of course, means that it also has a very low voting capability. The voting capacity of a share is directly linked to its par value. This type of structure was extensively used on the JSE in the past to enable a small group of shareholders to control a very large company. The approach is frowned upon, but still legal. In Naspers case, the “A” shareholders have 1000 times the voting power of the “N” shareholders. Despite this we believe that Naspers is worth about R5000 per share and it is currently trading for less than R3500. WE believe that, eventually, the archaic “N” share structure will be unwound and shareholder value released.LONG 4 LIFE (L4L)

Brian Joffe’s latest acquisition is Rage – a private company in the clothing and footwear business. This is an intensively competitive industry and Rage is one of the foremost contenders with 555 stores around South Africa. However, the price which L4L is paying seems to be much too high. Traditionally, private unlisted companies are purchased for 3 – 5 times their annual after-tax earnings. This deal is being done at 10 times. L4L will pay R3,9bn for it in a combination of shares and cash which will dilute existing shareholders and wipe out most of the company’s cash reserves. In our opinion, there are not many synergies between Rage and L4L’s existing businesses which makes the acquisition questionable, especially at a multiple of 10. The only thing going for L4L is Joffe’s reputation as an astute deal-maker. Maybe he knows or sees something that we do not.BARCLAYS AFRICA (BGA)

The “big four” banking shares (Nedbank, Standard, Barclay Africa and FNB) are usually good value when their dividend yields (DY) go above 5%. Because they are very stable, well-managed and service companies, their shares are always in demand by big institutional investors. Anytime one of them falls to the point where its DY goes above 5% there is usually substantial institutional buying which drives the yield lower. Right now, the banking index itself is trading on a DY of about 4,7% and Barclays Africa is trading on a DY of 5,35% and we don’t expect it to remain there for very long. So, if you are looking to buy into a solid blue chip share with a great future, there can be little doubt that this share is currently trading at a very good price.ELLIES (ELI)

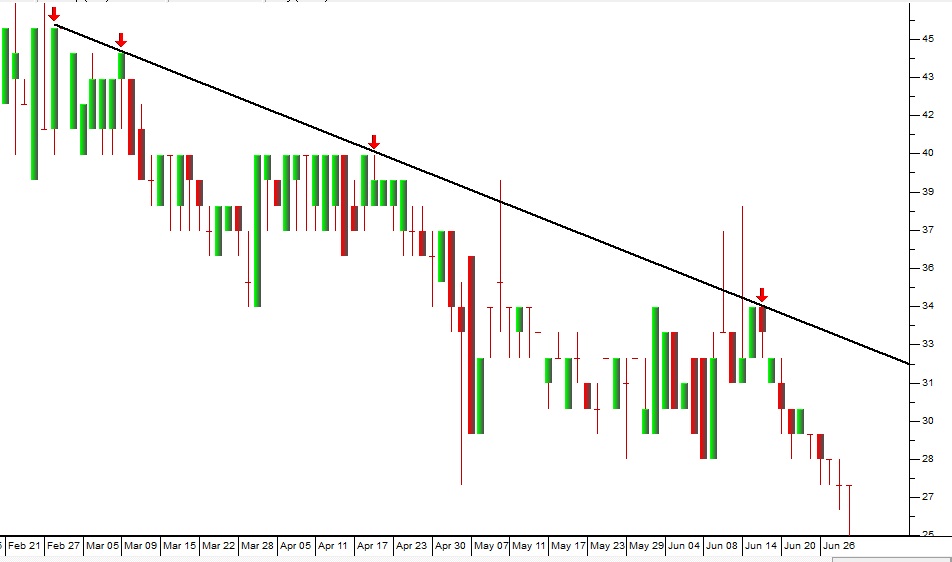

Sometimes penny stocks can be a great investment – especially if they represent good businesses that have fallen on hard times. Ellies used to trade at about R10 back in 2013 and today they can be bought for just 27c. They will return to profit in the year to July 2018 when their results are reported according to the joint CEO, Adrian Bock. If he is correct, and that profitability can be sustained, then this share probably represents a buying opportunity. At their 2017 results they reported net asset value (NAV) of 44,84c per share. The technical picture, however, is still negative with the share price in a firm downward trend. In a situation like this, if you feel like taking a speculative position, we recommend that you use a simple trendline to indicate when exactly you should buy in. Consider the chart:

Ellies (ELI) February 2018 to June 2018 - Chart by ShareFriend Pro

Here you can see that the downward trendline has four “touch points” (indicated by the red arrows) – which makes it a reliable trendline. So, you need to wait until that trendline is clearly broken on the upside before buying. And remember to have a strict stop-loss strategy.BRIKOR (BIK)

Brikor was suspended on the JSE five years ago for failing to produce its financial statements within the JSE’s deadline. Since then it has been trying to improve the business and pay off debt. Now it has re-applied to the JSE to have its listing resumed. When it comes back to the market it will be an interesting share to watch. Its last trade in July 2013 was at 9c per share – so it is definitely a penny stock – and a highly risky one because it is a supplier of building materials in an economy where building has taken a pounding. Nonetheless, after 5 years there will almost certainly be an over-hang of sellers who have been waiting patiently to get something back from their investment. So our advice is to wait a little and watch the daily market action – but this share once traded for 175c and it did produce headline earnings per share (HEPS) of 1,2c for the year to 28-2-18. Consider the chart:

Brikor (BIK) August 2007 to July 21018 - Chart by ShareFriend Pro

LEWIS (LEW)

This low-end furniture retailer, which has been in much trouble over its credit policies and how it has treated customers, is now looking like good value – a fact that its board of directors recognise through their repeated recent share buy-backs. They argue that the net asset value per share is R65.34 and the share is trading at around R28 – so they are getting their own shares for more than a 50% discount. The share price has fallen heavily in recent weeks from a cycle high of R48. Clearly, as it is a retail share and the JSE General Retailers index is down 20%, it is to be expected that Lewis would fall in sympathy. But it could be argued that with the new ANC leadership and the recovery in the world economy, sooner or later Lewis has got to start performing. So the question is “When?” In our view it already represents good value, but the share might fall a little further. Perhaps the best tactic is to wait for it to break up through its 45-day exponentially-smoothed moving average. Consider the chart:

Lewis (LEW) January 2018 to June 2018 - Chart by ShareFriend Pro

STEINHOF

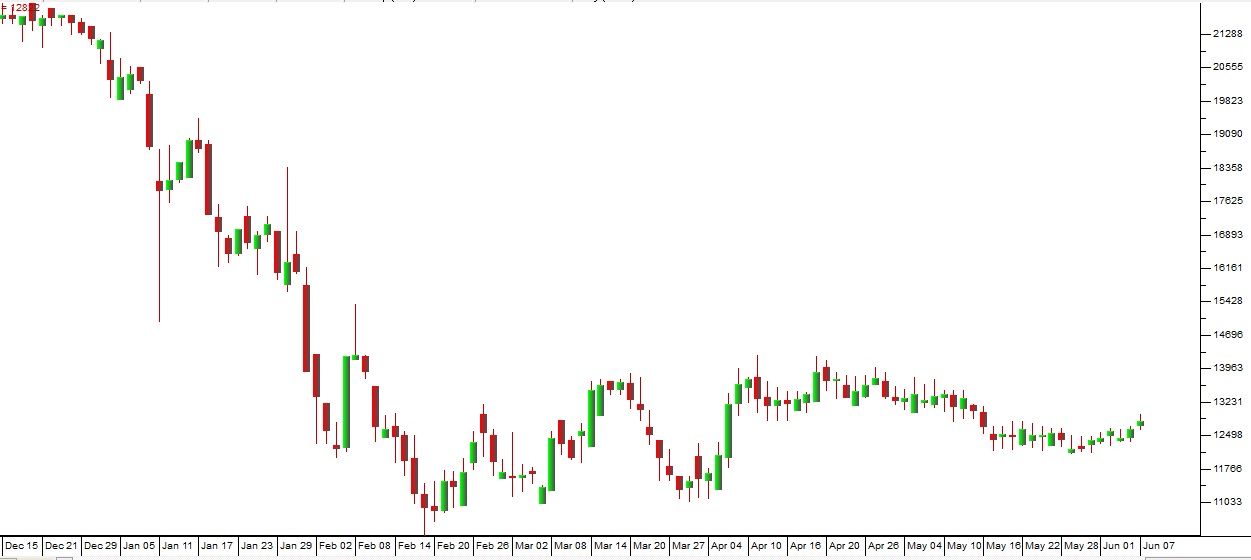

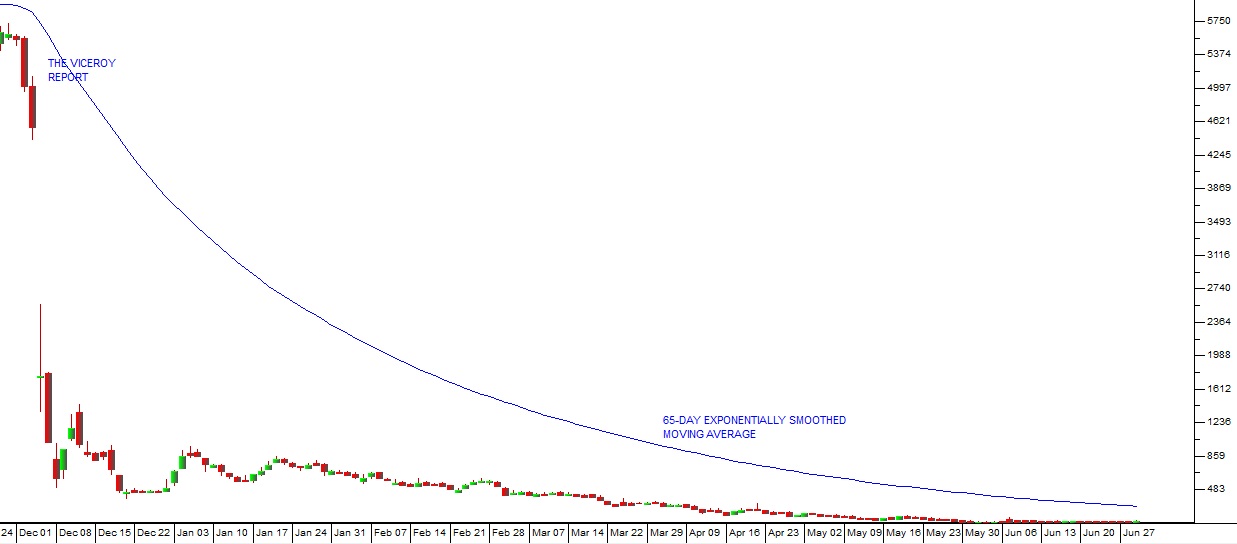

The attempt being made by Steinhof to get its creditors to extend the deadline for their indulgence to 20th July from 30th June has rattled the market further. If the creditors do not agree to this then it seems inevitable that Steinhof will go into liquidation. Ever since the Viceroy report came out on Steinhof, we have advised you to only consider buying Steinhof shares if they could break above their 65-day exponentially smoothed moving average. Consider the chart:

Steinhof (SNH) December 2017 to June 2018 - Chart by ShareFriend Pro

At that time, this moving average was at just under R60. On Friday it reached 276c – and it is still more than double the current price of Steinhof shares at 135c. We now think it is unlikely that Steinhof will ever break above its 65-day exponential moving average and that the high probability is that it ends in liquidation – but you never know… You can view a visual presentation of this report here. To be added to our mailing list for the next webinar, click here.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: