The Confidential Report - February 2018

Political

The election of Cyril Ramaphosa as head of the ANC in December signals a sea-change in South African politics. Ramaphosa is not yet in a strong position and he will have to manage the recall of Zuma extremely carefully, but it is apparent that some Zuma supporters (like speaker of the house, Baleka Mbete) have seen the writing on the wall and changed sides. The Zuma/Gupta camp will not give up easily, however, and we can expect them to fight back. They have everything to lose. Ramaphosa also has the sensitive matter of selecting Shaun Abraham�s replacement as head of the National Prosecuting Authority. This choice will be critical since ideally that person�s first function will be to finally pursue the charges against Zuma. Zuma still has some effective control of parliament and the NEC, but many of his paid supporters are now beginning to think that their salaries will be more secure by moving to the Ramaphosa camp. This shift in the direction of the political wind is best seen in the strength of the rand which ended to the year at its strongest level since July 2015 and looks set to continue strengthening. Extricating South Africa from the clutches of state capture will be a difficult and delicate process which will require all of Ramaphosa�s skill, especially considering that there is an election to be fought in 18 months� time.

Prior to the appointment of the new board of directors at Eskom, the accountants were saying that it was no longer a �going concern� because it is unable to re-finance its debt. Local banks and institutions had stopped supplying funds to Eskom because of its poor governance and only overseas investors, attracted by the [glossary_exclude]high[/glossary_exclude] yields, were possibly interested. Eskom needs to raise $20bn before March to get some breathing space and indications are that, with the new board, this has been achieved. The problem is that the demand for electricity in South Africa has been falling as more and more individuals and companies arrange their own renewable energy sources. Eskom�s unreliability and ever-rising prices are to blame for this. Like Telkom, they need to learn to compete. The monopoly which they have enjoyed for decades is rapidly coming to an end. The new acting CEO, Hadebe is at the forefront of the turnaround and has inspired the local banks to return as funders. He was previously responsible for sorting out the Land Bank in a similar manner ten years ago. The point is that with the new funding, the auditors have signed off on Eskom�s interim financials and the JSE won�t have to stop trading in Eskom bonds. So a massive national financial crisis has been averted � narrowly and with just weeks to spare.

Wall Street

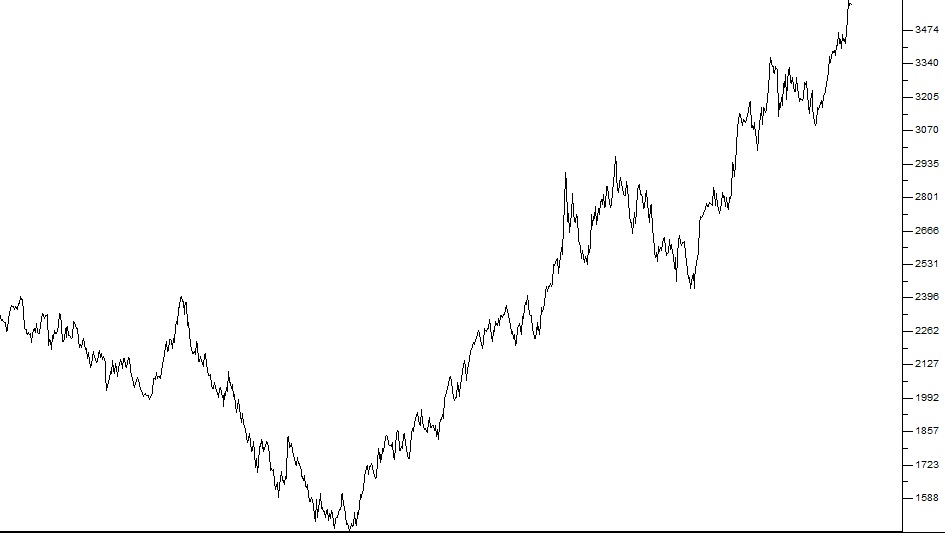

The sharp sell-off in the S&P500 over the past week (and especially Friday�s 2,12% and Monday�s 4,1% drop) is the first notable correction that we have seen on Wall Street since the 14,2% correction back in February 2016. However, so far the S&P has only reached 7,8% down and has only fallen for 6 trading days. In our article, �The Bigger Fool� on 29th January, 2018, we said �the S&P500 simply cannot continue rising at the rate of 100 points every ten trading days�. In other words, the upward move was simply too fast and a correction was imminent.

Here you can see the sharp acceleration of the S&P500 and then the six-day correction culminating in a 2,12% fall last Friday and the 4,1% fall on Monday. You can also see the long-dated moving average which continues to rise suggesting that the bull market continues. So we don�t think it signals the end of the bull trend.� We see this as a healthy correction and long overdue. So we see it as a buying opportunity, but the correction could continue for a while before it touches bottom. It is impacting on the JSE overall index which has come off 8,6% in the last eight trading days. Some of this sell-off is because of the strengthening rand which impacts on the massive rand-hedge blue chips which make up much of the JSE Overall index. From a fundamental perspective, 80% of the S&P500 companies that have reported so far this quarter have beaten their forecast earnings. This is unusually [glossary_exclude]high[/glossary_exclude]. At the same time, the average expert forecast of future S&P500 earnings indicates that will rise by 17,7% - and this forecast figure is still rising. This means that the earnings multiple of the S&P is probably still reasonable, despite its sharp rise. And most of the rise is being driven by the improvement in the tech-heavy shares of the Nasdaq. In other words, the boom on Wall Street is being driven by technology companies. In our view, the strong fundamentals of the US economy will limit the extent of this correction and the [glossary_exclude]bull[/glossary_exclude] market will resume.

The Rand

The rand began to strengthen on 13/11/2017 from its weakest point in the current cycle of R14.52 to the US dollar. Since then it has strengthened to current levels around R12. What is interesting about this sharp turnaround is that the ANC�s elective conference only began on 16th December, more than a month later, and the result was only known some days after that. Consider the chart:

This supports our view that powerful currency speculators (probably international), playing the rand market, had good quality inside information on the likely outcome of the conference even before it started - and they acted on it well before everyone else knew. This type of well-informed trading by major currency speculators makes the rand/dollar exchange rate an excellent barometer of major political events in South Africa. For the private investor, keeping a close eye on the rand was always far better than trying to make sense out of press articles on the voting patterns in the provinces and the so-called �unity votes� prior to the conference. So far the rand has appreciated by just over R2 to the US dollar. Further improvement will depend on what happens next and how Ramaphosa manages what must be an extremely delicate and finely balanced power struggle. He clearly needs to consolidate his position before he can make any radical changes. The pattern of the rand since conference showed a period of sideways movement between R12.30 and R12.45 since his accession, but in recent days it has strengthened further to under R12. This is probably a good indication that Ramaphosa is steadily winning ground against the Zuma/Gupta alliance.

Economy

Growth in the economy has definitely started to pick up noticeably. The surprise improvement of 2,5% in GDP in the second quarter of 2017 was probably followed by growth of around 1,5% in the third. Most of this is due to an increase in exports and that comes from the higher commodity prices in the world economy. The South African economy is being dragged up by the general recovery in America and, to a lesser extent, Europe. This is confirmed by the sales of new vehicles which rose in November for the sixth month in a row � and that total vehicle sales for the first 11 months of 2017 were up 2,2%. The positive growth in world trade is also lifting our manufacturing output, especially for exporting companies. Manufacturing production rose by 1,7% in November 2017 after a 2,3% rise in October 2017. It�s not much yet, but there is a nascent recovery going on which is not much commented on in these stormy days of political intrigue. Manufacturing is being stimulated by an increase in exports due to the recovery of the world economy. This is being off-set to some extent by the sharp R2 improvement against the dollar following Ramaphosa�s election as head of the ANC. So, although the IMF and World Bank have reduced their estimates of GDP growth for SA, we believe that this time they are wrong. We see growth in 2018 at around 1,5% and far better than that in 2019. One of Mr Ramaphosa�s first problems when he takes office will be to improve the level of tax collections. Personal taxes collected make up a substantial 37% of total tax and these have been falling off since Tom Moyane took over as the head of SARS. The culture of evading tax is growing as taxpayers become resentful of fruitless and wasted government expenditure and the much-publicised losses due to various forms of corruption and state capture. The budget deficit is forecast to rise from 3,1% to 4,3% of GDP � a horrifying statistic. The R50,8bn shortfall is a major blow to South Africa�s efforts to obviate ratings downgrades and suggests that the February 2018 budget will inevitably include a VAT increase. So, one of Mr Ramaphosa�s first tasks will be to find a really good and trustworthy Minister of Finance and instruct him to replace the current head of SARS with an experienced chartered accountant. He will have to weed out everyone in government that has the slightest taint of state capture or association with the Gupta�s. Ramaphosa has made some good announcements since becoming the heir-apparent to the presidency. He said of the nuclear programme �We have a surplus of power and no money� � a breath of common sense which just about sums up the situation. He also said we should be looking to create more renewable energy. At the same time he has been wading into the conflict between the Mineral Resources department and the Chamber of Mines. The new charter put up by Zwane is clearly unworkable � and the prospect of it has virtually stopped mining investment in South Africa. We cannot afford that. We need overseas and local investors to pour money into the mining sector to create new jobs and much-needed foreign exchange. So far, so good. The rand is certainly showing that overseas investors are very positive about the way Ramaphosa is going about his business.

General

DROUGHT

The drought in the Western Cape is very serious. Hundreds of thousands of people have moved to the Western Cape in recent years because of the perception that the DA has managed to improve the quality of life there. The water infrastructure has been stretched to breaking point and now there is the worst drought for decades leading to a crisis. The key question is whether this will be the �new normal� in the Western Cape or simply a very rare event. Some listed companies are not waiting to find out. Aspen�s subsidiary, Fine Chemicals Corporation, which manufactures essential components for drugs like pain-killers, is installing a bore hole and water purification plant to make it completely independent of municipal water and possibly even able to supply some of its staff�s needs. It has also been authoritatively suggested that other parts of the country like Gauteng may soon face �day zero� and should begin to make themselves self-sufficient for water. At the same time Moody�s, the international ratings agency, has threatened to downgrade the City of Cape Town�s credit rating to below investment grade. If this happens it will have serious consequences for the Cape economy.

BITCOIN

ON 8th December 2017, we published an article on what we described as the �Bitcoin Bubble�. We likened the bitcoin market to the famous bubble market for tulip bulbs in Holland in 1629. We suggested that the bitcoin market was very similar to a pyramid scheme in that those who got in first and got out first would make money, but most would lose. We advised you to stay well clear of it. As it happens, 10 days later, on 18th December 2017, Bitcoin peaked and over the next month it fell to less than half of its peak value. The problem appears to be various governments, especially in the East (i.e. China, Japan), considering the banning of cryptocurrencies, and even if they don�t, bitcoin itself is no longer the most desirable of these instruments. Once again, we advise you to stay clear of this highly speculative phenomenon.

OPTIMISM

The PwC report on their survey of 1300 CEOs of large companies world-wide indicates a sharp improvement in optimism. 2017 was the best year for business since 2010 and the economies of most major countries are growing � pulled up by the US. This optimism is clearly being reflected in the stock markets of the world, the most significant of which is Wall Street. We expect consumers and businesses to continue becoming more optimistic for the foreseeable future � because of:

- The massive monetary policy stimulation that is still going on in some places (like Europe)

- The decline in energy prices firstly from the 2014 fall in the price of oil and then secondly from the growing presence of renewables.

- The massive productivity benfits that are coming from new technologies like the smart phone and the rapid spread of internet access.

BONDS

Traditionally, bonds offer a very good hedge against any weakness in shares � and vice versa. This is especially true in America where the bond market is much more accessible to private investors. When interest rates are going down bond values are rising. This is because older bonds which were issued at higher rates of interest are obviously more valuable. As interest rates fall the capital value of bonds adjusts so that the effective rate of interest remains the same for any particular class of bonds. For example, if you are looking at a R1m bond which was issued with a coupon (interest rate) of 8%, then if rates fall to 7%, that bonds market value will immediately increase until the effective yield on it is comparable � i.e. 7%. The bond market in America has been in a [glossary_exclude]bull[/glossary_exclude] [glossary_exclude]trend[/glossary_exclude] for the past 35 years � which basically means that interest rates have been mostly falling during that time. Bonds have provided an excellent hedge for investors against any possible or perceived weakness in the equity market � such as the collapse of Lehman Bros and the sub-prime crisis which followed. Now, however, shares are in a raging [glossary_exclude]bull trend[/glossary_exclude] and interest rates have bottomed out and are beginning to climb. This has led some analysts to say that the 35-year old [glossary_exclude]bull trend[/glossary_exclude] in bonds in finally over (Bill Gross). Indeed, something had to give, because stocks and bonds have been rising together for the last few years � mainly because of the unprecedented quantitative easing undertaken by America and other countries. Now, as interest rates begin to rise, bonds appear less attractive, shares are still rising and the situation is normalising.

Commodities

ZINC

The Zinc price has doubled in the last two years from under $1500 a ton at the start of 2016 to $3445. Consider the chart:

Zinc is mainly used as a galvanising agent to make steel rust-proof � so the rising demand, especially from China, reflects the current growth in the world economy. We expect this trend to continue. The only option for South African investors is the newly listed Orion Minerals which plans to re-open the Prieska copper and zinc mine. Vendanta is a much larger player in the South African zinc market, but it is not listed on the JSE. In any event, the rising price of zinc is indicative of a general revival in commodity prices as the world economy moves into top gear and that will definitely benefit South Africa.

LITHIUM

With the current technology, lithium is important because it is one of the key components of modern batteries. As more and more activities rely on battery power, the demand for litium is bound to grow. This is especially true considering the move to electric motor vehicles which is gaining momentum all over the world. Tawana resources is a mining company that produces spodumene concentrate and tantalum pentoxide at it�s newly commissioned mine in Bald Hill, Western Australia. Both these items are key components of batteries. The share is listed on the Sydney stock exchange and on the JSE. Looking at the chart, Tawana has more than doubled in price over the past five months and is showing strong volumes traded. There are other possible technologies which could replace lithium in batteries. For example, recent research has developed a method where iron might replace cobalt in batteries. This approach suggests that a cheaper and longer-lasting battery could be produced this way. The main point is that soon mass-produced battery powered motor vehicles will be cheaper and have longer ranges than those using an internal combustion engine. This will spark a world-wide shift away from oil as the world�s main source of energy. As a private investor, you need to consider the many investment implications of this.

GOLD

The World Gold Council � which has the specific objective of stimulating demand for gold � predicts that the gold price has entered a [glossary_exclude]bull[/glossary_exclude] trend. They base this idea on four factors:

- The recovery of the world economy.

- The increased access to the gold market through ETFs which are tradable online.

- The weakness of the US dollar.

- Over-heated equity markets

According to the council, these factors are making gold a more attractive hedge investment . If we look at the chart (below) we see that gold has been through a cyclical low which bottomed in mid-December 2015. Any significant and sustained break above the cycle high of $1366 made on 6/7/2016 would signal a resumption of the [glossary_exclude]bull[/glossary_exclude] trend. Right now the metal is hovering around $1360 � so this is a distinct possibility.

A metals consultancy in London, GFMS, says the world�s average cost of extracting one ounce of gold is $885 and that South Africa is by far the most expensive producer at $1184 � and up $58 from the previous year. The next most expensive producer is South America at $866. These facts show that the South African gold mining industry is dying � quickly. Aside from the crazy efforts of Minister Zwane to destroy the mining industry in the country, the simple economics of mining gold �have made this inevitable.

COAL

Coal now generates more foreign currency for South Africa than gold. Exported through the world�s 3rd largest coal port, it is mostly sent to Asia (over 80%) with India as the biggest buyer. Richards Bay reached a record with 76,5m tons exported. This was largely due to Transnet�s increased capacity which now allows more than 25 trains a day to deliver coal. We expect another record for Richards Bay this year on the back of further improvements in the Transnet system. The rise in coal prices is being stimulated by the general recovery in the world economy and especially in India.

Companies

VICEROY

Viceroy is an American company that specialises in making money by shorting large listed companies � and then publishing a report which exposes their �accounting irregularities�. The company is run by John Perring and he has two young Australian business associates who assist him with the research. The Viceroy report on Steinhof, which was released the day after the then CEO of Steinhof, Marcus Jooste, resigned, is said to be extremely detailed, well-researched and professional. The point is that all of the information obtained by Viceroy for this report was in the public domain � so theoretically any investor could have come to the same conclusions. What Viceroy did was fundamental analysis of the information available to them in the public domain - and they came to the conclusion that Steinhof was in a very shaky position. What is interesting, however, is that its share price began to fall a long time ago, in August 2016 � well before the Viceroy report or any other negative revelations. Viceroy said it had another report on a South African listed company and several shares (Aspen, Nepi Rockcastle and� Resilient) have taken a pounding in anticipation. But in the end the share turned out to be Capitec.

CAPITEC (CPI)

The second Viceroy report on Capitec Bank appears to be something of a miscalculation. There is nothing much wrong with Capitec. It is extremely well-managed, strongly capitalised and has its parent company, PSG, and the South African Reserve Bank to [glossary_exclude]support[/glossary_exclude] it. So the extraordinary events of 26th, 29th and 30th January provide an excellent lesson for private investors. Of course, following the Viceroy revelations about Steinhof, investors were feeling very sensitive about anything that Viceroy did and so when their report on Capitec came out investors ran for the hills. This caused the share price to collapse from over R1000 to about R700. The CEO of Capitec was not slow to say that he disagreed with the Viceroy position � and he certainly didn�t resign like Marcus Jooste did at Steinhof. On the contrary, he bought R1,5m worth of Capitec at the lower prices to show his confidence. No doubt it will take a few months for Capitec to completely dispel the negativity that came with the Viceroy report � and in the meantime, we regard it as good value at any price below R900.

STEINHOF (SNH)

The big story at the end of 2017 was the sudden and unexpected collapse of Steinhof. Of course, as pointed out above, prior to the sudden collapse from R55, the share had been falling steadily, affording everyone the opportunity to get out on their stop-loss strategy. The Christo Wiese flagship, in which he personally was a major shareholder, appears to have been involved in some �accounting irregularities� � a euphemism for fraud. Marcus Jooste, who recently resigned as CEO, seems to be at the heart of these �irregularities� but so far no details have emerged. Wiese himself has taken charge in an effort to re-establish investor confidence � and undoubtedly the truth will come out over the next few months. As a private investor it is almost impossible to find out exactly what is going on � and, clearly, many institutional investors are also in the dark. The share has fallen about 90% in one month � but it does seem to be finding some stability at around 465c. The question is, �Should you take the risk of buying in?� Your problem is that the full extent of the accounting irregularities cannot be known yet. Can you take the chance that, say, half of their NAV of R57 is still there? It is very difficult to know, but in our view it is unlikely that Steinhof will fall much further than the 465c floor and you always have your stop-loss strategy to fall back on.

EOH (EOH)

Another startling collapse of a blue chip share, similar to Steinhof, was EOH. Both these highly regarded shares had been falling for some time and then experienced a sudden collapse. Consider the chart:

EOH made a very convincing �double top� with peaks at R178 on 6th August 2015 and then at R175 or 3rd October 2016. The failure in October 2016 to break above the previous high of the year before was a fatal sign. The resignation of long-time CEO Asher Bohbot in June 2017 came well after the ominous double top and obviously, anyone using a stop-loss strategy would have been well clear of the share by then. The share fell steadily, breaking below its January 2016 low of R125 in July 2017 (a sure signal for anyone watching the chart). But none of this would have prepared us for the drop from R80 to as low as R26.55 four days later. Apparently there are questions about how EOH has been able to land profitable government contracts (which is now being investigated by the Independent Police Investigative Directorate). The share has recovered to around R67 � but technically the chart does not look at all convincing. We recommend that you stay well clear of this share until everything is out in the open.

DISCHEM (DCP)

The decision by the major shareholders of Dischem to sell off 32 million shares at R35 each came as a shock to the market and was incorrectly stated in many newspapers (e.g. The Business Day) that Dischem had raised R1,1bn in capital. The reality is that three major shareholders � Saltzman, Goetsch and Hegarty sold these shares and so the money went to them � not to Dischem. In other words, they reduced their holdings - which was probably a smart move for them since Saltzman still controls the company with a 52,7% stake � and now he has a cash pile of around R1bn as well. It is not uncommon for families which have built up a business over many years to want to reduce their risk and exposure once the company is listed. But this sale had nothing to do with the company itself and the company did not get the money. The market reacted negatively probably because the leading shareholders were reducing their stake � however, we remain very positive about this share because of its undoubted growth potential.

CLICKS (CLS)

The Clicks results for the 20 weeks to January 2018 were impressive. The company was boosted by strong Christmas sales and its �3 for 2� promotions. It is aggressively expanding its number of stores with the goal of reaching 900 stores in total. In the retail sector, there can be little doubt that Clicks (and to a lesser extent Dischem) are the best performers. We expect this strong growth to continue and even improve as the SA economy begins to respond to new optimism following the election of Cyril Ramaphosa as head of the ANC and his much anticipated assumption of the presidency. The clicks chart shows a rising [glossary_exclude]bull[/glossary_exclude] trend, and although the share is fully priced we expect it to continue to perform.

AEEI and AYO

AEEI spun off and separately listed AYO in December last year. It was AEEI�s second listing (first was Premfish) and apparently there are more to come. In any event, AEEI has been one of the most exciting investments on the JSE, rising over 85% in the three months since it was listed. The listing of AYO raised R4,3bn which is now ear-marked for acquisitions, especially in the IT sector. AYO offers prospective companies an instant high-level BEE status. AYO will own AEEI�s 30% of British Telecoms SA � which is valued at R1bn. The company expects to be well-positioned to benefit from the government�s proposed National Health Insurance scheme since it already has the necessary hospital systems. We expect both these shares (AYO and AEEI) to continue performing well, especially if there are more spin-off listings.

WOOLIES (WHL)

The downtrend in the Woolworths share price since early November 2015 is characterised by a trendline connecting the top with the significant cycle high in August 2016. Extending this trendline shows that the current rally, significant as it is, does not break that downward trend. Woolworths is battling to make its Australian operations (David Jones and Country Road) profitable. At the same time it has suffered locally in its clothing division against stiff competition and a general depression among consumers. In our view, however, Ian Moir is a very experienced and talented businessman. In all likelihood he will manage to extract the company from its current woes. If the economy turns (as it is showing signs of doing) and the share breaks up through that trendline, it could be one of the better blue chip offerings on the JSE.

SHOPRITE (SHP)

The results which Shoprite reported for the six months to end December 2017 were instructive. The group produced a 6,3% increase in turnover, most of which came from its South African operations. The rest of Africa was flat, mainly, they say, because of relatively poor commodity prices. What was interesting is that their house and home division suddenly showed a 10,8% improvement � mainly because of OK Bazaars. The picture is one where the SA ecomony appears to be recovering while the rest of Africa languishes. It must be remembered that this growth comes on top of the 14% rise in turnover which they reported in the previous comparable period. Technically, the share is on a strong growth path and making new record highs, as can be seen from the underlying trendline:

LEWIS (LEW)

The Lewis share price has been falling since June 2015. It is a furniture retailer which concentrates mostly on the lower [glossary_exclude]income[/glossary_exclude] groups. It has come in for some serious criticism for its dubious policies regarding the back-end sale of insurance and other practices. It has also suffered from the tightening of credit rules and the drop in consumer spending in South Africa. It also operates in Botswana, Lesotho and Swaziland. Its recent results for the quarter to end December 2017 showed a marked improvement in certain areas � especially in debtor costs. Turnover was slightly up. The point is that if the SA economy is beginning to improve, then Lewis is one of the companies that will benefit the most. Its share price is about half of its net asset value (NAV) and it pays very good dividends with a dividend yield of just over 5%. We think it may represent an opportunity.

SASOL (SOL)

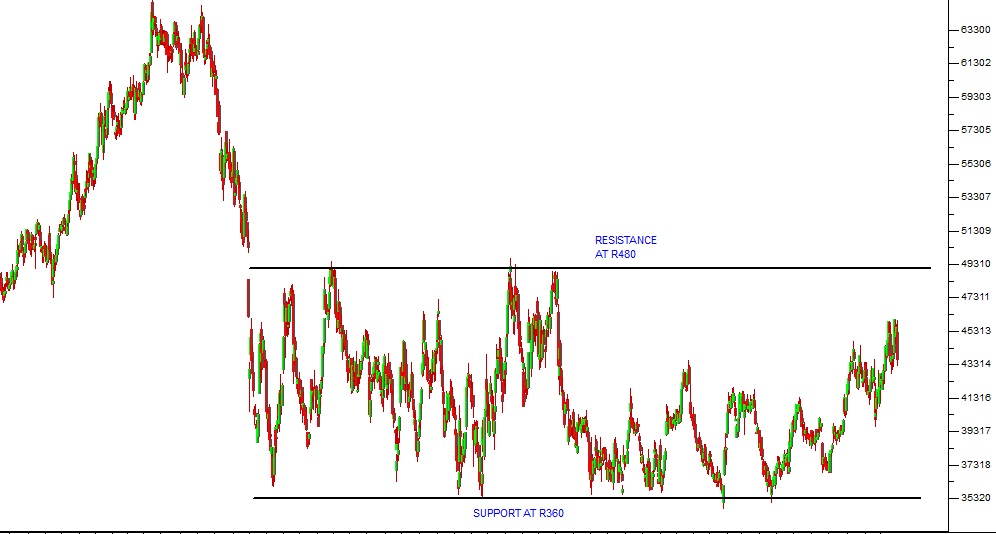

If you want to benefit from Donald Trump�s tax reforms in America, one way to do it is to buy Sasol shares. Sasol has been building an ethane cracker plant in Louisiana. That plant is now 81% complete and is expected to significantly increase Sasol�s profits from 2019 and 2020. It will also benefit directly from the reductions in tax passed by Donald Trump. In the meantime, Sasol is about 60% oil and about 40% chemicals. The oil price has ticked up quite nicely and is toying with the $70 per barrel level � mostly because of the rapid recovery of the world economy. At the same time, however, the rand has been strengthening since the advent of Cyril Ramaphosa � a trend which many expect to continue. These two opposing forces are influencing the Sasol share pirce. Consider the chart:

Here you can see that since the collapse of the oil price in the second half of 2014, the Sasol share price has been moving sideways between a support line at around R360 per share and strong resistance at about R480. Recently, with the stronger oil price, it has been trending up towards that resistance line. Technical wisdom says that if it breaks that convincingly, then there should be very good upside potential. Book for next webinar.

← Back to Articles