The Coming Blow-off

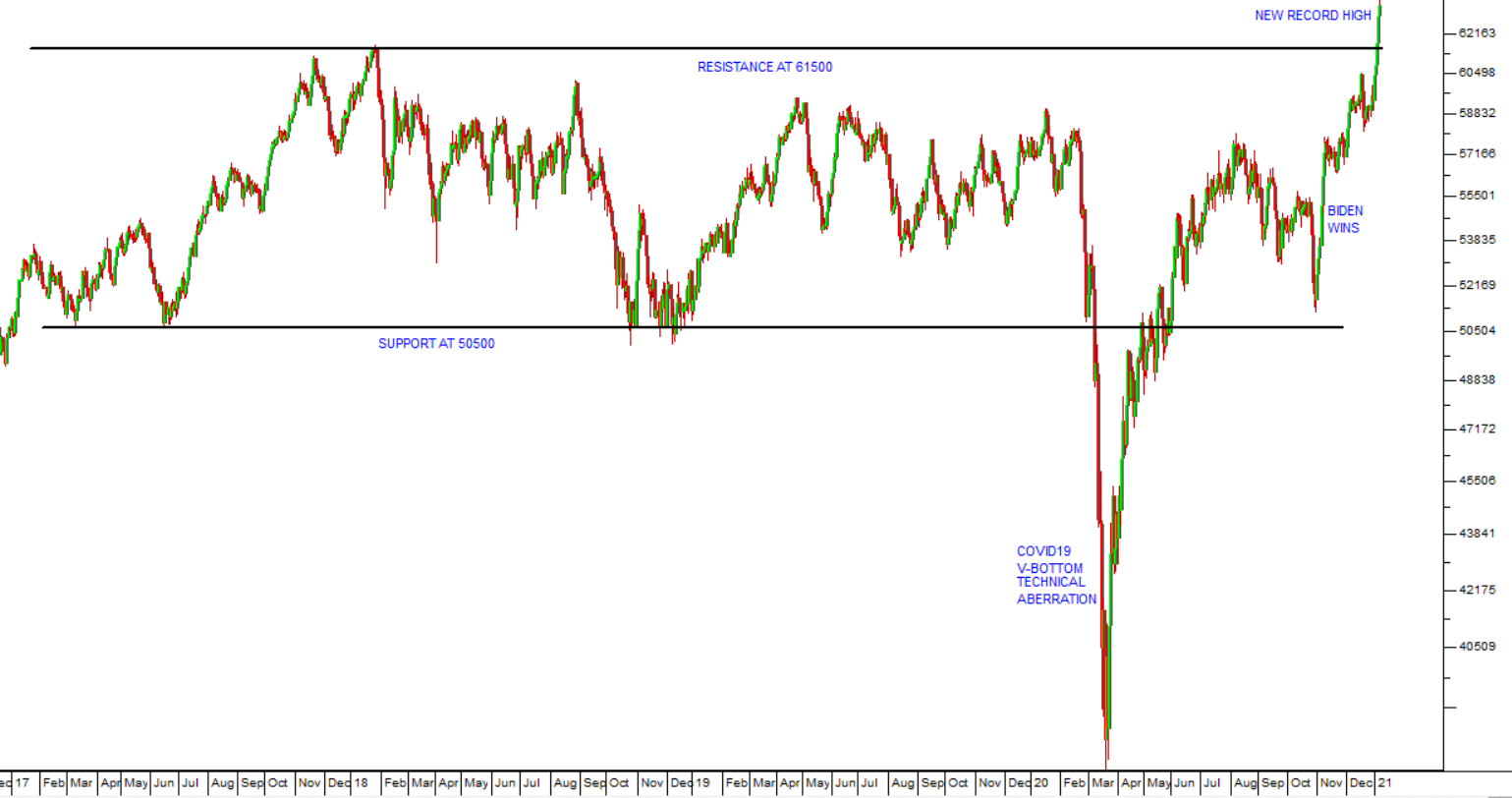

At the start of 2021, it is as well to stand back and consider the context of where world markets are as they slavishly follow Wall Street up to new record highs. Consider the 12-year chart of the S&P500:

The chart shows that the great bull market which began in March 2009 is on-going. It is moving within a clearly defined channel. The upper channel line is established by no less than 8 touch points (marked with the red arrows) - and the lower channel line is exactly parallel to it. What is interesting is that this lower parallel channel line precisely connects the initial low of March 2009 with the COVID-19 low of March 2020. This is not just a coincidence, but a strong confirmation of the validity of channel lines as a method of analysis.

Fundamentally, the strong upward trend is being driven by Biden’s clear win, both of the presidential election and now of control over the US senate. This clears the way for further massive stimulation of the US economy and share prices are eagerly anticipating this.

The bulls have taken heart from the fact that the market has, once again, made a startling recovery. If you consider the COVID-19 downtrend as a technical aberration, rather than a bear trend (which is our position), then this bull market is now almost 12 years old – an all-time record by some distance. The bears have been consummately beaten into submission.

Alan Greenspan’s 1987 innovation of pumping cash into the economy every time there was the possibility of a severe downward trend has established a pattern which now dictates economic policy. It has become politically impossible for the US Government (either Democrat or Republican) to countenance a recession. Every time one threatens, monetary policy stimulation supported by lavish quantitative easing (Q/E) becomes the order of the day. There can be little doubt that the new Biden administration will conform to what has become the unwritten economic policy norm.

This, of course, makes a huge bubble in shares not only possible, but virtual certainty. For many years now we have been predicting an unprecedented blow-off in equity prices based on the excessive printing of money in the world economy. As the bulls gain confidence, the bears retreat into obscurity and investors begin to believe that recessions and bear trends have been eliminated by new and ingenious economic policies.

The JSE Overall index, despite the parlous local economic conditions and the overwhelming second wave of the pandemic, has now also made a new record high:

It has been well said that, for the next Kondratiev wave to occur, investors must first forget about Kondratiev. In 1987, after the crash, everyone was talking about the Kondratiev wave. Today, 33 years later, nobody even knows who Kondratiev was.

← Back to Articles