Speculative Opportunity

26 August 2024 By PDSNETPDSnet is mainly concerned with teaching private investors about investment and medium to long-term opportunities on the JSE. The foundation of this approach is that South African tax law treats any gain on a share held for longer than 3 years as a capital gain. In other words, holding a share for more than 3 years means that the investor will not be treated as a share-dealer for tax purposes.

This is important because a capital gain in the hands of a private investor is taxed at an effective rate of 18% whereas if the investor is declared a share-dealer then any capital gain is added to their taxable income – and could result in them paying as much as 45% of capital gains in tax.

For this reason, when considering an investment, the private investor should always ask the question, “Where do I expect this company to be in 3 years’ time?”

On the 16th of May 2024, we added Kore (KP2) to the Winning Shares List (WSL) at 20c per share. Kore is an extremely speculative mining development operation in the Republic of the Congo (ROC). Kore owns the rights to two potash deposits. It is in the process of raising the funds necessary to bring the mine into production.

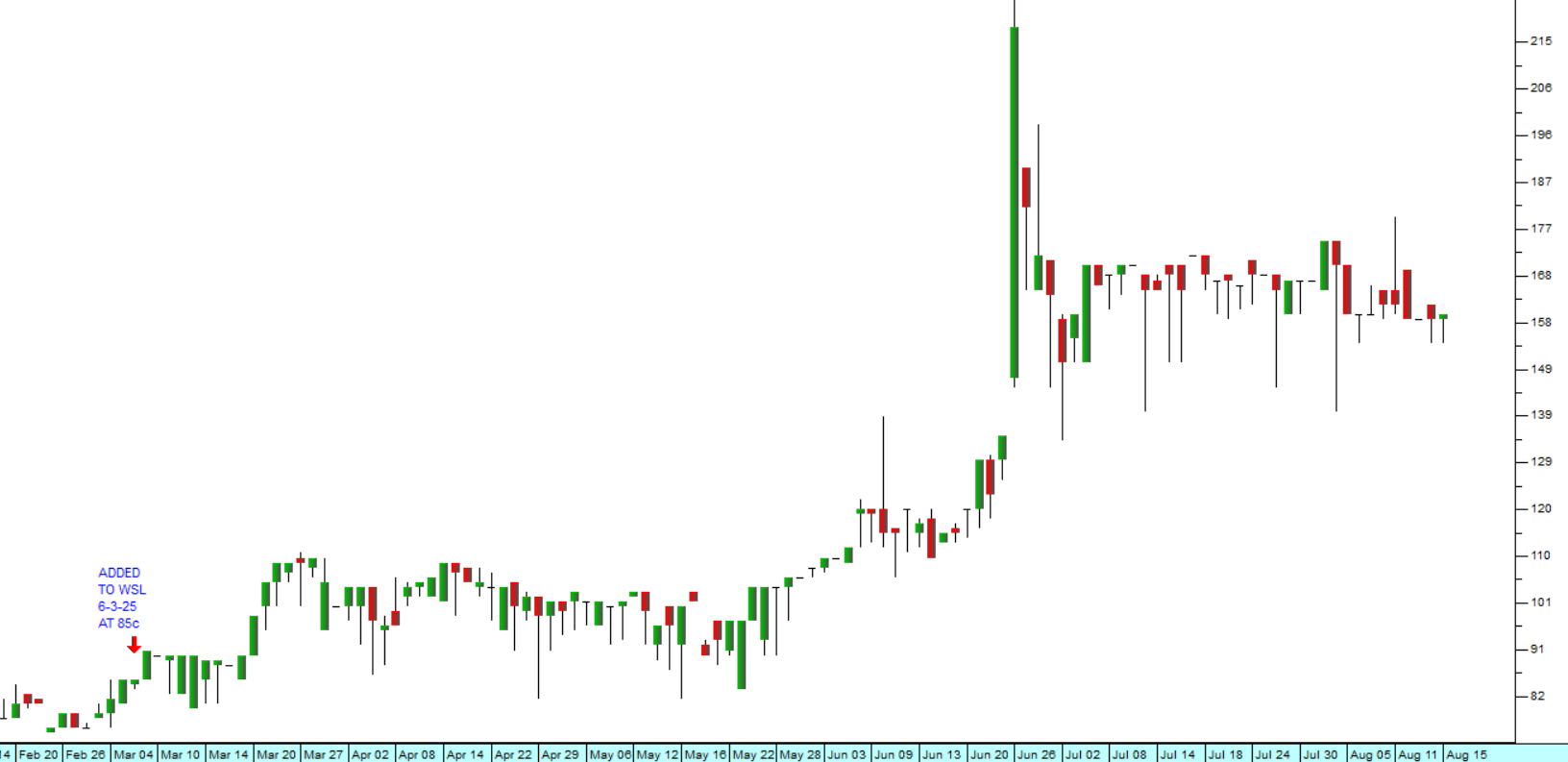

Our reason for adding Kore to the WSL was a clear on-balance-volume (OBV) buy signal based on a massive spike in volumes traded combined with a 5c jump in the share’s price. This is a clear indication that insiders are buying up all available loosely held shares in the market in anticipation of a major capital gain. Since then, the share price, while volatile, has doubled. Consider the chart:

The chart shows that until mid-May 2024 the share was trading for around 15c on very thin volumes – typical of a highly speculative mining exploration company with assets in an African country known for its political instability.

Without knowing the details of the company’s prospects, the price and volume action of the share showed clearly that its prospects had suddenly improved dramatically. Now, three months later, the share has held on to its price gain and may be about to rise further. On Friday last week, the company held a general meeting at which it was agreed that they sell 4,3m shares to the Chairman of the company, David Hathorn, for $60 000. This brings his shareholding to a total of 373,1m shares or 8,57% of the total issued share capital.

It is difficult for us to independently assess the viability or the risks of a mining exploration investment like Kore. There are many ways that it could go wrong, but when the Chairman of the Board of Directors is buying more shares to add to his already large holding, there is reason to believe that the prospects of the business are probably very good.

Volumes traded have dropped off, but the share remains well-traded at around 50c and appears to be entering a new upward trend. Based purely on what we know about it and its market action, we consider it to be a worthwhile speculative opportunity.

Obviously, with a potentially volatile and speculative investment like this it is very important to establish and maintain a strict stop-loss strategy.

I am reminded of a line that I used to use in my younger years: “If you never take any risks in life, nothing exciting will ever happen to you!”

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: