Recovery

15 April 2020 By PDSNETIn our article ("Bear Trend") on 13th March 2020 we said, "this bear trend is likely to be relatively short and sharp. Investors will begin to see that the virus has or is running its course in first world countries and, at some point in the next few months, they will re-enter the market as aggressive bargain-hunters. So, our expectation is that we will see a "V-bottom" in the chart".

Normal bear trends, which are based on the cycle of debt and repayment outlined in our article of 13th March 2020, are usually broken by a rally (or "dead cat bounce") of, at most, 50% on their way down. This is the "B" move of the typical "A-B-C" bear trend. Once the "B" move rally is over, then markets usually collapse towards a point of "capitulation". But that is in a normal economically-based bear trend. But as we have indicated, this is not a normal bear trend and is likely to follow investor perceptions of the virus's progress rather than the normal pattern.

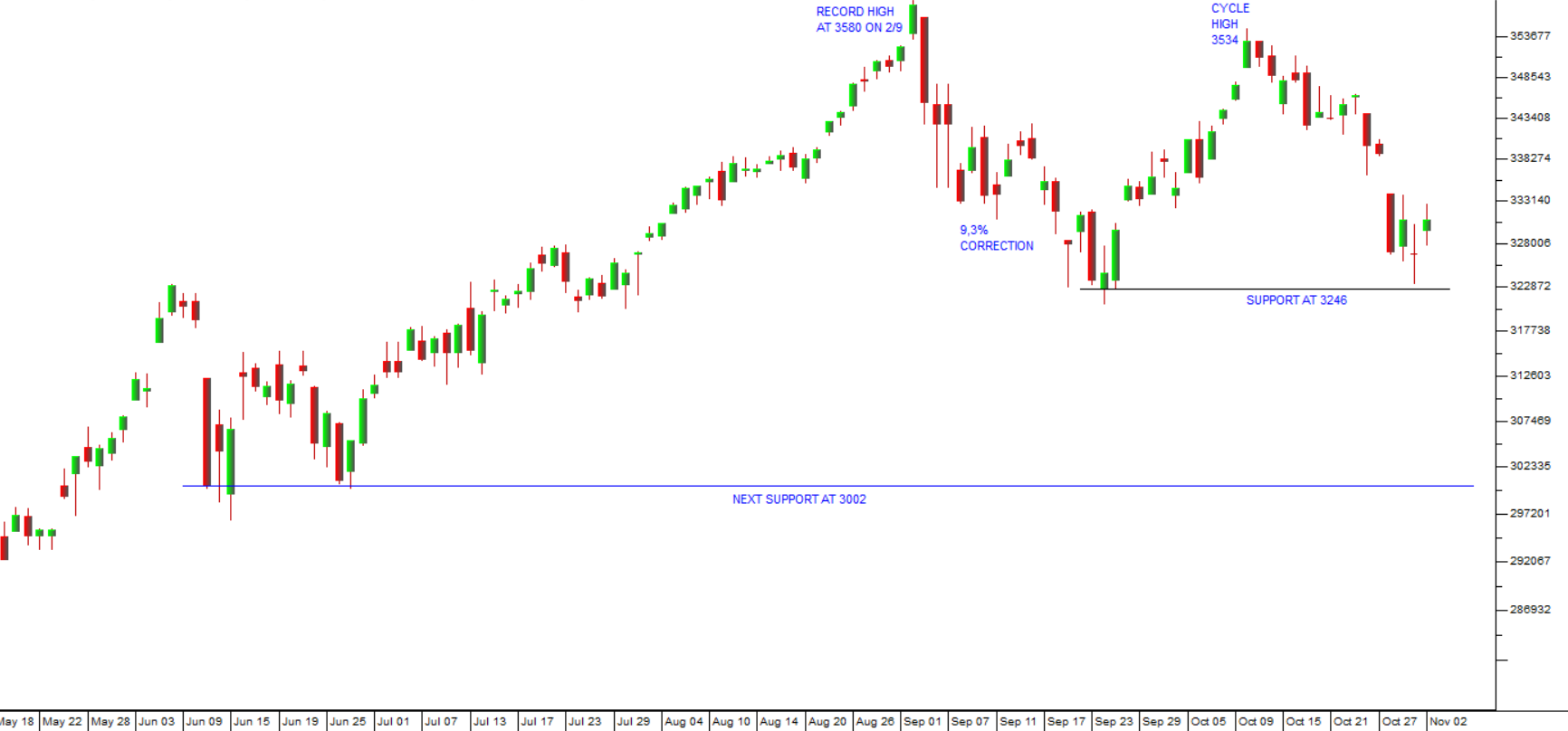

Consider the chart:

Last night, the S&P gained another 3% to reach 2846. This means that it has recovered 609 points or 53% of the 1149 points that it lost in the bear trend. This is slightly beyond the normal size of a large "B" rally in a normal bear trend. We would say that by the time this move reaches two-thirds of the 1149-point fall, which happens at an S&P level of 3000, you can be 80% certain that the bear trend is over and a new record high is on its way. The recovery is about 5% away from that point now and, as it approaches that point, the probability of a further fall diminishes in proportion.

The reason for last night's 3% gain on the S&P was a growing perception based on comments by the New York mayor, Andrew Cuomo, over the Easter weekend that the "worst was over". He based this on the fact that the trend in hospitalisations had "turned negative" in the state. New York has been the worst hit state in America, but the news that it may be on the mend has added to other news around the world to give investors confidence that this virus may be a relatively short-lived phenomenon.

The stock market always anticipates what will happen in the economy, especially the US economy - by between 9 and 18 months. So, you need to think about where the US is likely to be in, say February/March next year. In our view (and clearly the view of many "smart investors" in the US), the US economy will, by then, be well on the road to recovery. That explains the upward move in the S&P500 over the last three weeks (14 trading days).

Given the enormous fiscal and monetary stimulation that is being applied to the US economy now, it is reasonable to assume that the economy recovery will be dramatic and commence early next year at the latest. The 3% jump in stocks last night was driven by an amazing 4% rise in Amazon which reached a new all-time record high.

Of course, the JSE, like other world markets is slavishly following Wall Street up - despite all the doom-and-gloom about the South African economy. As a private investor you need to consider exactly when you will get back into blue chip shares. Banks, for example, look extremely cheap with an average dividend yield of 8,36%.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: