Rand Weakness

20 February 2023 By PDSNETThe progress of the rand against the US dollar over the past month has, in our view, been a function of:

- The electricity crisis in South Africa.

- An expected shift to risk-off as sentiment turns negative on Wall Street.

Much has been said about electricity in South Africa this year, especially following the President’s state of the nation (SONA) speech on the 9th of February 2023. The state of disaster is looking more and more like a last minute and desperate effort to fix Eskom, a problem which has been on-going since 2008, mixed in with much talk about enabling and encouraging private electricity generation. Most commentators do not hold out much hope of fixing Eskom – but the shift to private generation now appears to be inexorable.

The simple fact is that Eskom has become just another collapsing state-owned enterprise (SOE) which is riddled with corruption and incompetence, very similar to The Post Office, Denel, SAA, and others - only on a much larger scale. In fact, the progress of the “New South Africa” since 1994 can be seen as one of business stepping in to provide services which were previously supplied by government. Other examples include the education, healthcare and policing functions – all of which seen government administration fail to a greater or lesser extent. Some of these have spawned highly successful listed entities like Curro or Discovery.

The economy has been and is still heavily dependent on Eskom, whereas alternative solutions have been readily and easily available for other government functions and SOE's. The latest round of loadshedding since late last year has seen a sea-change in business and consumer attitudes towards Eskom. Most electricity users have now finally realized that the supply from Eskom is not going to get better – rather it will continue to be unreliable and increasingly expensive. This realization has forced them to make other arrangements and this is resulting in a significant movement towards renewables.

In the first 5 months of last year the country imported R2,2bn worth of solar panels and the pace has been accelerating since then. In fact, the unexpected recent strength of the economy is partly attributable to a surge in solar power investment. More and more capital is being committed to various installations, both private and corporate. South Africa is rapidly moving away from coal as its primary source of energy. In the medium to long term that will result is a substantial drop in energy costs not to mention achieving its climate change commitments.

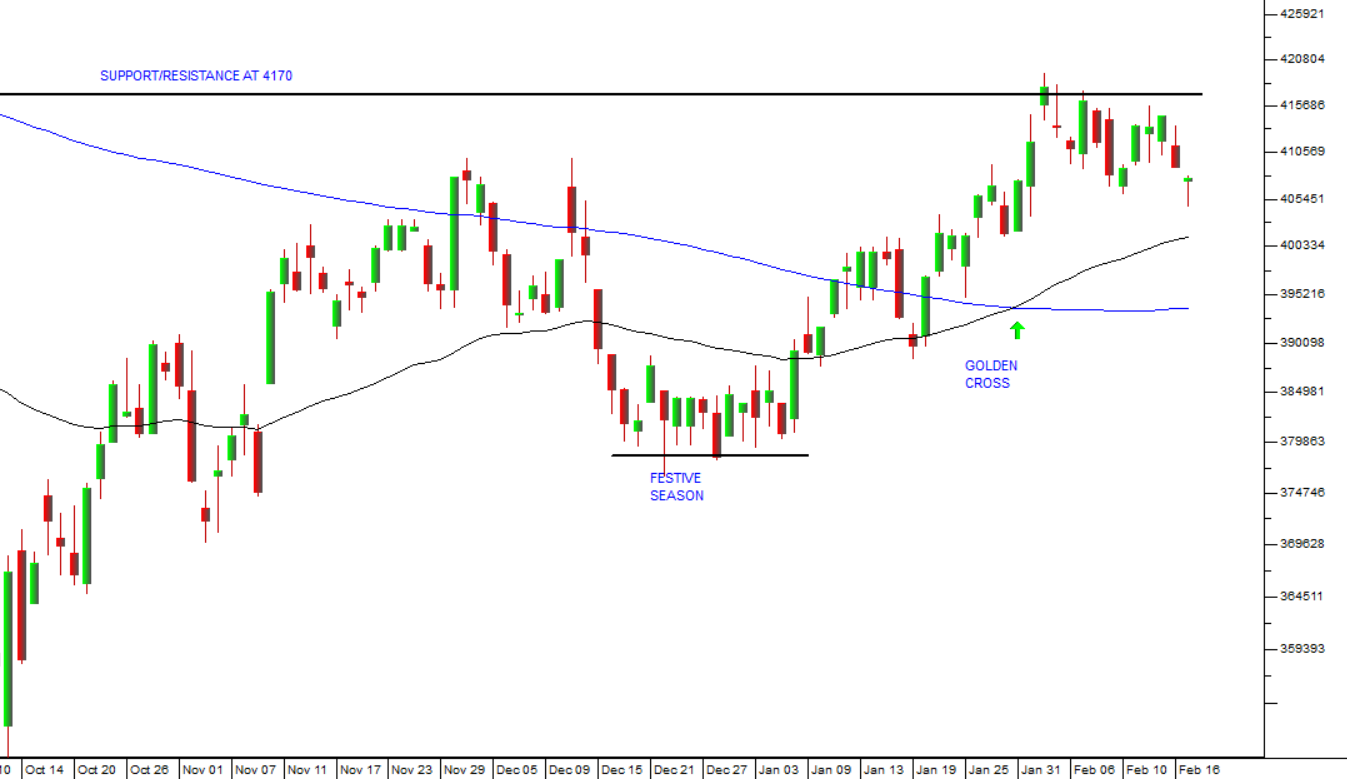

The second major factor in the rand’s current weakness is that Wall Street’s most recent burst of misplaced optimism appears to be running out of steam. Faced with the amazing jobs number for January 2023, followed by higher-than expected inflation figures and talk of a possible 50-basis point hike in rates at the March 2023 monetary policy committee (MPC) meeting, investors are finding it more and more difficult to sustain the idea that monetary policy has “pivoted”. The bears are once again gaining ascendancy and the 4170 resistance level on the S&P is looking more and more resistant. Consider the chart:

We have often drawn your attention to the fact that this bear trend began about 18 months too early – because of the impact which the Ukraine war had on the oil price. That has led to a residue of investor optimism which continues to characterize Wall Street. The US economy is showing no signs of slowing down anytime soon despite the rapid increase in interest rates. The seven months of declining inflation from its peak at 9,1% in June last year to 6,4% in January this year really reflect the drop in the oil price from over $120 to around $82 - rather than any fall-off in consumer spending or business activity.

So, we believe that the S&P500 index is going to fall now – and probably make a new lower low below the 3577 low made on 12th October 2022 – and that will undoubtedly be accompanied by a shift towards risk-off and a sell-off of emerging market currencies, especially the rand. Indeed, the rand appears to already be anticipating that change. Over the past month the rand has fallen from R16.80 to the US dollar to R18,05.

In our view, this weakness will continue until the impending correction on Wall Street is over and the electricity situation stabilizes. The much-vaunted “golden cross” buy signal of 31st January 2023 will in this case prove to be premature and a bull trap.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: