Rand Strength

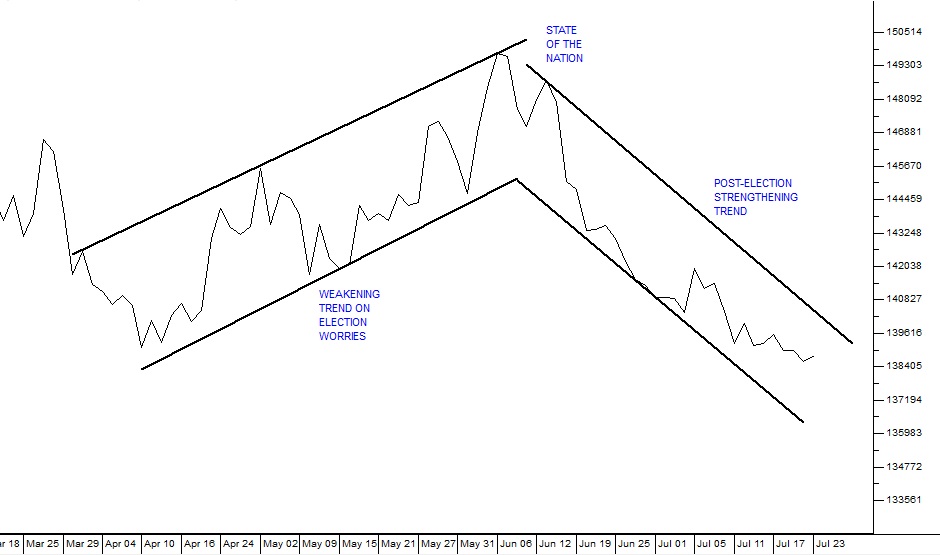

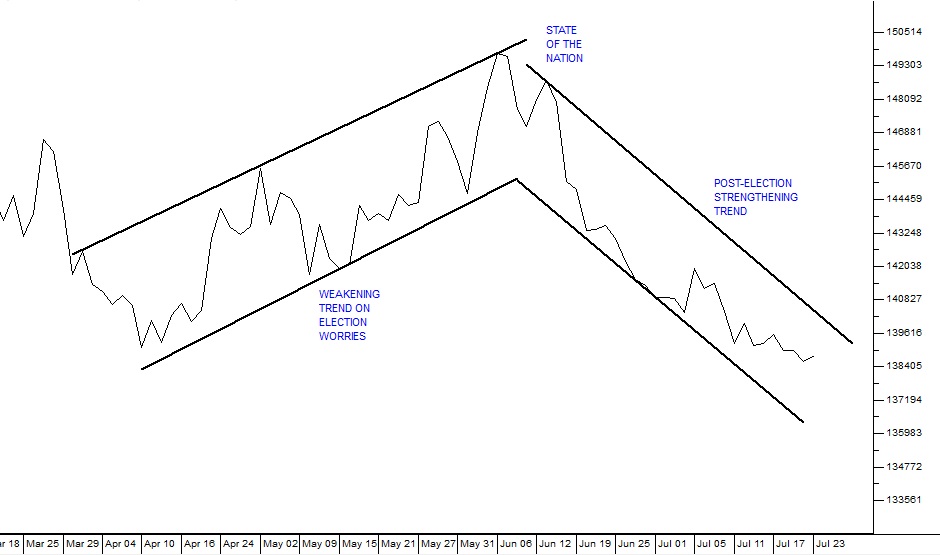

For most of June and July this year, the rand has been strengthening as international investors became more confident of the reforms which the Ramaphosa administration is implementing. It has, of course, been very volatile because it is buffeted by many factors which are outside South Africa – most notably the probable reduction of interest rates in the US and various developments in other emerging economies. But Ramaphosa’s decision to re-appoint Kanyago as Governor of the Reserve Bank and two long-serving insiders as his deputies has largely put to bed the fears surrounding that institution and the talk of quantitative easing. The rand responded positively, but now a new concern has arisen with RMB’s John Cairn’s saying that there is a high probability (47%) that the rand will fall by as much as 30% or more once the US begins a new cycle of reducing rates over the next year. Since the election result the rand remains in a strengthening trend:

Rand Dollar Exchange March to July 2019 - Chart by ShareFriend Pro

Our view is that the underlying US economy remains strong and that the current dovishness at the Fed is probably short-term. The fear that the US economy is topping out and about to enter a recession is, we believe, misplaced. We believe that sooner or later new data will emerge to show that the economic boom which is taking place there has simply paused to “catch its breath†and it will resume soon. Emerging economies are vulnerable to a slow down or recession in America because that would portend a world-wide reduction in the demand for the commodities which they produce. But we believe that there is very little chance of a recession in the US, especially in the run-up to the 2020 presidential election. In any event, the fact that the rand has not responded significantly to Cairn’s report shows that most investors do not agree with his prediction. So we expect the current (volatile) strengthening of the rand to continue for the foreseeable future. Perhaps the greatest internal threat to the rand is that the fixing of Eskom will inevitably bring the government into conflict with the unions sooner or later because retrenchments there are the only way forward. Eskom management itself acknowledges that about one third of their workforce is redundant. The unions are watching closely for any hint of retrenchments. The danger is that a protracted and violent stand-off ensues which disturbs the international perceptions of this country. Recently, a pattern of the unions backing down on their militant positions is beginning to emerge in South Africa – firstly, with AMCU’s climb down at Sibanye Gold and then with the very modest 4,5% settlement that NUM accepted in the motor industry. The current negotiations in the platinum industry also appear unlikely to result in protracted strike action. In any event, the stronger rand is good for the South African economy. It boosts confidence and brings the petrol price down.← Back to Articles