On Balance Volume

The On Balance Volume (OBV) indicator was developed by Joseph Granville in 1963, when he published his book “Granville’s New Key to Stock Market Profits”. Basically, Granville drew investors’ attention to the importance of the daily volume traded in a share. His motto was “volume leads price” – by which he meant that you will often see sharp rises in volume, accompanied by small increases in price just before the share price rises significantly.

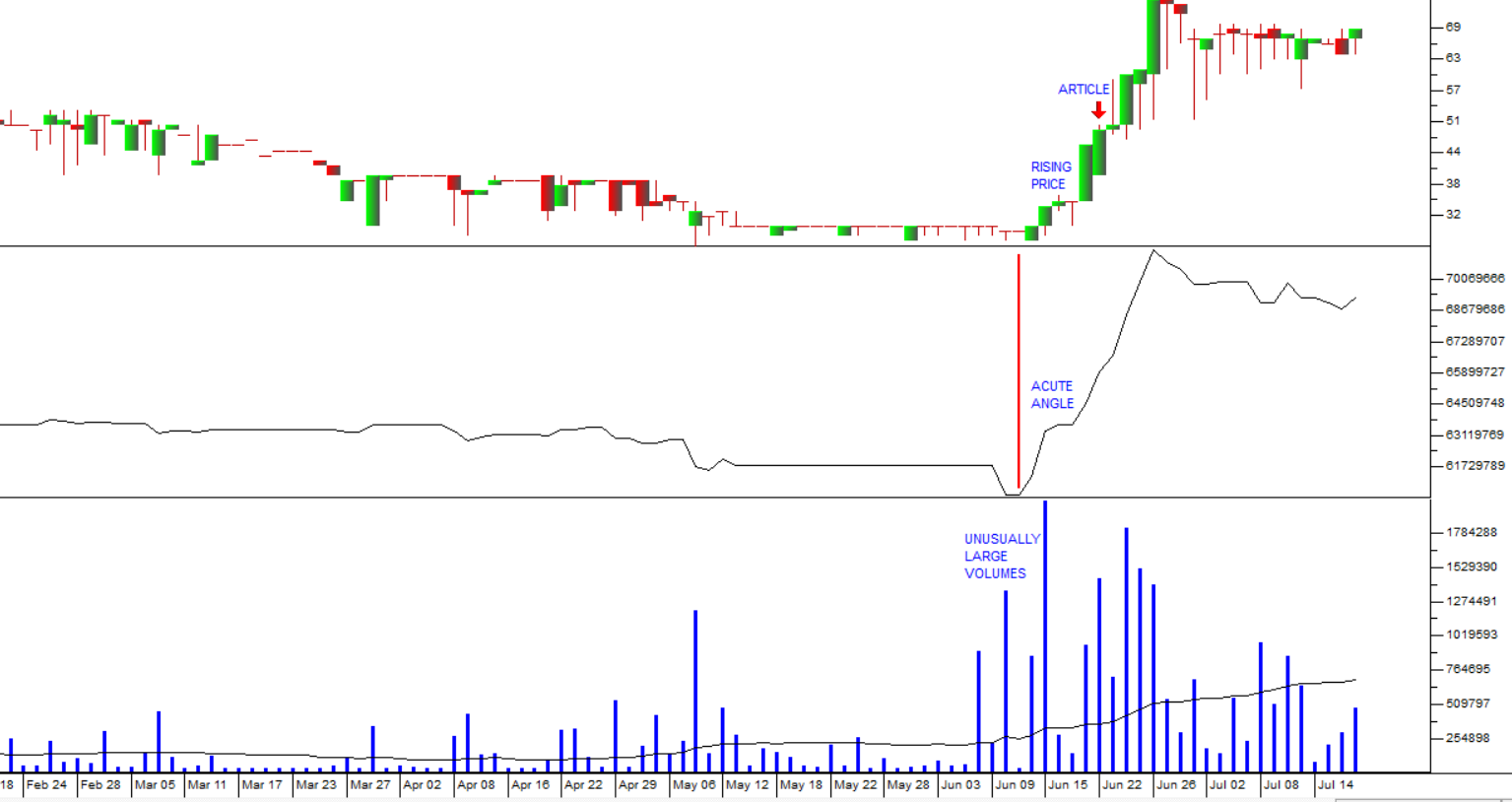

To exploit this, he developed the OBV. This technique is very simple from a mathematical point of view. You begin with an arbitrary number like 100 000 and the on days when the share’s price rises you add the volume and, on the days when it falls, you subtract the volume. Then you draw a chart of the result. Granville had to draw that chart by hand, but today your computer can do it automatically. What you are looking for is a sudden almost vertical rise on the OBV. Granville said it must go up at an “acute angle” to the vertical. Consider the chart of Labat, which we drew to your attention on 22nd June 2020:

The top chart shows a standard candlestick chart, the middle chart is the OBV and the bottom chart is a volume histogram. You can clearly see the acute angle to the vertical (the red line) made by the OBV in the middle chart and you can see that the cause is small increments in price accompanied by large increases in volume.

What you are looking at is insider trading. In every company there is a group of maybe six people who are very close to the action. They are usually directors or senior management and they know of important developments long before the rest of the investors. Inevitably, they will trade on that knowledge – usually indirectly through a third party so that they are not caught. Of course, this is illegal, but it goes on all the time.

The point is that it cannot be hidden from the technical analyst. It leaves a footprint in the chart. Prices begin to rise by small increments as the “strong hands” (the insiders) mop up all the shares they can lay their hands on and the “weak hands” let the shares go for a slightly better price because they have no idea what is about to happen. The result is a sharply rising OBV.

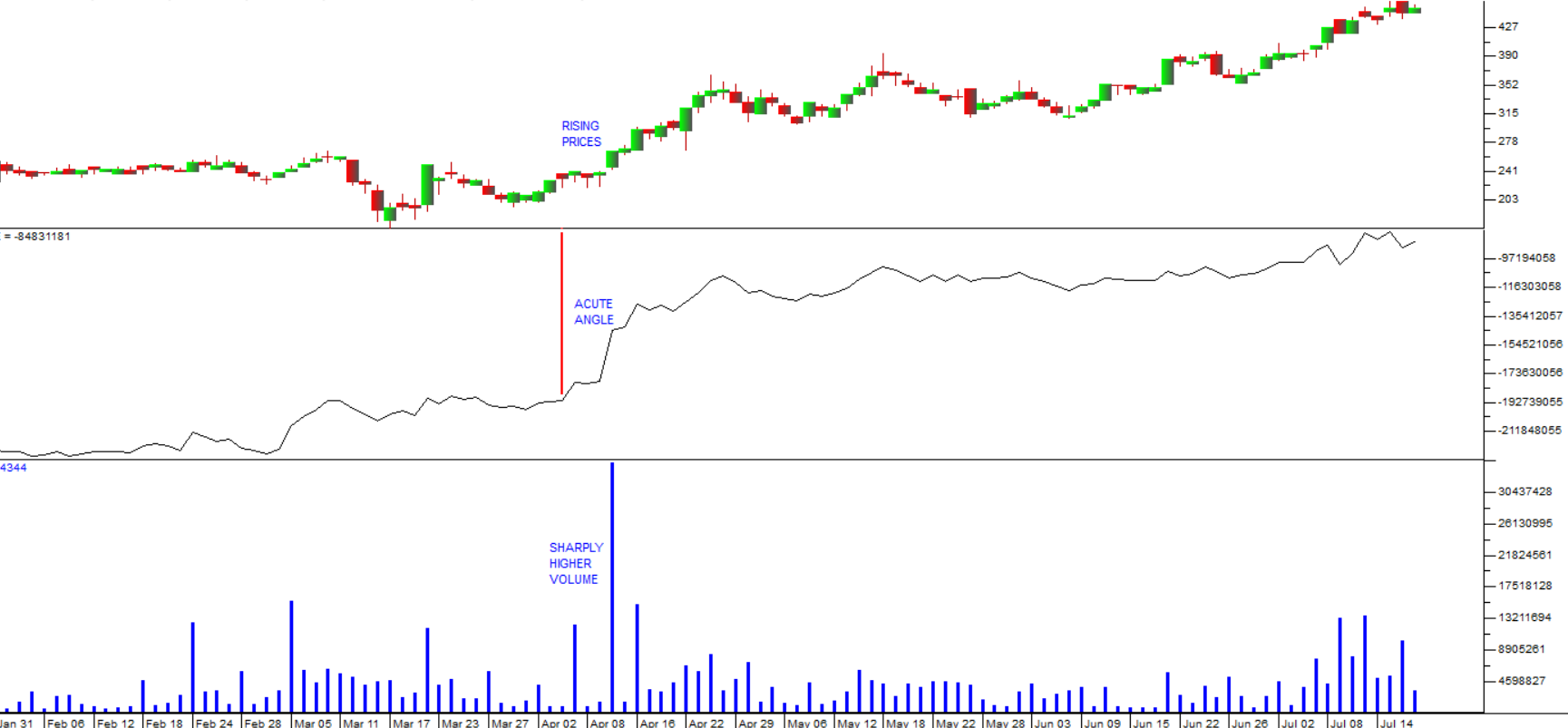

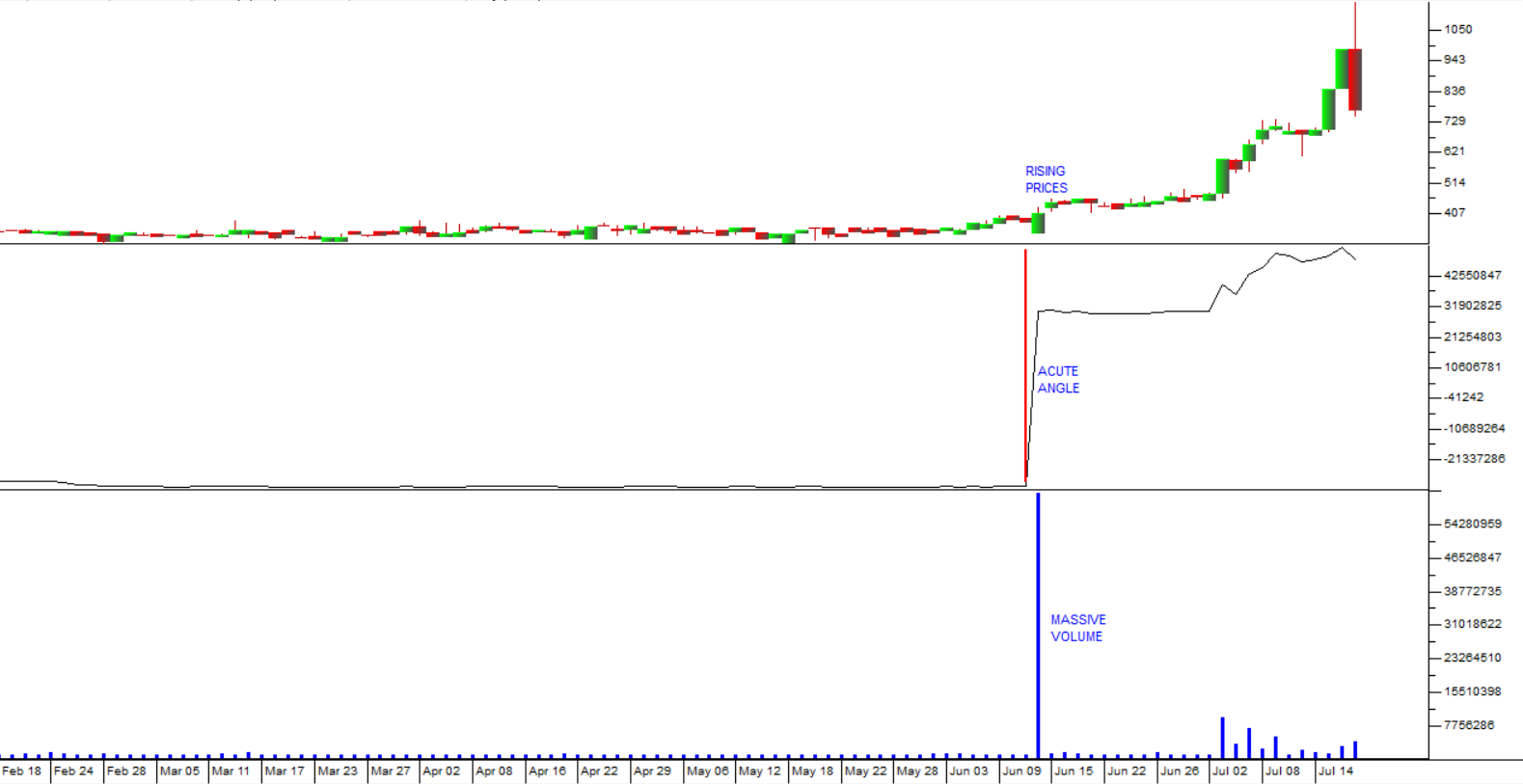

Here are two more recent examples:

This share is Pan African, and you can see here the same sort of pattern of rising prices accompanied by a large increase in volume leading to a sharp upward move in the OBV.

This share is Quantum. The same basic OBV pattern is visible here.

After giving the OBV signal, Labat went up by 114% in the next six trading days, Pan African went up by 70% over the next 3 months and Quantum went up by 120% in the next 23 trading days.

In all three cases the volume increase came after months of very low volumes and a price which was virtually flat or even falling. Without the OBV signal it would have been difficult to pick up what was happening.

← Back to Articles