NEPI Rockcastle

20 November 2023 By PDSNETReal estate investment trusts (REIT) offer an attractive investment opportunity for private investors at the moment. Many are trading below their net asset value (NAV) and those assets mostly consist of very secure properties which are independently valued.

NEPI Rockcastle is a REIT that specializes in owning and managing shopping centers in Central and Eastern Europe (CEE). This gives it the added advantage of being a rand-hedge.

As of 30th June 2023, the company owned 55 retail properties in CEE with a total value of 6,8bn euros. The business grows by developing and extending its existing retail properties while acquiring and developing new properties. The shares are listed on the JSE and on the Euronext in Amsterdam.

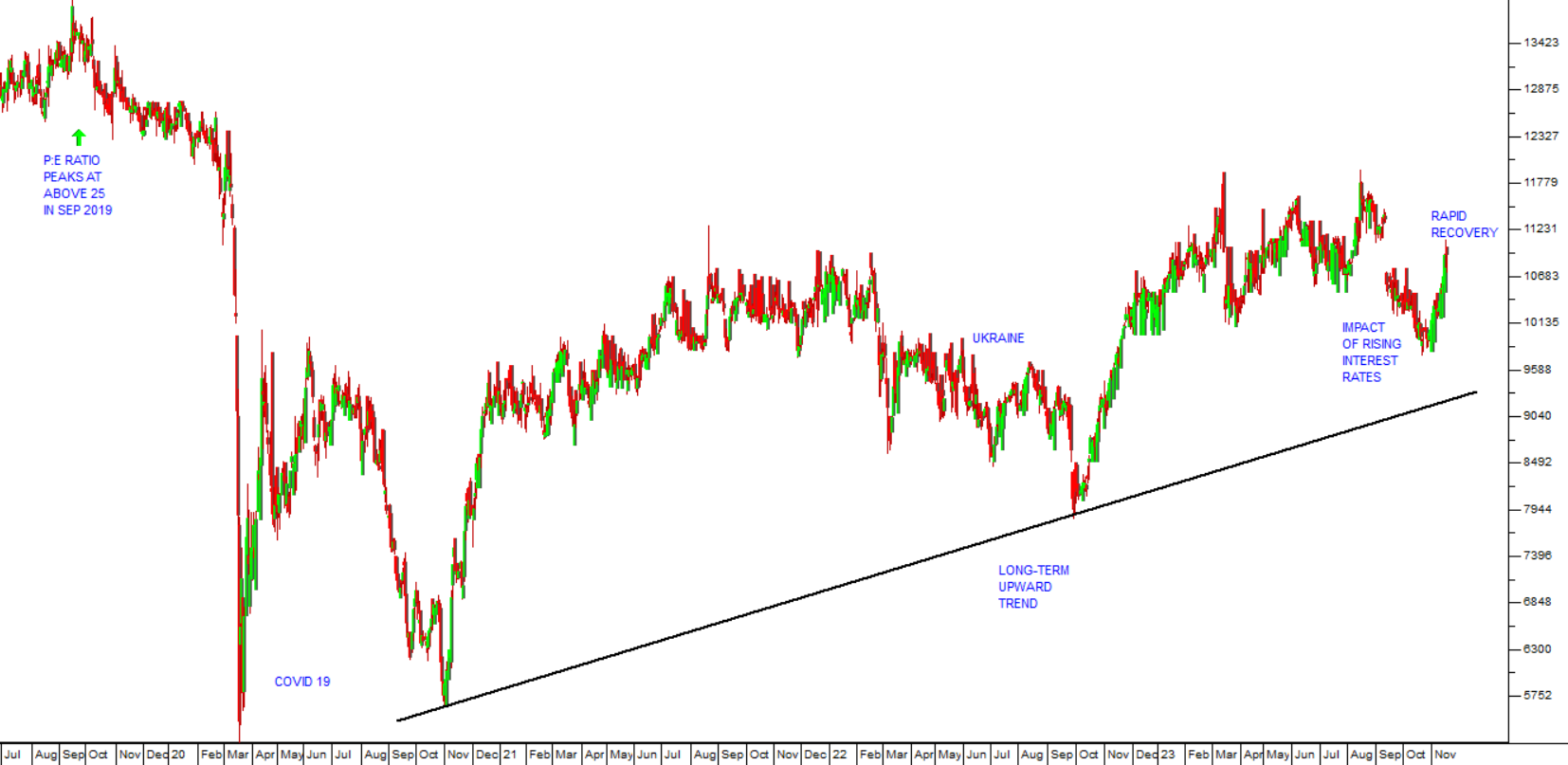

The company was heavily impacted by COVID-19 in March 2020, and was recovering well from that in February 2022 when the war in Ukraine began. Both events had a disproportionate negative impact on the share’s price as can be seen in the chart:

Recently, between the middle of August and the end of October 2023 the share felt the impact of rising interest rates and the correction on Wall Street. It is now recovering rapidly, but still looks very undervalued.

In a recent update for the nine months to 30th September 2023 the company reported that net operating income was up 23% over first 9 months of 2023. Tenant sales were up 14% driven by a 6% increase in like-for-like footfall combined with a 6% increase in average spend.

The company said, “Demand from both international and regional retailers for the Group's properties remained very strong resulting in retail vacancy falling to 2.2%. Rent collection rate for the period reached 97% by mid-November”. By offering a scrip dividend in the first half of 2023 which was 74% taken up, the company was able to improve its loan-to-value ratio (LTV) to 32,9%. In the 3rd quarter the company managed to sign up 348 new leases and lease renewals for a total of 64 600 square meters of space. International tenants like MacDonalds, Adidas, Flanco and Altex, Reserved, Gym+, Terranova, Ochnik and Nike accounted for about half of that.

As you can see, the share reached a price:earnings ratio of over 25 in September 2019 and now trades on a P:E of 9,96. This means that, while its business has made a substantial recovery to pre-COVID-19 levels, its share price has not – which makes it a great opportunity for private investors.

For the P:E to go back to 25 the share would have to rise by a further 250%. In our view, the risk is relatively low because of the company’s solid base of high-quality property assets.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: