Near Equities

An equity or ordinary share is one which shares in the risk and returns of a company. Most of the shares listed on the JSE are ordinary shares which rise and fall in price as the company’s potential profits (and hence the prospect for dividends) fluctuate. This is compared to other types of investments like redeemable preference shares and debentures which receive a fixed return and are insulated to some extent from the risk in the business.

Preference shares and debentures are thus designed to appeal to those investors who are more risk-averse, but there is another class of investment which is halfway between these two extremes. These are known as “near-equities” because in addition to their fixed return, they also “participate” in the ordinary dividends paid out by the company or they are “convertible” into ordinary shares at a specified date in the future.

Thus, for example, a participating preference share might receive a dividend of 8% of its par value and in addition receive one cent for every 10c which the company pays out in ordinary dividends.

Convertible preference shares or debentures are converted into ordinary shares at a specific future date – and as that date approaches, they tend to behave increasingly like the ordinary shares which they will become.

When companies issue and sell these various investment instruments, they are trying to appeal to a range of investors from those who want to be involved in the risk of the business and benefit from its success to those who prefer to get some sort of guarantee or security over the return that they are going to get.

A good recent example of a near-equity is the convertible debenture which has recently been issued by the mining conglomerate, Sibanye (SSW). To raise additional capital, Sibanye has sold $500m worth of convertible debentures which will get a return of between 4% and 4,5% per annum and then convert into ordinary shares on 28th November 2028 with a conversion premium of 32,5%.

For the next five years these bonds will get a fixed rate of return and then, when they convert, they will increase the company’s issued ordinary shares. The announcement of this issue caused the SSW share price to fall about 20% because it will ultimately result in a dilution of existing shareholders and some shareholders decided to sell their shares and buy the bonds because they offer the security of a fixed return during the next 5 years.

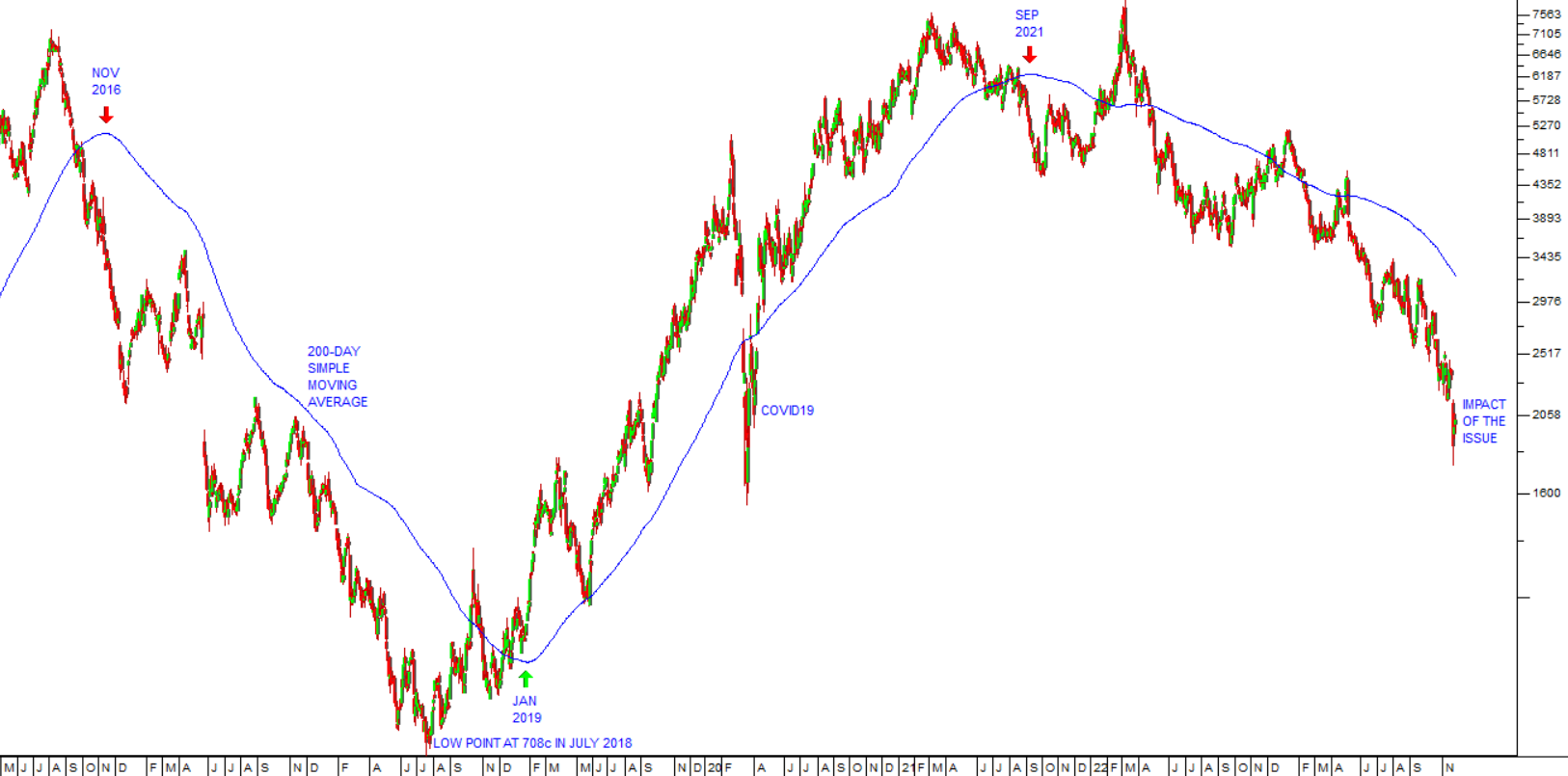

Consider the chart of Sibanye over the past 8 years:

Like all commodity shares, Sibanye is volatile, impacted by fluctuating platinum group metals (PGM) prices. It peaked on 4th August 2016 at R70 and eventually reached a low of 708c in July 2018. The subsequent upward trend lasted until February 2021 when it again peaked at around R70 before beginning a new downward trend.

You will notice that a good strategy is to use the points at which the 200-day moving average changes direction (indicated by the red and green arrows on the chart).

So, we suggest waiting for the 200-day moving average to turn up before investigating further.

Notably, Sibanye is not the only commodity share that is trying to raise capital in anticipation of a further fall in commodity prices. ARC Invest (AIL) announced a rights issue last week to raise R750m.

← Back to Articles