Mr Price Interims

9 December 2024 By PDSNETAlmost 6 months ago, on 17th June 2024, we wrote an article about Mr Price (MRP) in which we examined their results for the year to 30th March 2024. These results had been published on the Stock Exchange News Service (SENS) a few days earlier on 13th March 2024 and they were very impressive.

Of course, by June 2024, our local elections were over, and the government of national unity (GNU) had recently been appointed. The country was also celebrating the end of loadshedding and looking forward to the beginning of a downward cycle in interest rates.

At the time we said, "In our view this company will continue to perform well as the economy recovers - especially after the recent election results and the new Government of National Unity."

Now, nearly six months later, Mr Price has published its interim results for the 26 weeks to 28th September 2024 showing revenue up 5,2% and headline earnings per share (HEPS) up 7,1%. Most of the company's sales are for cash with a small amount on credit.

This helps with cash flow and the management of the balance sheet. On 30th September 2024, the company had R2,2bn in cash and no debt. A profitable company which has a big cash pile like this, and no debt is virtually risk-free from an investor's perspective. All they need to do is to keep adding new stores, either organically or by acquisition. In the October 2022 the company bought Studio 88 for R3,6bn. Studio 88 was the largest independent retailer of branded leisure, lifestyle, and sporting apparel and footwear in South Africa. Clearly it was an excellent fit for Mr Price. During the 6 months, Mr Price added 92 stores to bring its total number of stores to 2958.

Obviously, Mr Price is primarily a retailer of clothing, and this means that they have to carry substantial stock and buy ahead of time for the winter and Christmas seasons. Optimising stock levels is a critical area of the business and one which Mr Price handles very professionally. For example, the company managed to "...exit the winter season in a clean position and minimise end of season markdowns. "Obviously, the company does not want to be left with piles of old stock which is out of fashion and cannot be sold. Such stock usually has to be marked down and is often sold at a loss.

The company has managed during the period to take market share away from its competitors during the period - which is a real achievement in such a competitive market. And they have done this while increasing their gross profit margin by 1,1% to 39,7%. All in all, Mr Price has been superbly managed and continues to perform well as an investment. Consider the chart:

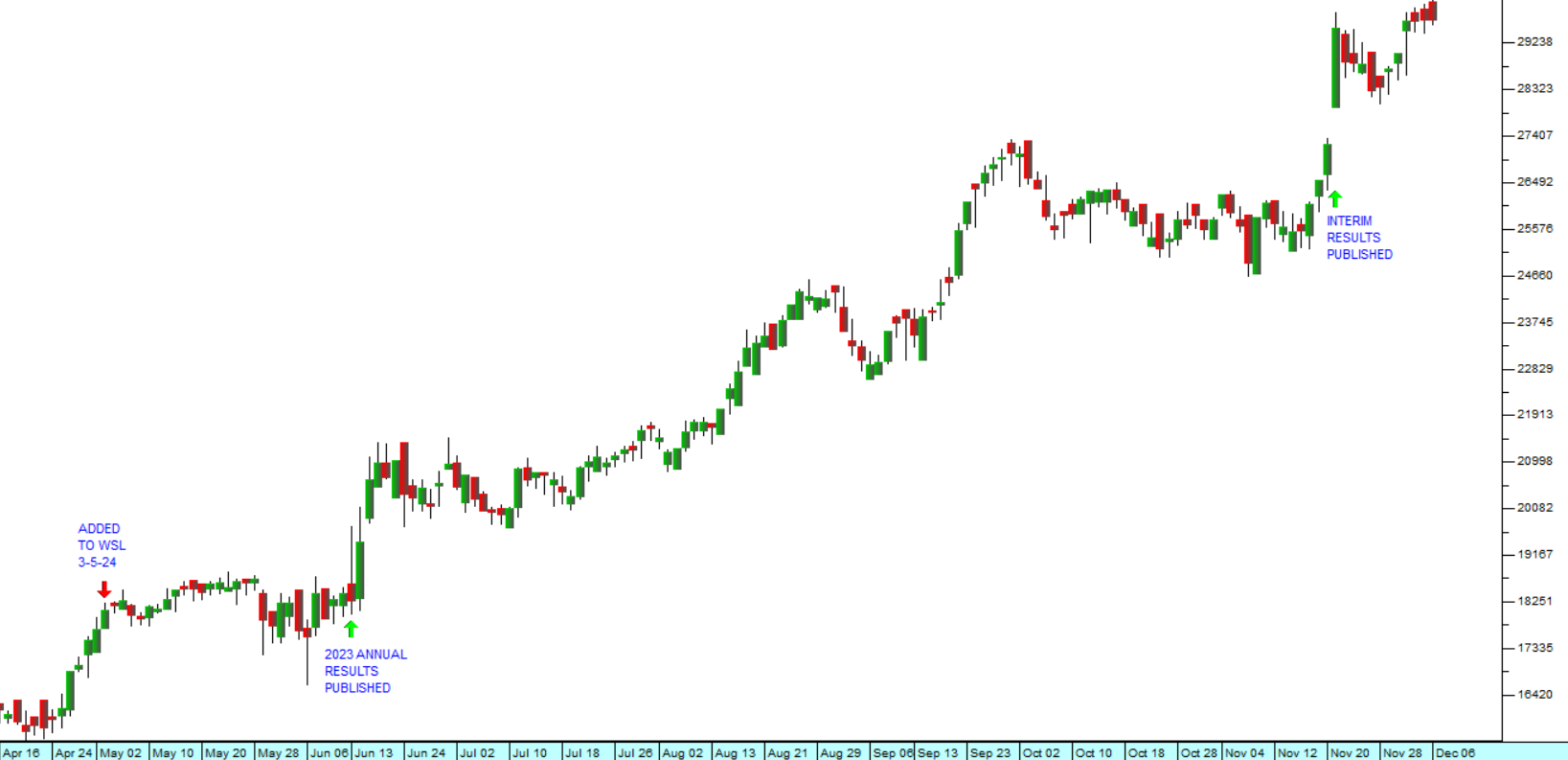

The chart shows the date on which we added this share to our Winning Shares List (3rd May 2024) at a price of 18085c. Note the impact of the annual financials and the interim financials on the share price. In each case investors were pleasantly surprised and re-rated the share upwards. On Friday last week the share closed at 29711c - a gain of 64% in just over 7 months.

You should also note that Mr Price has paid out a total dividend of 810,3c in the year to 30th March 2024 and has declared a dividend of 303,6c for the first 6 months to 30th September 2024.

Altogether this is an excellent investment.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: