Lewis Revisited

Working capital is always a key consideration when looking at a share, because it shows the quality of the company’s management. In simple terms, working capital is the cash tied up in the running of the business and it is calculated as:

Debtors + Cash – Creditors

Obviously, all companies try to keep their working capital to a minimum because usually it is funded by their overdraft on which they are paying interest.

Management of stock is a trade-off between having the right stock available when the customer demands it and minimising out-of-date or obsolete stock. The debtors’ book is also critical. Debtors must be chased up – but only when what they owe is due. They must be given enough credit to encourage them to buy, and then the debt must be collected effectively.

In the September 2020 in the thick of the COVID-19 crisis we recommended an investment in Lewis in that month’s Confidential Report.

Lewis is a retailer of furniture and appliances through 869 stores, 138 of which are outside South Africa. In this type of business, it has substantial working capital with a large debtors’ book and significant stock levels.

Normally a business like this would represent a high risk especially when the economy is in a difficult position as it was in 2020 immediately following the restrictions of COVID-19. Retailers were being forced to operate with very difficult rules and consumer confidence was at record lows.

Despite this, in the Confidential Report (CR) of September 2020 we recommended an investment in Lewis. Our main reasons for making this recommendation were its excellent management of working capital and its very low debt levels. We said of Lewis, “It is trading on a P:E of 6,65 and at less than a third of its net asset value (NAV) – so it looks very cheap to us”. We also noted that, “It has the great benefit of a balance sheet which is almost completely ungeared. This gives it the flexibility to acquire weaker less well-capitalised competitors in this difficult economy.”

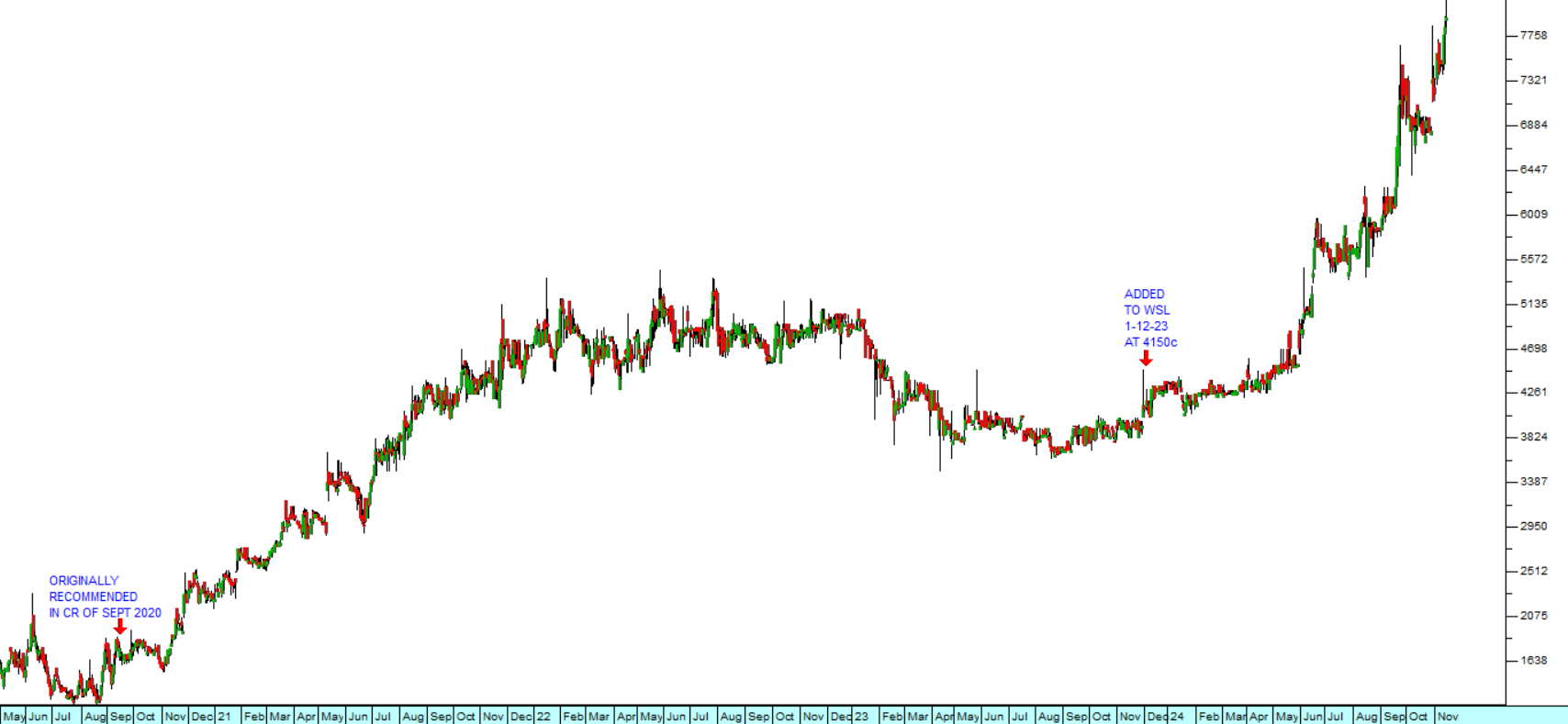

Consider the chart:

Here you can see our first recommendation to buy Lewis in the CR of September 2020 when the share was trading for 1700c. Later when we began the Winning Shares List (WSL) we added it on the 1st of December 2023 and by then it was trading for 4150c. On Thursday last week it closed at 7960c – which is a massive 468% gain over our first recommendation just over 4 years ago.

The company has also been paying out a steady flow of cash dividends:

2020 185c

2021 328c

2022 413c

2023 413c

2024 500c

In a trading statement for the six months to 30th September 2024 the company estimated that its headline earnings per share (HEPS) would increase by between 45% and 55%. Clearly, this is a share which is benefiting directly from consumer optimism following the end of loadshedding, the appointment of the government of national unity (GNU) and the fact that interest rates are now falling.

And the share is still trading on a low price:earnings (P:E) ratio of just 8,61 and a high dividend yield of 5,03%. So it remains a very good investment even at these levels.

There can be no doubt that Lewis should be part of every private investor’s portfolio.

← Back to Articles