The Confidential Report - September 2023

6 September 2023 By PDSNETAmerica

Altogether, it looks to us like the US economy may well avoid a “hard landing” despite the sharp rise in interest rates over the last 18 months. And certainly, judging from the market action, that seems to be how the market is interpreting the data. Consider the chart:

In July 2023 we published an article in which we explained our New Perspective on the progress of the S&P500 index. In that article we suggested that the 25% downward move between 3rd January and 12th October 2022 was almost certainly an exaggerated correction and not a bear trend – as we had originally suggested. We argued that therefore the bull trend which began in March 2009 was still in progress.

This perception constitutes a major shift in our view because it means that the new upward trend in the S&P500 since 12th October 2022 will probably continue in our view, and, ultimately, we believe, the S&P will break above its previous record high at 4796 (3-1-22).

If we are right about this, then the JSE and other markets will follow Wall Street up and private investors should look to be fairly fully invested.

As you can see in the chart above, within that bull trend, the S&P has experienced a 5% correction between 31st July and 18th August 2023. On 18th August 2023 we noticed that the rand had stabilized and was beginning to strengthen after a period of weakness. This indicated to us that there was a shift back towards “risk-on” and that the S&P would probably turn and begin to rise again. We published this tweet:

The rand seems to be bottoming out in this cycle. This may well be an early indication that the S&P is going to begin to strengthen again and that the current downward cycle is over. The smart money appears to be moving back towards "risk-on".

As you can see on the chart above, from the next day the S&P began to rise again – a pattern which is continuing. This shows that the performance of the rand is a reasonably good leading indicator for the S&P.

To follow our tweets go to: Twitter

The US economy has certainly been slowing down, but it still managed to create 187 000 new jobs in August 2023. At the same time the unemployment rate rose to 3,8% - more than analysts were expecting, but still incredibly low. The Federal Reserve Bank (the Fed) is now expected to keep interest rates unchanged once again at their meeting on 19th and 20th September 2023. This is partly because core inflation (excluding food and fuel) does appear to be coming under control even though consumer spending rose by a more-than-expected 0,6% in August. It is also reported that gross domestic product (GDP) increased by 2,1% in the second quarter of 2023 – which is not excessive.

Ukraine

Although Ukraine’s “Spring Offensive” has progressed far more slowly than many Western powers would have liked, the Ukrainians have made and are making some significant progress – especially following the re-capture of Robotnye. There is probably still about one month of reasonable weather remaining this year, and in that time, it seems likely that the Ukrainians will attack Tokmak. If they can capture Tokmak, they will be able to cut off Russia’s supply lines to Crimea – which would spell disaster for the Russian troops stationed there. As we have said before, if Russia loses Crimea, it is unlikely that Putin will be able to survive.

At the same time, with the help of their western allies, the Ukrainians have made enormous strikes in drone technology, both in the air and in the sea. They are apparently now able to destroy targets deep inside Russia or in the Black Sea at will.

Following the suspicious death of Prigozhin, Putin has suffered a significant drop in popularity, and may now face mutinies from other militarized national groups like the Chechens. His army is stretched by the war and cannot afford to re-allocate units to suppress a rebellion. With Prigozhin out of the picture, other vultures are circling.

At the same time, the collapse of the ruble shows that the Russian economy is taking enormous strain from the combined impact of Western sanctions and the escalating cost of the war in Ukraine. The national deficit has ballooned to about $29,3bn – which is unsustainable.

The Russian ruble recently fell below one hundred rubles to the US dollar meaning that a ruble is now worth about 1c (US). This compares to the rand which is currently trading at just over 5c (or R18.80 to the US dollar). The currency of a country is like the shares of a company. Just like a share, if a country is expected to do badly economically, its currency will fall against other currencies – and vice versa. Obviously, the ruble is beginning to seriously feel the negative effects of sanctions and the oil price cap. Russia has tried to sell its fossil fuels to India and China at discounted prices, but this trade has not been sufficient to compensate it for the loss of other markets, especially the European market. The collapse of the ruble below one hundred to the US dollar is a major blow to Putin who ordered the central bank to fix the situation. The bank held an extraordinary meeting on 15th August 2023 and increased interest rates by a whopping 3,5%. The effect of this massive hike has temporarily stabilized the ruble, but we expect it to continue losing value. The only way to rectify the situation would be for Russia to stop the invasion of Ukraine and seek to get sanctions removed – and that seems unlikely without a regime change which excludes Putin.

So, in our view, Putin is now coming under extreme pressure to abandon his “special military operation” in Ukraine – which is a political impossibility for him. The collapsing ruble is directly impacting the level of inflation Russia. It is notable that the current account surplus in Russia fell by 85% between January and July this year. Putin is trying to put the blame on the central bank governor, Elvira Nabuillina, but she really is not to blame – he is.

Political

The power sharing pact between seven opposition parties, led by the DA is significant. It prepares for a time after the 2024 elections when the ANC will no longer have a majority in parliament. The agreement will help with the running and management of coalitions generally in the provinces and municipalities, but it also opens the possibility of a serious united opposition to the ANC. The EFF has been excluded because their policies are too radical. This might have the effect of forcing the ANC to make a similar agreement with the EFF. Whatever happens, it is clear that next year’s elections are going to be a major turning point for this country. There is the possibility that the new dispensation will bring with it increased chaos, but there is also the possibility that it will see the beginning of the end of a revolutionary party that has fallen into abject corruption from which it does not appear to be able to extricate itself.

The city of Cape Town is facing off against the taxi industry, having impounded hundreds of taxis probably because they were not road-worthy or had committed traffic offences. This led to a taxi strike and blockades with the result that many workers have not been able to get to work. Many sectors of the Cape economy have been impacted and there have been five deaths from violence. Throughout South Africa, the taxi industry has been allowed to do more-or-less as it wanted, flagrantly ignoring the rules of road and operating taxis which were not road-worthy. This has led to far higher levels of traffic accidents. The City of Cape Town has clearly decided to stop these abuses and to bring the taxi industry back under control. In doing so, they are fighting a battle which will probably have to be fought in Gauteng in due course and elsewhere. The city’s concession to release impounded taxis has brought the immediate strike to an end, but no doubt the battle with lawlessness in the sector will continue.

The ANC is putting a brave face on the 2024 elections and aiming to win an outright majority. This appears increasingly unlikely, even according to the ANC’s own surveys, but they say they are not in talks with any other party about coalitions. In our view, the ANC will probably get about 40% of the vote next year and will thus be forced to compromise with one of the other parties – probably the DA. Such a coalition will be uncomfortable for both parties but may see improvements in the management of some key sectors of the economy if the DA becomes more influential.

The BRICS summit being held in South Africa is a double-edged sword. It overtly divides the countries of the world into two distinct groups and then leaves those countries to decide which group they will be loyal to. The Russia-China involvement means that those countries which belong to BRICS will surely come to be seen as anti-America and anti-NATO. South Africa’s effort to somehow remain “neutral” while belonging to BRICS is becoming increasingly difficult. The simple fact of the matter is that we have already chosen sides and hence our continued participation in America’s “African Growth and Opportunity Act” (AGOA) is becoming tenuous. Currently, the BRICS countries account for about 25% of world trade and just over 40% of the world’s population. Those numbers will increase rapidly now that six new members are joining with effect from January 2024. At the moment, BRICS countries account for 21% of South African trade, but our combined trade with Europe and America accounts for about 75% and so far exceeds that. Notably, Vladimir Kazebekov the Russian Chief Operations Officer of the New Development Bank of BRICS has rewarded South Africa for its loyalty to Russia by offering an R18bn loan to Transnet and another large, yet-to-be-decided loan for our crumbling water and sanitization infrastructure. Our ANC government will be well pleased with these new sources of funding which will undoubtedly offer many new opportunities for the comrades to “eat.” The idea that the BRICS countries could create a currency that would displace the US dollar as the medium of international trade and the major reserve asset of central banks has been described as “ridiculous” by Jim O’Neill, who was the economist who first coined the acronym BRIC to describe this block of emerging economies. The US dollar accounts for about 62% of all international trade and about 60% of the reserve assets held by central banks.

It comes as no surprise that the proposed National Health Insurance (NHI) is unaffordable. The government has made no serious effort to evaluate the cost of the NHI or how it will be funded since the idea was first suggested. Now the business community has pointed out that the estimated R200bn that it is expected to cost will require a massive increase in personal income tax, VAT, or the unemployment insurance contribution. Such cost increases are unaffordable for the South African economy which is already under extreme pressure due to loadshedding and rising interest rates. So, the NHI is another example of a populist idea which has not been properly thought through and which will probably have to be abandoned or substantially diluted in due course.

The fire at a building owned by the City of Johannesburg in the CBD which killed seventy-seven people is a further example of the ANC’s complete incompetence as a ruling party. The mismanagement of municipalities which has led to this disaster and a hundred other service delivery problems must be laid squarely at their feet. One point they should consider is that such a disaster would never have occurred under the previous much-denigrated apartheid regime. It is difficult for the ANC to propose that they care about the people that they represent when they allow this type of completely unnecessary tragedy to occur.

Economy

The South African economy has been taking strain because of high interest rates, persistent loadshedding, falling commodity prices and the logistics problems at Transnet. These factors have been mitigated somewhat by the recent drop in inflation, but the economy remains under pressure and growth rates remain low. Certainly, the economy is not growing quickly enough to absorb the annual influx of school-leavers – which means that the unemployment rate, especially among young adults, is excessive and rising. One point of optimism is the economy’s resilience and rapid adaptation to loadshedding. A growing percentage of businesses have or are implementing their own electricity solutions outside Eskom. This is bringing down costs and improving reliability.

The BankServ take-home pay index shows that the average take-home pay in July 2023 was R15503 – sharply better than June’s figure of R14170. This shows that businesses are adapting rapidly to loadshedding and can afford to pay their staff more. The drop in the inflation rate in July 2023 also helped consumers to have an increased disposable income.

The consumer price index (CPI) dropped to 4,7% in July 2023 – well within the target range of 3% to 6% and sharply lower than June’s figure of 5,4%. Both food and energy prices were lower. The lower inflation means that interest rates have almost certainly peaked and will trend downwards from here. The 16,8% drop in fuel prices year-on-year is a major factor. The Reserve Bank is expecting inflation to be 5,4% in the third quarter of 2023, but the latest inflation figure makes that unlikely.

Retail sales fell by 1% in the second quarter of this year. Rising interest rates loadshedding and high unemployment are constraining consumers and keeping spending levels down. Consumers cannot afford to take on more debt and are having to “downsize” to survive. Wages are not growing as quickly as inflation with the effect that disposable income is shrinking. Consumer confidence is also at record low levels with most consumers predicting that conditions will get worse in the future. Consumer spending makes up about 65% of the country’s gross domestic product (GDP).

The unemployment rate fell by 0,3% in the second quarter of 2023 to 32,6%. The South African economy has created two million new jobs since the start of 2022 in a gradual recovery from the impact of COVID-19. If the people who have given up looking for work are included, then the unemployment rate is 42%. To us it is amazing that the economy can create jobs at all, given the high level of loadshedding and general state of mismanagement. We can only imagine how rapidly it would be growing without these encumbrances. Obviously, the renewable energy sector has been a major employer as consumers and businesses installed solar power to escape Eskom. Surprisingly, the fast-food industry has also seen significant job growth. Manufacturing lost almost 100 000 jobs in the quarter and 68 000 were lost in financial intermediation, real estate, insurance, and business services.

Mining output was up by 1,1% in June 2023 year-on-year after May’s fall of 0,7%. The rise was due to a sharp rebound in the platinum sector with PGM’s rising by over 11%. Until June, the effect of falling commodity prices and the inability of Transnet to get mined product to port had been impacting production. Output is still running well below pre-pandemic levels and Sibanye has said that loadshedding could trim as much as 20% off PGM production in 2023. Coal producer Thungela said that it had lost 300 000 tons of coal exports in the first half of 2023 due to Transnet problems. Iron ore exports were also badly affected with Kumba cutting its dividend as a result.

Credit extension in the year to June 2023 dropped sharply to 6,3% from May’s 6,8% showing that consumers are wary of taking on new debt and banks are wary of extending it in this difficult economic environment. Unsecured lending in particular appears to be declining. Clearly, consumers are battling to make ends meet with lower take-home pay and rising interest rates.

New car sales in July 2023 were down by 9,7% and exports were up 47,% compared to July 2022. The increase in exports was due to the base effect from last year when the Toyota plant was impacted by the floods in Natal and was not producing bakkies. Total sales of cars and commercial vehicles were up 1,3% and year-to-date sales were up 4,4% on last year. Conditions are expected to improve during the second half of the year.

The ABSA purchasing managers index (PMI) fell to 47,3 in July 2023 from June’s 47,6 showing that manufacturing is still contracting, mainly due to continued power outages and loadshedding. Manufacturing contributes about 11% to gross domestic product (GDP).

The combination of lower tax revenue and the civil servants’ pay hike will almost certainly mean that the budget deficit will not come in at 4% of gross domestic product (GDP) as projected but will probably increase to around 4,5%. The ratings agency, Moody’s predicts that it will reach 5,6% and HSBC says it will come in at around 5%. The 7,5% increase in civil service wages will cost an extra R37bn. Tax revenue from the mining sector is expected to decline sharply because of Transnet problems and lower commodity prices.

ABSA is now predicting that the South African economy will grow by 0,7% this year, more than double its previous estimate. The bank is forecasting that corporate income tax collections are down by nearly a quarter in the three months to end-June 2023. The lower tax collections will place pressure on the Treasury in the current fiscal year and probably means that the budget deficit will increase. The Reserve Bank is now forecasting a budget deficit of 6,6% after including Eskom’s R254bn bailout.

Manufacturing activity increased by 5,5% year-on-year in June 2023 from 2,4% growth in May. The figures are improving as the sector reduces its dependence on Eskom and implements its own power solutions. The purchasing managers index (PMI), which is based on a survey of purchasing managers, is still negative, showing that they still believe that future growth will be curtailed. In our view, South African businesses across the country are responding rapidly to the “new normal” of continuous loadshedding. Business is implementing alternatives and once again filling the vacuum left by government inefficiency.

The BankServ Economic Transactions Index (BETI) has been falling steadily. In May 2023, it fell a massive 7,4% from April’s figure and then 1,7% in June and now a further 0,9% in July 2023. The index is a good measure of economic activity and shows that the South African economy is still contracting. June had lower levels of loadshedding, but that deteriorated in July with a return to stage 6. The problems with Transnet and the burning of trucks on the N3 and N4 have made the situation worse. The ABSA purchasing managers index also fell in July 2023 to 47,3 compared with June’s 47,6.

It is notable that Exxaro, which is South Africa’s largest exporter of coal has decided to completely stop sending coal to port by truck because of the fall in the coal price this year. The railway system is almost unworkable in this country which made trucking the only option, while the price of coal was at record highs of over $200 per ton. That price has now declined to $120, and trucking is no longer economically viable. The Richards Bay Coal Terminal (RBCT) handled just fifty million tons of coal last year – the lowest level since 1993. In the first half of 2023 the terminal handled 23,5m tons – 10% less than last year. The complete mismanagement of the rail system in the country is a severe indictment on the ruling ANC and it is costing the country enormously.

Debt Busters is a local company that handles debt consolidations and debt problems generally. The company reported that the average loan size has increased by almost 80% since 2016 and that people with an income of R35000 a month have a debt-to-income ratio of almost 190%. The company says that this is not surprising given that since 2016 the price of petrol has doubled, and electricity has gone up 90%. At the same time interest rates have risen sharply. South African consumers are increasingly paying for monthly expenses using short-term unsecured debt.

Private credit extension (PCE) in July 2023 fell to 5,9% - down from June’s figure of 6,3%. The steady decline in PCE over the past year shows that South African consumers and businesses have been cutting back on debt as the economy weakened. The use of credit cards reduced, showing that consumers are wary of this easy but expensive credit form. The impact of on-going loadshedding and rising interest rates is causing consumers to cut back on spending. It seems likely that the Reserve Bank has come to the end of its rate-hiking cycle and that rates will begin to fall fairly soon reducing the pressure on consumer spending.

Eskom

The government’s free basic electricity (FBE) program, to provide ten million poor households with free electricity is only reaching about 2,3m households because of misallocation of funds and poor administration. The problem is that they are trying to work through the municipalities which are notoriously badly run. Each poor family is supposed to get fifty kilowatt hours of electricity for free every month. The program costs the Treasury about R19,2bn a year, but only about half of the funds are actually used to help poor people. We can all imagine where the balance of the funds went.

South Africa imported R47,5bn worth of solar panels, batteries, and inverters in the first six months of 2023. This is almost 50% more than the R32,3bn worth imported in the whole of last year and more than three times what was imported in 2021. This shows how rapidly consumers and businesses are moving away from Eskom and implementing their own solutions. In our view, the country and the economy will soon be generating enough distributed power to make Eskom almost irrelevant – which is a good thing. Effectively, business will have taken over the management of this important resource from the government - which has shown itself to be completely incompetent. This is part of a pattern of incompetence characterizing the ANC’s almost 30 years in power which has seen business take over the management of education and healthcare and many other aspects of the economy like postal services and air travel (with the demise of SAA).

The city of Johannesburg is following Cape Town’s lead in an effort to make itself less reliant on Eskom. The city has accepted four bids from private power providers for a total of ninety-two megawatts of power – almost enough to avoid one stage of loadshedding. The goal is to eventually bring on five hundred megawatts and so avoid up to five stages of loadshedding.

AECI is in the process of building and implementing several massive solar power installations to make it less reliant on Eskom. Ultimately it plans to generate 14,3 megawatts of solar power through installations at its various facilities. So far it has commissioned a 1-megawatt system at Chem Park in Johannesburg, but it plans to spend as much as R145m on a variety of systems in total. This is an example of how South African business is responding to Eskom’s increasingly expensive and unreliable supply.

According to our Minister of Electricity, Eskom has twenty-five projects to eliminate loadshedding. These projects, when complete, will bring in thirteen gigawatts of new power. The cold conditions during winter have increased demand, resulting in the grid being under pressure.

The Minister of Electricity, Ramokgopa, has estimated that the impact of loadshedding will cost the economy R400bn more this year than it did last year. It will also shave R77bn off tax receipts. These figures show the enormous and on-going cost of loadshedding which is affecting the lives of all South Africans. This year we have already had 218 days of loadshedding, up to the first week of August. That compares with 202 days in the whole of last year. Our unemployment level, which was already one of the highest in the world is far worse with an estimated loss of about 860 000 jobs due to loadshedding. The measures put in place to reduce loadshedding earlier in the year now seem to be having less and less impact with loadshedding once again running at stage 4 almost continuously.

It comes as no surprise to us that Gwede Mantashe, our Minister of Minerals and Energy, is doing everything he can to delay the passage of a critical piece of legislation, the Electricity Regulation Amendment bill, through parliament. The bill has the support of President Ramaphosa and is urgently needed according to Business Unity South Africa (BUSA) to relieve the country’s loadshedding problems. Mantashe has been opposing the growth of renewables and the retiring of the old coal-fired power stations for years. If the bill does not get into parliament by September it will have to be reintroduced next year, after the election. This delay is another example of South Africa “shooting itself in the foot” economically.

Rand

One of the most interesting facts about the rand, as indicated above, is that it has become a leading indicator for the S&P500 index. This is because when overseas investors become worried and shift towards “risk-on” they sell out of their emerging market investments and buy so-called “secure” investments like US Treasury bills. This causes the rand to fall because the rand is one of the most heavily traded of the emerging market currencies. The same issue which is making overseas investors nervous will also cause them to sell out of equities – causing the S&P500 index to come down.

The opposite is also true. When the rand seems to be bottoming after a period of weakness, it is usually because the smart money has decided that a period of “risk-on” is about to commence and so they begin buying emerging market assets. As risk-on sentiment gathers momentum, the S&P500 index rises.

Of course, there are also local factors impacting the rand. Raising interest rates make our government bonds more attractive to overseas investors, but loadshedding and other evidence of the mismanagement of the economy tend to cause it to weaken. Overseas investors are attracted by our relatively low inflation and the independence of our central bank. They are repelled by populist and unaffordable or disruptive policies like the national health insurance (NHI) and expropriation of land without compensation.

Over the past 12 years, more-or-less since Trevor Manuel ended his term as Minister of Finance and his influence began to fade, the rand has been declining against the US dollar. It is normal for the currencies of emerging economies to fall against those of first-world economies and as investors we should expect the rand/dollar exchange rate to be volatile, and for the rand to fall fairly steadily over time. Consider the chart of the rand/dollar over the last 12 years.

The downward trend of the rand is evident, and we expect that to continue. Most listed companies on the JSE have an exposure to the rand, one way or another. They either benefit from rand weakness because they are exporting or earn most of their income overseas - or they suffer because they are importing products to sell here. It is important to know the vulnerability of the shares which you buy on the JSE to the rand.

Our view is that while there will undoubtedly be periods of strength, especially when international sentiment is “risk-on,” the underlying trend will always be downward.

Commodities

The oil price has continued to rise over the past month, despite a short-term correction. As the world economy recovers, dragged up by strong growth in the US, we expect oil to continue rising. Obviously, the rising oil price makes it more difficult for the Fed to achieve its inflation targets in America, but it is a clear indication of world economic growth. Consider the chart of North Sea Brent:

The upward trend in oil prices has persisted since last month and is not yet sufficient to have a significant impact on inflation rates.

Winning Shares List

As explained earlier, our view is that Wall Street, after what was an unusually large correction of 25% (lasting from 3rd January to 12th October 2022), has reverted to the great bull trend that began in March of 2009. In the light of this, we are now fully expecting that the S&P500 index will break to a new all-time record high, probably before the end of this year.

If we are correct in this interpretation, it means that private investors should be substantially fully invested, because listed equities world-wide will tend to follow Wall Street upwards.

To assist our clients with selecting shares that are likely to perform well, we have developed the Winning Shares List (WSL).

Beginning just over 2 months ago we began listing those shares which seemed to us to have the potential to give a significant capital gain. Obviously, with the best will in the world, some of our selections will perform badly and we remove these from the list when they reach their stop-loss levels.

A strict stop-loss strategy is, in our opinion, essential to avoid major losses in the market and ensure a consistently profitable performance. In fact, we have a rule that we never lose more than 15% on any share market investment – EVER. And that includes our dealing costs of 3%. So, our stops are never set more than 12% out.

The logic of this approach is that you can make 100%, 200%, 300% or more on your winners, and if you cut your losses at a maximum of 15% on your losers – then you have to be successful. It is almost a mathematical certainty.

At the close of trade on Friday 1st September 2023, there were thirty-nine shares on the WSL. Eleven of them were performing at 100% per annum or better and a further ten are performing between 30% and 100% per annum. Thirteen of the shares on the list (one third) are below the closing price of the day on which they were added, but none of those had fallen by more than 5%.

This shows that the WSL is throwing up a good proportion of winners – which means that if you select your shares from this list, you have a better-than-50% chance that they will go up. Remember:

Success in the share market is not about certainties. – It is about probabilities.

The WSL is available to our clients at our web site: www.pdsnet.co.za

The following shares have all been taken from the WSL after the close of trade on Friday 1st September 2023:

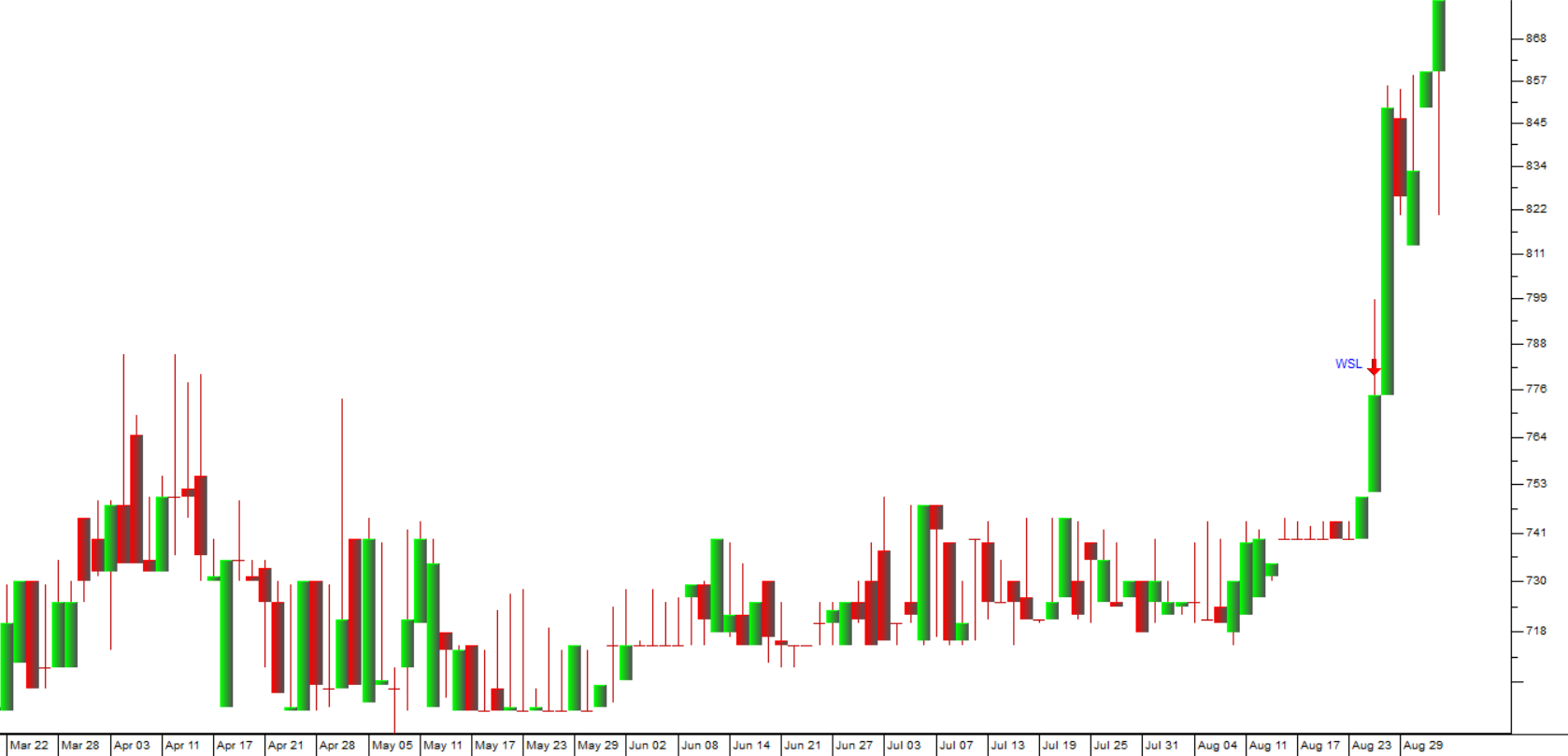

CA SALES (CAA) – Added to WSL on 25-8-23 at 775c.

This was our star performer having gained 13,55% in just 9 days. CAA is a recent listing on the JSE involved in food, health, alcohol, and fast-moving consumer goods (FMCG). It is also involved in point-of sale systems, warehousing distribution, and marketing. In its most recent results for the six months to 30th June 2023 the company reported HEPS up 21,5%. Obviously, the biggest disadvantage with a new listing like this is that it has a limited track record as a listed company and is therefore difficult to assess. However, we have liked CAA from the start and decided to add it to the list following its trading statement published earlier in August. Consider the chart:

You can see here that CAA had been moving sideways without attracting much interest until the publication of its trading statement. After that, investors including ourselves, began to look seriously at its business. We believe it will continue to perform well.

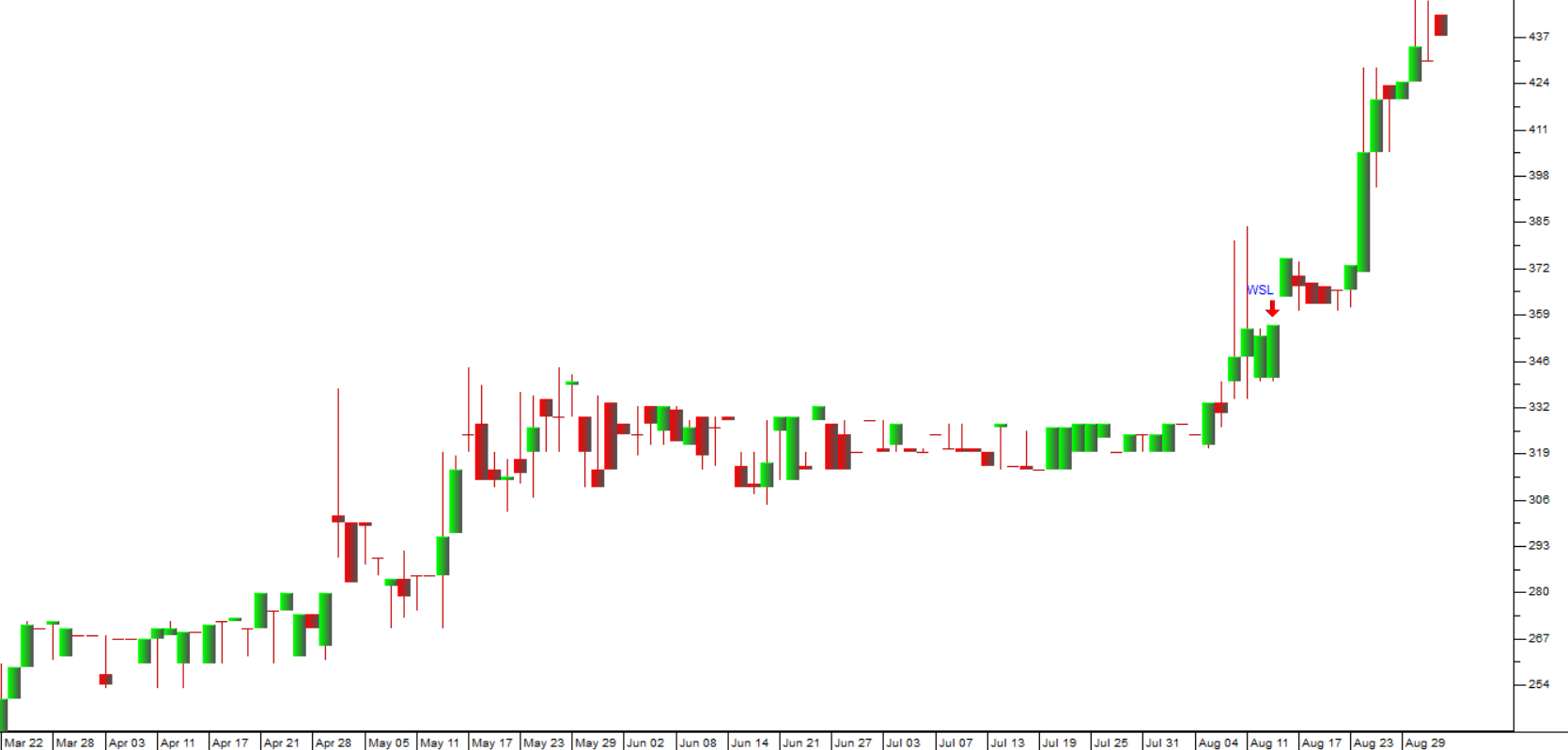

NAMPAK (NPK) Added to WSL on 26-7-23 at 18600c.

This is a well-known South African packaging company that has expanded overseas. The company had itself into difficulties with excessive debt, especially after the advent of COVID-19. By dint of selling non-core assets, cutting costs, and raising more cash from investors through a rights issue, the company now under new management has managed to set itself on a path to success and the share is once again attracting institutional interest. After the company conducted a 250-for-1 consolidation we decided to add it to the WSL because it was trading well below its net asset value (NAV). Consider the chart:

As you can see the share had been moving sideways since May 2023, but with the turn-around strategy began to appreciate. Over the 39 days that it has been on the WSL it has risen from R186 to Friday’s close of R287 – a gain of 54,3%.

CALGRO M3 (CGR) Added to the WSL on 15-8-23 at 356c.

This company is a property developer which has diversified into the provision of memorial sites. It acquires and develops land for residential use, either selling or renting accommodations. In its results for the year to 28th February 2023 the company reported HEPS up 45% off a 15,4% increase in revenue. Like many property companies, it is trading well below its net asset value (NAV) and so seemed to us to represent good value. Consider the chart:

As you can see the share was in a steadily rising trend and seemed to have considerable upside potential, especially given the assets which it held. Since adding it to the WSL 19 days ago, it has risen by just over 23%. We still see it as representing good value at 46% of its NAV. The NAV of property companies consists mostly of land and buildings – which makes it a more reliable measure of value.

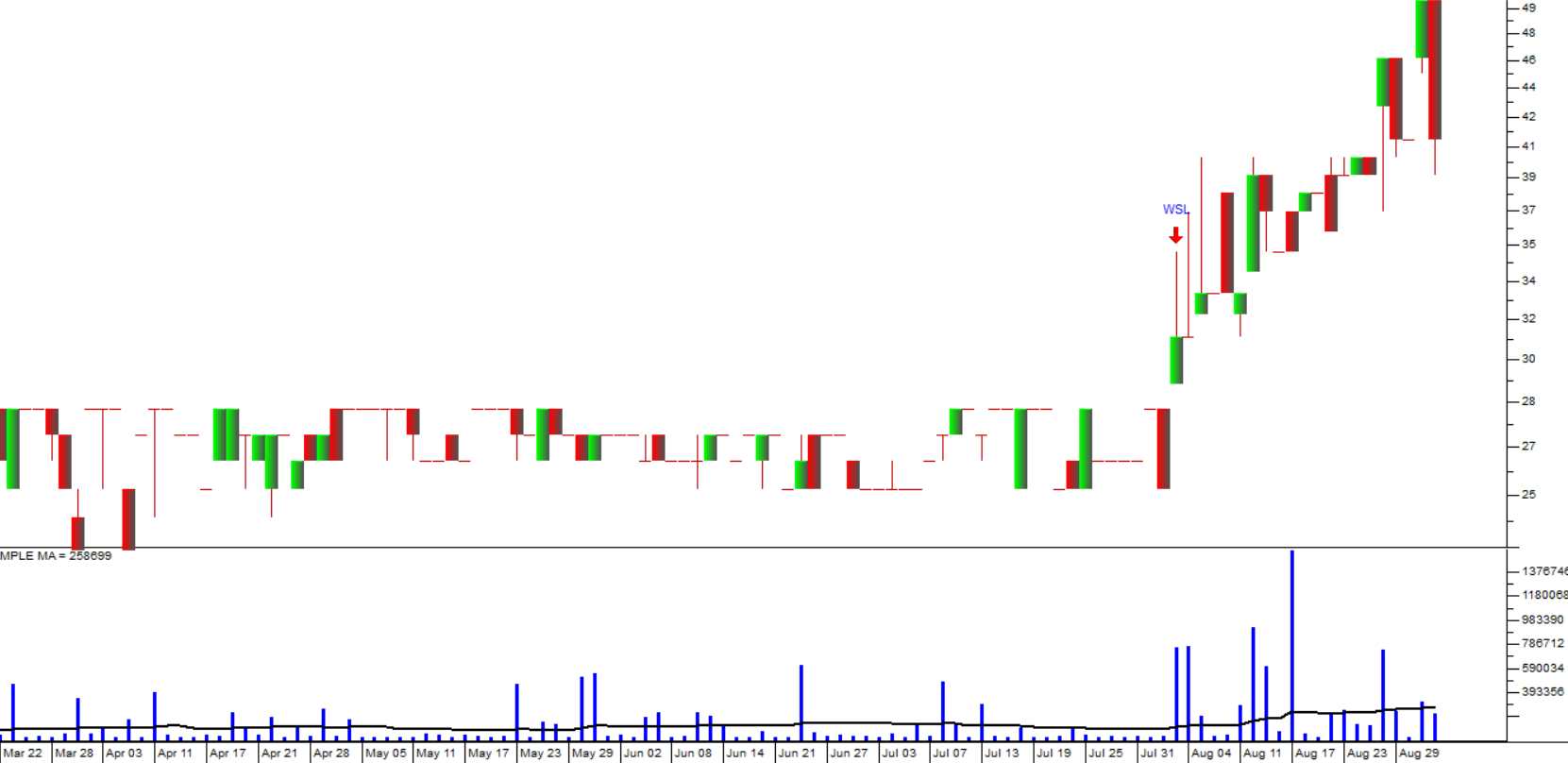

4 SIGHT (4SI) Added to the WSL on 5th August 2023 at 31c.

This is a penny stock based in Mauritius. It participates in the “4th industrial revolution” – which basically means that it develops “cyber physical systems” such as cloud computing and the internet of things. It is quite a large business with over three hundred staff and about 42% of its business is outside South Africa. In its results for the six months to 30th June 2023 the company reported revenue up 37,1% and headline earnings per share (HEPS) up 197.2%. These impressive results led us to conclude that the share was undervalued on the JSE and ripe for an upward move. Consider the chart:

The lower chart here is a volume histogram with a 30-day moving average superimposed. It shows that as the share price has been rising, the daily volumes traded have been increasing. The share is volatile but seems to us to have good potential. And certainly, it was cheap at 31c. Since we added to the list it has gone up 32% in just under one month. We do expect some profit taking as speculators cash in, but longer term it still looks good to us.

CURRO (COH) Added to WSL on 21-8-23 at 935c.

This share was spun out of PSG in 2015 and became a darling of the institutional fund managers, eventually reaching a JSE record high price:earnings ratio of 245. The company exploited the collapse of government-provided education in South Africa by establishing and developing high-quality schools throughout the country. The education business has the advantage that while it is capital intensive, it does not have major working capital requirements. Traditionally, parents pay in advance for their children’s education which means that Curro has extremely low or even negative working capital. Consider the chart:

As you can see here, Curro fell from its dizzy heights to a low following COVID-19 of around 770c. At this point there was an “island formation” which it broke out of on the upside. We feel that at current levels, on a much more reasonable P:E of 14,6, the share represents value. We added it to the WSL 13 days ago at 935c and since then it has moved up steadily to 1000c. We believe it still have substantial upside potential.

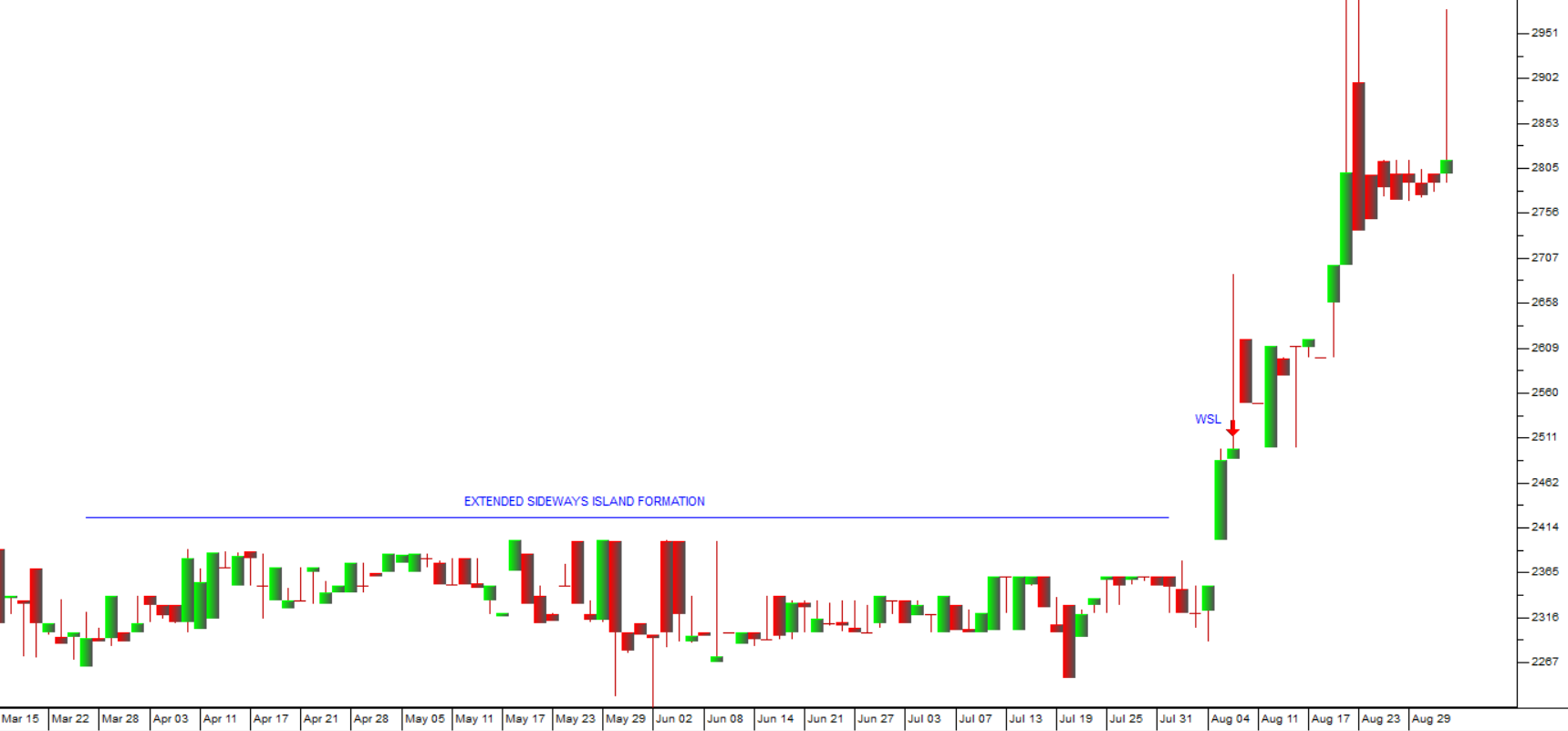

SPUR (SUR) Added to the WSL on 8-8-23 at 2488c.

This is an iconic fast food and restaurant business located in South Africa. The company was one of the worst affected by COVID-19 and has been slowly recovering since. It owns many well-known brands like John Dory, Panarottis and, more recently, RocoMamas and Hussar Grill. Altogether it has over 630 restaurants and franchise outlets. We believe that its latest results for the year to 30th June 2023 indicate a definite recovery. Franchised restaurant turnover was up 23% and headline earnings per share was up 81,1%. Consider the cart:

As you can see, the share has been through an extended sideways “island” formation and then broke up out of that formation. We added it to the WSL because of that upside break on 8th August 2023 at 2488c. It has subsequently moved up to 2815c – a gain of 13,14% in 26 days. We expect it to continue to perform well.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: