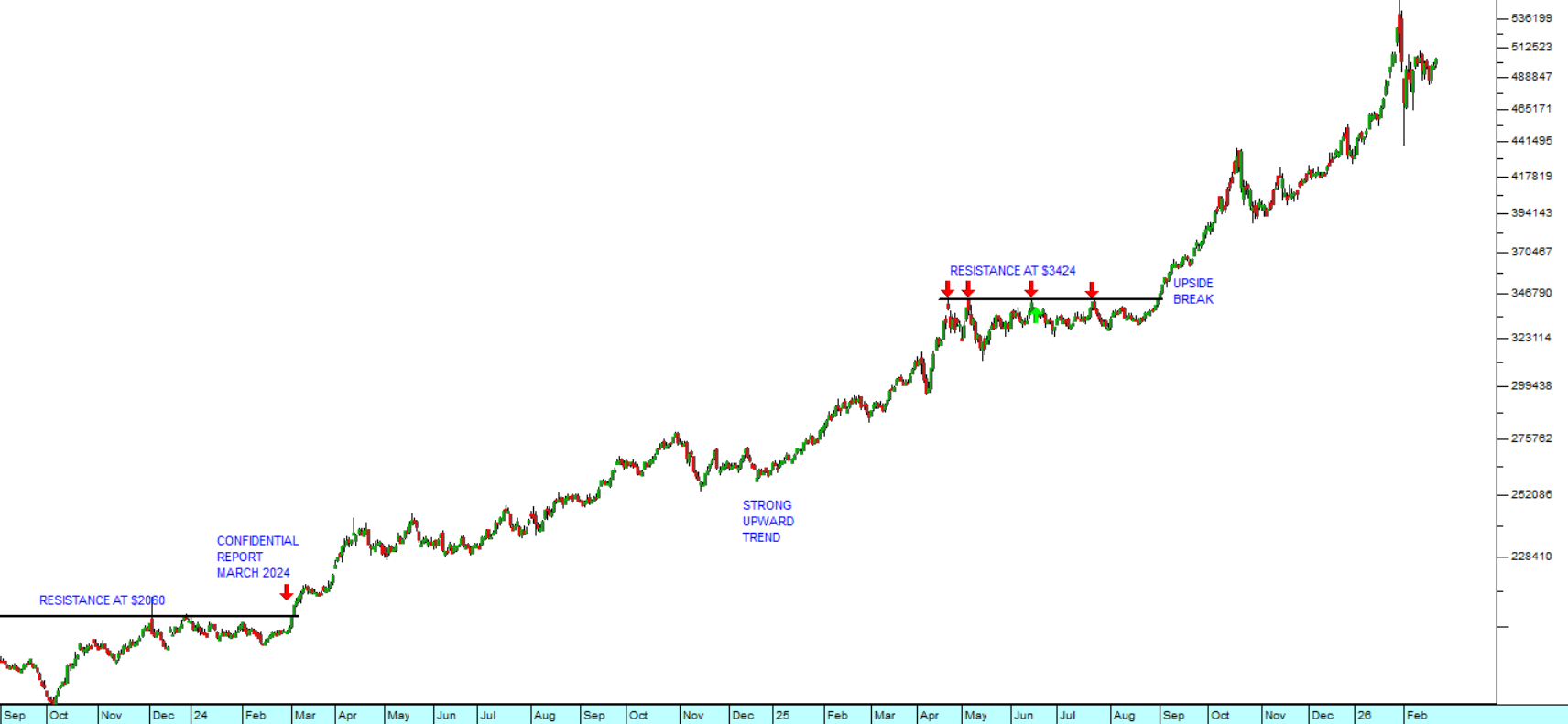

It is no secret that precious metals prices have been running. Most of the best-performing shares on the Winning Shares List (WSL) are mining companies with interests either in gold or platinum group metals (PGM). Gold in particular has dominated the investment world. The metal has risen 145% in US dollars since it broke up through resistance at $2060 at the beginning of March 2024, as reported in the Confidential Report of that month. Consider the chart:

Price of Gold in US dollars : September 2023 - 20th of February 2026. Chart by ShareFriend Pro.

Price of Gold in US dollars : September 2023 - 20th of February 2026. Chart by ShareFriend Pro.

As you can see here the break above resistance at $2060 sparked a strong upward trend. There was another period of resistance at $3424 in the middle of last year which was finally broken to the upside in early September. Gold may now, once again, be in for a period of consolidation, but the trend is clear.

The rising gold price is primarily due to central banks choosing to buy and hold gold as their most secure asset, rather than US Treasury Bills, despite the fact that gold offers no return. This is a testament to the rising levels of perceived geo-political risk in the world and gold’s ancient and undisputed status as the world’s most secure asset.

AngloGold has been a great beneficiary of the rising gold price. In its latest financials for the year to 31st December 2025, the company reported a 16% increase in production combined with a 45% increase in the average gold price received. Costs were flat in real terms which generated a massive 186% increase in headline earnings.

The company's total cash costs increased 7% over the year to $1242 per ounce with all-in-sustaining costs (AISC) of $1709 – against a gold price of over $5000. This is an immensely profitable company. Total dividends paid for the year amounted to $1,8bn or 357c (US) per share – which is R57.19.

The company was originally formed to consolidate the gold interests of Anglo American in South Africa. Those interests included ERGO, Eastvaal, Southvaal, FreeGold, Elandsrand, Joel and Western Deep. Today, AngloGold owns no South African mines at all. It has 11 mining operations on 4 continents, and it has moved its head office to New York and its primary listing to the New York Stock Exchange (NYSE). Given that South Africa still has more than 5000 tons of proven underground gold reserves, this is a sad reflection of ANC’s hostile attitude towards the mining industry in this country over the past 30 years and what that has cost us.

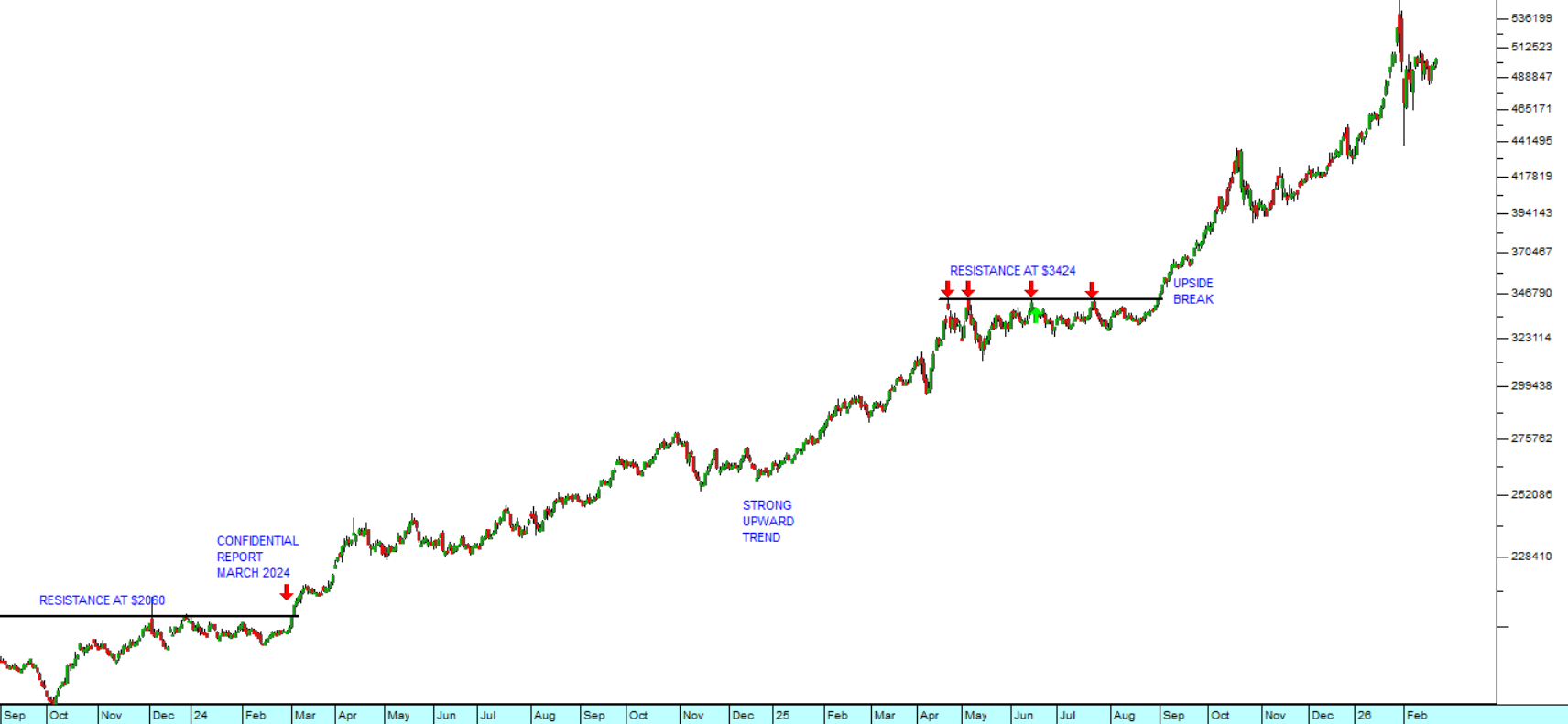

We added AngloGold to the WSL on 5th March 2024 at a price of 38932c – mainly because we could see that gold was breaking up through that key level at $2060. Since then the share has risen to 179102c – a gain of almost 340% in 718 days or 172,6% per annum. Consider the chart:

AngloGold Ashanti (ANG) : February 2024 - 20th of February 2026. Chart by ShareFriend Pro.

AngloGold Ashanti (ANG) : February 2024 - 20th of February 2026. Chart by ShareFriend Pro.

AngloGold is constantly adjusting its portfolio, adding exciting new gold prospects while divesting itself of non-performing assets. During 2025 it acquired Centamin which is proving to be a great addition. It also made three further acquisitions in Nevada. These acquisitions have increased the company’s mineral reserve to 36,5 million ounces – a 17% increase on 2024. This means that the company will be able to continue mining profitably for many years, especially considering its very low cost of extraction.

In our view, this share is speculative because it is dependent on the international price of gold over which it has no control. But it is geographically diversified and extremely well managed with relatively low costs and minimal debt. We believe that it will continue to perform well.