The fall in the Choppies share price from 795c on 2nd January 2026 to last Friday’s close at 290c is a great example of the volatility of markets, especially in shares which are relatively thinly traded. It demonstrates the importance of investor sentiment and the potential for popular shares to rapidly become over-priced once they attract the investing public’s imagination.

Choppies represents an unusual investment opportunity on the JSE, because it is a supermarket chain which is apparently highly successful in Africa outside of South Africa. This made it unique and a potential take-over prospect on the JSE. Most of the larger grocery retailers like Shoprite and Pick ‘n Pay have made an effort to establish themselves in other African countries with varying degrees of success. Those markets tend to be characterised by high levels of inflation and political instability. Choppies, on the other hand, was demonstrably successful in the rest of Africa, but found the South African market too competitive.

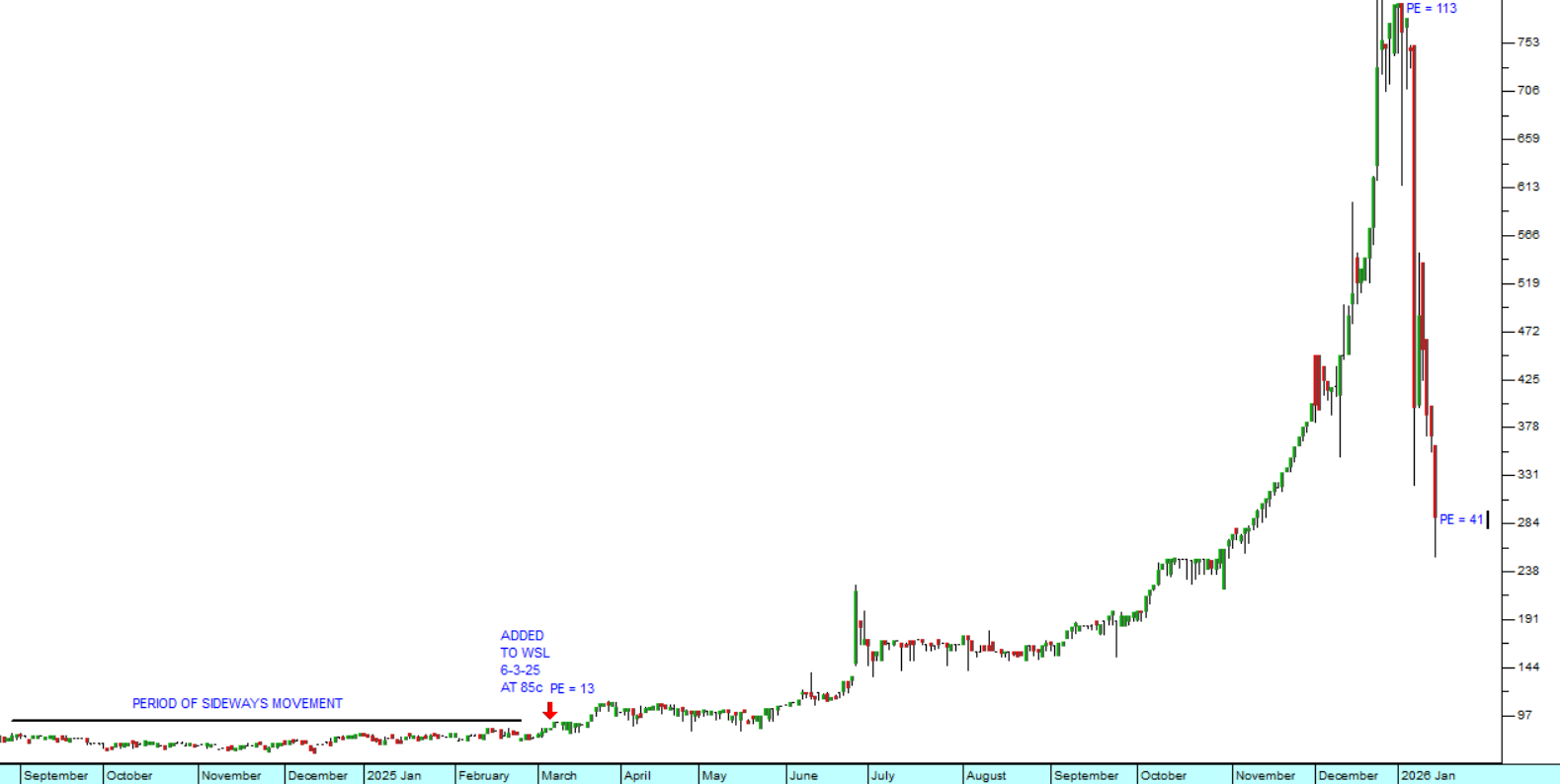

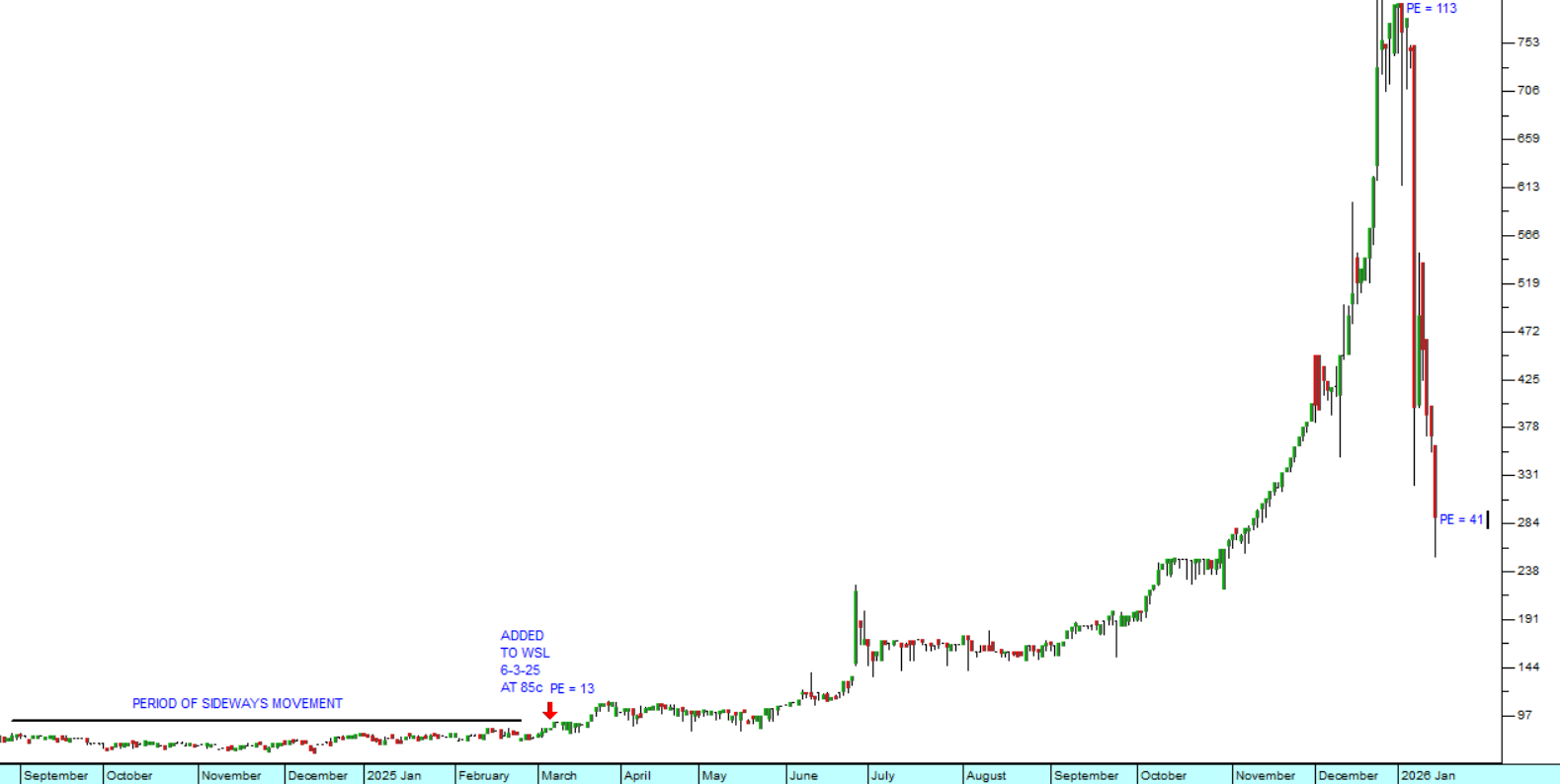

This made the Choppies story unique. We first recognised Choppies potential when it broke up out of an extended period of sideways movement in March last year. We added it to the Winning Shares List (WSL) on 6th March 2025 at a price of 85c and its performance was nothing short of meteoric. Eventually, by the beginning of 2026 it was trading on a price:earnings ratio (PE) of over 100. Consider the chart:

Choppies (CHP) : September 2024 - 16th of January 2026. Chart by ShareFriend Pro.

Choppies (CHP) : September 2024 - 16th of January 2026. Chart by ShareFriend Pro.

The chart shows the extraordinary climb in Choppies share price last year and then its subsequent collapse in 2026.

So, what happened? The answer to this question is that we really do not know. There have been no explanations or even comment given by the company itself in Stock Exchange News Service (SENS). There is some speculation that there was an offer from one of the other South African supermarket giants that was then abandoned, but again the company itself has said nothing.

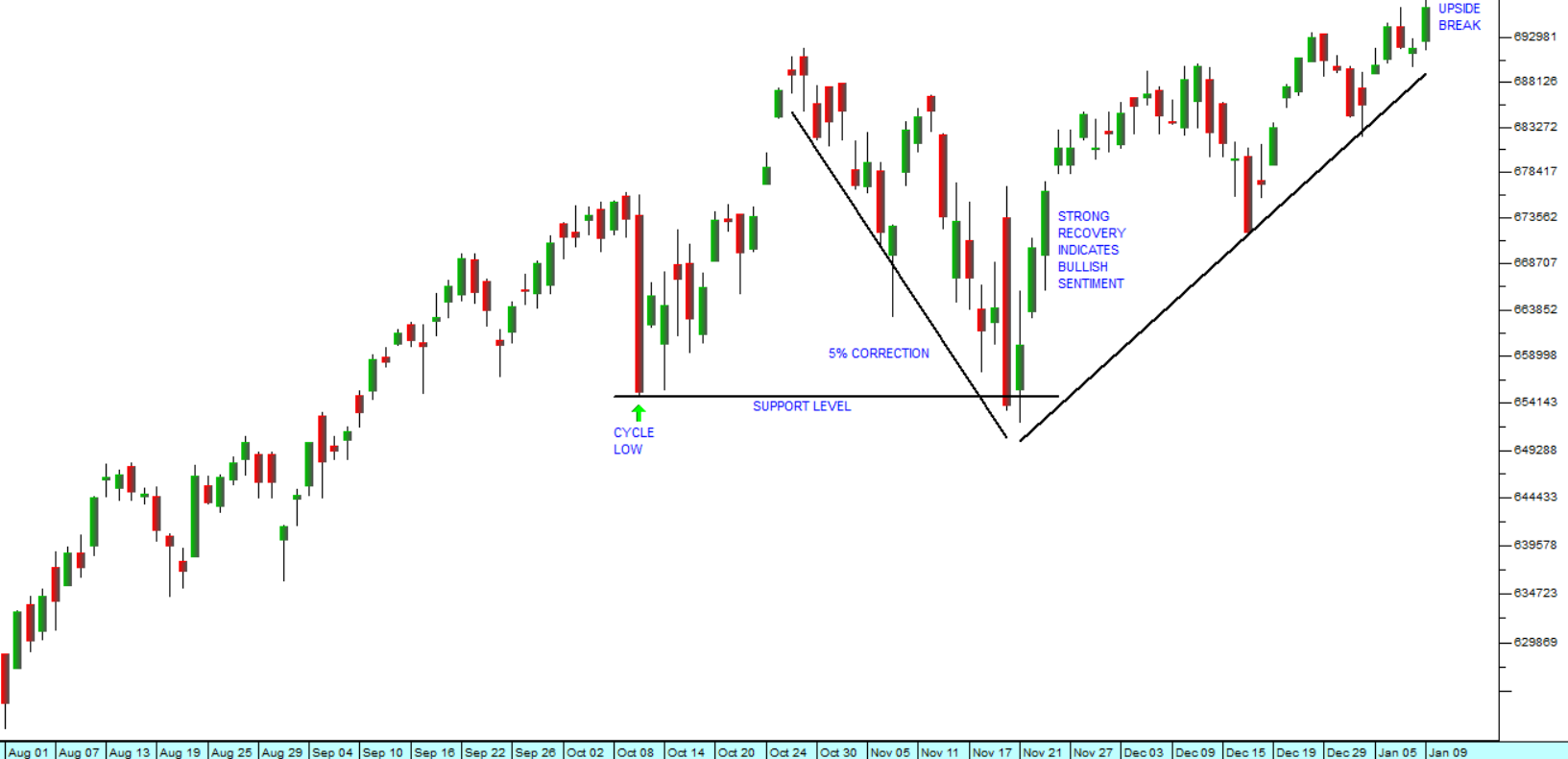

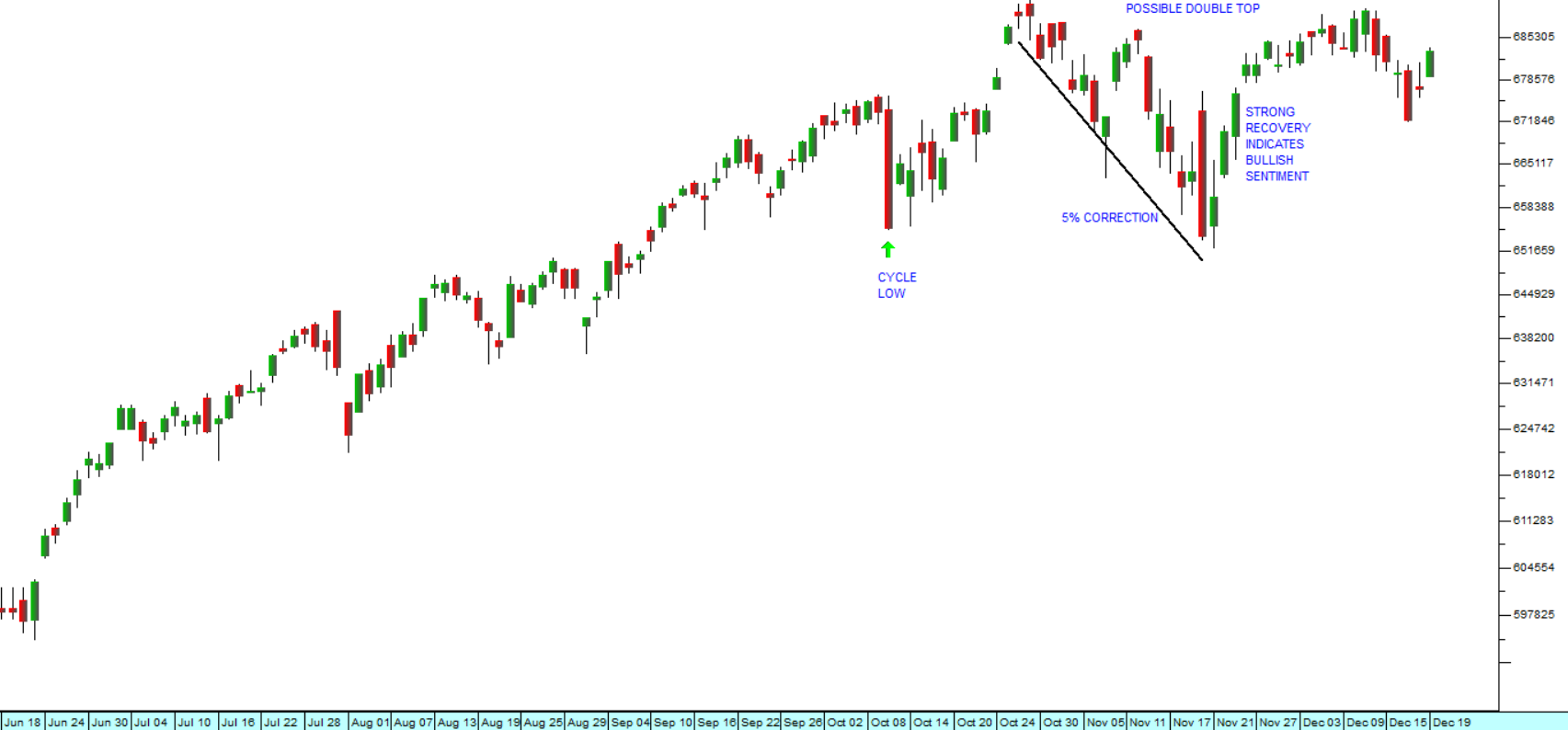

In our view, the Choppies business proposition gained momentum leading up to the publication of its financials on 22nd September 2025 causing its share price to run up too quickly – accompanied by rising volumes. Investors felt that the company had suddenly caught the attention of institutional investors.

On 8th January 2026, probably a single investor decided to take profits and gave a market order to his broker to sell a million shares “at best”. The investor concerned was almost certainly a beneficiary of the Choppies “Long-term Investment Scheme” (LTI) and a member of the company’s senior management. The trade demonstrated his ignorance of the share market because he dumped a huge amount of shares into a relatively thinly traded market in a single day. A more experienced investor would have dribbled the shares into the market over a number of days thus giving time for the market to adjust. The problem is that 89% of the shares in issue are held by just two investors – which means that the “free float” is relatively small.

So, how should you have handled this situation as a private investor? The answer is to strictly apply your stop-loss strategy. On the day after the share fell (Friday 9th January 2026) you should have sold out your holding on stop-loss. You would have got prices of at least 400c per share. If you bought the shares when we put them on the WSL on 6th March 2025, you would still more than quadrupled your initial investment. The lesson is never ignore your stop-loss.

And what should you do now? Well, when a share falls heavily like this, we always advise applying a 65-day exponential moving average (MA) and then waiting for the price to break up through that MA. There may still be some bad news which has not come out so you don’t want to buy prematurely. Wait for the share to settle down at these lower levels and then buy when it begins to move up again.

Notably, Choppies, at its current price (290c), is now on a P:E of 41 – which is far more attractive than its peak of over 113, but still very fully priced when compared to other grocery retailers on the JSE. Shoprite is on a PE 19.6 of and Spar is at 18,41.