Construction

The entire construction industry was decimated by the 2008 sub-prime crisis, the ANC under Jaco Zuma’s presidency and then finally by the pandemic in 2020. Hundreds of thousands of jobs were lost and massive companies like M&R were reduced to penny stocks on the JSE.

The JSE Construction and Materials Index (JS5011) lost just over 90% of its value over a period of twelve-and-a-half years.

Towards the end of last year, when it became obvious that the ANC would not be in control of Parliament after the election, the first signs of recovery began to appear. Since then, we have been adding construction shares, one by one, to the Winning Shares List (WSL) as we felt that their prospects had improved sufficiently.

WBHO (WBO) – This company probably survived the last 15 years in construction better than any other dropping to a low market capitalisation of R4bn in the immediate aftermath of the pandemic. We added it to the WSL on 19th September 2023 at R120.87 and it has since risen about 50% and now has a market capitalisation of R12bn.

Two weeks ago, we ran an article on Murray and Roberts (MUR) in which we pointed out the opportunity which it represented once it had managed to get its debt situation under control. We added it to the WSL on 21st December 2023, at a price of 106c and it has since more than doubled to 220c.

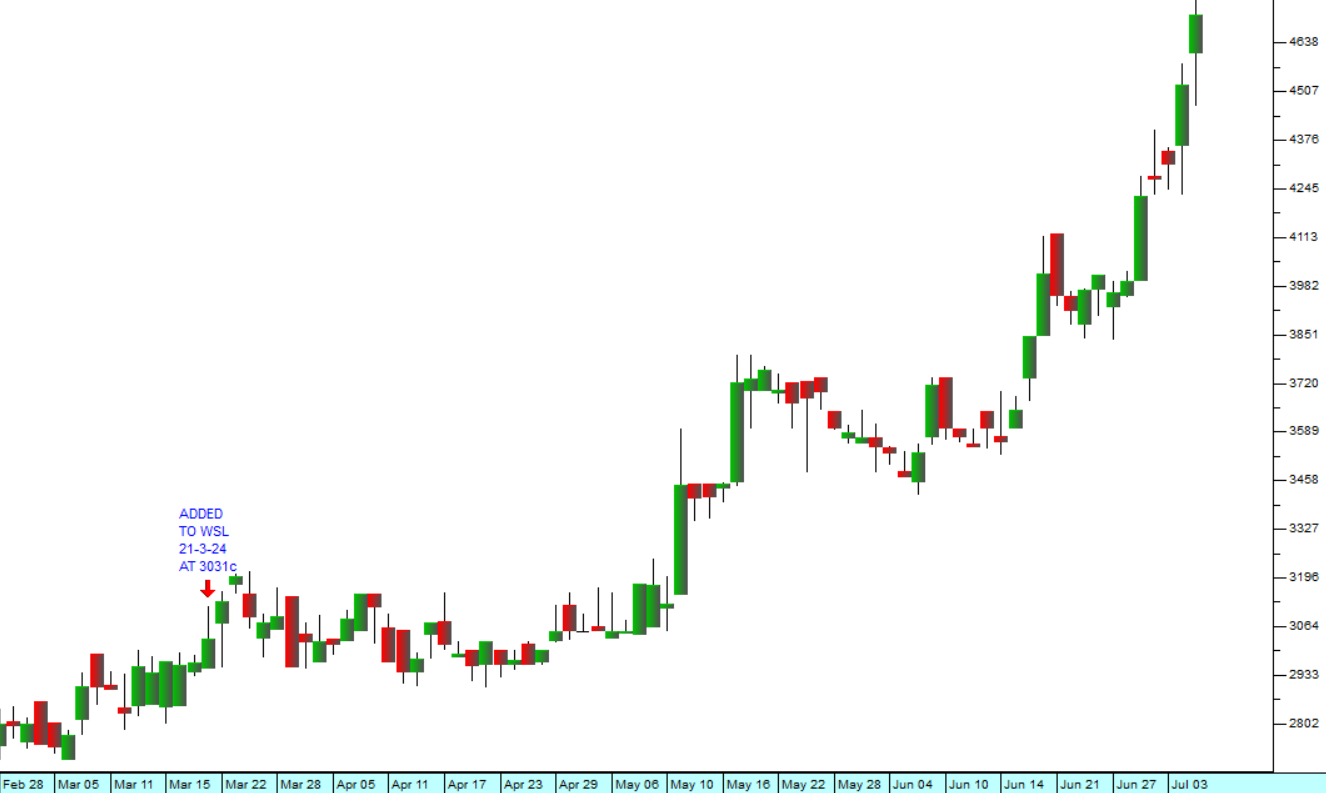

Raubex (RBX) - Was originally involved in construction, materials, and infrastructure, but with the dearth of construction work, branched out into solar and wind energy to survive. We added it to the WSL on 21st March 2024 at a price of 3031c and it has since climbed 55% to 4720c. Consider the chart:

Afrimat (AFT) - This company branched out into the mining of base metals and minerals (iron ore, manganese, phosphates, chrome and coal) to survive the collapse of the construction industry, but it still supplies composites, construction materials and other commodities to a range of industries in Southern Africa. We added AFT to the WSL a month ago on 9th May 2024 and it has already risen 11.35% since then.

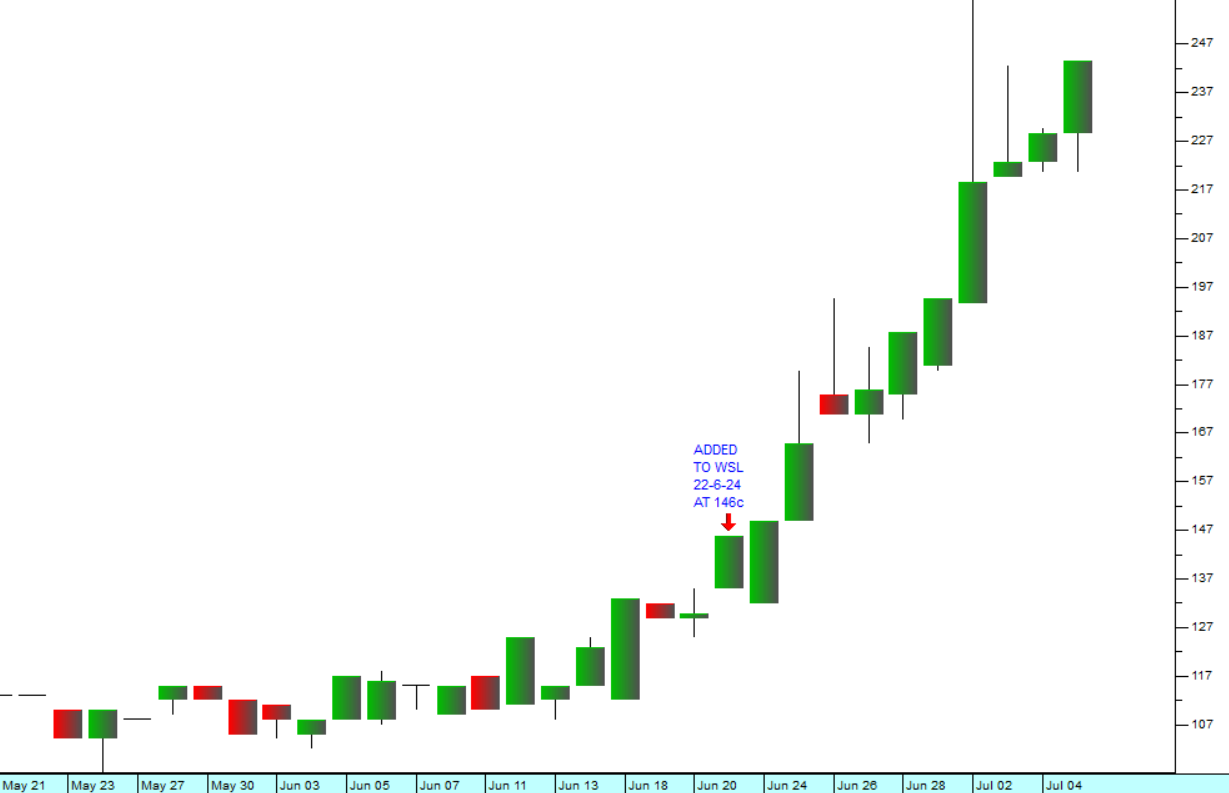

Stefstock (SSK) - Is a company involved in roads and earthworks, marine construction, concrete structures, bulk pipelines, piling, geotechnical services, open pit contract mining, affordable housing and mine residue disposal. On 14th November 2007 it reached a share price of 2700c on the JSE. By 13th December 2019 it had fallen to just 8c. We added it to WSL two weeks ago on 22nd June 2024 at 146c. It has since risen by 67% to 244c. Consider the chart:

Sephaku (SEP) - supplies ready-mixed cement products and cement to the construction industry. Its fortunes are a direct function of the progress of the construction industry generally. We added the share to the WSL last Tuesday (2-7-24) at a price of 160c. By Friday it had already risen by 11.25% to 178c.

What you can see is that the election result, combined with the formation of the Government of National Unity (GNU) in South Africa presage a significant increase in construction spending in this country. Public/private partnerships are likely to see a massive amount of investment into various infrastructure projects.

In our view, the boom in construction spending is just beginning.

← Back to Articles