Uncharted Territory

15 June 2022 By PDSNETThe world has entered a turbulent time, the outcome of which will largely determine the future order of things. There are six great areas of uncertainty which the private investor should formulate a coherent opinion on:

- The war in Ukraine is in reality the remnants of the cold war, a low-level conflict being fought between what remains of the USSR and the NATO alliance. It is a war which is costing both sides heavily in men and equipment. The difference is that the NATO alliance is massive economically and has the depth to continue virtually indefinitely, while Russia’s resources are decidedly limited. If Ukraine is accepted as a NATO member in the next few weeks, the stakes will certainly have been increased. Nobody can predict the final outcome of this conflict, but it is important for you to formulate a view.

- The battle between fascism and democracy is also being fought overtly by the US Senate’s J6 committee, during prime time, in the American court of public opinion. At the same time, behind closed doors, it is also being fought by the Department of Justice and in the criminal courts. The polarization of the world’s primary democracy over this issue has been frightening and, again, the final outcome is still far from certain.

- While all this is going on, there has been a sea-change in the markets of the world. The era of quantitative easing (Q/E) has ended abruptly and the era of monetary and quantitative tightening (Q/T) has begun. The Federal Reserve Bank is reducing the size of its balance sheet by $47,5bn a month (and promises to double that figure in September this year) and raising interest rates rapidly. They are intent on steadily mopping up all the surplus cash in the system – and that is the cash which has been driving the 13-year-old bull market which began in March 2009. Quantitative tightening is a monetary policy which has never before been tried on this scale and hence the consequences remain substantially unknown. What we do know is that, since the time of Alan Greenspan, it has become politically unacceptable to allow the US economy to go into a protracted recession, especially in the run-up to an election.

- The massive advances in technology over the past decade are still working their way through the economies of the world. Mostly they are enhancing efficiency and productivity, but their long-term effects are substantially unknown. The switch to renewables appears to be gaining momentum, but has clearly been insufficient to prevent Russia from using oil and gas as a weapon against various NATO countries. Indeed, the war in Ukraine itself has become an extraordinary demonstration of the importance of technology.

- Here in South Africa, we are facing our own rending battle between the factions within the ANC. The disgruntled Zuma camp, now out of power, is clearly missing their ill-gotten gains from state capture while the newly constituted National Prosecuting Authority (NPA) under Ramaphosa appears to be stepping up its efforts to obtain convictions. The November ANC elective conference is looming large and behind that is the next general election in which the ANC looks likely to lose its majority. What will happen in South Africa without a party which dominates parliament?

- In the background, behind all these uncertainties, lurks the great unknown of climate change and possible global warming. This factor, although probably not as imminent as the others mentioned above, is nonetheless going to begin to impact markets more and more. The floods in Natal are just an appetizer for what may be to come.

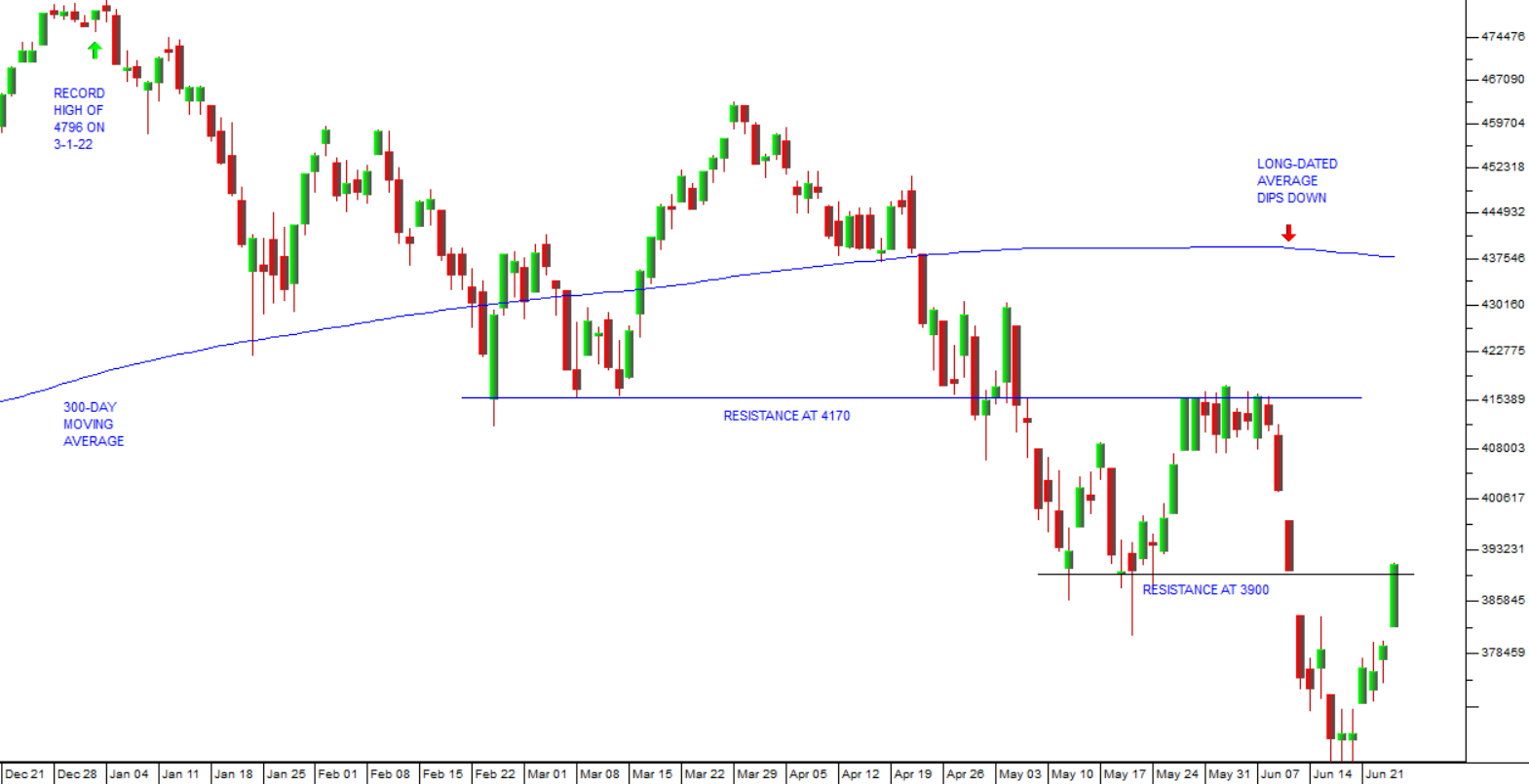

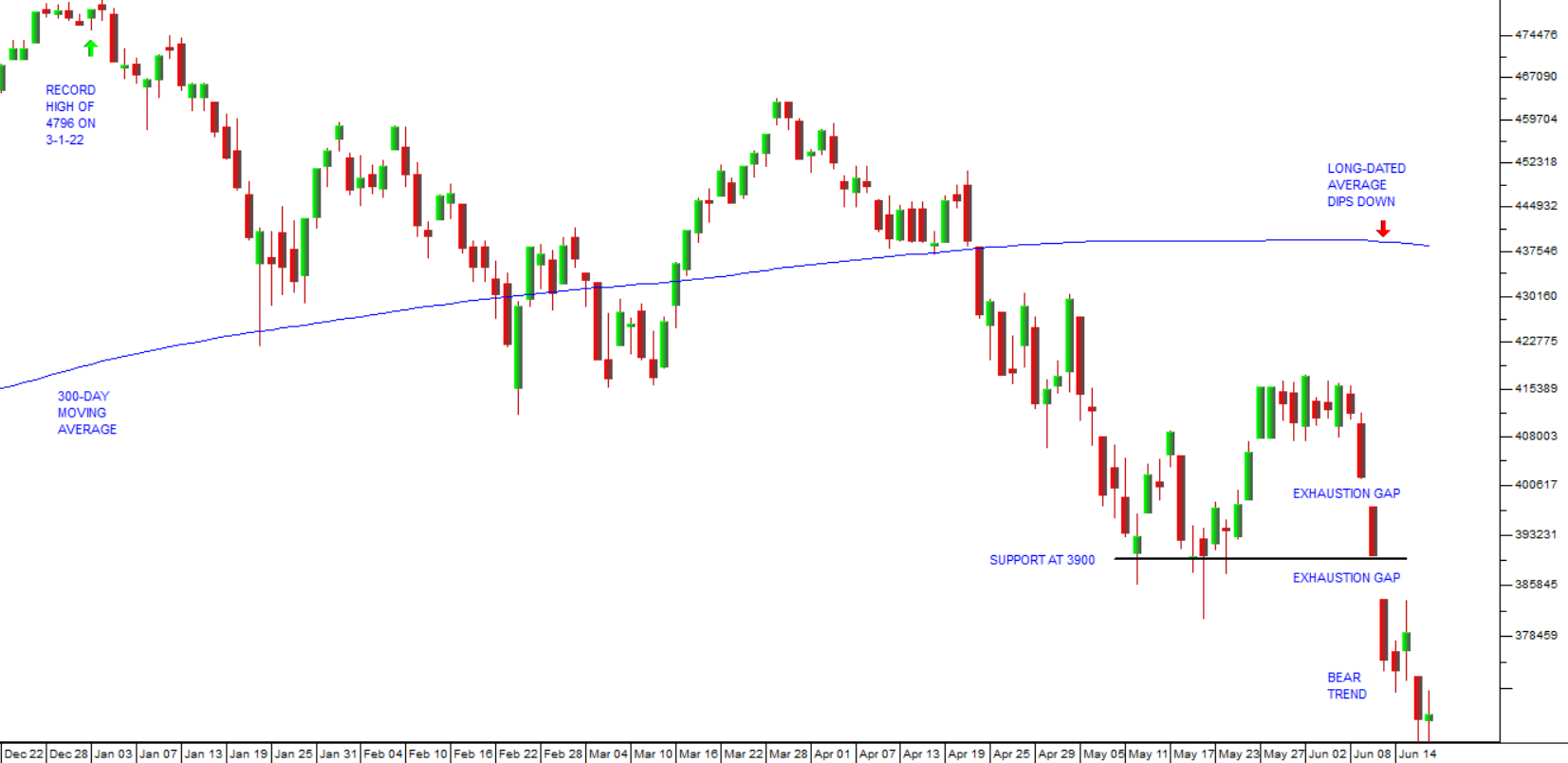

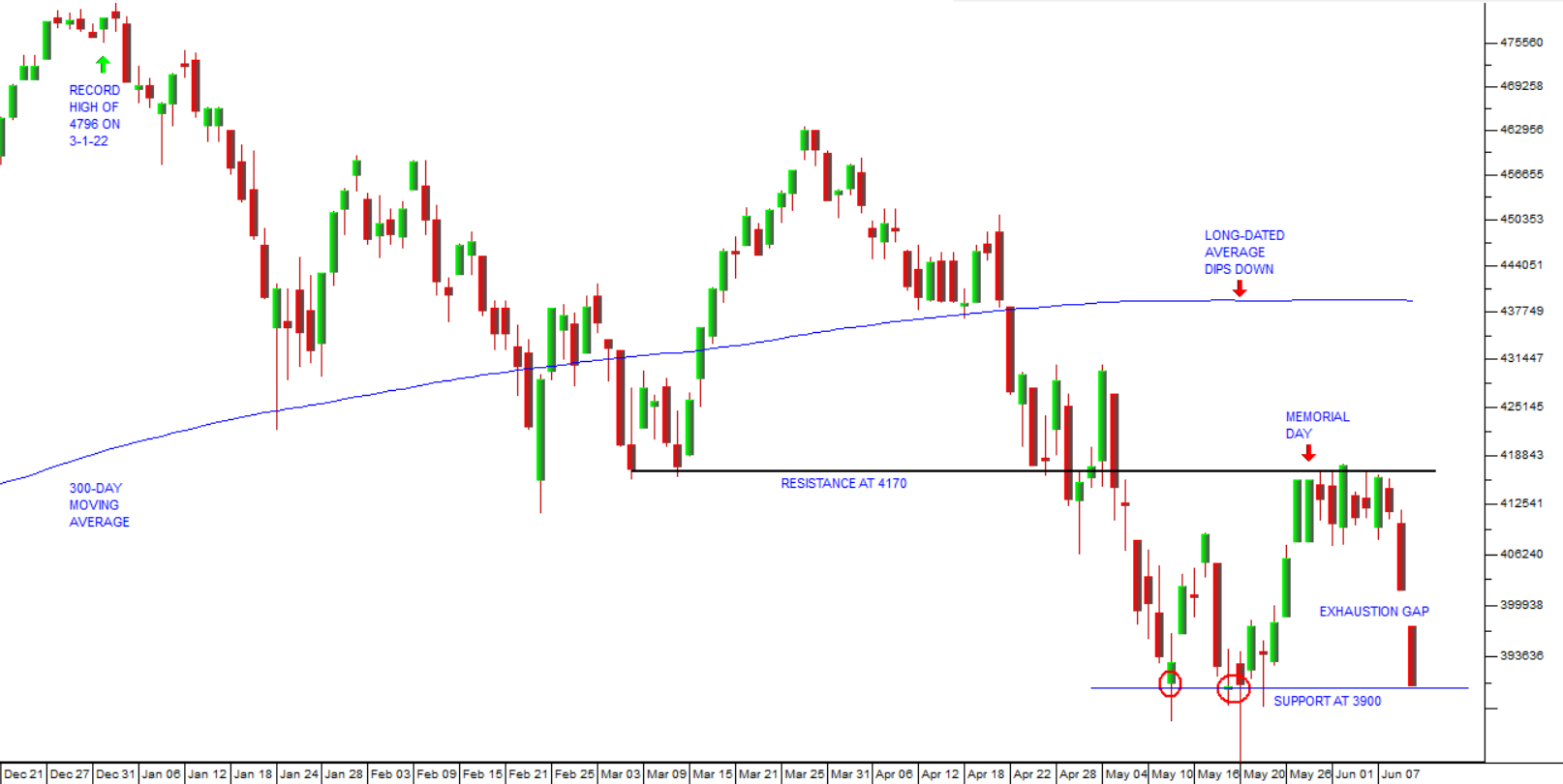

On Monday this week, Wall Street entered a primary bear market when the S&P500 index fell more than 20% below its record high of 4796 made on 3rd January 2022. We repeat what we have said previously, that during a bear market it is best to be completely in cash – because even high-quality shares will fall in line with the market. If you are in cash, you can wait patiently for some, or all, of the uncertainties mentioned above to resolve themselves before hopefully buying those same high-quality shares at much lower levels.

So, our advice is to be patient and observant. Keep your powder dry. Reduce your expenses and try to live well within your income. Watch the markets closely for signs of the bottom of the downtrend. Most bear markets in recent history have been fairly short-lived and taken the market down about 50% – but as we said above, we have no real experience of quantitative tightening so it is difficult to predict exactly how far down this market will go or how long it will last. It seems highly unlikely that the Biden administration would want to fight the 2024 election into the teeth of a recession.

Once again, we urge you not to ignore your stop-loss strategy.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: