Two Elections and Two Wars

8 January 2024 By PDSNETAs the New Year begins, private investors should consider the most important factors which are likely to impact on the prices of shares and the profits of companies listed on the JSE. Some of these factors are local, like the general election which is expected to take place sometime in May, and some are international like the oil price, the strength of the American economy, or the outcome of the US presidential elections.

It now seems highly likely that the ANC will not be returned with a majority in Parliament in the general election later this year. Even their own polling indicates that they will almost certainly be forced to compromise with at least one other party after the results are in. The DA’s polling indicates that the ANC will get 39% of the vote while they will get 32% - and that therefore their alliance of minor parties may get sufficient votes in total to displace the ANC completely.

Given the extraordinary mismanagement of the economy which has characterized the ANC’s 30 years in office, such a development could certainly be expected to have a significant long-term impact on equity prices.

The price of oil is an incredibly important factor, both locally and internationally because it impacts directly on inflation rates and growth levels around the world. Since President Biden’s visit to Saudi Arabia in mid-2022, the oil price has been in a downward trend – and there is no indication that it will rise significantly during 2024.

The lower oil price has almost certainly been the most important factor in enabling the US economy to enjoy a “soft landing” despite the 10 interest rate hikes totalling 5% which have been implemented there. The soft landing of the US economy together with the massive job creation and rising stock market during the Biden presidency will be major factors in his favour in the presidential elections in November 2024.

At the same time the lower oil price is impacting directly on the situation in Ukraine. The cumulative impact of drop in the oil and gas prices combined with significantly lower volumes over the past year has damaged the Russian economy badly, at a time when it can least afford it.

Russia’s desperate need for additional soldiers to fight in that war has resulted in them offering foreign nationals’ Russian citizenship and a signing up bonus of $2000 to join the fight against Ukraine. This offer is appealing to migrants from Kazakhstan, Uzbekistan, Kyrgyzstan, Turkmenistan, and Tajikistan. It is also attractive to potential migrants from other countries like Cuba, Ethiopia, Nepal, and Syria. But the quality of the troops which it produces is highly suspect and their morale is very fragile.

Ukraine is also feeling the need for more soldiers with President Zelensky suggesting the conscription of a further 500 000 people.

In our view, the war will continue until Russia runs out of financial, human, and military resources – and it is difficult to predict exactly when that might happen. Our view is that NATO, including America, will find a way to continue supporting Ukraine because the prosecution of this war is highly beneficial to them. It is accomplishing their need to deal with Putin’s megalomania and to degrade Russian military capability.

It is difficult to predict what will happen in the US presidential elections, but we believe it is becoming increasingly difficult for Donald Trump to win. He is facing ninety-one criminal charges in four cases at both the Federal and state levels. The US Supreme Court is now considering the decision of the Colorado supreme court to remove him as a candidate from the primary ballot in that state.

In addition, while Biden has not been doing well in the polls, the Democrats have been winning minor elections all around the country. Much of this has to do with the massive loss of support for Republicans following the Roe Vs Wade decision which deprived women of important personal rights.

Overall, we are positive about the prospects for equity markets and the JSE in the year ahead. With two critical elections and the on-going prosecution of the wars in Gaza and Ukraine (which are in our view connected), we see it as a year in which the forces of fascism both here in South Africa and elsewhere are likely to be substantially diminished.

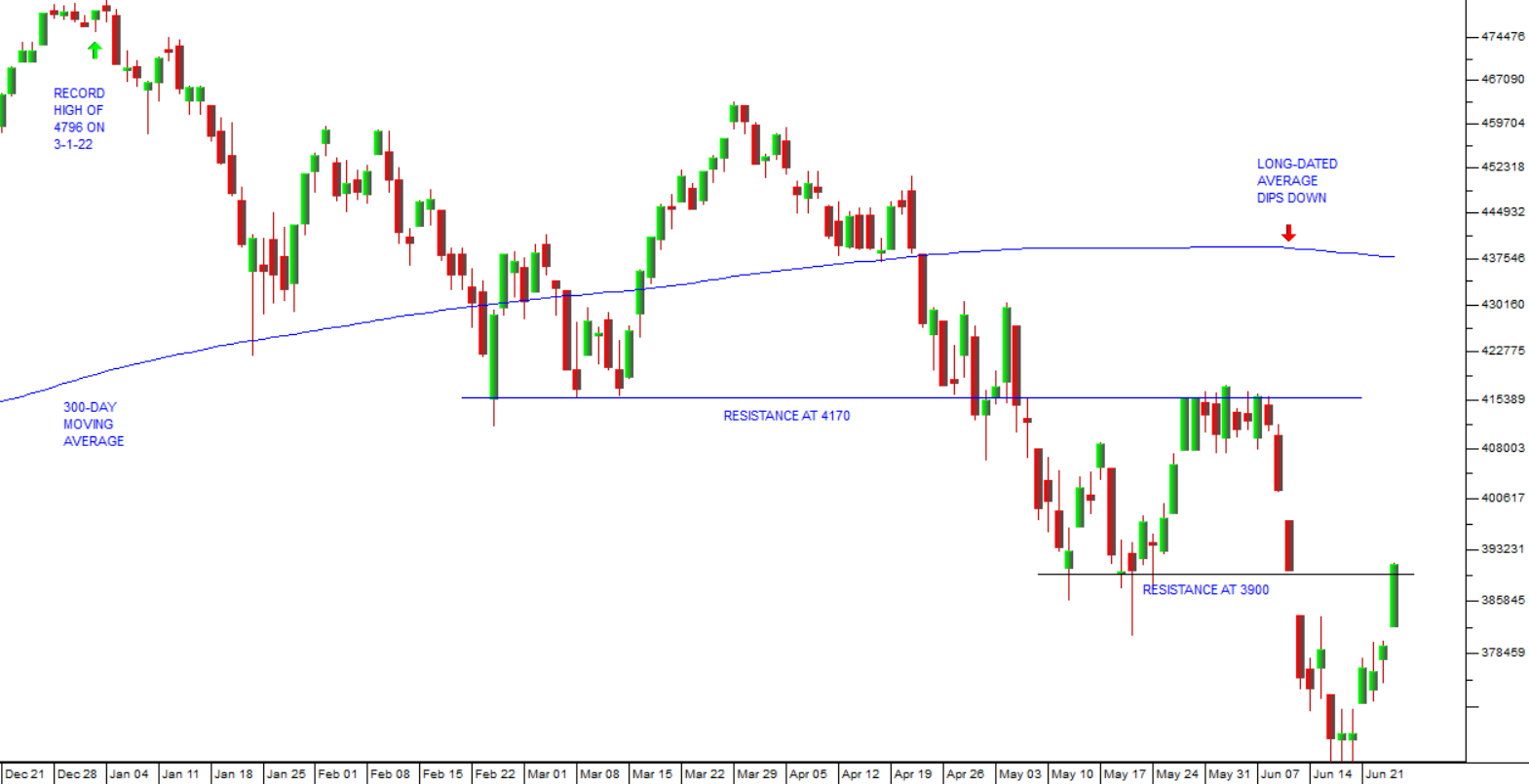

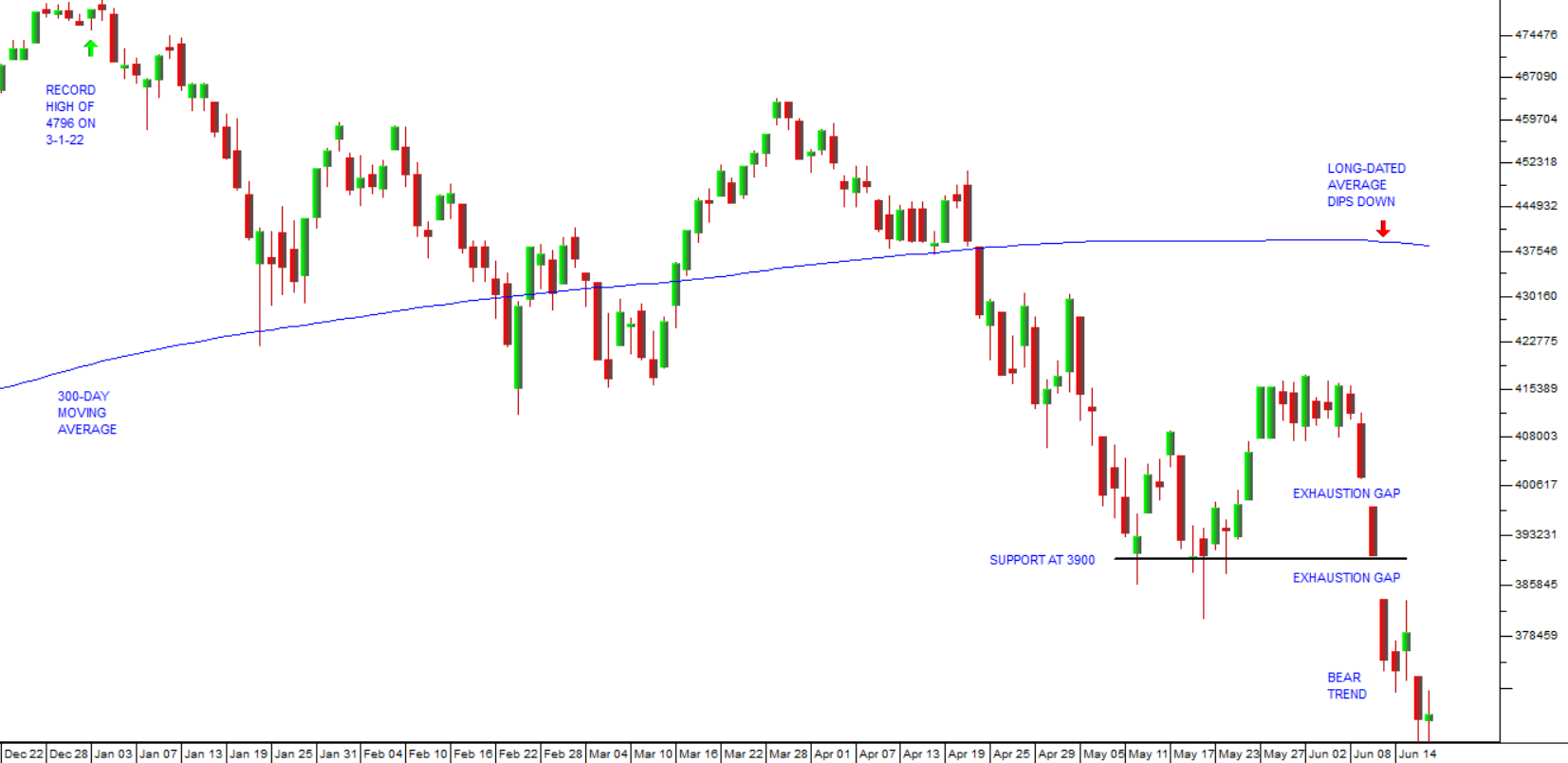

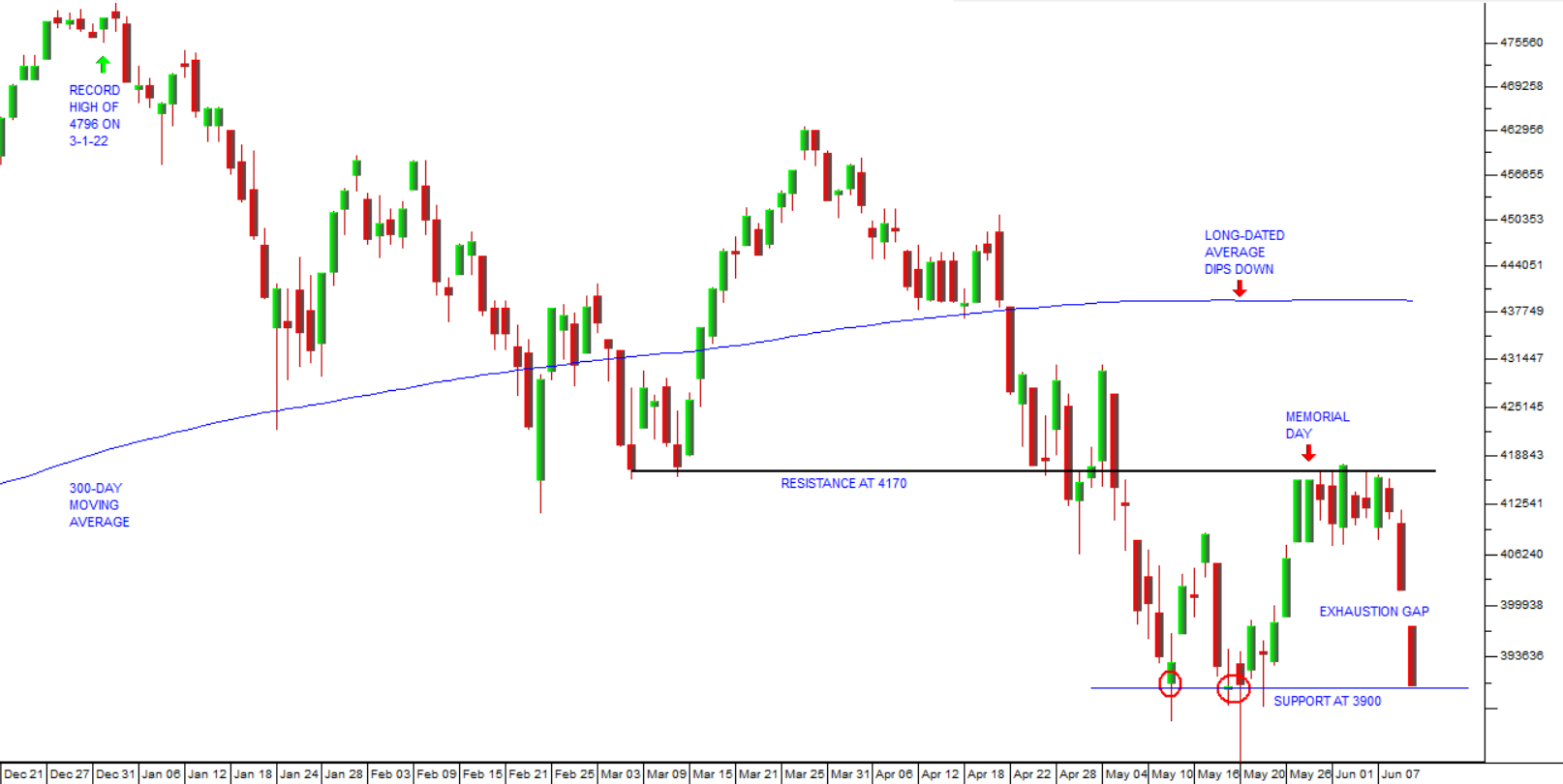

The S&P500 index is on the brink of breaking up to a new all-time record high and it is our view that, when this happens, it will presage a substantial further upward move in stock markets around the world including the JSE.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: