4Sight

29 January 2024 By PDSNETThe world has, in the last twenty years, entered what has been characterised as the 4th Industrial Revolution (4IR). It has been described as “... the biggest structural change of the past 250 years — a transformation of scale, scope and complexity unlike anything humankind has experienced before.” In simpler terms, 4IR refers to the digital convergence of artificial intelligence (AI), the Internet of things (IOT), robotics and cloud computing.

The importance of 4IR was perhaps best illustrated by the announcement of Tesla’s Optimus Gen 2 humanoid robot in December 2023. This robot is specifically designed to operate in and learn from a world which is designed for people. It has the physical form and capabilities of a human being, but with greater strength and endurance.

Elon Musk suggests that within a relatively short time there will be millions of humanoid robots in the world performing thousands of boring, repetitive or dangerous tasks which are currently done by people. This development is at once both exciting and frightening since it will revolutionise almost every aspect of human behaviour. 4IR aims to increase productivity in all areas of human endeavour.

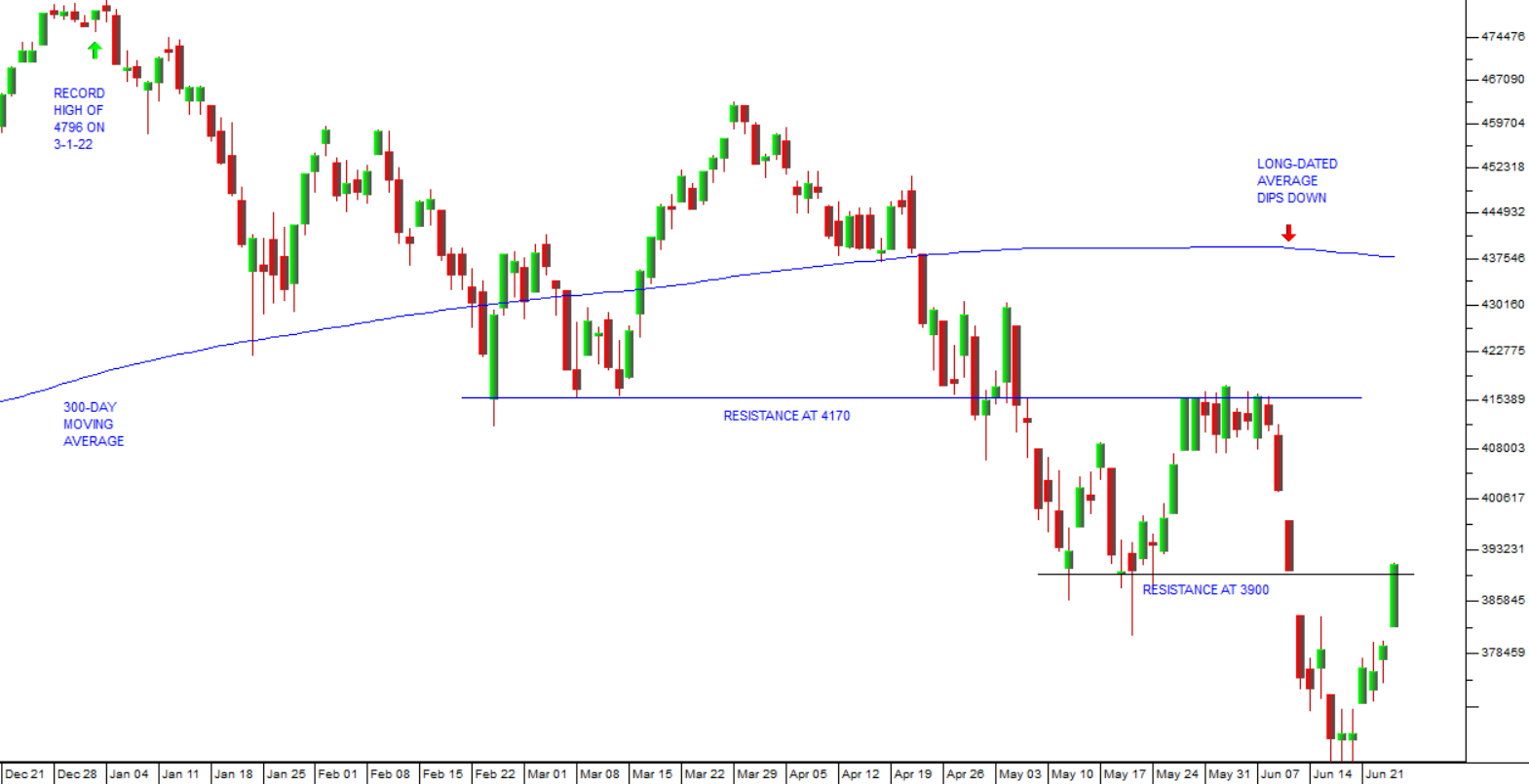

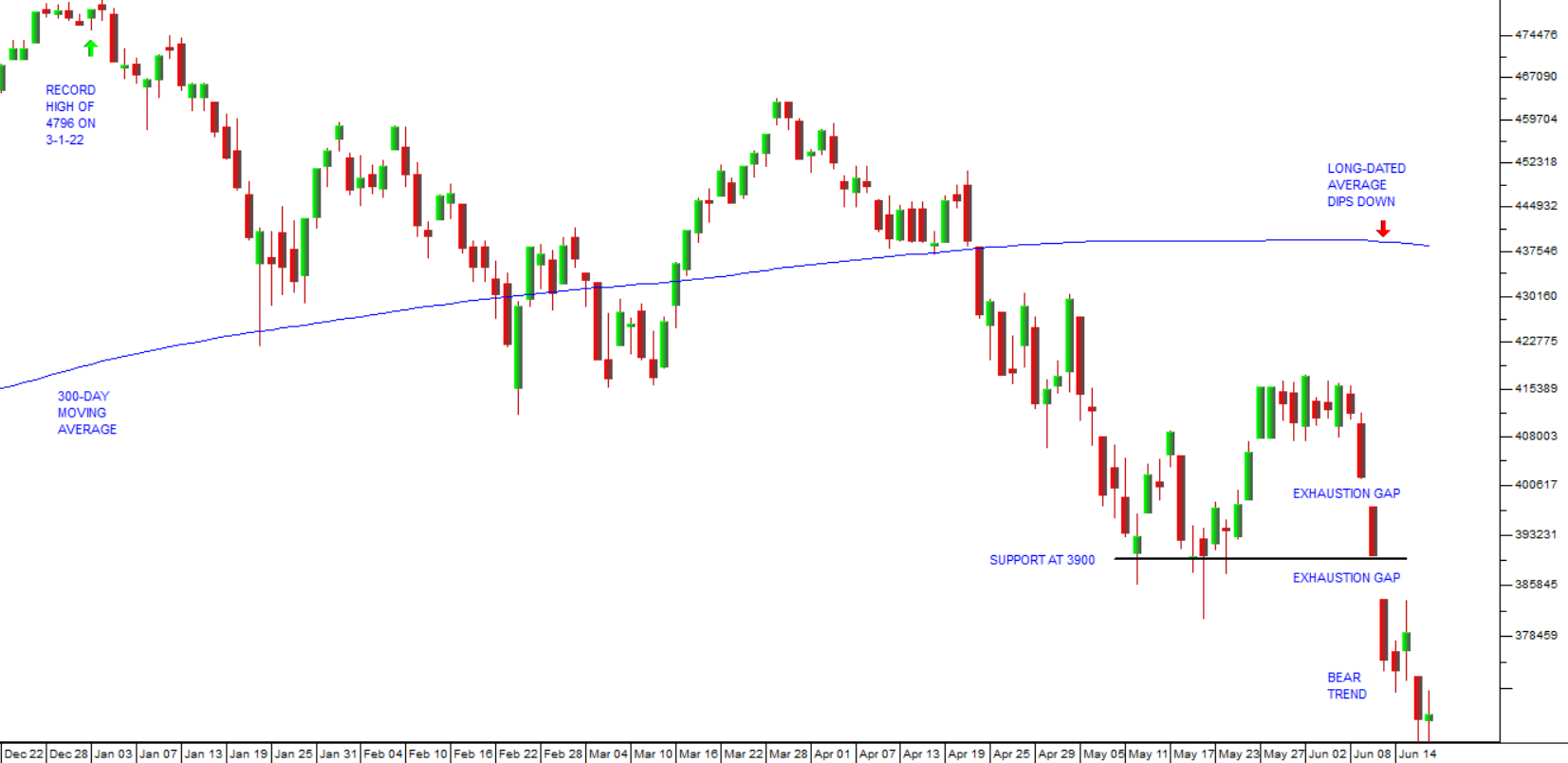

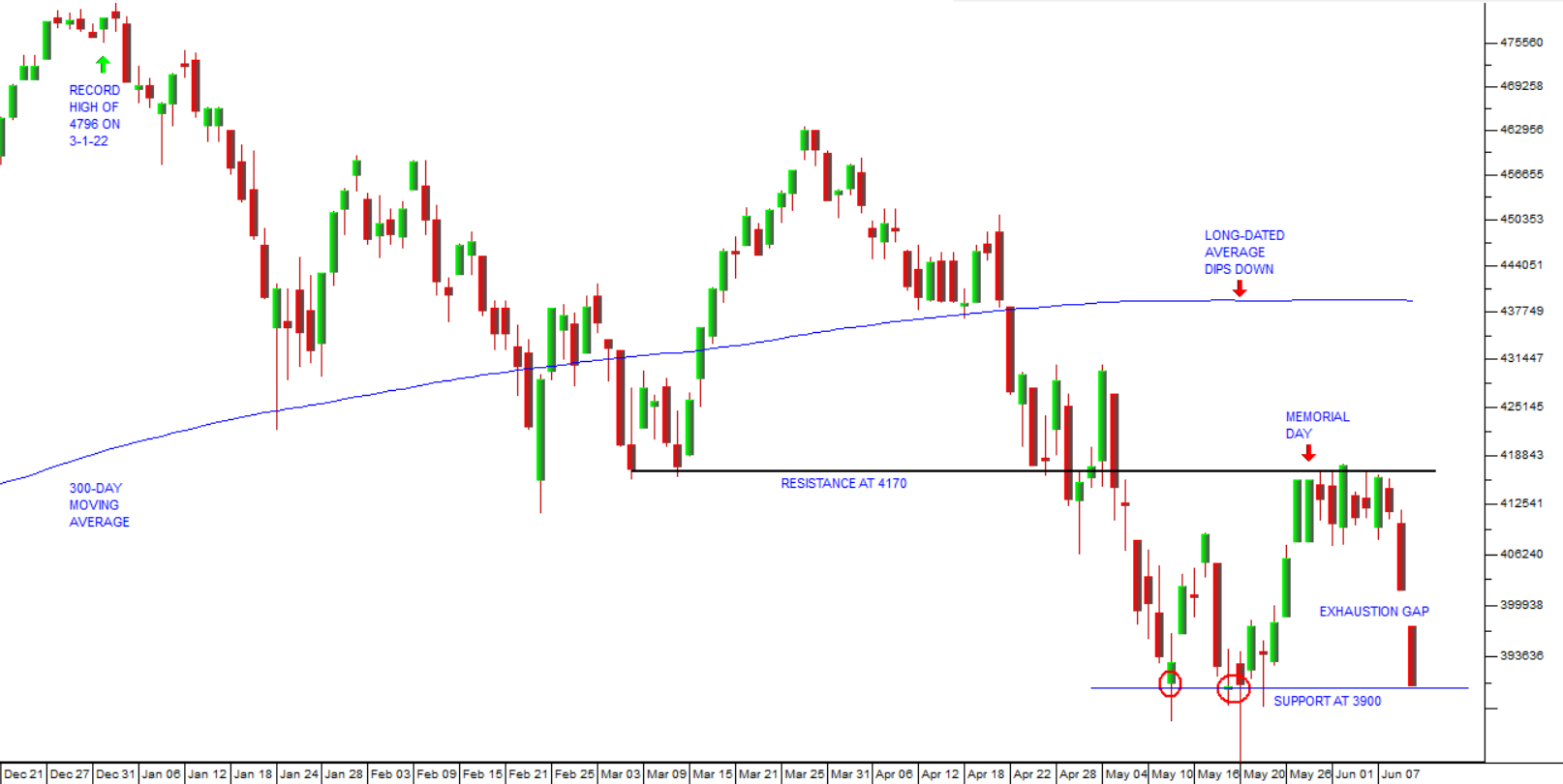

The only company listed on the Johannesburg Stock Exchange (JSE) which is specifically exploiting the shift to 4IR directly is 4Sight (4SI). 4SI listed on the JSE in October 2017, but only began to attract the attention of investors towards the end of last year. We added it to the Winning Shares List on 5th August 2023 at a price of 31c and it has since risen to 72c. Consider the chart:

The company operates through four “clusters”:

- Operational Technologies - 4IR technologies and services to help industrial customers with their full end-to-end digital transformation journey.

- Information Technologies - enabling the digital transformation of ERP, accounting, human resources, and payroll disciplines.

- Business Environment - partners with customers to drive value-creating digital transformation in specific areas of the business.

- Channel Partner - supporting and empowering an ever-expanding channel of value-added resellers across Africa, the Middle East, and Central Europe.

In its results for the six months to 30th June 2023, the company reported revenue up 37,1% and headline earnings per share (HEPS) up 197,2%.

The company’s balance sheet shows a healthy cash balance of R93m, up 33% on the previous comparable period.

In our view, this is a company growing rapidly on the back of the latest developments in computers and the internet. The only real problem with investing in a share like this is understanding exactly what it is that they do – but they are clearly very successful and expanding quickly.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: