Aveng Consolidation

13 December 2021 By PDSNETWith the destruction of the South African construction sector following the 2010 Soccer World Cup, the Aveng share price collapsed from around R75 in August 2008 to as little as 1c following its two 1,5c rights issues in 2021. The company is now left with two profitable companies:

- Moolmans, a construction company in South Africa with a focus on mining contracts; and

- McConnell Dowell, a construction company in Australia which generates about 66% of group revenue.

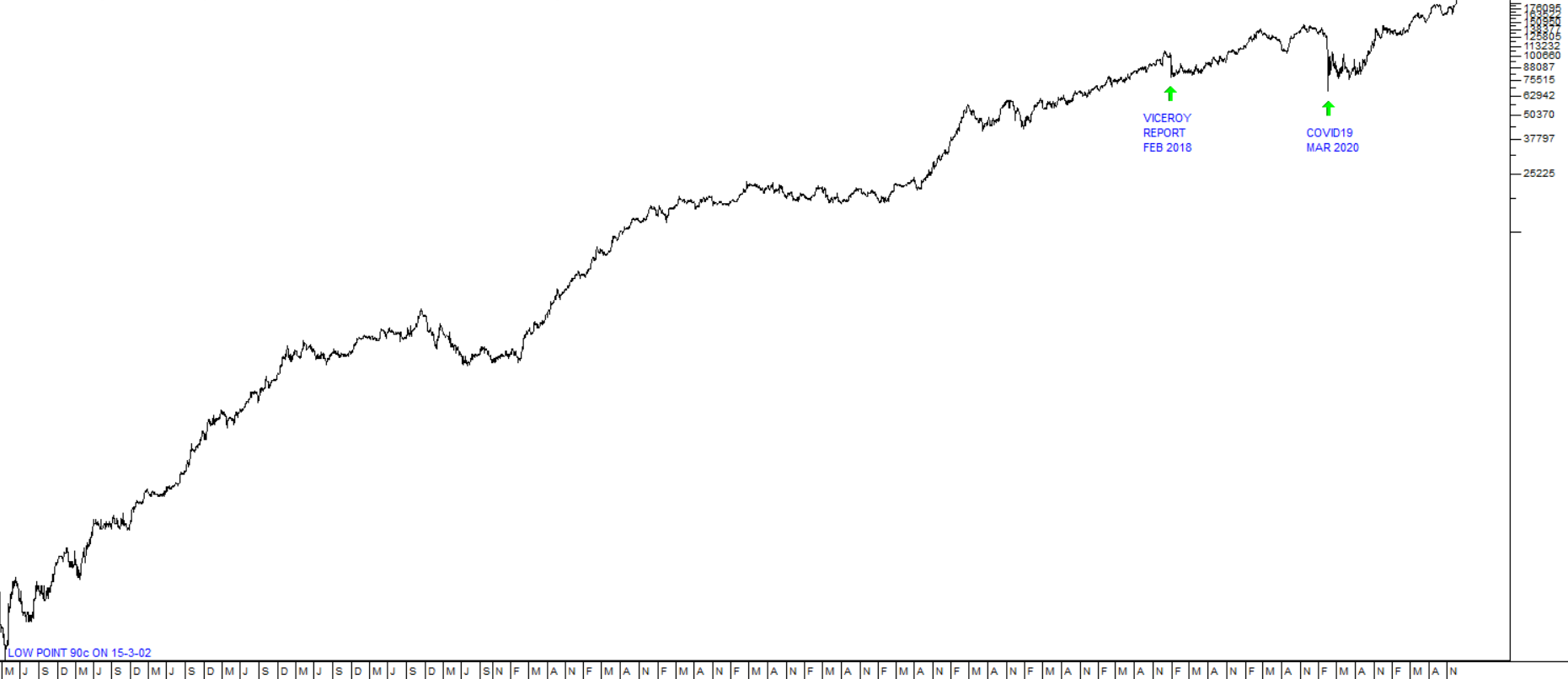

We previously suggested that readers could take a speculative punt on Aveng as far back as 2018. Read "Our Aveng Story" here. Those who took up this suggestion and followed their rights ended up with Aveng shares at an average cost of about 2,5c each. In the second half of 2021 the share was trading for between 5c and 6c and it had become a speculators plaything with millions of shares changing hands every day. After the two rights issues, the company found itself a heavily traded penny stock with 60bn shares in issue.

To resolve this situation, the company decided to undertake a 500-for-1 consolidation to take effect on 8th December 2021. In other words, every 500 shares at the close of trade on 7th December 2021 were converted into 1 share when the market opened the next day (8th December 2021). Consolidations are relatively rare on the JSE and are usually done where the company wants to get away from speculators and the stigma of being a penny stock.

A person who bought R10000 worth of the shares for 4c each and then followed their rights would have ended up with 566 000 shares trading for between 5c and 6c immediately before the consolidation. The consolidation would then have reduced their holding to 1132 shares (566000/500) trading for between R20 and R30. As it happens, after the consolidation many of the speculators decided to take their profits and go elsewhere (which was the objective) and the resultant profit taking caused the share to fall to 2550c.

In its most recent results for the year to 30th June 2021, the company reported headline earnings per share (HEPS) of 2c -which came to 1000c per share after the consolidation. This puts the company on a price:earnings ratio (P:E) of 2,55. Given that it had work in hand worth R25,3bn and a net cash position of R1,1bn at 30th June 20201, this makes the shares extraordinarily cheap.

The JSE overall index has an average P:E of 12,18. It would be reasonable to expect a construction company to trade at a lower P:E – but even if it trades at half the P:E of the overall index (at say, 6) the shares should be changing hands for around R60 each. No doubt it will take a little while for the institutional fund managers to realise this point, but when they do, it seems reasonable to expect Aveng shares to rise rapidly.

Another interesting point is that on 23rd November 2021 Bernard Swanepoel who is a non-executive director of Aveng bought 5,9m Aveng shares at 5c each. Swanepoel is an extremely experienced and very well-known mining engineer who used to be the CEO of Harmony gold mine. I doubt he would be buying this share unless he saw a bright future. At the same time Aveng announced on 10th December 2021 that Bank of America has increased its stake in the company to just under 10%. You should ask yourself why a massive international banking group would be buying the shares of this little known South African construction company.

For the shareholder who bought the shares at 4c and followed the rights, the average cost per share (after the consolidation) would be around R12.50 – so that person has already made more than 100% profit and could see their profit rise to as much as 400% if the share rises to R50.

So, altogether this has been a great opportunity for private investors. It still remains a great opportunity to make a good profit, even from current levels.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: