2018 Will Be Better

3 January 2018 By PDSNETThe year just past was full of uncertainties � an extremely difficult year for private investors to assess. In the background was the general recovery of the world economy and its impact on our commodity prices. In the foreground was the looming ANC Elective Conference and the nail-biting uncertainties of South African politics.

The ANC conference is behind us now and South Africans generally are celebrating the unexpected Christmas present of Ramaphosa�s win. Of course, he is still in a very delicate position and the war is not yet over � but a very important battle has been won.

The impact of his win on the strength of the rand is proof of its significance. Now, at last, our country�s economy can begin to be run more rationally. A surge of hope is evident. Ramaphosa�s first task will be to appoint a new head for the National Prosecuting Authority (NPA). His choice is critical, because this person will have to decide what to do about the charges outstanding against Jacob Zuma. The question now is whether Ramaphosa is strong enough yet to choose an independent, competent and principled person. If he does, then Zuma will face a deluge of charges which will be very difficult to survive.

As we suggested more than a year ago, the US stock markets are booming on the back of strong economic growth. We expect this to continue and even to gain momentum, although some kind of correction is almost inevitable at some point. Europe, which was showing some good signs of recovery last year, will forge ahead this year. China, Japan and the countries of the Pacific Rim will feed off the general recovery, demanding more and more of our raw materials to manufacture their exports. Eventually, the entire world economy, South Africa included, will be in a boom and that will be reflected in stock markets world-wide.

Our rand is likely to continue strengthening for the time being as we attract more investment and as our economic management stabilises. At the same time, the economy which has already shown two consecutive quarters of growth will continue to recover. Any credit that Zuma claims for this will be even more farcical than Trump�s claim to be responsible for the US economic growth in the past year.

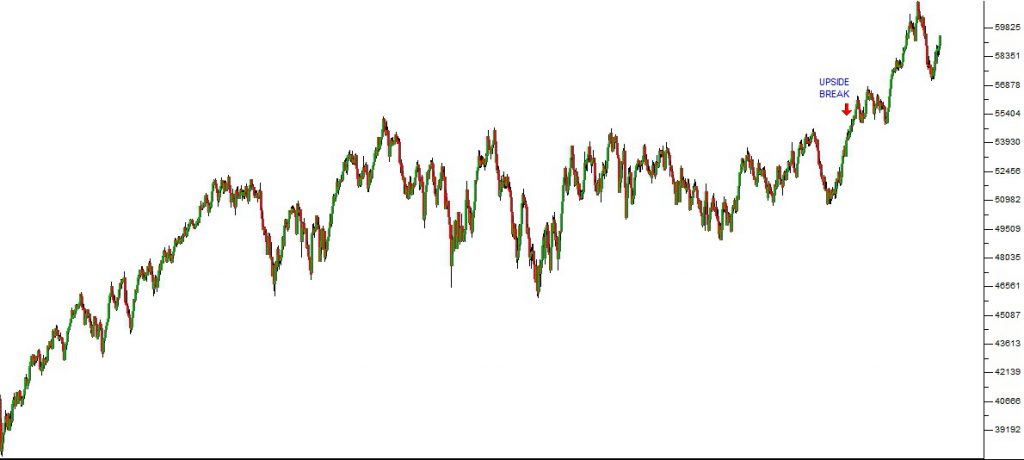

In the middle of last year, our JSE overall index broke up out of the sideways pattern in which it had been trapped for the previous three years. It is now busy following world stock markets higher:

JSE Overall Index - Chart by ShareFriend Pro

As an investor, our advice is for you to be almost fully invested in high-quality, blue chips shares. Of course, the boom will not go on forever � but we are confident that 2018 will be a very good year, both for the economy and the stock market - especially for those who maintain a strict stop-loss strategy.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: