The Confidential Report - February 2026

America

Since the previous Confidential Report on 3rd December 2025, the S&P500 index has completely recovered from its 5% correction in November last year. It has continued to move upwards making a new closing all-time record high of 6978.6 on the 27th of January 2026, and then a new intra-day record high, the next day. On the 28th of January it traded above 7000 for the first time in history.

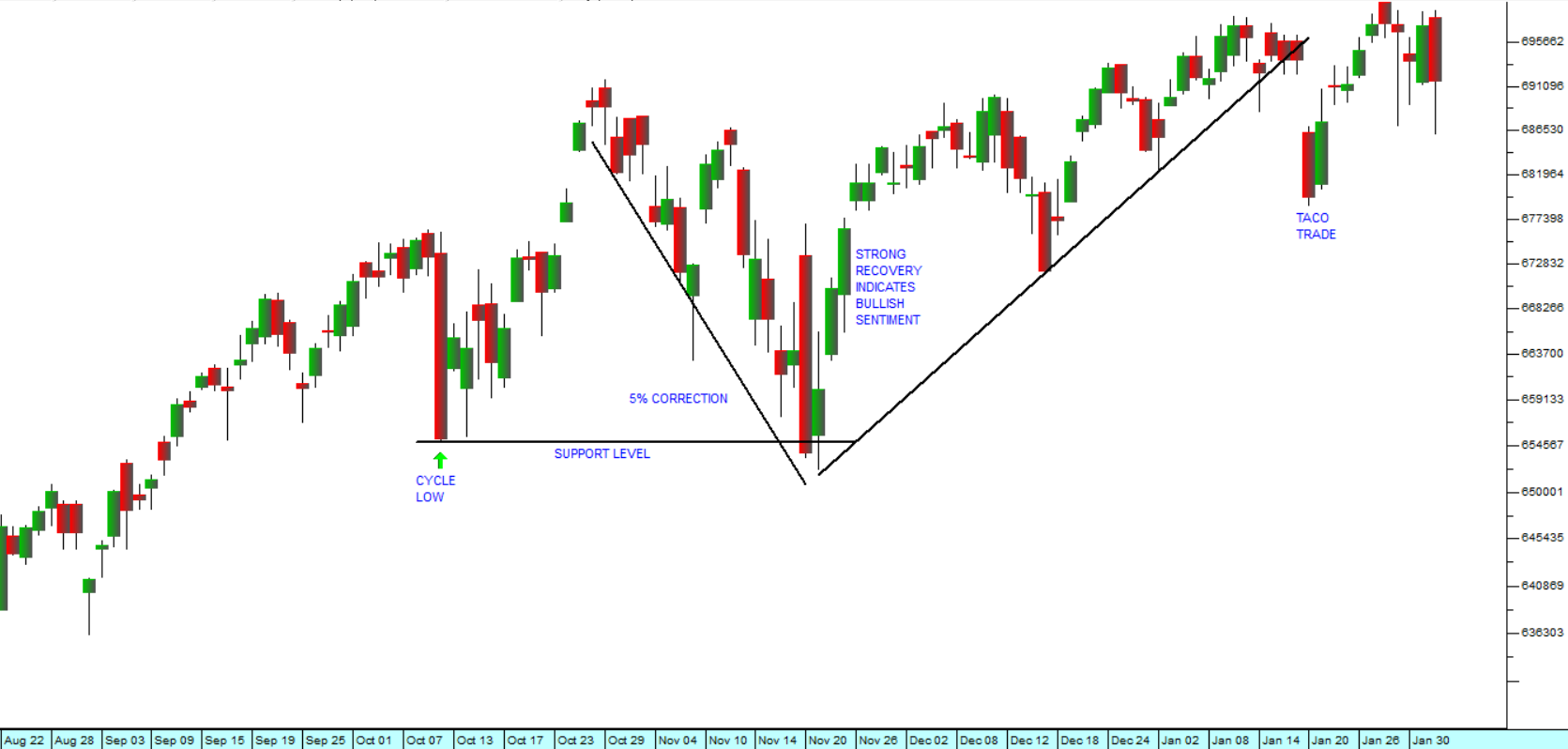

The market had a strong Christmas rally on the back of continued good news from the “magnificent seven” and technology shares generally. Following its record high there has been some rotation out of tech shares and some profit taking which has brought the index down a little, but the bulls continue to enthusiastically “buy the dips”. Consider the chart:

The chart shows the strong recovery from November’s 5% correction above the support level around 6550. Then there was a sharp drop on 20th January when Trump decided to impose tariffs on those European countries which did not support his Greenland ambitions. That provided the opportunity for a perfect “TACO trade” (Trump Always Chickens Out). We expect the S&P to continue rising steadily interrupted by periodic corrections.

Looking at the US economy, the monetary policy committee (MPC) decided to cut interest rates again on 9th December 2025 taking the Fed funds rate down to between 3,5% and 3,75%. Powell’s remarks were seen as bullish because he ruled out any interest rate increases in the near term and focused on supporting the weak labour market.

In December 2025 the US jobs number came in below 50 000 jobs created and gave an unemployment rate of 4,4% - down from November’s 4,5%. This shows that the jobs market has definitely “cooled” but is not yet in dangerous territory. With the steady reduction in interest rates we can expect the jobs number to begin to improve later in 2026. This should be balanced against the prospect of retrenchments due to the continuing spread of Artificial Intelligence.

The gross domestic product figures for the third quarter showed the US economy growing strongly at 4,3% per annum – much higher than the consensus forecast of 3,2%. This shows that the US economy is performing very well and that there is no reason to think that the bull trend will be dislodged any time soon.

The number of S&P companies providing positive guidance is higher than it has been at this time previously, especially among companies producing semiconductors & semiconductor equipment and software. This shows that AI is the driving force and supports the idea that the market will continue to rise.

We confidently predict that the S&P500 will close above 7000 soon and that it will continue to make new record highs going forward.

Trump’s nomination of Kevin Warsh as the new Chairman of the Federal Reserve Bank to replace Jerome Powell has been cautiously welcomed by the markets. Undoubtedly, Warsh will support Trumps demands for lower interest rates, but his appointment hardly means that the independence of the Fed is under threat. Warsh has previously been a member of the Federal Reserve Bank’s board of governors between 2006 and 2011, particularly during the 2008 sub-prime crisis. In any event, his appointment may lead to a more dovish approach to rates, at least in the short term, but it is unlikely to have a major impact on markets.

From a political perspective, everything now hinges on the Midterm elections coming up in November 2026. CNN polls are showing that the Republican party’s narrow lead in both Houses could be completely overturned. The polls currently show that the Democrats have a 5% lead – the same lead that they had in January of 2018 during Trump’s first term in office. In the mid-term elections that followed, the Democrats won an impressive 40 seats in the House.

In general, the voter turnout in a mid-term election is lower than it is in a Presidential election and it can be a major determining factor. The CNN poll shows that the Democrats have a 16% strong advantage over Republicans when it comes to those “...extremely motivated to go out and vote”. In our view, and especially considering the recent killing by ICE officials of protesting American citizens, the Republicans are probably going to lose both Houses, leaving Trump as a lame-duck president – and possibly even leading to his impeachment.

Trump’s capture of the Venezuelan President, Nicolas Maduro of Venezuela has boosted his confidence. His ambitions to make Greenland a part of America have significantly increased the level of political risk in the world. Investors have responded by buying more gold and other precious metals. NATO has been a solid part of the world’s balance of power since World War II and it is now under threat. Our view was always that Trump would back down on Greenland and his threats of tariffs against various NATO countries – which is exactly what he has done.

We believe that Trump’s influence is fading rapidly and that the midterm elections will negate much of his remaining power. His health is also coming into question with more evidence that he suffers from some kind of dementia. The activities of ICE have severely damaged his popularity, even among Republicans and there are demonstrations demanding his impeachment all over the country. Hopefully, the world will not have to contend with his dangerously erratic behaviour for much longer.

Bitcoin and Trump

On 15th December 2025 we published an article drawing your attention to the sharp decline in the price of Bitcoin and cryptocurrencies generally. In that article we wrote about the Nobel prize-winning economist, Professor Paul Krugman, who suggested that the fall of crypto prices was directly linked to the fall in Trump’s influence and power in America.

We believe that he may well be right. There can be little doubt that the Trump and MAGA movement have suffered some significant setbacks this year and that the excitement that his return to the White House created for cryptocurrencies has more than evaporated.

There can also be little doubt that the big players have been dumping their holdings of Bitcoin or as Krugman puts it, “the Trump trade is unwinding”. Consider the chart:

The chart shows the rapid decline in Bitcoin over the past 15 weeks since its high point of $125265 on the 6th of October last year. What has become abundantly clear is that cryptos are definitely not digital gold as some of their most ardent supporters were claiming a little while back. The need for investors to find a safe haven has been amply demonstrated in the current environment by the record-breaking rise in the gold price – but at the same time cryptos have been collapsing. So, they are definitely not a hedge against political risk or the weakness of paper assets. What they are at best is a speculative investment which was linked to Trump – and as he fades so do they. The break down through support at $83286 is significant – the selling is continuing.

We have always advised against investing in cryptos because they represent no assets or income streams and they do not offer any particular protection or hedge benefits. Gold has been known and recognised as a thing of value by literally everyone throughout the world for thousands of years. Cryptos are a recent invention known and patronised by a very small group of passionate supporters – the market is similar in many ways to the Tulip mania that gripped Holland between 1634 and 1637.

The JSE Overall index has been making a series of new record highs as it responds to the bullish sentiment on Wall Street and good news at home. Last week on Thursday it reached 125249 up 7,3% in first month of this year. That comes on top of last year’s 37% gain. Last year alone JSE-listed shares added about R2,2 trillion to their market capitalisation.

Ukraine

According to a report from The Moscow Times, Russia has sold off three-quarters of the gold in its National Wealth Fund since May 2022. Proceeds from these gold sales have been used to help finance Russia's federal budget, state companies, and critical infrastructure projects. The Russian National Wealth Fund has reportedly seen its gold reserve drop by 71% between 2022 and 2025. As of January 1st, 2026, the fund contained just 160.2 tonnes of gold in its unallocated accounts at the Russian Central Bank. In May 2022, the National Wealth Fund held 544.9 tonnes of gold in its reserves. The Kremlin has sold off gold from the fund in nearly every month of 2023 and 2024, according to The Moscow Times.

The Russian Ministry of Finance originally based the country’s federal budget for 2026 on the assumption that the average price for a barrel of Russian Urals oil would be $59 dollars. However, the new sanctions imposed on Russia by the United States have pushed the average price for a barrel of Russian oil to $39 dollars. The Kremlin has been forced to cover the shortfall in its budget by selling off more gold from its National Wealth Fund. The Russian Ministry of Finance will now reportedly sell 12.8 billion rubles worth of gold and foreign currency from the National Wealth Fund each day between January 5th and February 12th. The new round of asset sell-offs from the National Wealth Fund is the fastest pace of asset sales from the fund since Russia began using this type of intervention to cover its budget shortfalls. It is apparent to us that the Russian economy is nearing the end of its ability to fund the war in Ukraine.

Russian revenue from oil exports has collapsed. It is down 35% since October last year. It is now less than $1bn per week – mainly due to Ukrainian attacks on Russian shadow fleet tankers. The shadow fleet has been keeping Russian oil exports alive, but more and more of these ships are now no longer transporting oil for them. Oil revenue is crucial to the Russian war effort and the shortage of funds is beginning to affect their recruitment drives as various parts of the country can no longer afford the high sign-up bonuses that new recruits are being offered.

All wars eventually come down to money. In other words who has the deepest pockets and can fund the costs the longest. On 19th December 2025 the leaders of European Union (EU) have agreed to fund the Ukrainian war effort for the next two years by providing an interest-free loan facility of 90bn euros. The money will be backed by frozen Russian assets. This is a pivotal moment – because, as we have seen, the Russian economy is on its last legs. Putin simply has no more resources to pay for the war. He has lost hundreds of thousands of soldiers and placed the Russian economy under severe strain. And all in order to hold on to about 20% of Ukraine. Something surely has to give – soon.

Political

Next year’s local government elections have to take place by law between the 2nd of November 2026 and the 30th of January 2027. The electorate in South Africa is not very happy with the progress that has been made since 1994 when the country became democratic. In 2004, 25% said they were unhappy and by 2023, 58% were unhappy. This trend obviously accounts for the steady erosion of the ANC’s support over the years that they have been in power. Most people still believe that it is their civic duty to vote in elections, but many are saying that they will abstain in protest. There are 27,7m registered voters out of about 38m who would be eligible to vote if they registered. 55% of the registered electorate are women. President Ramaphosa’s speech on 8th January 2026 to ANC supporters in Rustenburg shows that the ANC is very worried about the impending elections. Ramaphosa says the ANC will spend R54bn to fix infrastructure, specifically, water and electricity systems. In our view, the electorate is tired of this type of ANC promise which has historically remained unfulfilled. They have had more than 30 years to get it right and nothing of significance has changed. In the previous local government elections in 2021 only about 26 million of the 46 million eligible voters turned out to vote. According to the Electoral Commission, there are now 540 parties – about 100 of which are new arrivals..

The ANC’s long-time ally, the South African Communist Party (SACP) has said that it will contest this year’s local government elections separately from the ANC for the first time. The ANC has rejected this stance and given the SACP an ultimatum to reverse this decision. Fikile Mbalula has said that dual membership of the ANC and SACP will not be allowed and that members of the SACP will face expulsion from the ANC. The ANC’s National Executive Committee (NEC), by taking this position, has effectively brought the tripartite alliance to an end. This decision will undoubtedly hurt the ANC in the elections next year.

In January 2024, Frans Cronje, Chairman of the Social Research Foundation (SRF) said in May 2024 that the ANC would get 40% of the vote – he was dead right. And that was before any of us thought about the MK and Jacob Zuma’s party taking such a large slice of the vote. Today, the SRF is saying that their polls show that, in the municipal elections at the end of this year, the ANC will get 37% and the DA will get 32% according to their polls. He also says the EFF will get 7%, the MK 8%, the IFP 6% and the PA 4%. The rest will split about 6% between them. This is a massive shift for the DA – if it happens they will be gaining 14% of the vote over their previous election result. We surmise that this may be because they are seen as being good at administration and service delivery – and that they are not corrupt. Their polls also show that Helen Zille is second only to Ramaphosa as South Africa’s favourite political leader – that is also a shock. If these polls are even halfway true it means that the DA will have a much larger share of the Government of National Unity (GNU) after the election than they have now – which will have enormous ramifications for the economy.

China is now by far South Africa’s largest trading partner, accounting for the lion’s share of imports and generating more import tax than the next seven countries combined. Much of this comes from the surge in imported motor vehicles from China which now dominate the local car market. A disturbing result is that South Africa is now running a massive trade deficit with China. Between January and September 2025 we exported goods worth R164bn to them while importing more than R300bn from them, leading to a deficit which is now approaching R130bn. Of course, China is a fellow BRICS member, but these figures show the rise in Chinese influence in South Africa – which is matched by a general decline in influence of America especially under Trump.

The sharp drop in the yields on South Africa’s government bonds since the advent of the Government of National Unity (GNU) in 2024 is a clear indication that our coalition government is working. Falling rates indicate a surge of international investor interest in the country as political risk is seen as declining. The rate on our 10-year treasury bond has declined about 3 percentage points since the election that saw the ANC lose its majority in Parliament. Some of that fall is due to lower inflation rates and the drop in the target range for inflation. This has enabled local interest rates to be brought down by 1,5% so far. The result has been a much stronger rand against the US dollar, but also against other hard currencies like the euro and the British pound.

Economy

The monetary policy committee’s (MPC) decision to keep interest rates unchanged is typically conservative and in line with the Reserve Bank’s moving toward a lower target, closer to 3%. It is done at a time when the US MPC is under fire from Trump and the independence of central banks is being challenged. Our Reserve Bank Governor, Lesetja Kganyago, said that rising electricity and meat prices were a concern. The rand strengthened in the wake of the decision to keep rates unchanged, moving firmly below R16 to the US dollar. In our view, the MPC’s stance is keeping inflation under control in this country which is a key determinant of our slowly rising prosperity.

The falling fuel price is a major contributor to the South African economic recovery. Petrol is now the cheapest it has been for four years – and it is expected to fall by a further 65c on 5th February 2026. The decline puts more money into every South African’s pocket. The drop is caused mainly by the strengthening rand – and that, in turn, is a function of significantly better economy management in the form of far lower inflation. Consumers are experiencing higher levels of take-home pay and that pay has greater purchasing power. Payinc maintains an index based on 2,1m salary earners in South Africa with salaries between R5 000 and R100 000 a month. In 2025, salary-earners enjoyed a second year of real increases in their earnings because inflation averaged 3,2% - the lowest level for over 20 years. The declining fuel price has been a major factor leaving more cash in consumer pockets and brining the inflation rate down.

The sharp 45% decline in the price of maize this year is having a big impact on food prices across the country. Maize is used as chicken feed and so is lowering the cost of our main protein source. The entire world had a bumper crop of maize this year which brought international prices down and the South African season has been the second best on record at about 16,5m tons. This enables South Africa to export grain and generate foreign currency. The lower maize price will begin to impact food prices positively by the middle of this year. The bumper crop also benefits hundreds of thousands of subsistence farmers who rely on growing a few acres of maize to feed their families.

The consumer price index (CPI) in December 2025 rose slightly to 3,6% - up from November’s figure of 3,5%. Inflation for the whole of 2025 was 3,2% - the lowest level for more than two decades. Food prices were up 12,6% in the year while electricity and water were also up significantly. Inflation is expected to continue falling during 2026, especially if the oil price continues to decline and the rand continues to get stronger. Headline inflation, which excludes food and energy, was steady at 3,3%. The fact that interest rates are well above the inflation rate encourages the repaying of debt and the accumulation of savings in the economy.

GDP growth in the 3rd quarter of 2025 came in at 0,5% - lower than the second quarter’s 0,9%. A major factor was the higher prices of gold and platinum group metals (PGM). Growth for the year to end September 2025 was 2,1%. In our view, the South African economy is on the mend. The higher prices of commodities, the excellent rainy season and the end of loadshedding have combined with improved port and rail logistics to put us onto a steady growth path. We expect that growth to continue, especially now that inflation is around 3%.

The World Bank has increased its estimate of GDP growth in the South African economy to 1,3% for 2025 with growth expected to be 1,4% in 2026 and 1,5% in 2027. A major factor in this improvement has been the end of loadshedding which was preventing growth. Growth in SA is still well below that of Southern Africa which is expected to average 4%. For comparison, Nigeria had growth of 4,2% in 2025. The Reserve Bank’s efforts to reduce the inflation rate obviously had a negative impact on growth, but they have also resulted in a rising level of real incomes – and that, in turn, has reflected in increased consumer spending and rising business confidence. The American House of Representatives voted to extend the African Growth and Opportunity Act (AGOA) on 12th January 2025 with strong bipartisan support. This does not however mean that South Africa will continue to benefit. That decision still has to be made with relations between the two countries taking considerable strain.

The International Monetary Fund (IMF) has also revised its projection for growth in South Africa up to 1,3% for this year from its previous estimate of 1,1%. The revised figure is still well behind projections for other African countries which range from 3% to 4%. The IMF points to structural impediments to growth like labour market rigidities, governance weaknesses and high government debt. The rise in the forecast is due to improved consumer spending and low inflation. The IMF praised South Africa’s inflation targeting, its independent financial institutions, deep capital markets and flexible exchange rates.

Manufacturing output rose in October 2025 by just 0,2%. Food and Beverages were up 1,9% and electrical machinery was up 6,5%. Wood products were down 6,9% and glass products were down 5,8%. Essentially, the figures show that manufacturing in South Africa is flat – neither growing nor declining. In our view, 2026 will be a better year for manufacturers.

The ABSA purchasing managers index (PMI) came in at 42 in November 2025 – well below the neutral level of 50 and the worst reading since April 2020 in the middle of the pandemic. The reason is the weak state of international demand combined with the US tariffs which are hurting demand. The business activity sub-index was 36,7 – down from October’s 49,4 and new sales orders fell to 35,6 from 48,9. Local and overseas demand was sharply lower. Logistics remains a problem despite the fact that Cape Town port’s performance has improved.

The National Energy Regulator’s (NERSA) decision to cut the cost of electricity to companies with ferrochrome smelters is a desperate attempt to retain these important first line beneficiation operations in business. The 35% cut in their electricity costs will certainly return many of them to profitability, but indicates a deeper problem. Eskom’s electricity in South Africa has just become too expensive. The company has 40 000 employees who are earning an average of more than R1m per annum as a result of successful union action over the decades of ANC rule. The effect has been to accelerate the country’s move to alternative energy, but it has also resulted in thousands of businesses becoming unprofitable with concomitant job losses.

The tourism industry in South Africa is taking off with 10.485m international visitors to the country last year. Arrivals were up 17,6% and above pre-COVID-19 levels for the first time. Much of this is due to the holding of international business meetings and conferences in South Africa. Last year there were 51 such events. Clearly, tourism is a massive job creator and brings in much-needed foreign currency.

Retail sales increased by 3,5% in November 2025, following on from October’s increase of 3%. The general dealer category, which includes supermarkets, gained 2,2%. This shows that consumer spending is increasing steadily as the level of real incomes rises. That, in turn, is a function of the falling level of inflation. The accumulated impact of falling interest rates has also put more cash into the pockets of homeowners. Rates are expected to fall by a further 25 basis points in March when the monetary policy committee (MPC) meets again.

Online retail spending rose by 50% during the Festive Season. According to Visa, in store retail spending increased by 4,1% year-on-year and e-commerce spend was up 49.9% as consumers sharply increased online shopping. Food and restaurants showed the strongest growth with an increase of 29% over last year, while retailers were up 28% and travel was up 14%. The strong spending indicates an economy that is recovering rapidly due to lower interest rates and low inflation combined with increasing real incomes.

Mining production in November 2025 fell by 2,7% year-on-year. Trump’s tariffs are being blamed as well as the difficulties at the Richards Bay Coal Terminal (RBCT). Coal prices fell to an average of $89 per ton in 2025, down from $105 in 2024. Kumba’s output has also fallen by 2% and overseas demand for iron ore has declined. Electricity costs to mines have risen by 16% over the past year which has made many local smelters unprofitable causing them to shut down. Added to that the cost of water has risen by almost 12% over the same period and labour is about 6% more expensive. There are still difficulties with logistics which constrain output. Precious metals producers have been saved by the rising prices of gold and platinum group metals (PGM).

South Africa’s motor vehicle manufacturing is being threatened by cheap Chinese and Indian imports of kits which just require local assembly. Almost half of new car sales are now accounted for by these vehicles which have the advantage of being significantly cheaper than locally produced vehicles. Of course, the local industry is trying hard to get the government to implement tariffs on overseas importers, but in the meantime South African consumers are benefiting. Many of the importers are now getting to the point where they are considering manufacturing here rather than simply importing. From the economy’s perspective this “invasion” has been beneficial and could result in several Chinese manufacturers opening factories and employing people in this country. In the past 9 months 374 000 imported vehicles have come into SA. Imports have increased by 30% in the period. The increased competition has put local manufacturers under considerable pressure and is causing some retrenchments.

The government is now considering anti-dumping tariffs against Chinese and Indian cars entering the country, even though all three countries are members of the BRICS alliance. Imports are now 55% of total sales and Chinese imports are up 370% since COVID-19 while those from India are up 135%. This has resulted in at least 13 local companies going out of business and the loss of more than 4000 jobs. Obviously, this is preventing local manufacturers from reaching the scale which is required for South African tax concessions.

Vehicle sales in November 2025 came in 12,5% higher than November 2024 and total sales year-to-date were 15,4% up on last year. A major factor has been the relatively low cost of imported vehicles. Cheaper cars from China and India are taking a large slice of the local market. The car rental industry took 21,2% of the cars sold and 16,3% of the whole market. Light commercial vehicle sales rose by over 20% showing that small businesses are recovering. The robust and unexpected improvement in vehicle sales indicates that South African consumers and businesses are becoming more optimistic.

The road accident fund (RAF) has been insolvent for decades and now owes a massive R600bn in settlements. The fund spends a large amount every year just on legal costs and there is a backlog of 320 000 claims. The fund has forced the closure of at least one hospital because it failed to pay out R300m in claims. The fund also appears to have a serious fraud problem with over 180 staff suspended on fraud charges in a four-year period. Ultimately the RAF’s debt will have to be met by the government.

The deal between Eskom and Glencore/Samacor will basically halve the cost of electricity to 12 smelters that have been forced to close down. Glencore will supply coal at cost and Eskom will supply electricity at half price in order to make the smelters viable again. The real problem, which affects all electricity users in South Africa, however, is that Eskom has allowed its wage bill to become excessive. It has 40 000 staff and a wage bill of R43,1bn – which means that the average wage of Eskom employees is over R1m per annum. This is clearly excessive and is causing electricity prices in South Africa to become unaffordable. Thousands of consumers and businesses are moving to renewable energy to avoid Eskom as a result, and this pattern will ultimately cause Eskom’s demise.

The Business Confidence Index produced by the Bureau of Economic Research increased by 5 points to 44 in November 2025. This means that 44% of respondents to the survey were positive about business conditions. The improvement is wide across all sectors of the economy including the building and construction industry. Manufacturing confidence climbed 16 points to 39 is a significant turnaround and retail sentiment improved by 11 points. The most confident sector was the new vehicle dealers whose index improved by 4 points to 58%.

The trade account of the Balance of Payments (BoP) shows the flow of cash for imports into SA and exports from SA. For the past couple of years, SA has been running a surplus because of the high prices of commodities – mainly platinum group metals (PGM) and gold. So, in October month SA exported R192,2bn and imported R176,6bn – so we had a trade surplus of R15,6bn. That is less than the R22,3bn surplus that we had in September. The surplus in 2025 until the end of October was R142,7bn – slightly less than last year’s R148,1bn at the same time. South Africa is primarily an exporter of raw materials, and we are benefiting from the strong gold and PGM prices at the moment. We expect the surpluses to continue coming next year. Surpluses help to keep the rand strong against first world currencies.

The Reserve Bank’s quarterly bulletin for the third quarter of 2025 shows that PGM sales were higher than expected because of rising prices, while motor vehicle sales were negatively impacted by Trump’s tariffs. The current account deficit was smaller because of reduced interest and dividend payments. The deficit was R57bn or 0,7% of gross domestic product (GDP) which is considerably lower than the 2nd quarter’s R72bn or 1% of GDP. South Africa is beginning to reduce debt and get itself into a better financial position. Both precious metals and base metals and other commodity prices were better, on average up about 0,6%.

The illegal cigarette business in South Africa gained a lot of momentum during COVID-19 and today it accounts for up to three quarters of all cigarettes sold in the country. The high level of sin taxes on legal cigarettes means that those produced and sold illegally enjoy a significant price advantage. The ANC government has proved completely unable or unwilling to police illegal cigarette sales, in part because of rampant corruption - with the result that the legitimate cigarette industry in this country is dying. British American Tobacco (BAT) has finally decided to close its cigarette production here which means that about 100 tobacco farmers will lose their primary market. More than 30 000 jobs will also be lost as the legal cigarette manufacturing industry closes down. Illegal cigarettes are estimated to cost the government about R30bn a year in lost tax revenue and are sold in more than three quarters of all stores according to Ipsos .

The Rand

Over the past 10 months, the rand has been steadily strengthening against the US dollar after reaching its weakest point on 9th April 2025 at R19,75. There was a period of resistance at R17.50 before it broke through that level which then became a support level. From late November last year the rand has been strengthening more quickly and broke below R16 to the US dollar on 26th January 2026. Consider the chart:

As you can see, the pattern of strength has gained some momentum, partly because the dollar has been weak – but the rand has also been strengthening more slowly against other hard currencies like the euro and the British pound. This indicates a fundamental shift in international investor sentiment towards South Africa. The political risk in this country is perceived to be decreasing and the Government of National Unity is seen as fairly solid.

The country’s exemplary inflation rate and the rising price of precious metals have been a help. We expect the rand to continue strengthening, despite the sell-off on Friday last week.

Commodities

OIL

The sharp rise in the price of oil is entirely due to the heightened tensions between Iran and America. Iran has the 4th largest oil reserves in the world – so America’s belligerent approach is naturally causing the price of oil to rise. Trump has said that he has an “armada” of warships near Teheran – which probably means at least one aircraft carrier group. Given his successful lightening attack on Venezuela and the apprehension of its President, oil traders are naturally nervous about what might happen next.

Another factor is the steady weakening of the US dollar in recent months which has caused all commodity prices to rise. The higher price of oil is naturally a boost for Russia’s war chest.

South African consumption of petrol and diesel has been falling since 2015. In that year we consumed 12bn litres of petrol and 14bn litres of diesel. In 2024 those numbers had dropped to 8,7bn and 11,8bn respectively. This is a 20% decline in 9 years showing firstly the impact of COVID-19 and then subsequently the switch to hybrid and electric vehicles. This pattern is being repeated throughout the world and accounts for the drop in the international oil price. Locally the falling demand is impacting petrol stations. In South Africa we have 4600 service stations which employ thousands of people.

PRECIOUS METALS

The troubles in Iran and the probability of Trump committing US forces there has also impacted the gold price. Gold surged to a new record high of about $5300 on the news before succumbing to some profit taking. The rising gold price is a strong indication that world political stability is in jeopardy. Large international investors do not commit billions of US dollars to gold unless they are trying to protect their assets. Gold does not deliver a return and so even US Treasury bills are usually preferable, but right now investors are willing to sacrifice even that return for the safety offered by holding gold.

Platinum, palladium and other platinum group metals (PGM) have also been rising rapidly since the middle of December last year. Platinum is now forecast to move above $3000 per ounce in due course. Both gold and platinum are correcting on some profit taking, but we believe that the upward trend will continue. Since South Africa has about 75% of the world’s known underground reserves of platinum and is still a major producer of gold, the rising prices of these metals is directly benefiting the economy.

COPPER

The copper price has surged 40% due to rising demand for electronics, especially electric vehicles (EV). There have also been some major disruptions to the supply of copper from Indonesia. Essentially, copper is in short supply with demand out-pacing supply resulting in higher prices.

Companies

STADIO

In its results for the six months to 30th June 2025, Stadio reported revenue up 16% and headline earnings per share (HEPS) up 28%. Student numbers increased by 9%. The education business is a very good business because traditionally people pay in advance – which means that education companies like Stadio generally have very limited working capital requirements. They do have significant capital requirements for their various schools and campuses which can be a risk factor.

Consider the chart:

We added Stadio to the Winning Shares List (WSL) on 29th June 2024 at a price of 525c per share. It reached a high point of 1400c on 9th January 2026 before succumbing to some profit-taking. Over the 18 months that it has been on the WSL it had gained 132%. We believe that it will continue to perform well going forward.

ABSA

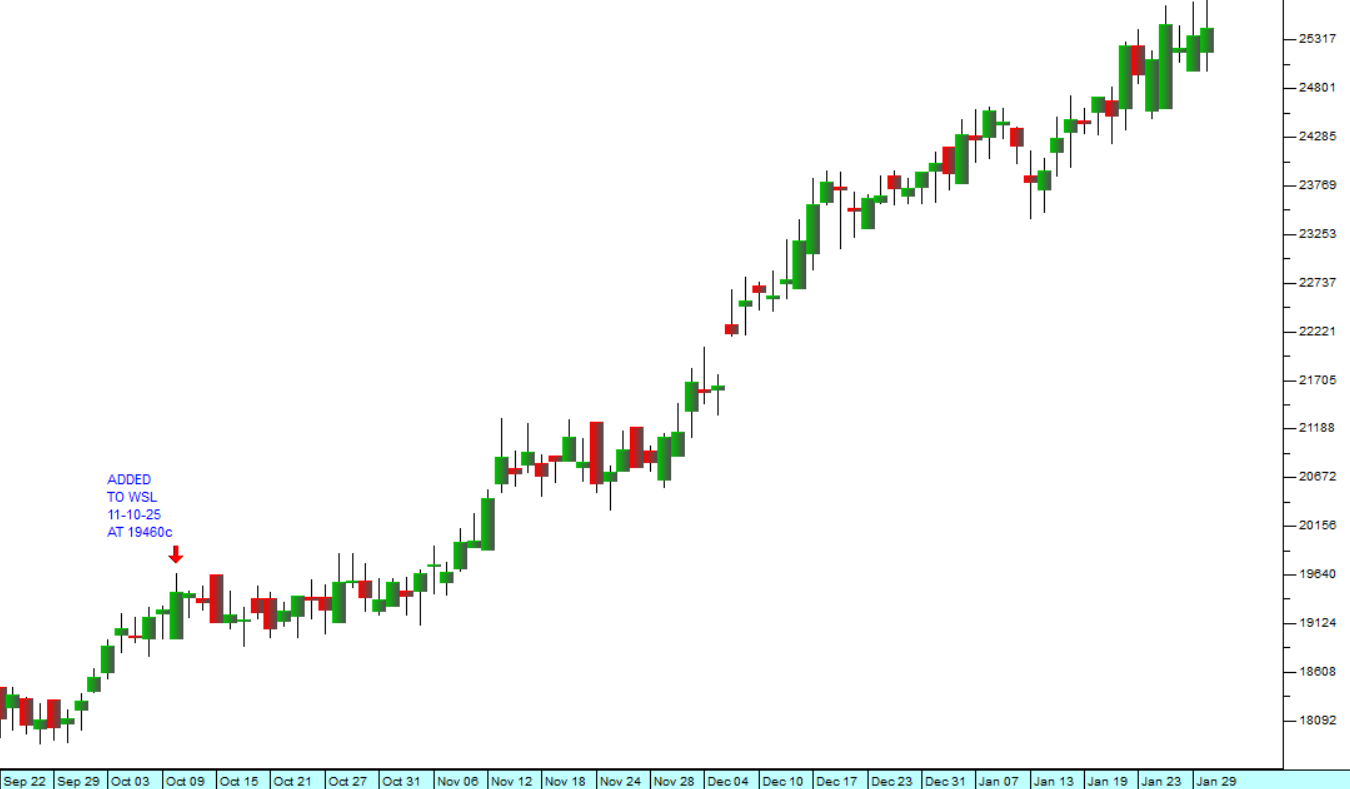

This commercial bank is one of the “big five” banks operating in South Africa. It is not as successful as FNB, Standard or Capitec, but it is still a major blue chip financial share. In a recent update on their performance in the 2025 year ABSA said they were in line with their guidance and that percentage revenue would grow in the mid-single digits. The forecast that their cost-to-income ratio will be slightly higher at 53,2%. Generally a solid performance and one which is directly linked to the growth of the economy at large. Consider the chart:

ABSA (ABG) : 22 September 2025 - 30 January 2026. Chart by ShareFriend Pro.

We added ABSA to the Winning Shares List (WSL) on 11th October 2025 at a price of 19460c. It has since risen by 30,89% to 25471c. We believe that it will continue to perform well.

BHP

The copper price has been rising rapidly as shortages begin to make themselves felt in the market. BHP is a major producer of copper. In an operation review for the six months to 31st December 2025 the company reported copper prices up 32% and iron ore prices up 4%. The company has increased its copper production guidance since its flagship copper producer, Escondida, achieved guidance range. BHP is benefiting directly from the surge in copper demand as a result of AI and electric vehicle (EV) production. Consider the chart:

We added BHP to the Winning Shares List (WSL) on 5th December 2025 at a price of 50350c It has since moved up to 56098c – a gain of 11,4% in 57 days. We believe it will continue to perform well, especially if the copper price continues to rise.

WEAVER (previously Homechoice)

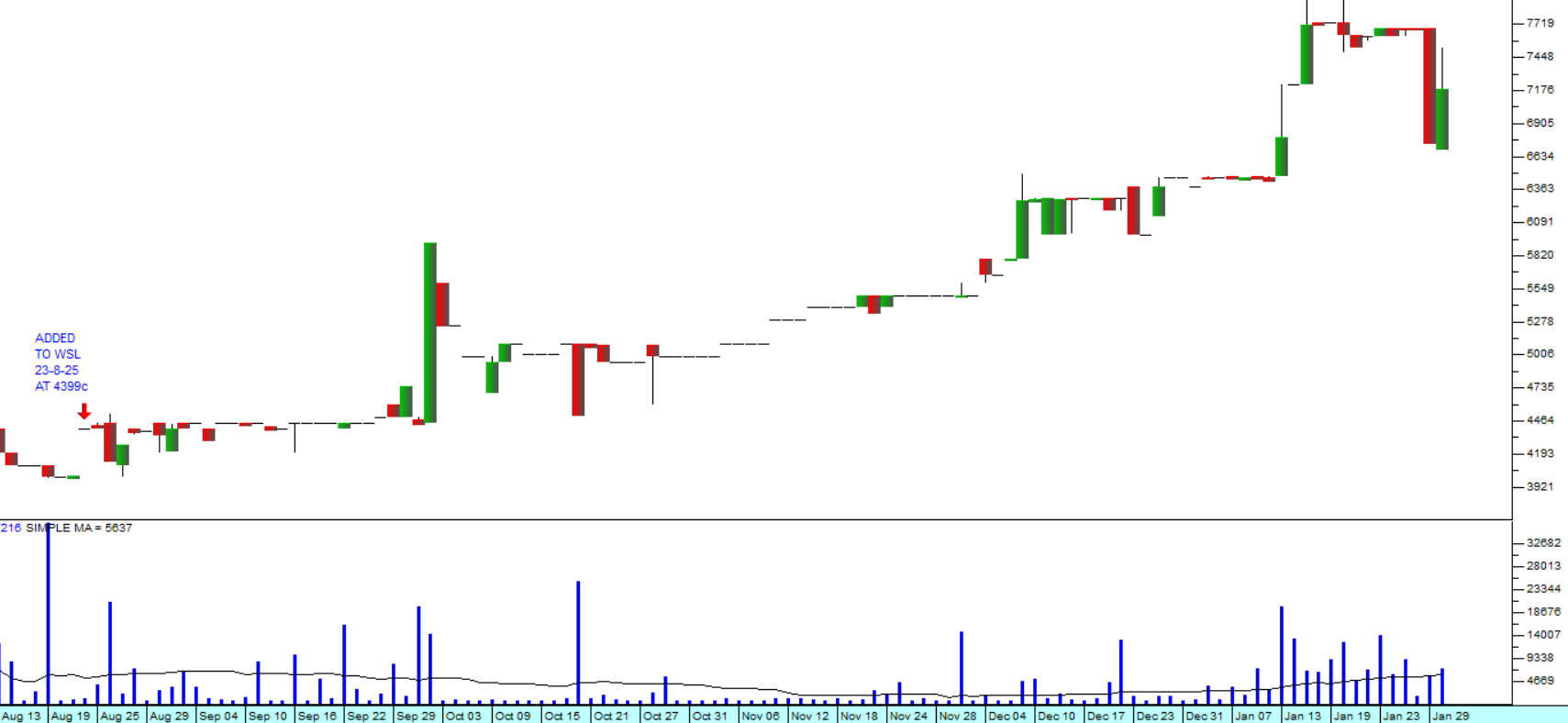

Homechoice was South Africa’s largest home-shopping retailer selling a range of home appliances, clothing, footwear, and other products. It has recently become involved in Buy-Now-Pay-Later (BNPL) which has had the effect of doubling its market capitalisation. It bought 85% of PayJustNow which has considerably expanded its appeal. Fintech revenue rose 33,8% to R2,5bn, pushing profits up. Their BNPL platform has seen merchandise value rise by 157% and headline earnings per share HEPS is up 45%. Consider the chart:

As you can see, we added Weaver to the Winning Shares List (WSL) on 23rd August 2025 at a price of 4399c. It has since risen to 7200c – a gain of 63,7% in 162 days. You will also notice the increase in volumes traded this year indicating that the share is beginning to attract considerable institutional interest. In our view, Weaver will continue to appreciate going forward.

CLICKS

Clicks is one of the JSE’s foremost blue-chip shares. It has a long track-record of rising profits and excellent management. Technically, it is a share that goes from the bottom left-hand corner of your screen to the top right-hand corner over decades. We call this type of share a “diagonal” and advise investors to accumulate it on weakness. We published an article on Clicks on the 26th of January 2026.

Periodically, however even diagonal shares have periods when for some reason, they are out of favour with the institutional fund managers. Clicks is going through just such a time right now. The best way to see this is to study the share’s over-bought/over-sold (OB/OS) chart:

This chart shows the past ten years of Clicks shares prices in the top half and then a 200-day OB/OS in the lower half. What you can immediately see is that whenever the OB/OS falls below about 12% it is almost always good to buy Clicks. You can see that over the past ten years we have reached -12% on five previous occasions – and each of those represented a very good buying opportunity. We are at just such a point right now. Do not miss this opportunity.

TIGER BRANDS

The Tiger Brands story over the past 8 years has been instructive. At the end of 2017, Tiger was regarded as one of the JSE’s foremost blue-chip shares. It was an extremely well-managed food company that owned dominant brands like Jungle Oats, Tastic Rice, and All Gold. Then it went through the Listeriosis poisoning crisis for the next four years which took it down from a high of R474 per share to a low of R135. Consider the chart:

After that massive sell-off, the share made a “double bottom” and has been rising ever since. We added it to the Winning Shares List on 1st December 2023 at a price of 18295c and it has now risen to 33750c. We believe that it will continue to perform well. Like Clicks, it is currently at a cycle low which may represent a good buying opportunity.

← Back to Reports