The Confidential Report - September 2022

7 September 2022 By PDSNETAmerica

The market action on Wall Street’s S&P500 index from mid-June 2022 to mid-August 2022 was a classical bear market rally. Bear market rallies are usually about 50% of the fall, but in this case, the rally was 56,5% (638 points up after an initial bear market fall of 1130 points). This was more than the usual 50% - probably because of persistently high levels of optimism among investors – a feature which has characterized this bear market to date.

In our view, the Ukraine war brought this bear market forward by about 18 months, mainly because of the radical impact it had on the oil price and hence world inflation rates. We were expecting the bear market to begin in the second half of 2024 and only predicted a “major correction” beginning in January 2022. That incorrect prediction (made in the Confidential Report of November 2021) was made several months before the start of the Ukraine war - which then pushed the markets beyond a major correction into a full-blown bear trend.

The premature nature of the bear has meant that it began at a time when the US economy was still very strong and growing – the Federal Reserve Bank (the Fed) had only put through 2 quarter percent interest rate hikes and the pace of rate hiking was not expected to impact economic growth for at least a further 2 years. At that time, the Fed was looking to bring inflation under control with a “soft landing” for the economy.

The unexpected commencement of hostilities in central Europe and the sharp rise in the oil price forced the Fed to adopt a much more aggressive approach, hiking rates in two 75-basis point jumps in an effort to catch up. The result was that, as the bear market took hold, there remained a residual feeling in the market that the economy was still booming and that the bear trend had begun too soon. There were still plenty of investors who did not accept the change in direction and were keen to “buy the dips”.

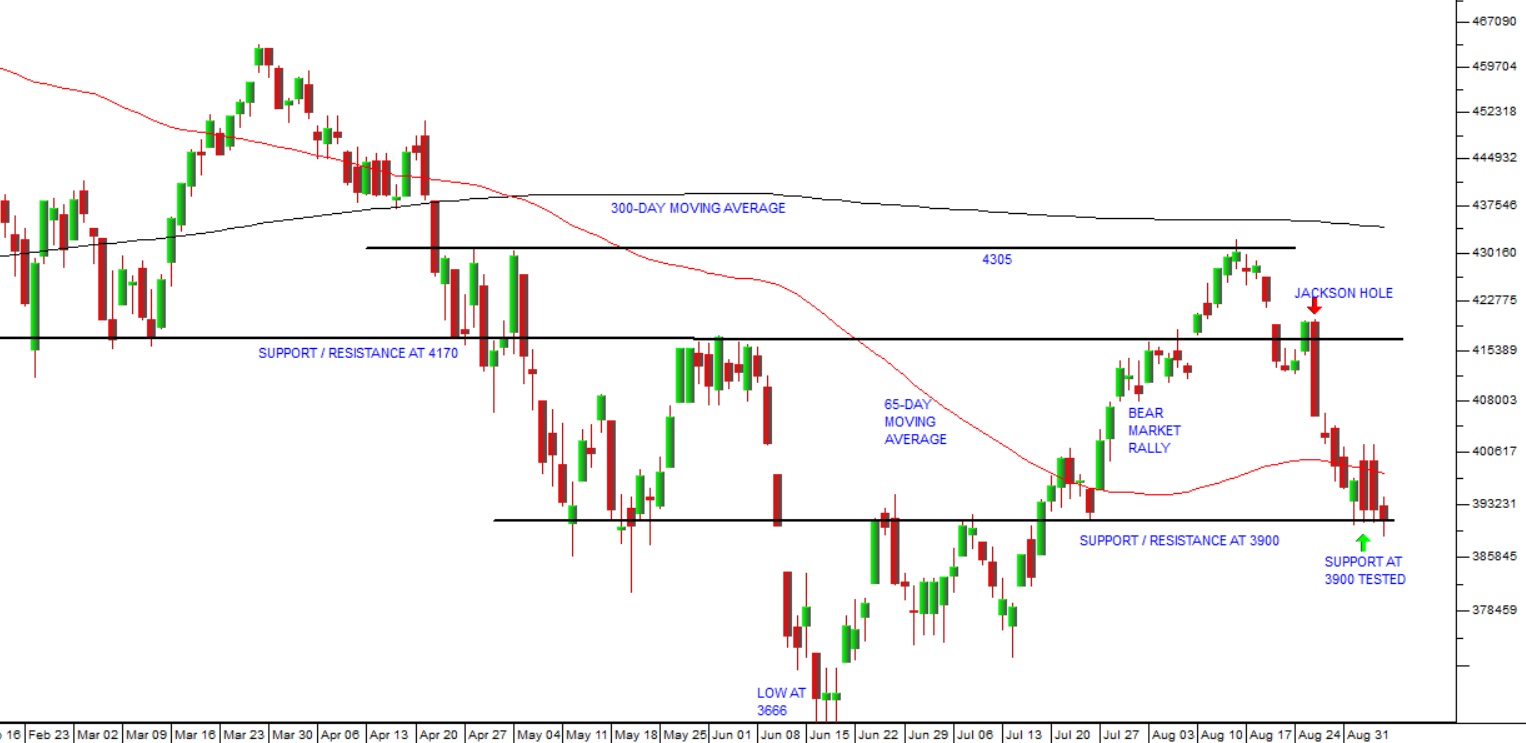

This investor enthusiasm gained momentum when the North Sea Brent oil price fell back below $100 a barrel in early July 2022 – probably as a result of pressure on Saudi Arabia by the Biden administration. The lower oil price resulted in a drop in the US inflation rate from 9,1% in June 2022 to July’s figure of 8,5%. That July inflation figure was greeted with what we can only describe as “irrational exuberance” by the market. The S&P gained 2,13% on 10th August 2022 and then rose to a cycle high of 4305 as a direct result. Reality came with Jerome Powell’s 10-minute speech at the Jackson Hole symposium. He said that it would take some time to get inflation back down to the 2% target level and that the economy would have to experience some pain in the process. This threw a bucket of cold water over the bullish enthusiasm on Wall Street and the S&P500 has been falling steadily ever since. Consider the chart:

You can see here the 2-month bear market rally from the mid-June 2022 low of 3666 to mid-August 2022 high of 4305. The chart also shows the key levels of support and resistance. In our view the rise above resistance at 4170 in the second week of August was a clear indication of that excessive optimism. Following Jackson Hole, the S&P has now fallen back to test the support level at 3900. In our view it will sooner or later penetrate that level and go down to test the cycle low at 3666. And we expect that low to be broken as well, as the bear trend resumes.

Historically, bear trends have mostly taken the market index down about 50% from their peak - which would see the S&P go down to about 2400. In our opinion, however, this is not a normal bear trend because the Fed is also trying to claw back its over-sized balance sheet with a program of quantitative tightening (Q/T). Since this has never previously been attempted on the current scale, we do not really know what impact it will have on markets, but it seems reasonable to expect the bear trend to fall further and last longer than usual.

Bank of America has forecast that the process of quantitative tightening (Q/T) will cut 7% off the S&P500 index. The US Federal Reserve Bank’s balance sheet sits at $8,9 trillion and it is doing $95bn in Q/T every month with the eventual goal of bringing it down by $1,1 trillion a year. The effect of this on share prices is estimated, by Bank of America, to be substantial, especially when added to the rapid increase in the Fed funds rate and higher oil prices. In our view, it now seems almost inevitable that the US economy will go into a recession next year.

Our view has always been that the factors keeping inflation high in the US are deep-seated and far from being under control. We see the US monetary policy committee (MPC) continuing to raise interest rates at a rapid pace and we see the bear trend continuing. Right now, the market is projecting a 74,5% probability of a third 75-basis point hike in the fed funds rate later this month. We believe the probability should actually be closer to 100%.

The August 2022 jobs report in America revealed that 315 000 new jobs were created in the month – ahead of the consensus forecast of 300 000. At the same time the unemployment rate increased to 3,7% from 3,5%. Now everyone is waiting for the consumer price index (CPI) which will be published around 15th September 2022. If that is above expectations, the result will almost certainly be another 75 basis point hike in the fed funds rate.

So, there is growing evidence that the US economy will fall into recession towards the end of this year and in 2023. The effect of rising interest rates is cumulative, and it will take time for the impact to be felt in corporate profits. More interest rate hikes are certainly in the pipeline especially given the relatively strong statistics which keep coming out of the economy. By next year the cumulative impact of these rising rates will begin to be seen in margins and corporate profitability. So far, the housing market in the US has not really responded to the pattern of rising interest rates, but we believe that it inevitably must sooner or later. The housing market comprises roughly one third of the consumer price index (CPI).

The economic situation in America should also be viewed in the context of what is happening in the UK and Europe. The situation in the UK has become very onerous with inflation predicted to reach 13,3% and the central bank has increased interest rates by 0,5%. At the same time the price of energy for the average UK household has tripled over the past year meaning that many consumers are facing a bleak winter. Much of the problem stems from Russia’s cutting off or cutting down gas supplies to the UK and Europe. It is expected that the UK economy will enter recession later this year and remain in recession throughout 2023. The UK is also in the middle of a leadership crisis.

Political

The arrest of Brian Molefe, Siyabonga Gama, Anoj Singh and others in the Transnet state capture case will go some way towards improving President Ramaphosa’s image as someone who is fighting the crime and corruption within the ANC, associated with state capture. The case is the first of 9 important state capture cases being pursued by the National Prosecuting Authority (NPA). The complexity of these cases has caused lengthy delays, but it is apparent that they are now resulting in the arrests of people who were key agents of the Gupta brothers. At the same time, the appointment of the President’s National Anti-Corruption Advisory Council (NACAC) is a further step in curtailing corruption.

Raymond Zondo’s has observed that the ANC’s failure in parliament to act on the various motions of no confidence against Jacob Zuma means that the party has put its own interests ahead of the country’s. He said this means that if there were a new move towards state capture today it would probably succeed. Of course, recently the ANC has been using its majority in parliament to shield President Ramaphosa from answering questions about Phala Phala. It is also noteworthy that current ANC ministers like Gwede Mantashe and David Mahlobo were implicated in the Zondo Commission hearings, but are still in office.

We have previously given our opinion that President Ramaphosa will probably survive the December 2022 ANC elective conference, but that the ANC will, in all likelihood, fall below 50% in 2024 elections. The ramifications of this are significant. Certainly, a development like that will negatively impact on overseas perceptions of the country’s political stability – at least until a new order is established. That could have a negative impact on the rand and foreign direct investment (FDI). If the ANC gets less than 50% of the vote, it will have to strike a compromise with one of the other parties to remain in power. Depending on how much support the ANC needs, we think that compromise will most likely be with the DA whose policies are close enough to the Ramaphosa administration’s to be negotiated. Other parties are either too radical or too small to be effective partners.

Economy

The surprise job creation and unemployment figures for the second quarter were far better than predicted by most economists. The economy created almost 650 000 new jobs in the quarter and the official unemployment rate dropped to just under 34%. On average, economists were expecting unemployment to rise to about 35% because of the Natal floods and the effect of recent loadshedding. Clearly, President Ramaphosa’s reforms at least in the energy sector have started to have an impact. Most of the new jobs came from restaurants, retailers, hotels and car dealerships, while the government created a further 275 000 new jobs. The Reserve Bank is expecting gross domestic product (GDP) to shrink by 1,1% in the second quarter. In any event, the rebound in employment bodes well for the economy going forward, especially if it is sustained.

The consumer price index (CPI) rose by 7,8% in July 2022, up from June’s figure of 7,4%, but in line with expectations. Obviously, rising food and fuel prices are to blame and those are both external factors rooted in the Ukraine war. The CPI is now well outside the Reserve Bank’s target range of between 3% and 6% which means that a further 75-basis point hike in interest rates in September 2022 is almost inevitable. The price of oil has come down to about $100, but food inflation is running at over 10%. There are some indications that inflation may have peaked and that future figures will be lower. The CEO of Bidcorp, Bernard Berson, says that that in their opinion inflation should come down from here.

The producer price index (PPI) rose by 18% in July 2022, mainly as a result of the rising price of fuel, but also because of increasing food prices. The PPI measures prices “at the factory gate” and generally feeds through to the consumer price index (CPI) in time. Since July 2022 the oil price has come down and the rand has strengthened leading to a drop in the petrol price, but we expect that the situation could get worse again in the future.

In an effort to keep the cost of food down, the Minister of Trade, Industry and Competition, Ebrahim Patel, has announced that the duty on imported chicken will be suspended for a year. This will enable foreign importers to bring in large quantities of chicken at lower prices. It will also put the local chicken industry under enormous pressure to compete and could lead to the closure of some facilities. We have never been in favour of imposing tariffs on imported products to protect a local industry because that inevitably means that local consumers have to pay a premium for that product. This has been true in the chicken industry and other industries, most notably, the cement industry. The suspension of this tariff on imported chicken will force local producers to become more efficient.

The new method of pricing gas produced by the National Energy Regulator of South Africa (NERSA) will allow Sasol to increase the price of gas by 96%. This will have a serious negative knock-on impact for those companies that use industrial gas – such as the bread manufacturers who use it for their ovens. It will probably also lead to rise in the cost of bread which is a staple for poor families. The new methodology is based on the international price of gas rather than the local cost of producing it.

There can be little doubt that South African consumers took a massive hit in the second quarter of 2022. Beset by rapidly rising petrol prices, rising interest rates, higher food prices and loadshedding, consumers found their disposable income declining rapidly. This can best be seen in the Consumer Financial Vulnerability index which is produced by Unisa in conjunction with Momentum. This index weakened sharply from 53,4 in the first quarter to 48,5 in the second. The drop reflects a dramatic worsening of the average household’s ability to cope financially and will impact on consumer spending patterns and gross domestic product (GDP) during the rest of the year. Obviously, some of the negatives have improved somewhat since the index was produced – most notably, the petrol price and loadshedding, but the relief may have come too late for many households.

The ABSA purchasing managers index (PMI) for July 2022 fell to 47,6 from June’s 52,2 and May’s 54,8 and then moved back to 52 in August. The fall was more than predicted by economists and shows the effects of the floods in Natal combined with the increase in loadshedding. There was Eskom loadshedding for 23 days in August 2022 rising to stage 6 at times. Exports have also declined in line with declining growth in the world economy. The fall is in line with falling PMI's in many countries around the world, especially in the Eurozone. Germany, for example, has seen a sharp fall-off in business due the effect of the Ukraine war on gas supplies from Russia. German GDP growth is now only expected to be 1,3% in 2022 and to fall further in 2023.

Tax collections are still running ahead of budget with some analysts suggesting that they could be as much as R50bn above the forecast – mainly due to the on-going commodities boom. This, however, compares with last year, when the South African Revenue Services (SARS) collected more than R200bn above what was budgeted. Tax collections for the first 3 months to 30th June 2022 are up 10,6% on last year. Company tax was up 14,4% which probably means that most of the surplus was due to the mining sector. In the first quarter, SARS collected 41% of what was budgeted for the whole year. Of course, commodity prices are already declining, and it is expected that the world economy will move into recession as widespread interest rate hikes take their toll.

Sibanye’s trading statement for the six months to 30th June 2022 indicates that company expects its headline earnings per share (HEPS) to halve. This is due in part to the flooding in Montana and the recently settled strike at its gold mines in South Africa, but it is also due to a drop in the prices of precious metals. Obviously, this general decline in the prices of metals, both base and precious, is going to impact directly on tax collections in South Africa and probably signals the end of the tax bonanza which this country has been enjoying. Anglo American has also recently announced a drop in its profits by about 33% and we expect other exporters of raw materials to follow suit as recessionary conditions in first world countries begin to take hold.

Mining production fell for the fifth month in a row in June 2022 – down by 8% over the year. Gold production was down over 28% as a result of the strike in that sector, loadshedding and other supply constraints. Platinum group metals were down 10% and coal production fell 6%. Obviously, falling production means lower profits and hence lower taxes which will place more strain on the fiscus. Our view is that the commodities boom is now just about over, and the government will no longer be able to rely on a tax bonanza from this source.

The latest Broad-Based Black Economic Empowerment (BBBEE) report suggests that the level of total Black ownership of companies had fallen from 31% to 29,5% in 2021. Management control fell from 57% to 51,5% and there are no longer any listed companies on the JSE which are completely Black-owned. In our view, BBBEE is a misguided policy which fails to achieve its stated objectives and costs the country billions of rands each year. It is also an administrative nightmare for most companies of any size and especially for listed companies. No doubt, the Minister of Trade, Industry and Competition, Ebrahim Patel, will use the report to further tighten the screws on big business.

Retail sales in South Africa shrank by 2,5% in year to the end of June 2022 which was considerably worse than the 0,5% expected by economists. This obviously reflects the rise in the petrol price and interest rates combined with the recent surge of loadshedding and the rise in inflation to 7,4%. Consumers have been under pressure for some time and are reducing their spending. This will impact directly on gross domestic product (GDP) growth because consumer spending is roughly two thirds of that statistic. The recent drop in the oil price and the relative strength of the rand are positives. Food inflation is becoming a factor with June 2022 at 8,6% and the government is said to be looking at ways to control it. The price of bread rose by 11% and the price of cooking oils by 32%. The on-going war in Ukraine is causing grain and oil prices to remain at high levels. The motor industry in this country is heavily supported by government tax incentives. New vehicle sales improved in August 2022, up 14,2% on 2021. This was partly due to the Toyota factory stepping up production after it was closed for 4 months following the Natal floods. 28600 vehicles were exported and exports are now 5,8% ahead of where they were by this time last year. Overall, it seems that vehicles sales in 2022 will be back to pre-pandemic figures. This shows that the South African economy is more buoyant than previously thought, especially given the rise interest rates this year.

The negotiations with public service unions over the government wage bill are now being conducted by the Minister of Finance, Enoch Godongwana. The unions have brought their demand down from 10% to 6,5% while the government is offering 3% plus the extension of a R1000 gratuity. Obviously Godongwana has been keen to keep the wage increase to the 1,8% which is already in the budget. He is trying get the unions to agree to a one-year wage deal after which he says the true negotiations can begin. The government’s wage bill is the single biggest item in the budget at R665bn. It has been suggested that civil servants are substantially over paid and that there are too many of them in proportion to South Africa’s size.

Enoch Godongwana has said that Eskom can apply to the Treasury for funds to do essential maintenance on its existing fleet of coal-fired power stations. It is estimated that this could be as much as R2bn to be added to the R8bn which Eskom has already budgeted for maintenance. The idea is to accelerate the maintenance on certain power stations and release as much as 3 gigawatts of additional power to reduce loadshedding. Eskom has an overall debt of about R400bn which the Treasury is going to relieve by taking perhaps as much as half onto its own balance sheet.

The debt owed by municipalities to Eskom has risen by 10% to R49bn, mainly because municipalities are battling to collect rates and fees for water and electricity. Obviously, this negatively impacts Eskom’s cash flow and worsens its debt problems. Municipalities have been ordered to pay outstanding accounts but are mostly in a state of complete disarray. The inability of municipalities to provide basic services is at the root of protest action. This is becoming a major factor ahead of the ANC’s elective conference in December 2022.

The Rand

The rand’s performance since August 2020 has been impressive. It has gained ground steadily against the euro. In August 2020 it was over R20 to the euro and today it is around R17.16. Of course, the euro has been under pressure due to the war in Ukraine – but the rand’s strength began well before that war began. The rand has recently fallen to R17 to the US dollar, but this has been mainly due to dollar strength rather than rand weakness. Compared to other emerging market currencies and even first world currencies, the rand is performing remarkably well. The strength of the US dollar against all currencies is mostly due to the rapid rise in interest rates in America which has seen a shift in investors sentiment towards “risk-off” and a flight to US Treasury bills. In our view the rand is fundamentally under-valued against first world currencies and especially the dollar. We see it strengthening in the future – which will obviously help to keep local inflation under control. Consider the chart:

This chart shows the progress of the rand against the US dollar since the beginning of last year. The rand has been in a weakening channel primarily because of US dollar strength rather than rand weakness. In the past six months there has been a notable further shift towards risk-off mainly as a result of the Ukraine war and the perception that US interest rates will have to rise significantly.

You will also note the strength of the rand against the dollar since 20th July 2022. This is in line with the bear market rally on the S&P500 and the simultaneous shift back towards risk-on. Now that the bear trend is again gaining ascendancy, the rand is weakening against the US dollar.

Oil

The chart below shows the price of North Sea Brent since the pandemic took it down to low levels around $25 a barrel in April 2020. Since then, it has been rising steadily between two channel lines. Consider the chart:

The outbreak of war in Ukraine took the price above the upper channel line and more recently the efforts of the Biden administration and some excess production have brought it down to the lower channel line at about $93 per barrel. There are some indications that it might bounce back up in the relatively near future and from a purely technical perspective we would not be surprised to see it go back up to find that upper channel line – which would involve a rise to about $125 per barrel.

On this note, UBS is predicting that oil prices will bounce back to $125 per barrel by the end of 2022. This is due to supply constraints and a resurgence of demand from China. The decision by OPEC to increase production by 100 000 barrels per day from September 2022 is insufficient to meet demand. The reality is that most oil producing countries are producing at capacity. It is only Saudi Arabia that really has significant further capacity to bring online. As Russian oil production falls, OPEC countries and especially Saudi Arabia have been taking up the shortfall. By the end of 2022, countries in the European Union are planning to cut consumption of Russian oil and oil product imports by 3 million barrels per day. The bear market rally in equities on world markets is over, but if the oil begins to rise again, we can expect equity markets to react negatively and fall further. If the price begins to climb towards the end of the year, as UBS suggests, it will result in rising world inflation and a major sell-off in equities.

Companies

The recent Bureau of Economic Research survey of the construction sector found that confidence levels are at a 5-year high despite loadshedding, the rising price of petrol and rising interest rates. The construction sector is a very large employer in the economy but has been in decline since at least 2009. The value of building plans passed slumped in 2020 because of COVID-19 but has been improving steadily since then. In 2021 the government announced that it would investing almost R800bn in construction and there has been a marked increase in tenders recently. The boom in commodities has also impacted construction favourably.

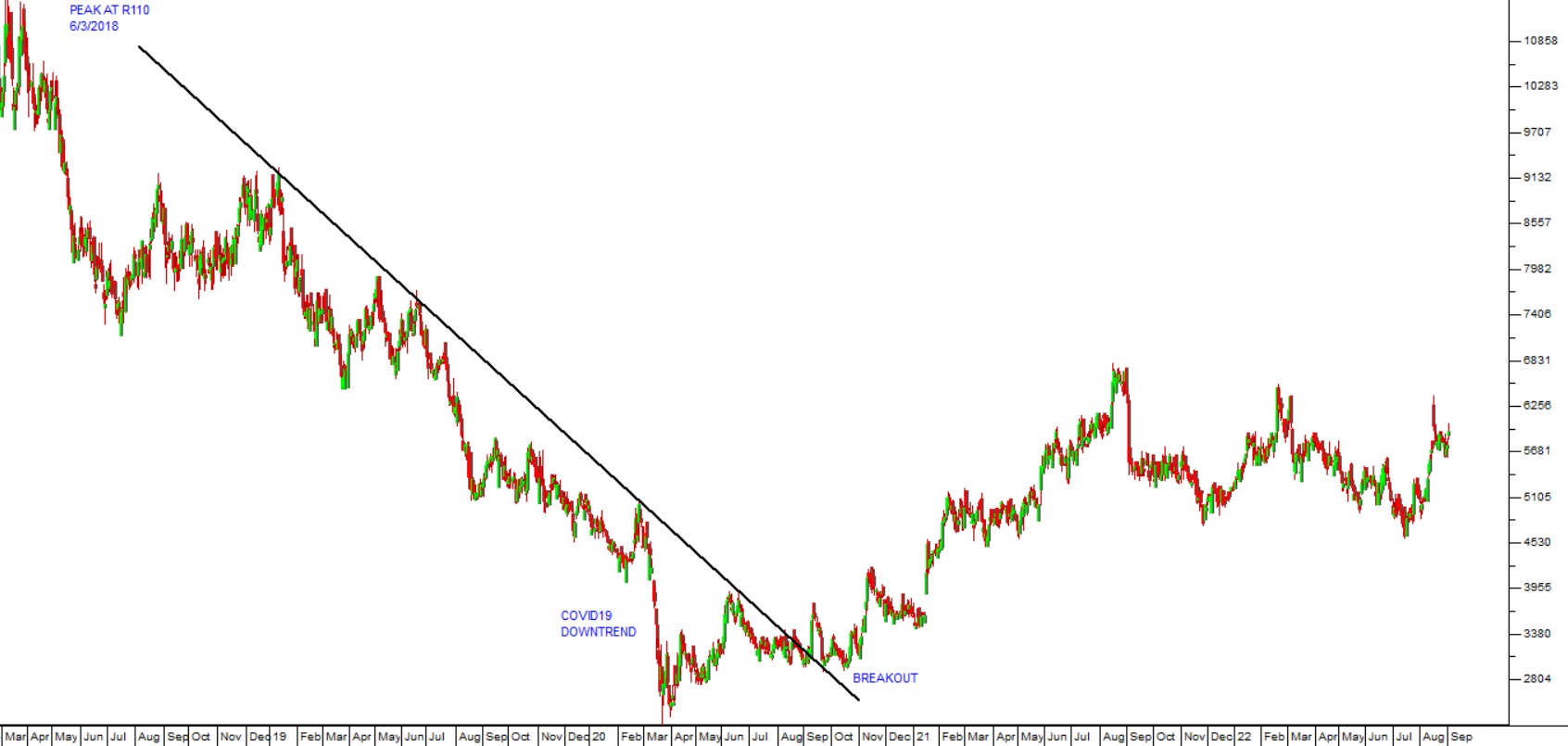

TRUWORTHS

Truworths (TRU) is a clothing, footwear and accessories retailer that operates in Southern Africa and the UK. It is listed on the JSE and the Namibian Stock Exchange. It makes a significant percentage of its sales in South Africa on credit - so its credit management strategies are critical. It is in a highly competitive industry where everyone is selling clothes from Woolworths, Checkers and Pick 'n Pay to the Foschini Group, Mr. Price, Ackermans and Pep. It is an industry constantly beset by the entry of overseas brands like Cotton On and which is entirely dependent on consumer confidence and spending. Its sales are also dependent on a fine appreciation of the rapid changes in the fashion industry. All these factors make it difficult for the company to remain profitable. Truworths has a very conservative approach and is constantly refining its business model. It has 785 stores in South Africa with thirty-six in the rest of Africa and 92 stores in the UK, Germany, and Ireland. In an update on the 53 weeks to 3rd July 2022 the company reported South African sales up 5% and UK sales up 16,6%. These results caused the share price to rise. Technically, the share fell on COVID-19, but we suggested waiting until it broke above its downward trendline. That break came on 4th September 2020 at a price of 3195c. Since then, the share has appreciated to 5759c. We still consider it to be good value at current levels on a P:E of 7,39. Consider the chart:

BLUE LABEL TELECOMS

Blue Label Telecoms (BLU) is a company which has interests in selling secure tokens of value - such as airtime, starter packs and electricity. In a disastrous decision the company decided to buy 45% of Cell-C in September 2016 for R7,55bn. In April 2019, S&P Global Ratings downgraded Cell-C's debt to CCC- from CCC+ because its capital structure was "unsustainable". Eventually, Bluetel wrote its shares in Cell C down to zero. In a trading statement for the year to 31st May 2022 the company estimated that HEPS would increase by between 34% and 38%. The company has been achieving positive cash flows and had the benefit of the sale of its 3G handset division - which helped to bring down debt levels. Technically, the share went through a reverse head-and-shoulders formation with the “head” in March 2020 at the height of the COVID-19 sell-off. We advised waiting for the share to break up through its long-term downward trendline before buying. That break came with the share at 259c on 26th May 2020 and the share is now trading for 613c - a gain of 136% in 30 months. Read the article we published on 6th September 2020 about Bluetel. Consider the chart:

GRINDROD

Grindrod (GND) is an international freight and financial services company which operates in 19 countries. In mid-June 2018, Grindrod unbundled and separately listed its loss-making shipping division (Grinship - GSH). This accounts for the "cliff" in the share price at that time. The company is now focused on its two remaining divisions - freight and financial services. Grindrod owns the North-South railway line from Beitbridge to Victoria Falls as well as port terminals at Richards Bay, Natal, Walvis Bay, Namibia, and Maputo. The company is positive on the growth of its financial services division which is now about 30% of the business. The company is focused on getting its retail banking division involved with small and medium sized businesses. In its results for the six months to 30th June 2022 the company reported revenue up 31% and headline earnings up 53%. Ports and Terminals achieved earnings growth of 164%. Technically, the share has been difficult to assess because of the split off of Grindrod Shipping, but it has completed a rising triple-bottom and has risen off this base into a new upward trend. We recommended waiting for an upward break through its long-term downward trendline before buying. That break came on 15th July 2020 at a price of 340c. The share has since moved up strongly to 1087c. The company has benefited directly from the Ukraine war. On a P:E of just over 7, we believe that this share still represents excellent value. Consider the chart:

MASTER DRILL

Master Drilling (MDI) is a South African company that specialises in drilling exploration and other holes for the mining industry, and which has diversified into drilling for hydro-electrical projects and construction. The company has moved away from the South African mining industry and now provides services in North and South America, Europe and elsewhere. It has developed a new horizontal drilling technology, or tunnel boring machine, which could revolutionise the mining industry world-wide. This technology enables the drilling of horizontal tunnels or tunnels which are inclined up or down by 12 degrees. It is much quicker and cheaper than the traditional blast and clear methods currently in use. At the moment it requires three operators, but the company is working on a completely automated remote-controlled version. In its results for the six months to 30th June 2022 the company reported revenue up 34% (USD) and headline earnings per share up 55,5% (in rand). Technically, the share was in a steady downward trend from February 2017, and we advised waiting for a clear upside break through its downward trendline before investing. That break came in March 2021 at 806c. Since then, it has moved up to 1475c. It is now trading at about 77% of its net asset value (NAV) and on a price:earnings multiple of 6,17 - which looks like extremely good value. We regard the company's horizontal drilling technology as a potentially disruptive technology in the mining industry which extends the life of some mines and makes others viable again. So, while this is a risky share, because it is linked to the commodities markets, it has the potential to offer strong growth because of the new technologies which it has that have the potential to revolutionise the mining industry. That potential is now beginning to be realised. Consider the chart:

CLIENTELE LIFE

The insurance business is a good one for investors because it is a service business without the usual working capital problems of manufacturers and retailers. It is fiercely competitive with many players fighting for the disposable income of increasingly constrained consumers and businesses. Clientele (CLI) is a small insurance business offering both short- and long-term insurance with some underwriting, mostly in South Africa. In its results for the year to 30th June 2022 the company reported headline earnings per share (HEPS) up 12% and a 34,8% increase in new business. On a P:E of 8,98 and a dividend yield of 8,13% the share looks like a bargain to us. Clearly, it is not yet big enough or with sufficient volume traded to attract serious institutional interest, which makes it a potential opportunity for private investors. Technically, the share fell at the start of COVID-19 in April 2020 but has been recovering steadily since then. Now it looks poised to break to the upside.

ASPEN

Aspen (APN) is a massive international pharmaceutical company that over-extended itself and has been working to reduce debt and to strengthen its balance sheet. It operates in over 60 countries offering hundreds of drugs in four categories: thrombosis, anaesthetics, cytotoxics and nutritionals. The pharmaceutical business is one of the best defensive industries in the world because, even in a recession, consumers have to buy their medication, especially if it is chronic medication. In its financials for the year to 30th June 2022 the company reported revenue up 2% and headline earnings per share (HEPS) up 31%, which shows a substantial improvement in cost management. Technically, the share has fallen from a high of around R275 in September 2021 to a low of R132 in June and July of 2022. There it made a “double bottom” and has been rising since. Last week it broke up through its long-term downward trendline and we think it is poised for a new upward trend. Consider the chart: