Sasol Breaks Up

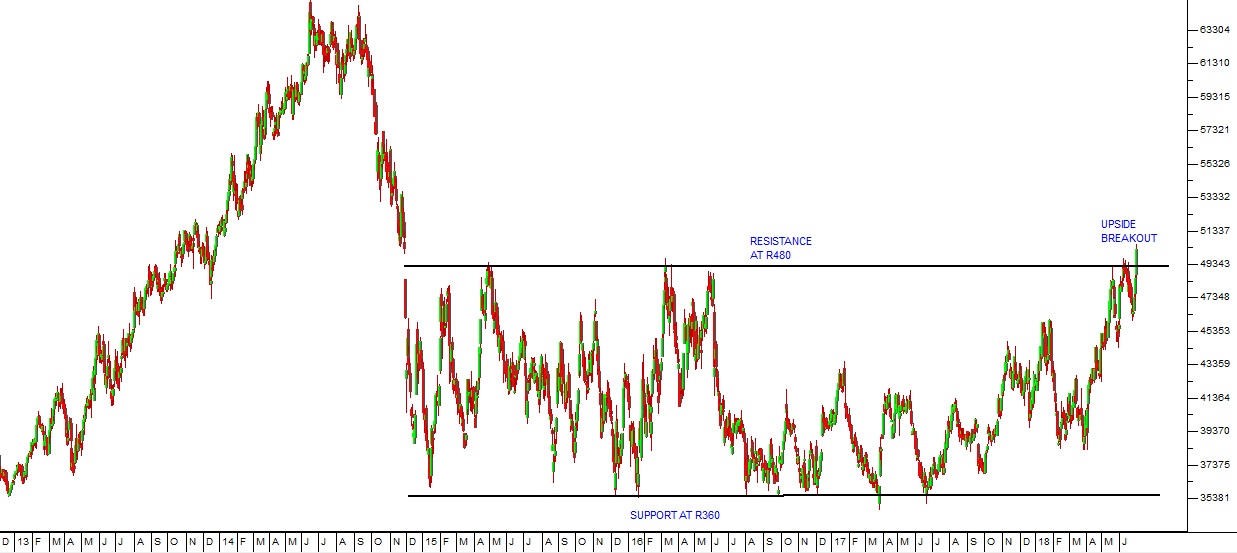

2 July 2018 By PDSNETan article about the fact that Sasol, since the collapse of the oil price, had entered a sideways market between resistance at R392 and support at R360. Sasol’s collapse was caused by the sharp fall in the oil price with the widespread exploitation of shale gas, especially in America. At the time about 60% of Sasol’s revenue came from oil so the fall from around $115 per barrel to as little as $28 had a major impact.

But Sasol re-grouped, reducing its exposure to oil, and moving more into chemicals. And, of course, the oil price rallied back up to around $80. The stronger oil price is a result of the generally stronger world economy which has increased the demand for oil.

So Sasol remained within this sideways market for four long years – from April 2014 until now. The upside breakout is very significant technically, especially after such a lengthy “consolidation”. Theoretically at least, Sasol’s price should now move up strongly. Consider the chart: