The Ramaphosa Impact

27 July 2018 By PDSNET

This is no mean achievement. He has managed to get one third of his $100bn target in just six months. The effects of this flood of new cash are tangible and so far from what the previous incumbent could have achieved as to be laughable – that is, of course, assuming that Zuma even understood the concept of FDI and its importance.

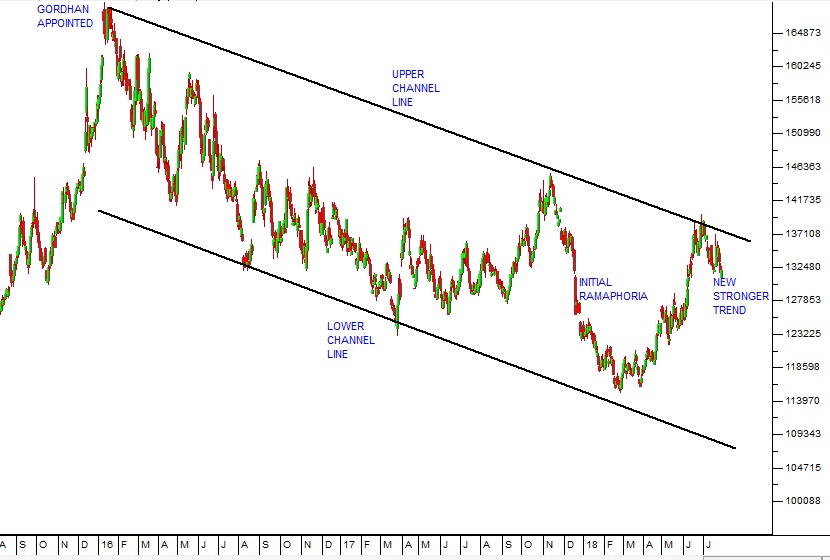

The most noticeable impact has been on the strength of the rand. As the currency market has grasped the idea that Ramaphosa is a veritable FDI salesman, the rand has done an about turn and moved steadily stronger. From its weakest point of almost R14 to the US dollar it has strengthened to R13.20 and looks to continue strengthening from there. Consider the chart: