Banks

12 August 2019 By PDSNETThe back-bone of the South African economy is the banking sector – dominated by the “big five†banks – Standard, FNB, Nedbank, ABSA and now Capitec. Banking shares offer private investors a very solid long-term investment. Mostly they are relatively safe investments which grow steadily as the economy grows.

It is important to understand that they are service companies and unlike manufacturing companies or mining companies, they don’t have large amounts of capital tied up in fixed assets such as land, buildings, plant and equipment. Their primary assets are their staff and their systems. They do obviously have capital at risk and indeed risking capital is the essence of their business, but generally, they are much lower risk investments than the other sectors of the share market.

And they are immensely profitable. Nedbank (which is arguably the smallest of them) has just produced its results for the six months to 30th June 2019. In that half-year Nedbank made a headline profit of just under R7bn – in one of the most difficult, low-growth economic periods on record.

And their income is mostly annuity income that they take directly off their clients’ bank accounts at source. They do not have to invoice their customers and wait to be paid like other businesses.

Perhaps the only real challenge they have is keeping up in a competitive and highly technical environment that is constantly shifting. The advent of a number of new banks in South Africa is potentially disruptive – and yet most people are reluctant to change their bank unless provoked by very bad service or blatantly excessive fees. Winning market share in the banking sector is an expensive and difficult process.

So how do you assess the banking sector? Our suggestion is that you study the dividend yield (DY) firstly of the entire sector and secondly of the individual banks.

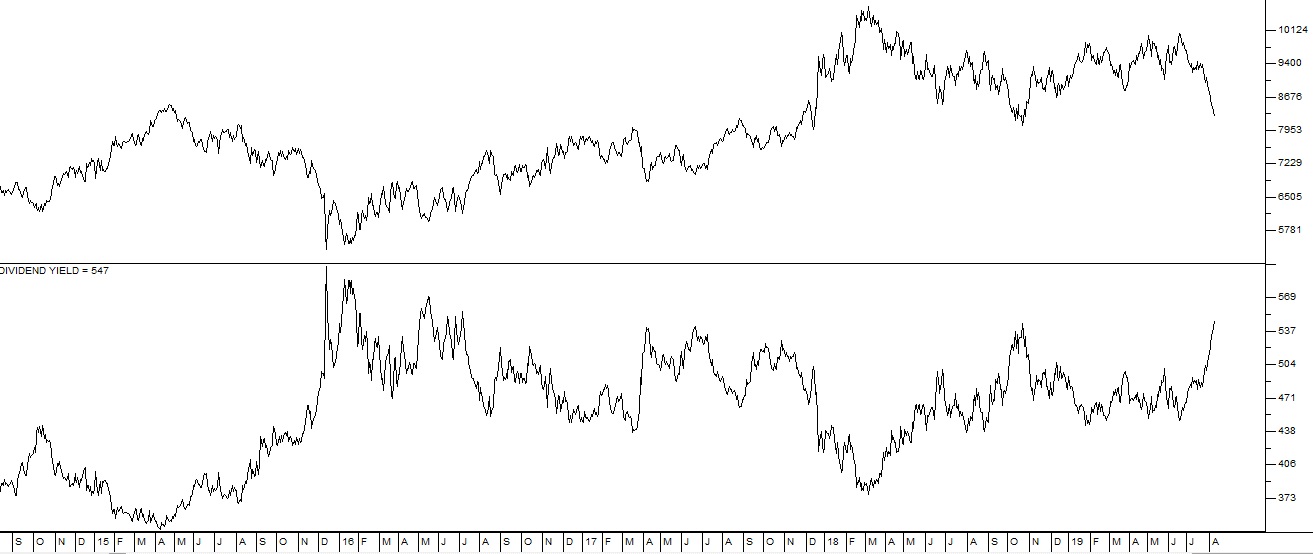

The JSE Banks index (J835) generally maintains a DY of less than 5%. Almost 11 years ago, immediately after the sub-prime crisis, in March 2009, the DY of the JSE Banks index reached its worst level on record at 7,14% (9-3-08). Since then it has tracked between 3%, when the shares were over-priced, and 5,5%, when they were cheap. Right now the DY on that index is 5,47%. While it could certainly get worse, the high probability is that banking shares are cheap.

Consider the chart: