The Confidential Report - October 2022

5 October 2022 By PDSNETAmerica

The entrenched nature of inflation in America became more apparent with the release of the core inflation (personal consumption expenditure or PCE) figures for August 2022 which came in at 4,9% year-on-year and 0,6% for the month. This shows that the interest rate hikes, which total 3%, that have been passed by the Federal Reserve Bank’s monetary policy committee so far are nowhere near what will be required to bring inflation down to the required level. Real rates of return in America are still heavily negative and will probably remain negative for some time. All of this means that the pattern of rising interest rates is likely to continue and that the bullish sentiment which dominated markets from mid-June to mid-August was both misplaced and foolish.

The US monetary policy committee (MPC) increased the federal funds rate by a further 0,75% - the third such hike this year. The hike was anticipated, but the hawkish remarks of Jerome Powell were not. He again emphasised the need to bring inflation in the US below 2% and said that this was more important than the unemployment rate. He said that his views had not changed since he spoke at Jackson Hole. In fact, he said that the labour market was too tight, and that demand still needed to be curtailed. The S&P reacted by falling below 3800 in a clear indication that the bear trend is definitely in place. That has been confirmed by Friday’s close at 3585 – well below the previous cycle low of 3666 made on 16th June 2022. So now we have a classic pattern of lower highs and lower lows. Consider the chart:

This chart shows the various support/resistance levels that exist on the S&P500 index in this bear market. The most recent is the 3666 level first established on 16th June 2022 and now clearly broken. The chart is very instructive because it shows how the specific levels at 4170, 3900 and now 3666 were established historically and the influence of those levels on the progress of the index.

The question now arises, “How far down will the bear trend go?”

As we have pointed out in previous Confidential Reports, it is difficult to establish an end point for this bear trend with any great accuracy. In the past bear trends have generally fallen to about 50% of their peak value – which would imply that the S&P will fall to around 2400 (i.e., half of its 3rd January 2022 peak of 4796). However, this bear market is likely to be worse than the average because of the Federal Reserve Bank’s need to reduce the size of its balance sheet by sucking excess US dollar liquidity out of the world economy and the US in particular. This bear trend is now nine months old. In 1929, the bear trend went on for 30 months and saw the Dow Jones index fall to just 11% of its peak value.

You may have noticed that we have superimposed a 300-day simple moving average (MA) on the chart above. This is because the slope of the 300-day MA gives a historically reliable indication of the change from bull to bear and back again. You can see that the slope of this long-dated MA turned down in about the middle of June 2022. That was the time when we accepted the existence of the bear trend and sold out our entire equity portfolio.

One method for evaluating the current bear trend is to consider how over-sold the market and specific shares have become in comparison with previous down trends. The over-bought/over-sold indicator (OB/OS) shows the gap between a moving average and the index expressed as a percentage of the index. If you need to refresh your knowledge on the construction and interpretation of the OB/OS you should re-read module 27.

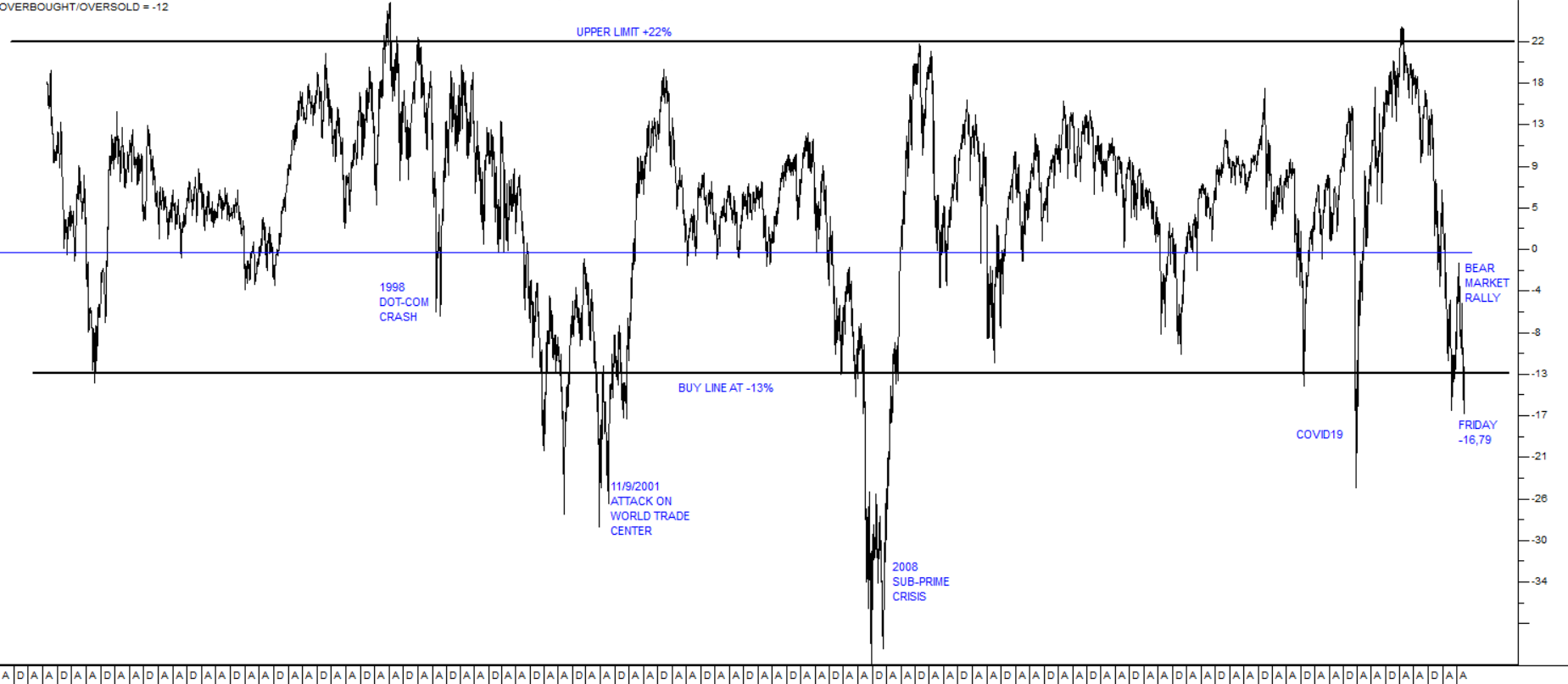

The chart below shows the OB/OS of the S&P500 against a 300-day MA:

To give some historical context, this shows the OB/OS going back to mid-August 1989. We have drawn in a -13% buy line and a +22% upper limit line to give an idea of the range within which the index has moved over that 33-year period. Between these two lines is the horizontal line representing a neutral OB/OS of zero. We have marked on the chart the 1998 dot-com crash, the 2001 attack on the World Trade Centre, the 2008 sub-prime crisis and the impact of COVID-19 in 2020. To show its relative insignificance, we have also marked the bear market rally which recently took place between mid-June and mid-August 2022.

You can immediately see that last Friday’s 1,51% sell-off of the S&P took the OB/OS down to -16,79% which is well below the -13% buy line. This does not mean that we are now at a good place to begin buying shares. The OB/OS can remain below the buy line for some time – as it did for most of the time between October 2000 and May 2003 which indicates that the index was still falling. We believe that the OB/OS on the S&P will remain in or around negative territory now for some time and that this bear trend still has a considerable distance to run.

What is also interesting is the upper limit line at +22%. You can see that the S&P very seldom reaches anywhere near this level – and when it does it is most probably heavily over-priced and due for a downward trend. If you buy when the index is above 22%, your probability of making money is extremely low – and the opposite is also true for -13%. But it is also a fact that there was definitely someone who did buy at +22% - because otherwise the chart would not go there. So, you can see that watching the OB/OS definitely improves your probability of being right in your transactions.

The Federal Reserve Bank adjusted expected growth in America down to just 0,2% for this year, followed by 1,2% in 2023. The recent results of Fed Ex and Ford, both of which made dire predictions for the future have impacted investor sentiment and technology stocks in general have fallen. At this stage, the S&P500 is on a forward P:E of 16,8 – well below its peak of 22 at the beginning of this year. The S&P’s expected consensus earnings growth for the third quarter of 2022 is 5% - but most of that is in the energy sector. If that is stripped out then growth slumps to -1,7%. Consumer spending and financial shares are the biggest losers.

We are about to enter the third quarter earnings season in America when all the S&P500 companies will report their profits. It will be interesting to see whether the cumulative effect of rising interest rates is impacting on their turnover and earnings yet. The bearish sentiment on Wall Street is now impacting on all equity markets around the world including the JSE. As sentiment in international markets turns negative there is a natural shift to “risk-off” which directly weakens the rand.

China

Growth in China is projected to fall dramatically in 2022 according to the World Bank. The bank expects the Chinese economy to grow 2,8% this year – a considerable drop from previous forecasts of 5% and next year the forecast has been trimmed from 5,3% to 4,5%. Obviously this radical slow-down in the Chinese economy is having a significant impact on commodity prices and hence on South Africa. One of the causes of the slowdown has been the stringent response of the Chinese government to recent flare-ups of COVID-19. This impacts on companies like Barworld which supplies equipment to the mining industry, but it also has a more generalised impact on the world economy which appears to be heading inexorably into a recession. In addition, Barworld’s order book in Russia has fallen by two-thirds since the start of the Ukraine war.

Ukraine

The recent successes that Ukraine has had in the Northeast are a major blow to Russia and to Putin’s dictatorship. He has to somehow maintain the image of being victorious and winning the war while the opposite is now the reality on the ground. He is finding it increasingly difficult to sustain the disinformation campaign that he has been presenting to the Russian people and there have been some rumblings of discontent and even suggestions that he must go. At the same time, the Russian economy is clearly taking strain from the Western sanctions. An economist has estimated that without the sanctions the Russian economy would have grown by as much as 5% or 6% in 2022. As it is, Putin himself is projecting a 2% contraction, his ministry of economy is talking about a 3% contraction and the World Bank is talking about more than 11%. As we have indicated previously, we believe that Russia’s position is now unsustainable, and some kind of radical change will be probably forced upon Putin within the next few months. He has implemented a partial mobilisation of Russian reservists to fight in the war – which is a clear admission of how badly things are going for Russia and it may well back-fire on him, destroying what popularity he previously enjoyed. The rushed and illegal annexation of land in Ukraine is a further indication of his desperation. Our view has always been that Putin will not survive this war in Ukraine – and now it seems he may not survive more than a few more months.

If the war in Ukraine were to end, however that may come about, it will bring a certain relief to the world economy – mostly in the form of lower energy costs. No doubt this will have at least a short-term positive impact on equities.

Political

As the ANC’s end-of-year elective conference draws nearer, it appears that President Ramaphosa will easily win re-election. The provinces of Limpopo and the North West have now given him their endorsements, while Gauteng, the Eastern Cape, Mpumalanga and the Northern Cape are also expected to endorse him. Obviously, the Phala Phala farm issue still has to be resolved, but we expect that it will not result in him having to step aside. This means that the political status quo will remain in South Africa – at least until the 2024 general elections – when we are expecting that the ANC will almost certainly lose its majority in parliament and be forced to make a compromise with the DA. In any event, the political future of South Africa still looks fairly stable for the moment.

Cosatu is once again re-considering its support for the ANC as part of the so-called “tripartite” agreement. They have called a special conference in 2023 to reconsider their relationship with the ANC. Four of Cosatu’s unions representing 600 000 members have called for the alliance to withdraw its support from the ANC. We think that it is unlikely that they will withdraw their support, but if they did it would obviously impact on the 2024 elections and reduce the ANC’s support even further. The government’s court-endorsed refusal to implement the final year’s wage increases in their 3-year agreement with the civil service unions signed in 2018 has done much to alienate the union movement.

Economy

The Reserve Bank predicted that gross domestic product (GDP) would shrink by 1,1% in the second quarter of 2022. In fact, it shrank by just 0,7% - and that comes on top of the (revised) 1,7% growth in the first quarter. Obviously, an array of factors caused the negative growth such as the flooding in Natal, increased loadshedding, strike action in the mining and manufacturing sectors, the sharp rise in the petrol price and the cumulative impact of rising interest rates. Some of these factors are “once-offs” and so we can expect the figures for the third quarter to be better. The figure has impacted negatively on both the rand and the government long bond yield.

The drop in inflation to 7,6% in August 2022 from July’s 7,8% is an indication that it may be topping out. Despite this the monetary policy committee (MPC) raised rates by a further 0,75% at its meeting in September. Following the 0,75% hike in the US and other rate hikes elsewhere, there is a need to keep South African long bonds attractive to international investors. Core inflation fell to 4,4% from July’s 4,6% probably in response to the drop in the oil price. The producer price index (PPI) for August 2022 was also slightly lower at 16,6% (down from July’s 18%) and included a 37,6% increase in the category which includes fuel and an 11,6% increase in the category which includes food products. The civil service unions are demanding an increase at least in line with inflation and Eskom is looking to hike electricity costs by 32%. The rand has fallen through R18 to the US dollar as risk-off sentiment dominates world markets.

The monetary policy committee (MPC) raised rates by a further 0,75% in a narrowly approved decision, with two out of the five members of the committee believing that a 1% hike was needed. The Reserve Bank’s projections for gross domestic product growth are now 1,9% for this year, 1,4% for 2023 and 1,7% in 2024. Obviously, the MPC wants to stay well ahead of its American and European counterparts so that the yield on South African bonds remains attractive to overseas investors. It is notable that, while the Reserve Bank’s growth projections are conservative and low, they are well above the 0,2% by which the US Federal Reserve Bank expects that economy to grow this year. Overall, we believe that the South African Reserve Bank has done an excellent job of managing monetary policy over the past 30 months in a very difficult environment.

The rapid decline in mining production over the past six months will impact on employment and tax collections. In July, mining production fell by 8,4% after June’s 7,1% decline. There are a multitude of factors behind this decline including loadshedding, difficulties with Transnet’s operation, strike action and a fall-off in commodity prices. What is clear though is that the commodities boom is rapidly ending and that any further social spending based on it is unwise.

The Balance of Payments unexpectedly moved to an R87bn deficit in the second quarter. Economists were forecasting a R100bn surplus. This deficit shows that the commodity cycle has turned down causing the trade surplus to fall by almost R100bn. The surplus was insufficient to cover the massive dividend payment to foreign investors during the quarter. The deficit on the Balance of Payments will undoubtedly put pressure on the monetary policy committee to increase interest rates to make our local bonds more attractive to overseas investors.

The recent remarks of the Governor of the Reserve Bank, Lesetja Kganyago, at the Centre for Education in Economics are very significant. There he stated that his longer-term goal was to bring South African inflation down to 3%. To date, the management of monetary policy in South Africa has been exemplary, a rare positive achievement of the ANC and probably one of the reasons that the economy is still functional in these times of international turmoil. To his credit, Kganyago urged the government to implement structural reforms to achieve private sector growth rather than simply trying to spend its way out of difficulty. Inflation in South Africa is still lower than in the US or Europe which is a clear indication of the effectiveness of our monetary policy committee (MPC). Commenting on fiscal policy, Kganyago observed, “...the economy is barely able to grow faster than 1% with a shrinking tax base and a weak outlook”. Perhaps he should enter the ANC’s December leadership contest.

The Treasury document which opposes the continuation of the social relief of distress (SRD) grant in its current form shows how the ANC under President Ramaphosa is coming to terms with the need to “cut its coat according to its cloth”. The document discusses the various options for funding the SRD in such a way that it does not require an increase in the government’s high levels of debt and concludes that raising VAT to 16% or 17% would be the least disruptive. Each percentage point increase in VAT would generate about R25bn of additional revenue. The Treasury proposes that the SRD be curtailed to apply only to the “extremely poor” who had no other source of income and who were actively looking for work. The importance of debt consolidation may be gaining ascendancy over populism.

Retail sales rose by 8,6% year-on-year in July 2022 coming off the low base in 2021 when spending was impacted by the civil unrest in Natal and Gauteng. However, retail sales have been falling for the past 3 months this year due to loadshedding, the rise in the petrol price and rising interest rates. Consumer spending accounts for about two-thirds of gross domestic product (GDP) so the declining trend will impact growth.

Finance Minister, Enoch Godongwana, increased the government’s offer to the civil service unions to 3% - now well above the 1,8% which he included in the February 2022 budget. Predictably, the unions are rejecting this offer and insisting on an increase which at least beats inflation - now running at over 7%. The courts allowed the government to get out of its previous 3-year wage deal with the unions during the COVID-19 pandemic and the unions maintain they have effectively had no increases since 2020. The size and cost of the civil service in South Africa is considered to be excessive for a country of this size. The allocation of government funds to substantial further wage increases obviously reduces its ability to provide funds for other social support purposes. In our view, it now seems probable that we will have a civil service strike.

Foreign direct investment (FDI) dropped sharply in the second quarter of this year to R26bn, down from R40bn in the first quarter. Fallout from the Ukraine war has added to rising international interest rates resulting in a shift in investor sentiment towards “risk-off” – which has impacted on emerging economies and South Africa in particular. The waning commodities boom has also made international investors less interested in investing in an exporter of raw materials like South Africa. The drop in FDI also reflects a general drop in investor confidence in South Africa following the floods in Natal and the current problems with loadshedding.

Eskom

The sudden escalation of load shedding in September has placed an enormous strain on the economy and will inevitably result in lower levels of gross domestic product (GDP) growth and ultimately higher unemployment. It is apparent that Eskom’s fragile and aging fleet of power stations can no longer cope with the electricity demands of the economy. Eskom is now trying to buy a up to gigawatt of additional power from those companies who already have installed capacity. It is also re-employing eighteen previous Eskom workers, with decades of experience, to help it deal with the problems.

Electricity users are faced with the prospect of a further 32% hike in electricity prices in the coming year, having just absorbed a 9,6% increase in April this year. These problems will undoubtedly cause more companies and consumers to set about implementing their own power generation solutions, despite the short-term costs. For both businesses and consumers, generating your own power, if you can afford it, is becoming almost an essential for survival in South Africa.

One of the reasons that we are having extreme loadshedding is that the National Energy Regulator of SA (NERSA) has been slow in registering renewable energy projects for mining companies. Twenty-nine mining companies have applied to implement eighty-nine projects which would collectively produce 6,5 gigawatts of power, but NERSA has only registered 0,5 gigawatts of that so far. If all these projects were registered, they would certainly reduce the strain on the national grid and almost eliminate the need for the current loadshedding. The stage 6 loadshedding implies that the grid is short of six gigawatts of power – which could be supplied by these mining companies who are awaiting a bureaucratic registration process.

Businesses have been forced to shut down manufacturing and processing for extended periods of time as a result of loadshedding. This, in turn, will lead to further business failures and lower employment levels. Third quarter GDP will probably be much lower than was projected following the second quarter contraction of 0,7%. During the September quarter electricity availability dropped below 60%. Some economists are expecting growth of 0,5% in the third quarter, down from as much as 2% originally projected.

The decision by Pravin Gordhan to re-structure the Eskom board will probably not solve the country’s loadshedding problem. There is certainly a case to add some directors who have an engineering background to the board, but replacing the entire board is going to have a negative effect. We agree with the DA’s assessment that it is the Minister of Mineral Resources and Energy, Gwede Mantashe, who should be removed. He has stood in the way of renewable energy for years and prevented the country from transitioning away from its aging coal-fired power stations.

The Rand

The pattern of weakness in the rand against the US dollar since April 2022 really reflects a general shift in international sentiment towards risk-off as more investors seek the perceived safety of the US dollar and move away from emerging market currencies. That shift has been caused by the aggressive interest hikes by central banks in the US and elsewhere.

The movement of international investor sentiment is having an impact on all emerging economies and has seen the euro pass parity with the US dollar a few months ago. More recently the British pound has taken a beating because of the policies implemented since Liz Truss took over as prime minister. The weakness in the rand has tended to negate the fall in the oil price back to $88 (North Sea Brent). Consider the chart:

The rand is certainly falling against the US dollar, but it has been holding its own against the euro and the pound. For this reason, we are not too deeply concerned about the weakness against the dollar.

Commodities

The platinum price has fallen from a high of around $1300 per ounce in February 2021 to current levels around $936. South Africa produces about 75% of the world’s platinum group metals (PGM) and they have been a major source of tax revenue for the government. In Finance minister Enoch Godongwana’s mini budget to be delivered in less than a month on 26th October, it seems likely that revenue will exceed the February budget estimates by between R50bn and R100bn. This will enable the government to reduce its deficit, especially as a percentage of gross domestic product (GDP). However, the bonanza from the commodities boom is clearly coming to a rapid end. Consider the platinum chart:

Here you can see the steady decline in the US dollar price of platinum – which has to some extent been off-set by the fall in the rand. The iron price too has fallen sharply over the past few months dropping from $161 per ton in April 2022 to current levels below $100.

Companies

Obviously, now that the bear trend is gaining momentum, private investors should be substantially in cash and trying to pick the best moment to buy back into quality shares at bargain prices. That time is probably still not imminent, but that is just our opinion, and we can be wrong.

Much depends on how risk averse you are. For the risk averse, the slope of the 300-day moving average is probably the safest indicator. When that turns upwards you can be fairly sure (but not certain) that a new bull trend has begun. In the markets there are no certainties – only probabilities.

For those who prefer to take a greater risk with the objective of buying in closer to the bottom, a 65-day exponential moving average of the S&P500 index will give a much earlier signal – but with the risk that it could be reversed.

Whatever your risk preference is, you will have the great satisfaction of knowing that you are not buying in at the top of the market as some people clearly did. So, you are doing better than them.

CAPITEC (CPI)

A share which is worth watching closely as it falls is Capitec. This is because it is a very high-quality company with a good track-record of excellent growth. It has fallen from its high of 238348c to last Friday’s close of 155300c – which is 34,8%. The P:E ratio has come down from 34,64 to 20,83.

Since it is a virtual certainty that Capitec is not in the process of going into liquidation, the only question that now remains is, “When will it turn?”

One of the best ways to get a reliable buying signal on a blue-chip share which has fallen rapidly like this is to apply a 65-day exponentially smoothed moving average. Consider the chart:

You can see here the progress of Capitec shares since March 2022. The share was in a downward channel, but collapsed from 7th September 2022, when it became apparent to many that international investors had shifted to risk-off, because the bear trend was likely to resume. You can see how the 65-day exponentially smoothed moving average has dipped down sharply in response to the downward trend. You need to wait at least until the share breaks up through it before investigating further.

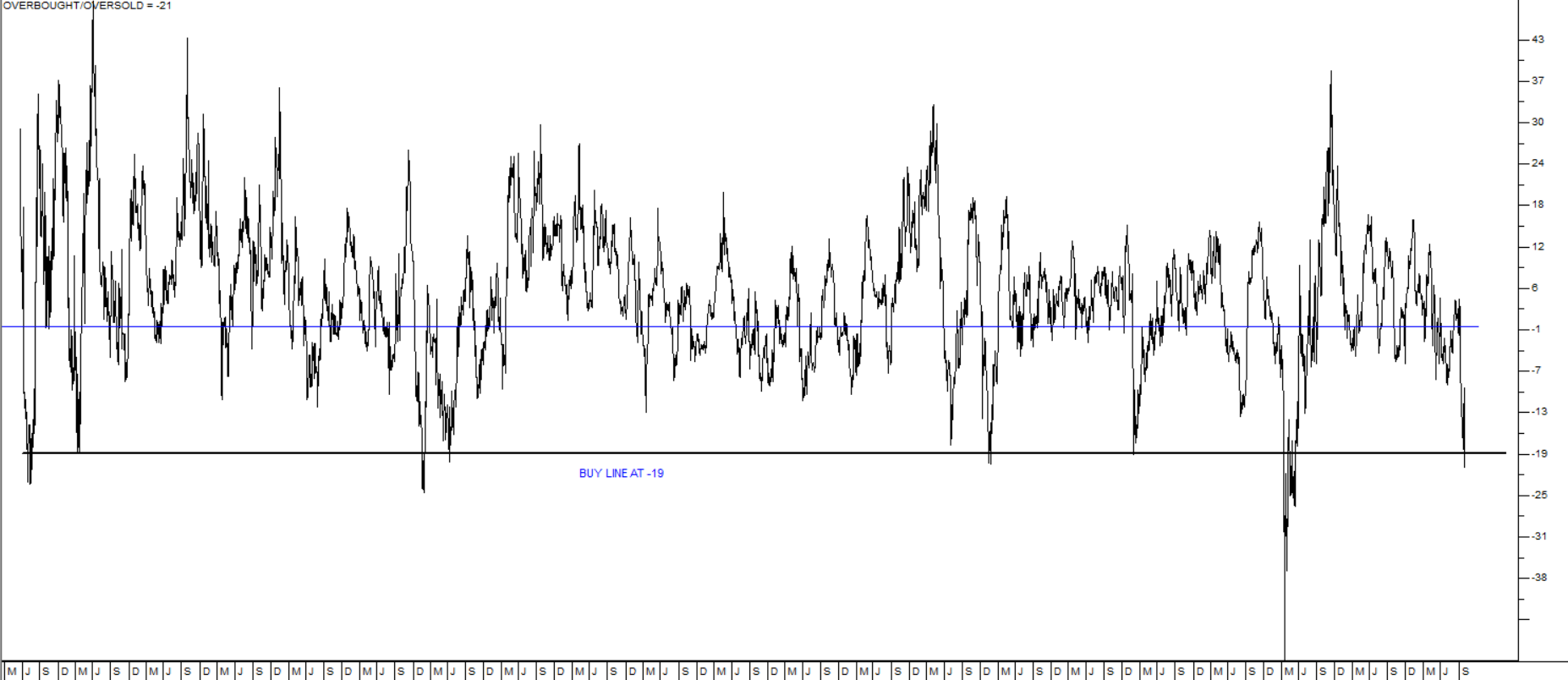

An even more sensitive indicator is the OB/OS against a 65-day moving average. The following chart shows Capitec’s OB/OS against a 65-day MA going back to 2002:

We have drawn in a buy line at -19% - and you can see that last Friday’s close put the share at -21% just below that line. Of course, this does not necessarily mean that it is time to buy – but it does mean that the share is in historically oversold territory.

NEW LISTING

A special purpose acquisition company (SPAC), Cilo Cybin is planning to be listed on the JSE in November 2022. The company’s share offer opened on 12th September 2022 with the objective of raising R2bn. The company plans to buy a cannabis manufacturing facility in Pretoria which has the capacity to produce R150m worth of cannabis and vaping product per month. Cannabis is a growth industry, and this share could do well. However, we would prefer it to prove itself as a listed entity before becoming interested in its shares.

CAXTON (CAT)

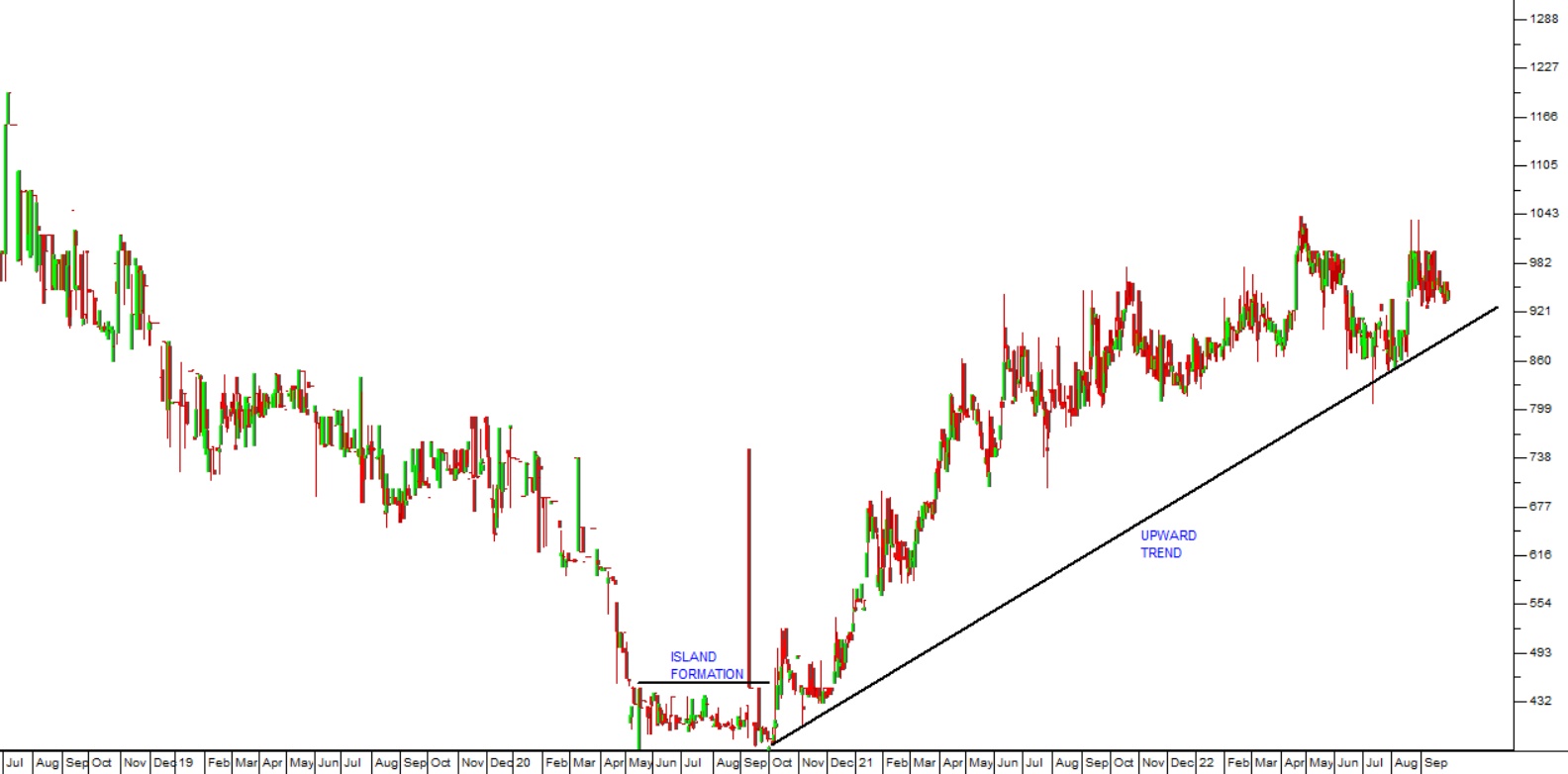

Caxton (CAT) is a South African printer and publisher. This company is at the heart of the displacement of hard copy by digital and it is adjusting by reducing costs and trying to move across to digital platforms. There has been a steady erosion of advertising revenue and even before COVID-19, the purchase of magazines was in decline. In its results for the year to 30th June 2022 the company reported revenue up 14,5% and headline earnings per share (HEPS) up 108,2%. The company's net asset value (NAV) rose by 9,9% to 1887c per share. Caxton is financially stable and entered a new upward trend in 2021. The share has broken up out of an island formation and continues in an upward trend. Consider the chart:

TRUWORTHS (TRU)

We suggested that Truworths was worthy of your attention in September’s Confidential Report and since then it has produced financials for the 53 weeks to 3rd July 2022 in which it reported headline earnings per share (HEPS) up 50%. At the same time, the share price has fallen below R50 – which makes it even better value in our view. This is a clothing, footwear and accessories company operating in South Africa and the UK. It is a long-term retail success story with an excellent track record. What is notable about this company is that it is debt-free. In the current tough economic conditions, there are very few retailers who have no debt on their books. Being debt-free means that the company is well-positioned to withstand any shocks and to take advantage of opportunities. At the same time, from an investment perspective Truworths trades on an earnings multiple of just 6,39 against the JSE’s average P:E of 10,36 – and it is on a dividend yield of 8,1% - which means that it is giving investors a very good return. Technically, we originally advised waiting for the share to break up out of its long-term downward trend following COVID19 – which it did on 9th September 2020 at a price of 3552c. The share moved up to a high of 6700c in August of 2021. Since then, it has been impacted by the current bear trend and has been falling back. In our view it is one of the shares to watch and to pick up when the bear trend is over. Consider the chart:

HYPROP (HYP)

Property shares, or real estate investment trusts (REIT) are among the cheapest on the JSE at the moment. Most of them are trading well below their net asset value, with some close to one third. This is significant because a REIT’s NAV is typically made up of property which tends to be a very secure asset.

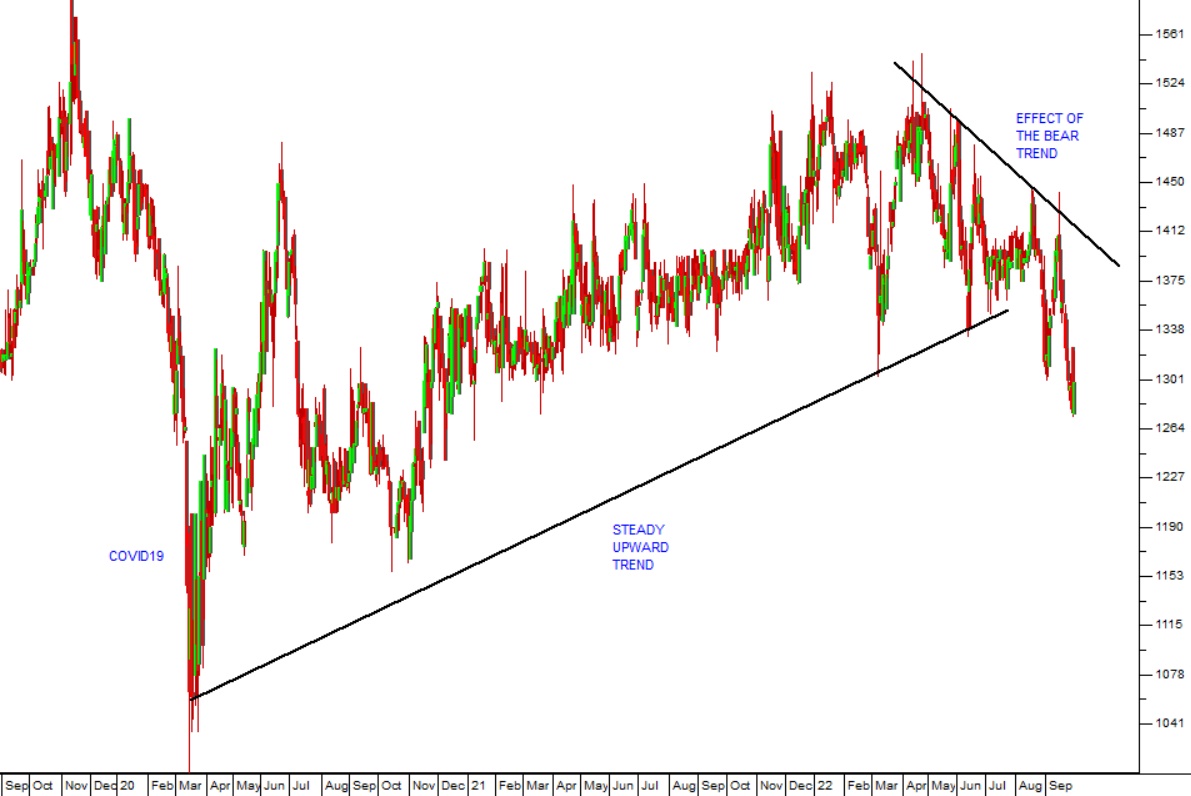

Hyprop (HYP) is a leading property REIT that specialises in high-quality shopping malls in South Africa and has some interests in Eastern Europe and Africa to the North. It owns some of South Africa's best-known shopping malls like Rosebank, Canal Walk, Hyde Park and Clearwater. It has been impacted to some extent by the fall-off in consumer spending through lower trading densities. This share is currently trading at close to half of its net asset value (NAV) of R60.88 - which in our view makes it a good buy. The new CEO, Morne Wilken, is intent on building roof-top gardens and offering shared workspaces to lure customers back to its shopping malls. In its results for the year to 30th June 2022 the company reported a loan-to-value (LTV) of 36,4% (down from 45,8%) and a retail vacancy rate of 2% in South Africa. Headline earnings per share (HEPS) were up 34,9%. Consider the chart:

Technically, following the COVID-19 sell-off, the share completed an "island formation" and broke up convincingly. Since that break it has been trending steadily up.

SAPPI (SAP)

Sappi manufactures paper, dissolving wood pulp (DWP) and paper pulp internationally and supplies products on 3 continents. DWP is used to manufacture clothing, packaging products and many other applications. DWP, specialty and packaging products were seen as the profit generator in the future, but until recently, the price of DWP had fallen sharply. Then in 2021 the price of DWP began to rise as demand from China surged. It is directly linked to the level of consumer spending and it is well diversified geographically. The company has had problems with the backlogs at Durban port and rising energy costs. On 29th September 2022, the company announced that it had sold three of its European mills for 272m euros which significantly improves the company’s position. Consider the chart:

Technically, the share collapsed off a triple top in 2017 and 2018 to reach a low of 1915c in March 2020 following COVID-19. Since then, it has been recovering and has broken up through its downward trendline signalling a new upward trend. The share appears to be recovering strongly. It is essentially a commodity share and hence somewhat risky.

STOR-AGE (SSS)

Stor-age is the JSE's only real estate investment trust (REIT) which specialises in buying and running domestic storage facilities in all major South African cities and in the UK. Its business is split about 60% in South Africa and 40% in the UK. It expects its UK business to exceed the South African business in due course. The company owns 74 properties worth R4,7bn in SA and R2,9bn in the UK. The business of Stor-age tends to do well in recession as well as in boom periods of the economy. The average client keeps his storage unit for 2 years. The client base is widely diversified and very stable from a statistical point of view. The company's foray into the UK demonstrates its ability to find appropriate properties and add them to its portfolio. It also gives the share a rand-hedge element. The company's loan-to-value (LTV) was just 27,9% on 31st March 2022. In a business and trading update for the period ended 31st August 2022 the company reported that in South Africa occupancy increased by 2% and the average rental rate by 6,7%. In the UK occupancy was up 1,3% while the average rental rate increased by 10,8%. We believe that this is one of the better property investments available on the JSE. It offers a steady growth and minimal risk. The company has been exceptionally well-positioned to survive COVID-19 with a strong balance sheet and a business which tends to benefit from people down-sizing their homes. Technically the share was rising steadily until the impact of the bear trend since April 2022. Consider the chart:

This share has a very steady and reliable passive income from renting out storage facilities – which makes it a defensive share in these difficult times.