2020 Prediction

13 January 2020

By PDSNET

1. The dominant prediction for 2020 is that Wall Street will continue on its upward journey with the S&P500 breaking a series of new highs during the year. In this process it will go through at least one major correction – which is already probably overdue – and that will represent a buying opportunity. This prediction is based on our perception that the US economy will continue to grow strongly and with it the world economy. This growth is driven by the massive quantitative easing and monetary policy stimulation of the past decade. We do not see any significant recession occurring in the US or elsewhere during 2020. If anything, the pace of economic growth will probably become more widespread and stronger. The great bull market, now in its tenth year, is showing no signs of slowing down. Bearish commentators are consistently being proven wrong to the point where few are willing to stake their reputation on calling the top.

S&P500 Index 2009 to 2020 - Chart by ShareFriend Pro

- The South African economy, which is miniscule in relation to first world economies, will probably improve. We believe that the GDP growth estimates for 2020, which are mostly below 1%, err on the conservative side. We are expecting at least 1% and maybe as much as 1,5% this year. This idea is based on the steady implementation of reforms within the economy and the fact that we are experiencing a commodity boom which is impacting our mining sector positively despite the best efforts of the government to create a hostile investment climate. This prediction obviously assumes that our problems with electricity and Escom are at least mitigated. We believe that Escom represents an outdated and obsolete mechanism for power generation and distribution. New technologies are opening the way for distributed generation - which will be largely undertaken by private enterprise. Eventually, government involvement in the energy sector will probably disappear or be much reduced - as will the use of fossil fuels. Both are expensive and unnecessary. 2020 will certainly see some disruptions as this realization slowly sinks in and while we are still dependent on government-supplied fossil fuels. Forward thinking companies are already implementing their own solutions for power generation as Escom power becomes increasingly expensive and unreliable.

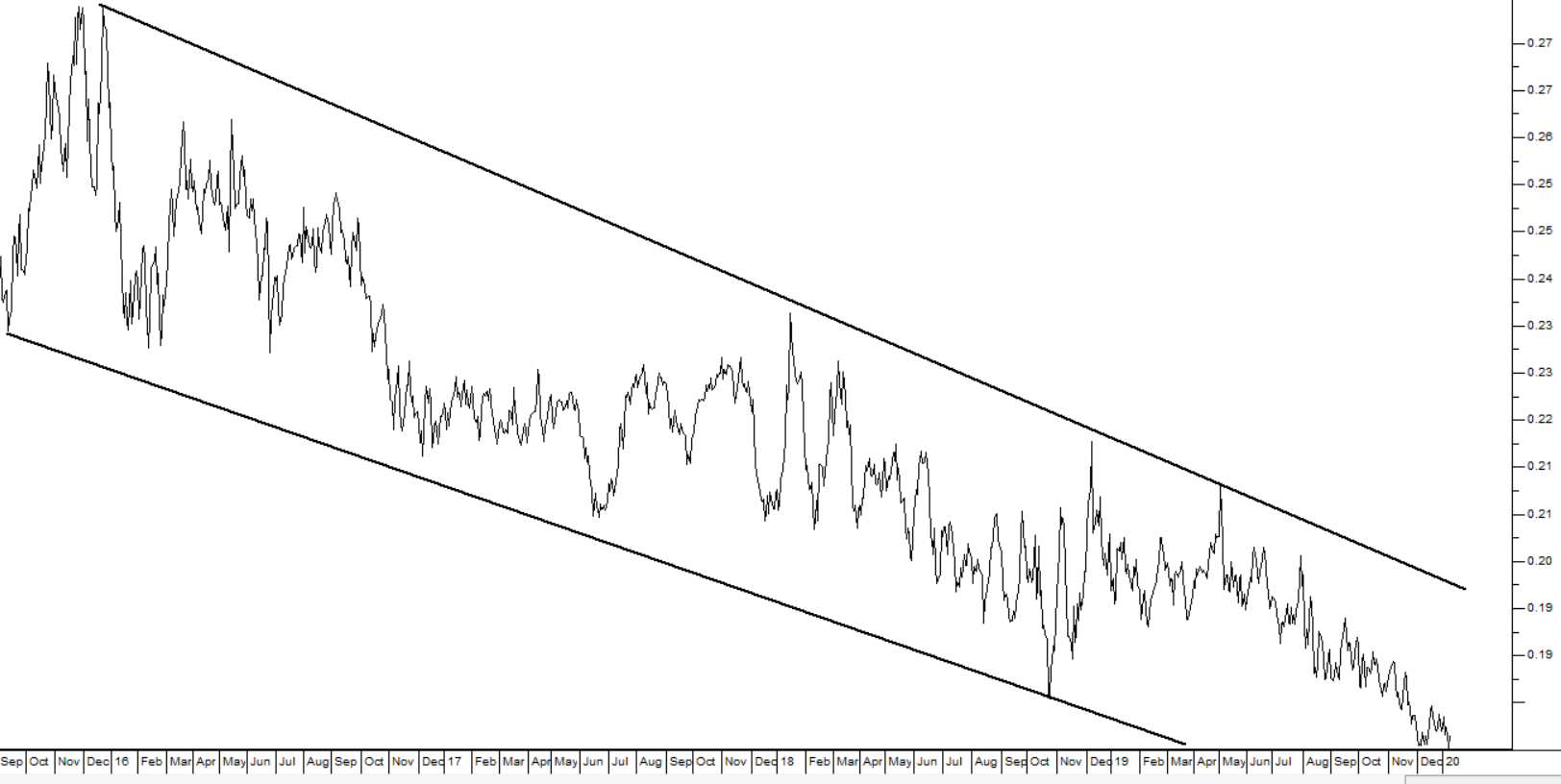

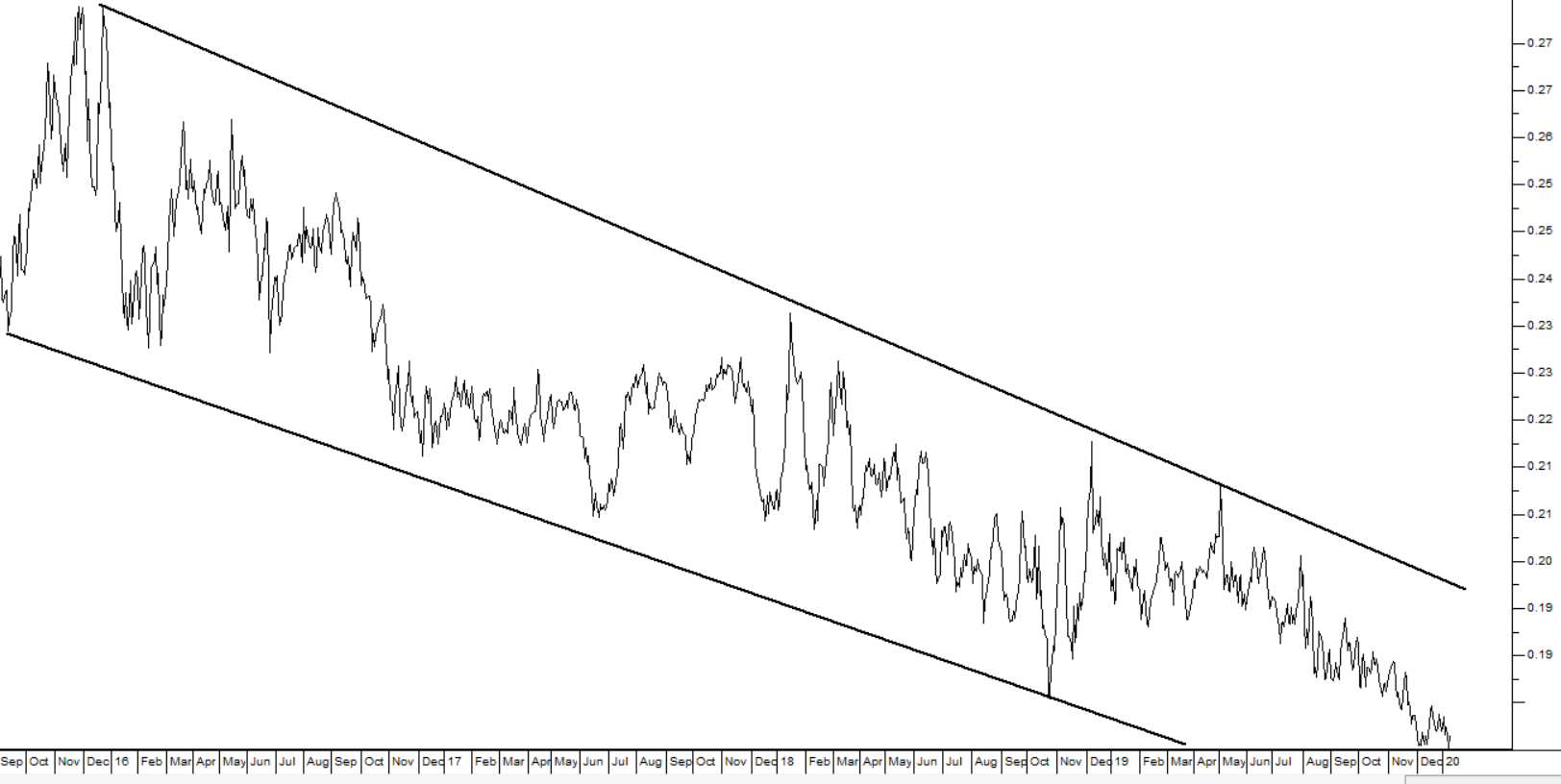

- The JSE will begin to catch up with other world markets. The JSE has been consistently under-performing the S&P500 index since the start of 2016. This can be clearly seen by a comparative relative strength chart:

Comparative Relative Strength S&P500 to JSE Overall Index - September 2015 to January 2020 - Chart by ShareFriend Pro

We believe that the JSE will begin to catch up with world markets during this year. Our blue-chip shares are heavily underpriced in relation to world markets, even allowing for our emerging market status. A return by international investors to risk-on sentiment should see significant re-investment in both our equity and bond markets.