Wall Street in Context

30 January 2019

By PDSNET

www.pdsnet.co.za) there is a section which deals with how we see the stock markets of the world in the context of their history. We call it “Our Background Approach”. It sets out the context of the current situation on Wall Street as we see it.

To this background approach we have added an excellent tube of a lecture given by Jeff Diest (https://www.youtube.com/watch?v=KIgsmm2uR8M) which you should take the time to watch.

The New York Stock Exchange (NYSE) is on track to reach its tenth year in a bull trend – which is an all-time record. Experts and analysts are at a loss to explain its continued upward trend. No bull market in history has ever gone on for this long. But what they are missing is that, as Diest says, we are in completely uncharted territory.

We simply have no way to assess the impact of the unprecedented monetary policy stimulation of the world economy over the past decade.

Two points we can be certain of are that the quantitative easing (creating and injecting over $12,5 trillion into the world economy):

- is achieving its objective of putting the world economy into a boom phase.

- is only just beginning to be discounted into world markets.

This bull market, far from being near its end, is probably only just getting into its stride. As confidence levels grow, consumers and businesses all over the world are beginning to spend the cash that they hoarded following the sub-prime crisis of 2008. Their spending has driven the US unemployment rate down to all-time record lows below 4%. The US economy is now creating over 200 000 new jobs on average every month.

Europe is beginning to follow the American economy into a boom phase with countries like Spain in particular showing good growth. Central Banks are not yet concerned about inflation because the general level of world inflation has been kept at low levels due, at least in part, to the fall of the oil price since 2014.

The US Federal Reserve Bank has been edging interest rates up, but remains consistently dovish. Rising interest rates are not yet a major factor for investors.

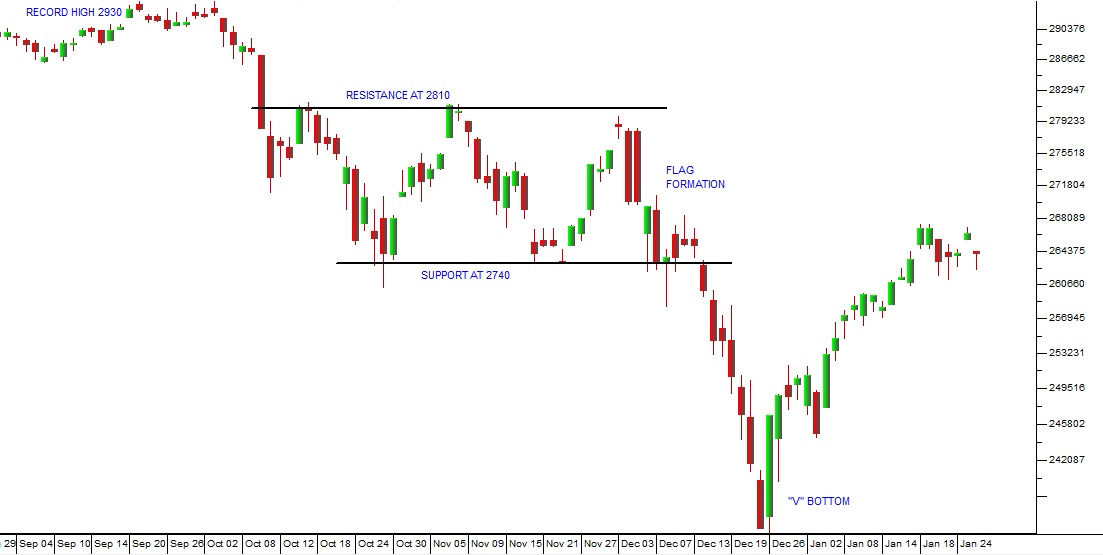

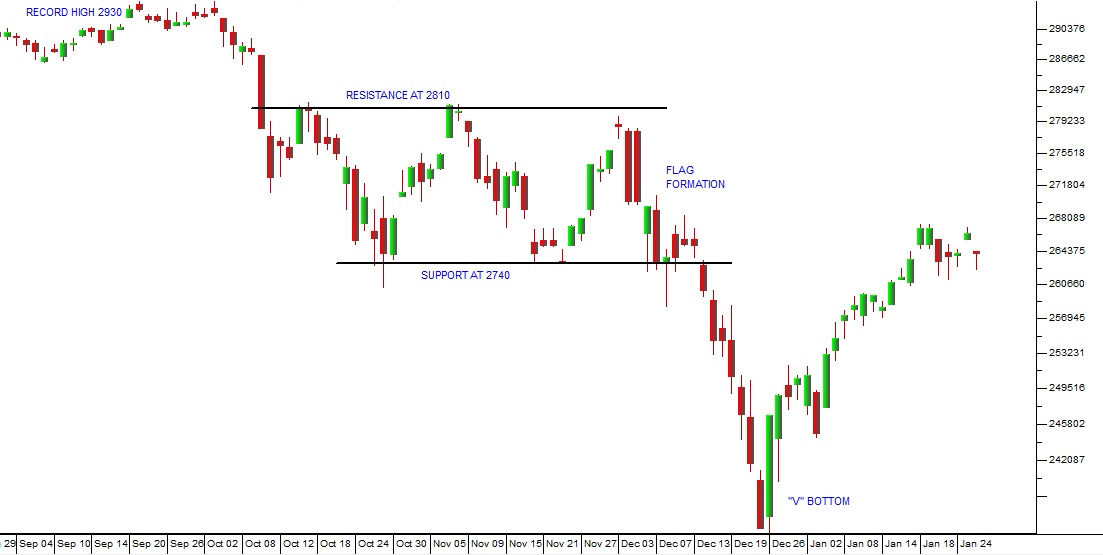

Donald Trump has impacted markets by dropping US tax rates – which is accelerating the growth trend that was already there before he took office. The recent shut-down of the US government unnerved the thinly traded pre-Christmas market, but the V-bottom which we predicted in our article “

Trump’s Debt Stand-Off” published on 27

th December 2018 has materialised. Now it appears to us that the S&P500 is heading back towards record levels. Consider the chart:

S&P500 Index September 2018 to January 2019 - Chart by ShareFriend Pro

The S&P must inevitably follow the progress of the 500 US companies which it represents and those companies are continuing to make good profits.

The correction is now 4 months old and we predict that the S&P will reach a new all-time record high by April 2019.